Author

Sergey Ershov

Registration number in the register of lawyers of St. Petersburg – 78/5563

Your father was going to leave his property to you, but did not have time to draw up a will. And now you don’t know whether you’ll have to share the house with his widow and young stepdaughter. I will tell you which of the relatives of the deceased is considered the primary legal successor, what is the established procedure for distributing the inheritance, and in what shares the heirs of the first priority will receive it.

When and how does legal inheritance occur?

Entering into inheritance is a process that requires clear and timely actions, as well as knowledge of the law. It is the legal ignorance of the parties that gives rise to quarrels and disputes, leads to conflicts even within the same family and becomes a serious test for potential heirs.

The article will help you understand all the intricacies of accepting an inheritance according to the law and the rules for dividing it between first-line successors.

When an inheritance is divided according to law

The grounds for this method of entry arise in the following cases:

- There is no will and no inheritance agreement has been concluded.

- The administrative document was canceled by the testator himself.

- The will was declared invalid by the court.

- The testator bequeathed only part of the property, while the other part remained unwilled.

- The persons specified in the expression of will are recognized as unworthy heirs after the document is drawn up.

- The heirs under the will did not declare their rights or formalized a refusal of the inheritance, and there are no designated successors.

- The heir indicated in the testamentary document died before the testator, and there are no designated successors.

On a note. Sub-designated successors are the persons specified in the will to whom the right of inheritance will pass in the event of: the death of the main heir, non-acceptance or refusal of the inheritance, or removal as unworthy.

Related articles:

How to recognize an unworthy heir this year - instructions

What are the rules for inheriting property without a will?

Inheritance by law (without a will) is a transfer in the order of priority of rights and obligations after the death of a citizen to his legal relatives (blood and equivalent). Please note several rules that apply when entering into inheritance rights by law:

- Inheritance occurs according to the procedure of universal succession. Those. the entire hereditary mass passes directly to the heir and at one moment. The recipient cannot accept something and refuse something.

- Legal successors can be citizens of Russia, foreigners and stateless persons who are alive at the time of the testator’s death. The rule also applies to the testator’s children who were not yet born at the time of opening the inheritance.

- Inheritance by law is carried out in order of priority, establishing the priorities of some heirs over others.

- The entire inheritance mass is divided into equal shares in proportion to the number of heirs in one line, regardless of their gender, citizenship or property status. An exception is those who inherit by right of representation, when the share of the deceased before or at the same time as the testator is divided among his descendants.

- Heirs of the first stage have priority when joining. If there is only one person in the first queue, all property goes to him and applicants from other queues will not be called upon.

- Heirs of other lines are called up only if there are no successors of the previous line or if all of them do not have the right to inherit/are removed/deprived/not accepted/refused.

- Disabled dependents of the testator, whether or not included in the list of heirs by law, inherit together and equally with the heirs of the called-up order.

- To obtain the right to inheritance under the law, the applicant must prove a family connection with the testator. The exception is disabled citizens who are not included in the circle of heirs by law.

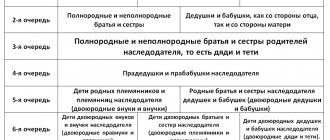

What is the order of inheritance

The order of succession is provided for in Ch. 63 of the Civil Code of the Russian Federation, the procedure for dividing the blood relatives of the testator and persons equated to them in line. There are seven such queues in total.

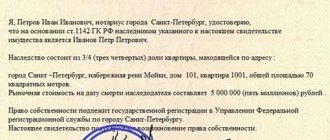

The diagram below will help you understand how an inheritance without a will is distributed between relatives:

Order of succession by law

Also, the Civil Code of the Russian Federation establishes special categories of heirs by law. These include - Art. 1148 Civil Code of the Russian Federation:

- Relatives of the testator who were disabled by the day the inheritance was opened and who were dependent on him for at least 12 months before his death. For this category of heirs, it does not matter whether they lived with the testator or not.

- Persons recognized as disabled who are not relatives of the testator. But provided that they were his dependents and lived with him for at least 1 year before death.

- If there are no heirs by law, then disabled dependents who are not relatives are recognized as heirs of the 8th stage and inherit independently.

Seventh line of succession

The heirs according to the law of the 7th stage include:

- stepsons and stepdaughters of the testator - children of his spouse not adopted by the testator;

- the stepfather and stepmother of the deceased are the non-adopting spouse of his parent.

In 2012, the Supreme Court of the Russian Federation, in Resolution No. 9 of May 29, 2012, clarified that the calling of the persons listed above to inheritance depends on two circumstances. Firstly, on the status of marriage with the parent of the stepson and stepdaughter. If it is not terminated, stepsons and stepdaughters are called upon to inherit after the death of their stepfather and stepmother, and stepfather and stepmother - after the death of their stepchildren.

Secondly, the basis for the termination of the marriage matters. If it was terminated during the life of the testator due to the death of the spouse or the declaration of his death, the listed persons receive the inheritance in the 7th line of heirs. At the same time, if the marriage is terminated by dissolution and also declared invalid, they do not have the right to inherit.

