Deadlines for accepting an inheritance by law and will

Article 1114 of the Civil Code of the Russian Federation of 2001 provides for the concept of the period for opening an inheritance. This is the moment from which relatives can contact a notary with a handwritten application to open an inheritance. As a general rule, this is the date of death of the citizen. That is, the next day after receiving a death certificate, you can contact a notary, and the total period for entering into an inheritance begins to be counted from the day of the citizen’s death.

In addition to biological death, the second basis for obtaining inheritance rights is the recognition of a person as dead in court. When making a final decision, the court indicates from what day the person is considered dead. From this time on, the general inheritance period will begin, but you can use a court decision and contact a notary only after the document enters into legal force, that is, 30 days after the decision is announced.

If the testator and heir die at the same time, they cannot claim each other's property. The same applies to their legal successors. Only direct relatives of a person or other participants specified in the will are involved in inheritance.

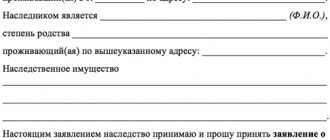

Registration of inheritance rights occurs only in relation to people who have submitted a handwritten application to the notary to open an inheritance. This must be done within 6 months from the moment the grounds for inheritance arise.

What affects the timing of inheritance registration?

The procedure for acquiring property rights to inheritance consists of several stages:

- opening of inheritance;

- accepting applications from potential candidates;

- receiving and processing documents;

- production of a notarial certificate for subsequent re-registration of property rights.

In practice, circumstances may arise in which at each of these stages a suspension of registration or an increase in time for it is required. The total duration of the process is influenced by the following factors:

- the date of filing the appeal of each of the heirs (each person has six months to prepare the appeal, without taking into account the situation when this time is extended by 3 and 6 months);

- increasing the period for collecting necessary documents that the testator or potential recipients of property did not have.

From what date is the inheritance case considered open?

The procedure begins when at least one of the deceased’s close relatives submits an application to the notary to open an inheritance. After receiving and registering the application by a notary, the inheritance is considered open. This can be done only after the death of the testator or recognition of him as deceased in court with the provision of supporting documents.

These rules are the same for receiving property by will and in accordance with the legal order.

Suspension of the inheritance period is possible if a child of the deceased testator is conceived but not yet born. The passage of time is suspended until the baby is born and a birth certificate is issued. Next, the child’s legal representative enters into the inheritance case and protects his rights.

Is it possible to receive an inheritance before 6 months?

Article 1163 of the Civil Code of the Russian Federation provides that a notary can prepare a certificate of inheritance earlier than six months only if there is accurate information that there are no other claimants to the property and there will be no disputes about the property and no one’s rights have been violated.

The heir himself must prove the absence of a dispute and the possibility of obtaining a certificate earlier.

Inheritance of part of the property

Let's consider whether it is possible to accept part of the property and refuse the other part? The law does not provide for such a possibility. The share of the inheritance is acquired as a single whole (Article 1110 of the Civil Code of the Russian Federation).

The heir must receive the due property, as well as the corresponding share in the debts of the deceased.

The inheritance is distributed in equal parts among the recipients. The exception is the joint property of spouses. From such property the part of the second spouse is allocated. And the remainder of the assets is divided among the remaining participants.

Important! The spouse is included in the legal heirs. However, if a refusal of inheritance is formalized, the allocation of the marital share does not equate to consent to accept the property of the deceased.

Example. The testator and his wife had joint property (apartment, car). The only child is a son. After the death of the husband, ½ of the joint property goes to his wife. The second half of the assets is divided equally between the wife and child. A court decision is not required to allocate the marital share. The notary independently carries out all the necessary calculations.

Additionally, you can accept part of the inheritance if one of the relatives renounced their share in favor of the beneficiary. The procedure for registering papers for a share of property is the same as when inheriting an entire property (apartment, car).

Deadlines for actual inheritance

Article 1153 of the Civil Code of the Russian Federation provides for different ways of accepting an inheritance. The first is submitting an application to a notary, and the second is the actual acquisition of inheritance rights. Upon actual acquisition, the heir does not apply to the notary, but carries out one of the following actions:

- continues property management;

- uses measures to preserve property;

- protects property from attacks;

- independently covers the costs of maintaining the facilities;

- voluntarily and promptly repays the debts of the deceased testator that relate to the property.

The heir must begin to carry out these actions immediately after the death of the testator, that is, during the first six months. These actions must be documented in order to be able to obtain a notarized certificate for the re-registration of property rights in the future.

When actually accepting an inheritance, you can contact a notary for a certificate at any time, even after 6 months, provided there are no property disputes with other participants in legal relations.

If a person actually accepted the property, but the inheritance was opened on the initiative of another relative, who, after six months, received a notarial certificate for this property, then the conflict must be resolved in court.

Entry into inheritance after the death of a brother by will and by law

What documents does a notary need to enter into an inheritance according to law and will?

What actions need to be completed within the allotted time?

During this period, the recipient of the property of the deceased must provide a civil passport and a will to the notary office at the place of last registration of the deceased owner of the property. A person must fill out an application expressing his attitude towards the inherited property.

Important! The recipient of property under a will is given the right to accept the property or refuse it.

If the heir does not want to accept the inheritance, then he formalizes a refusal. The document must be in writing. The refusal can be absolute (in favor of any other heirs) or targeted (in favor of another recipient under the will). The refusal cannot be cancelled.

If the heir wishes to receive the property of the deceased, then the following documents must be prepared:

- title documents for inherited property;

- legal documents;

- certificate from the last place of registration of the property owner;

- technical documentation for property objects;

- report on the value of the inheritance.

The recipient of the property is required to pay a fee for registration of inheritance.

