Entering into an inheritance is a very important step in the life of every person, which, unfortunately, is often accompanied by annoying legal errors and sometimes fraud.

To avoid all these horrors, we prefer to contact a competent specialist, so we go to a notary who will allow us to competently assess the market value of all types of property, from an apartment and house to shares and shares in an LLC.

But sometimes notaries are stingy with words and do not provide enough information during their consultations. But this does not apply to notaries in St. Petersburg. Most of the specialists in St. Petersburg are competent, treat their clients with respect, and provide detailed and informative advice.

Is it in the interests of the heir to study the legislation of our state and find out what nuances may be revealed when assessing property?

What points should you pay attention to in the real estate valuation procedure and what should you ask a lawyer about during your consultation?

Who has the right to evaluate property?

Only appraisers - lawyers specially trained to solve this type of problem - have the legal right to evaluate inherited property.

Since the valuation of an inheritance is a difficult process, not without potential legal errors, only those legal appraisers whose qualifications meet the requirements of the Law “ On Valuation Activities in the Russian Federation”

.

According to it, a qualified appraiser will be a member of a self-regulatory non-profit organization of appraisers who has confirmed his liability with insurance in accordance with the requirements of current legislation.

In this case, the appraiser must have a higher legal education, have no criminal record, and regularly take advanced training courses.

The purpose of assessing the inheritance is to calculate the notary fee

According to most lawyers, the assessment procedure is necessary to achieve two goals: resolving controversial issues between heirs (if there are several of them) and to calculate the notary fee. The last option is the most important.

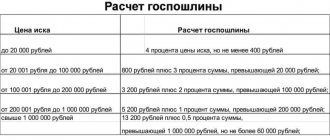

To determine the state notary fee for performing notarial acts, it is necessary to find out the market value of the inherited property.

Notaries are looking for a solution to this problem, guided by the current legislation of the Russian Federation.

The market value of the inheritance receives an independent assessment from experts of the organization that has received the right to conduct appraisal activities.

When preparing the calculation of the notary fee, the notary must draw up a special report, which contains data about the object of assessment, information on market analysis, calculations of the value of property given as an inheritance, etc.

The notary fee is paid in full to the notary.

It is necessary to take into account changes in the Tax Code of January 1, 2013, in the second part of the law

and it is indicated that the calculation of the state duty will now be calculated exclusively on the market value of the property.

Resolving disputes between heirs

An agreement between the heirs is a guarantee of a successful resolution of the case. But there is some specificity here.

Firstly, you should be aware that prompt resolution of controversial issues is necessary due to:

- limited period for registration of inheritance, which is 6 months.

- other heirs can quickly receive a certificate of inheritance during the opening of an inheritance and even claim sole ownership of the testator’s property.

- the possibility of restoring a missed inheritance period does not guarantee its restoration.

- It is beneficial to be an owner, since from the moment you take ownership, you can dispose of the testator’s property at your own discretion and carry out any actions with them, including sale, rental, etc.

It should be borne in mind that both you and other heirs may be susceptible to psychological stress caused by the death of a person close to you who is a common testator.

In a stressful situation, people, being affected, can behave inappropriately and provoke disputes, which does not contribute to achieving agreement.

How to effectively resolve property disputes between heirs?

Firstly , the best solution would be to contact a lawyer who will find a solution that satisfies all parties.

Probate lawyers will help resolve any conflicts and establish a comprehensive list of property and inheritance, including cash, securities, non-cash funds, property rights, etc.

Secondly , in order to understand the complexity of inheritance law, you need to familiarize yourself with it.

It is important to understand such legal categories as heir, will, opening of inheritance, queue, inheritance mass, obligatory share in the inheritance and others.

It is important to find out in what cases a will is considered invalid and the heir is considered unworthy.

You can learn about this on specialized resources dedicated to inheritance issues.

You will probably be interested in watching the mental map “How to receive an inheritance”, with step-by-step instructions for heirs

Or HERE you will find out how to enter into an inheritance

Necessity of an advance agreement when purchasing an apartment:

How to get a high-quality assessment for a notary inexpensively - 3 useful tips

Notarized valuation of property and assets is a responsible procedure and requires the presence of competent specialists. Quality services, by definition, cannot be too cheap. However, if you approach the event wisely, you can save your money without reducing the level of services.

How to do it? Read expert advice.

Tip 1. Consult with lawyers first

Free preliminary consultations will help you competently structure a conversation with representatives of the appraisal company and set the most specific tasks for specialists.

The more information you provide to appraisers, the faster their work will be and the lower the cost of services.

Today you can get a full consultation with a lawyer without leaving your computer. Take advantage of modern digital technologies - if done regularly, they will save you a lot of money.

Tip 2. Participate in promotional offers from appraisal companies

Every self-respecting appraisal company periodically conducts marketing events in the form of promotions, discounts, and offers for regular (or, conversely, newly arrived) clients.

It would be a sin not to use such programs. You can track them by subscribing to the news of the companies themselves or some rating agencies.