Who is the first priority heir?

The heirs of the first stage according to the law are Art. 1142 Civil Code of the Russian Federation:

- Children of the deceased.

- Surviving spouse.

- Parents of the deceased.

- Grandchildren and their descendants, entering by right of representation.

Also, along with the primary heirs, the dependents of the deceased enter into inheritance rights. Next, I will talk in detail about each of these categories of assignees. You will learn about all the nuances that they may encounter when confirming their belonging to the first line of heirs.

Which child has the right to inheritance?

All children of a deceased citizen, by law, have equal rights to property.

Children have the right to inherit after the death of their father/mother:

- Those born in marriage for whom paternity has not been disputed.

- Born within 300 days from the date of dissolution/invalidity of the marriage, unless paternity is contested.

- Illegitimate children for whom paternity/maternity has been established voluntarily, with the consent of the guardianship and trusteeship authority or through the court. If the child has not been officially recognized, then his descent from the testator can be tried to be established in court even after death.

- Adopted persons, even if at the time of opening the inheritance the adoption was canceled by a court decision, but has not yet entered into legal force. If a stepson or stepdaughter was officially adopted, they are considered equal to natural children.

- For those born within 300 days of the death of the testator, paternity is certified by a record of marriage with the mother of such heir. If the parents were not married - on the basis of an application submitted to the registry office during pregnancy (during the life of the testator) or in court (posthumously).

- In respect of which the testator was deprived of parental rights or voluntarily renounced them. If the child was subsequently adopted, the court decision on adoption indicates the preservation of rights and obligations in relation to his relatives by origin.

- Wards not included in the circle of relatives, if they lived with the testator for more than 1 year and were supported by him. This applies to disabled children, minors and full-time students (up to 23 years old).

Important! The testator's dependents have the right to enter into inheritance rights along with the first priority.

Cannot inherit:

- Adult children of the testator who maliciously evaded the fulfillment of their responsibilities for his maintenance - such a circumstance must be confirmed in court.

- Children of the deceased who have committed deliberate unlawful acts against the testator or his heirs - the circumstances must be confirmed in court.

- Those given for adoption to other persons - they do not inherit after their biological parents, unless the rights and obligations were reserved for them in the court decision on adoption.

What are the features of allocating a share for minor heirs?

Minors inherit the property of a deceased parent according to the general rules, i.e. in equal shares with other first-line legal successors. The law does not establish any privileges for this category of heirs.

But the registration of the inheritance and the collection of all necessary documents should be handled by their legal representative (the surviving parent, trustee, guardian). With the consent of their legal representatives, minors over the age of 14 have the right to independently accept an inheritance.

In what cases do parents inherit?

The first-degree successors include the parents of the testator:

- Blood - provided that the relationship was formalized during life or established through court after death.

- Adoptive parents - they are equal to relatives by origin.

- Those who have used artificial insemination or embryo implantation are considered biological parents.

- Those who agree to implant an embryo into another woman for the purpose of carrying it are recognized as the parents of the child if the surrogate mother has given her consent to this.

Parents cannot inherit from their children:

- Those who were deprived of parental rights and did not restore them at the time of opening of the inheritance.

- Biological, after their child was adopted by others.

- In respect of which the adoption was canceled in court and at the time of opening of the inheritance such a decision had already entered into force.

- Those who maliciously evaded fulfillment of alimony obligations - removal of such heirs is possible only by court decision.

- There is no information about maternity/paternity in the birth certificate and in the birth register.

On a note. If, by a court decision, the adopted child has maintained a relationship with one of the parents by origin, then after his death this parent will inherit.

What are the features of inheritance by a surviving spouse?

After the death of a husband or wife, according to the law (without a will), the surviving spouse inherits along with other first-degree heirs. But this rule only applies if the marriage is officially concluded, i.e. executed in the manner established for state registration of acts of civil status.

On a note. Marriages concluded outside of Russia between citizens of the Russian Federation are recognized as valid provided that they are concluded in compliance with the laws of the state in which they were registered. The rule also applies to marriages between citizens of the Russian Federation and foreign citizens or stateless persons.

If the spouses lived separately, but their marriage was not dissolved, the right to inheritance is retained. In the event of a divorce through the court, the former spouse of the testator has the right to inherit in the specified capacity, if on the day of opening the inheritance the court decision has not entered into legal force.

In cases where the marriage was “civil”, inheritance relations do not arise by law. In this situation, it will be possible to obtain a share in the property of the deceased only by proving the fact:

- Being dependent on the testator due to incapacity for work.

- Living together with him for the last year.

Please pay attention to the following nuances:

- Same-sex marriages legalized by the laws of other countries do not comply with the family legislation of the Russian Federation and are not recognized as official. Therefore, a union of men or women living together has no legal status—the other has no right to inherit after the death of one spouse.

- In the event of a divorce in court, the former spouse is excluded from the list of first-priority heirs by law. An exception is that the divorce decision did not enter into legal force until the day the inheritance was opened.

- Spouses who die on the same day do not inherit after each other - the inheritance opens after each of them.