Duty calculation

| No. | Payment amount | Recipient category |

| 1 | 0.3% of property value | For citizens who are children, parents, spouses, brothers, sisters, grandparents of the deceased |

| 2 | 0.6% of the value of property | For other individuals and legal entities |

The recipient of the property must confirm the presence of a close family relationship. Otherwise, he will have to pay a duty of 0.6% of the value of the property received.

Inheritance contract and terms of acceptance of inheritance

In 2021, a new mechanism for obtaining property rights to inheritance began to operate. This is the drawing up of an inheritance agreement. The agreement is drawn up before the death of the testator between him and the future recipient of the property. The agreement is signed and registered with a notary.

The execution of the agreement begins only after the death of the testator. The execution can be requested by the heir specified in the contract, the involved executor or legal successors of the heir, or the notary who opened the inheritance case.

Within 6 months from the date of death of the testator, the notary gets acquainted with the inheritance agreement, involves the heirs, acquaints them with the rights and consequences, and checks whether the deceased person has property rights to the property specified in the agreement. That is, it confirms the possibility of further implementation of the contract.

After this, the heir either refuses the agreement or completely accepts it and begins implementation. This can be done within six months allotted for opening the inheritance. In the absence of conflicts and disputes with other participants in legal relations, a notary can prepare a certificate of inheritance earlier than 6 months have elapsed.

Extension of the period of entry into inheritance

Circumstances that make it possible to change the period of inheritance:

- It is allowed to increase the time of inheritance by 3 months if the heir died before accepting the property, and his right is transferred to the successor. This applies to persons who received the right of inheritance due to the absence of an application for opening an inheritance on the part of other candidates, as well as second-degree heirs, provided that relatives of the first degree did not submit an application to receive the property on time.

- The time for receiving an inheritance is extended by six months for successors who acquired inheritance rights after the death of the failed heir, if at least 3 months remain before the end of the main period for acquiring inheritance rights. If the property of heirs of one line is abandoned, the values are transferred to relatives of the second degree of kinship, while the time of inheritance is extended by six months.

The interested heir prepares supporting documents and a handwritten statement and contacts the notary conducting the proceedings.

The lawyer checks the accuracy of the documents, confirms the possibility and legality of extending the established period. On such a decision, a corresponding decree of a notary is made, which is attached to the inheritance case and announced to other participants in legal relations.

Mandatory share

- Children under 18 years of age or disabled children.

- Disabled parents.

- Disabled spouse.

- Other related dependents or those without blood ties.

All these people have the right to receive their piece of the deceased’s property in any case (Article 1149 of the Civil Code of the Russian Federation). Any of them can take possession of it on any of the grounds of inheritance or on all of them at once.

We present to your attention information about unworthy heirs and commorients. Read about who the heir of the deceased heir is and what to do if the heir has not entered into the inheritance within 6 months.

Restoring a missed deadline for accepting an inheritance

If one of the heirs missed the allotted time to receive property, this can be resolved peacefully. To do this, the candidate collects a statement from each established heir stating that they are not against the recalculation of property. After this, all applications are transferred to the notary, who resumes enforcement proceedings and recalculates the property, taking into account the interests of all persons.

If one of the participants has already re-registered the property right to transport or real estate, then a new notary certificate of inheritance is sufficient grounds for making changes to Rosreestr and the State Traffic Safety Inspectorate.

If it was not possible to avoid a conflict, then the interested candidate prepares a statement of claim in a federal court of general jurisdiction located at the location of the property or in the region where the inheritance was opened by a notary. The claim is supported by documents indicating the existence of valid reasons for missing the deadline.

The court considers the appeal and makes a final decision. If the claim is satisfied, the judge revises the list of property and re-divides it taking into account the requirements of the law. The final decision is submitted to the notary, who confirms it for execution and prepares the notarial certificate.

Valid reasons for missing the deadline:

- the heir did not know and could not know about the person’s death;

- lack of information about the existence of a will;

- the heir is incompetent;

- the potential candidate for the property is a minor;

- long-term illness with hospital treatment;

- surgical treatment;

- military service under contract;

- emergency service;

- business trip;

- living in another country.

The court will consider the statement of claim only if, within six months after the expiration of valid reasons, the potential heir files a claim in court.

Recovery procedure

Algorithm of actions of an interested person in the judicial restoration of inheritance terms:

- preparation of a claim detailing the circumstances and indicating valid reasons for missing the time of inheritance;

- preparation of the necessary documents, including passports, death certificate of the testator, a document confirming the relationship of the deceased and the plaintiff, a notarial certificate of refusal to engage as an heir due to missed deadlines;

- filing a claim with the district court, which can be done in person, through a representative or by mail;

- actual consideration of the dispute;

- making a final decision;

- entry into force of the decision;

- implementation, which is carried out by the notary who initially opened the inheritance proceeding.

Read more about the procedure for restoring a missed deadline for accepting an inheritance.

Limitation periods

The general statute of limitations for disputes related to inheritance is 3 years. This time begins:

- from the day when valid reasons ceased to apply;

- from the day when a person learned about the violation of his property rights.

Inheritance of property of an adopted child

Adopted children have the same rights as children born into the testator's family. Consequently, they can count on the property of the adoptive parent, along with first-line relatives.

After the court decision on adoption enters into legal force, adoptive parents can also claim to inherit their property, by analogy with blood parents.

As for biological parents, they lose property rights regarding their child immediately after the paperwork for his adoption is completed. A similar rule applies when adopted children inherit the property of their biological parents. They are losing this right.

The exception is the situation when the child was adopted by a stepmother or stepfather. Mutual property rights/responsibilities in relation to the father/mother do not cease.