Tip 3. Choose companies that provide guarantees

Reputable appraisers always give their clients money-back guarantees in case the work is performed poorly, not on time, or not as required under the terms of the contract.

For example, if a notary refused to accept the appraiser’s report, arguing for his actions with a low level of assessment or incorrect execution of the document, you have the right to demand your money back from the company. But this can only be done if the contract contains a corresponding clause regarding the conditions for the return of funds.

Features of inheritance valuation

Property valuation is necessary, since without it it will be impossible to enter into inheritance rights.

When registering the right to inheritance from a notary, the heir pays a state fee, which is calculated based on the assessment carried out by a lawyer-appraiser.

This procedure may also be necessary if any property disputes arise between other heirs involved in the process of obtaining rights to the testator’s property.

Do not forget that any inherited property will automatically be subject to taxation.

When are the services of an appraiser needed?

- Calculate the amount of state duty arising from the cost of the apartment.

- Division of an apartment into unequal shares arising from the cost of the apartment. Shared inheritance is one of the options for dividing housing. It becomes necessary if the owner did not leave a will and did not give orders regarding his real estate.

- Provide the appropriate paper to the court. The judicial authority can divide the housing among the heirs based on its value.

According to the law, appraisal work in an apartment is possible only after the death of the owner or his recognition as missing. The cost of the apartment is “tied” to the date of death of the owner/the date he was declared missing, and not to the date of this service.

Documentation

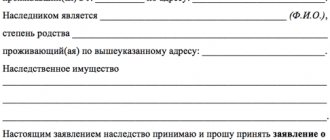

First of all, the heir needs to come to the notary with the initial package of documents.

It includes a passport, death certificate of the testator, including a copy, a certificate from the Federal Migration Service from the last place of residence of the testator in Form No. 9, or an extract from the house register in the original.

Different types of property will require different types of documents:

- The assessment of a land plot will require a certificate of ownership/act of allocating the plot to personal ownership, a certificate from the tax office confirming the absence of tax arrears and a cadastral plan of the land plot.

- Valuation of securities for inheritance will require an extract from the register of shareholders, a report on the assessment of the market value of shares, a bank deposit agreement and a savings book.

- Valuation of a car for inheritance - the heir will need original documents - a registration certificate, a sales contract, a certificate of invoice.

- Valuation of an apartment for inheritance will require a share certificate from the housing cooperative, a certificate from the BTI in the original, an extract from the personal account confirming the absence of any debts, a certificate of ownership, agreements for shared participation in construction, a privatization agreement, including copies.

- Valuation of shares in property - a certificate of the right to inheritance.

What determines the appraised value

When accepting the work to the heir, it is important to check the inclusion in the report of all mandatory items that will be needed when providing materials to the notary.

The list of mandatory assessment parameters includes:

- Information about the age and mileage of the vehicle

- Data on the condition of the engine and body

- Materials showing what additional equipment is present on the car (navigator, alarm and other systems)

- Generalized data on the approximate market value and market demand of a car based on the results of an analysis of market offers

- Average cost indicators for similar cars

- Data on potential loss of marketable value

The conclusion must be accompanied by photographs of the vehicle being assessed, a list of technical publications on the basis of which the assessment was carried out, and a detailed list of regulatory documents.

Such an assessment is always made only in writing, which is signed by the customer and the appraisers.

The complete package to be provided to the notary must be supplemented by all the papers of the heir and a copy of the license certificate of the person who carried out the assessment.

Specifics of assessment objects

Depending on the type of inherited property, different types of lawyers will be involved in the valuation procedure.

Experts from the Ministry of Internal Affairs or companies related to vehicle maintenance are invited to evaluate vehicles.

To evaluate real estate, BTI employees are involved, and if this institution is not located in the place of residence of the heir, then he will need to contact the corresponding municipal unit for the same purposes, which evaluates it at its residual value.

Income approach to valuation

This type of approach to valuation is currently used in real estate and is the most popular, since it does not provoke problems with finding calculations of initial information and is essentially universal, because any property generates income.

Lawyers conducting valuations using this method use two methods - direct capitalization and discounted cash flows.

These methods are based on determining the value of real estate by establishing current income and income that will be received in the future from this property, and the final price of the property will be fixed by agreement between the heirs.

Advantages of MCEO

Among the many positive aspects of the Interregional Center of Expertise, in the first place is the exceptional quality of work performed in the shortest possible time and an independent approach to each task in compliance with all regulations and norms established by the Law. It is also worth noting that our prices are quite reasonable, which always attracts clients.

By visiting our website advokatservis.ru and calling or sending an email, you can get specialist help and find out all the details about the rules for business valuation.

Comparative approach to assessment

In another way, this method is called market and is applied mainly to real estate.

It is a set of methods for estimating the final price, based on a step-by-step comparison of the valuation object with its taxes on the market, which have information about the cost of transactions with them.

The developed real estate market became the starting prerequisite for the subsequent application of the comparative approach in legal practice.

At the same time, assessment specialists are guided by several principles:

- supply and demand, since there is a relationship between limited supply and the need for a property;

- substitution, which states that the buyer will not pay more for the property than the market price.