- If the marriage was declared invalid, the spouse is deprived of the right to inherit, even if the court decision entered into legal force after the opening of the inheritance.

What is the spousal share and why is it allocated?

All property acquired by spouses during legal marriage and in the absence of a marriage contract is considered their joint property. Each of them is the owner of ½ part, regardless of who paid for the purchases and to whom the ownership was registered. If a marriage contract has been concluded, the share is determined according to its terms.

The right of inheritance belonging to the surviving spouse does not detract from his right to part of the property acquired during the marriage with the testator - Art. 1150 Civil Code of the Russian Federation. The composition of the inheritance includes only half (part) of this property, which passes in equal shares to his heirs by law.

If the marriage was not dissolved at the time of the husband/wife’s death, the surviving spouse should:

- First, contact a notary to allocate the marital share.

- Then apply for acceptance of the inheritance.

If the spouses divorced and did not divide the property, the allocation of the marital share is possible only in court.

Important! After the death of a spouse, the marital share must first be allocated, and only then the remaining property must be divided among the heirs. If you ignore the process of allocating the marital share, all property will be included in the inheritance mass and will be divided among the heirs.

When grandchildren inherit first

As independent legal successors, grandchildren cannot claim the inheritance. However, the law provides for such a concept as the right of representation. It applies when the son or daughter of the testator died before or at the same time as him - the right of inheritance passes to his grandchildren and their descendants.

Important! Grandchildren, great-grandchildren and more distant descendants, when inheriting by right of representation, take the place of “retired” heirs, i.e. inherit only the share due to their deceased parent. If there is only one grandson, he inherits the entire share due to his father/mother, and if there are several grandchildren, the parent’s share is divided equally between them.

Which of the dependents of the deceased inherits along with the 1st line

Dependents will receive property on an equal basis with the heirs of the first stage, even if they are not included in it.

The testator's dependents are classified as a special category of successors by law and are entitled to the same share in the inheritance as the heirs of the first stage. This method of entry is most often used:

- Former spouses.

- Cohabitants, so-called "civilian" husbands and wives.

- Children of cohabitants.

- Children who were under guardianship (trusteeship).

- Guardians (trustees) of the deceased.

- Grandchildren with living parents, etc.

In order to claim the inheritance together with the 1st stage legal successors, they will have to prove:

- Your disability.

- Staying dependent on the testator for a period of at least 12 months before his death.

- Living together with the testator for a year before his death - this rule applies only to citizens who do not belong to the circle of heirs by law (stages 2-7).

On a note. Recipients of annuities under a lifelong maintenance agreement with dependents concluded with the testator are not entitled to inherit as dependents.

The following citizens are recognized as disabled:

- Those who have not reached the age of 18 and have not married before reaching adulthood - provided that the day of majority (marriage) came later or coincided with the day of opening of the inheritance.

- Men and women who have reached the age of establishing an old-age labor pension - regardless of their actual ability to work. But provided that the birthday occurred before the opening of the inheritance.

- Officially recognized as disabled children, disabled people of groups I, II or III. Only if disability is established before the opening of the inheritance or on that day. And if it is given indefinitely, until the date coinciding with the day of death or until a later date.

Please note that the fact of dependency can be established both out of court and in court. The notary or the court makes a decision by determining the relationship between the amount of assistance received and the dependent’s own income.

Important! The permanent nature of the assistance suggests that it was not random or one-time, but was provided systematically - it was a constant and main source of livelihood.

Persons who received from the testator:

- Full content.

- Systematic assistance, which was the main, but not the only source of livelihood for this person.

On a note. The legislation does not exclude dependents from having any income of their own - earnings, pensions, scholarships and other payments. When assessing the evidence presented, it will be taken into account whether the amount of the disabled person’s own income was sufficient to meet the necessary needs of life.

Second stage

According to the law, the heirs of the second stage are the brothers and sisters of the deceased - both full and half-blooded (half- and half-blooded), as well as his grandparents - the parents of the father and mother.

At the same time, children of second-order heirs (nephews and nephews) can enter into inheritance, like the grandchildren of the deceased, only by right of representation.

Heirs of the second stage can exercise their right of inheritance only if there are no living heirs of the first stage, or they are deprived of inheritance rights or voluntarily renounced them.

How is the inheritance distributed among first-line heirs?

The disproportion between the received property and the inherited share is eliminated by monetary compensation.

As a general rule, the property of the deceased in the absence of a will is divided equally among all heirs of the same line who promptly contacted the notary. When establishing the size of the share, the rules apply - Art. 1141 Civil Code of the Russian Federation:

- Applicants of the same line inherit in equal shares.

- An exception is legal successors by right of representation, who share among themselves only the share of the inheritance intended for the deceased heir.

Next, I will try to explain in detail how in Russia property is divided according to the law between heirs of the first priority and in what shares. You will also find out who can count on what when dividing the inheritance.

What primary legal successors can and cannot inherit

You can accept an inheritance only in its entirety, without dividing the inheritance into income and expense parts. You can inherit the following that belonged to the testator on the day the inheritance was opened:

- Real estate - residential and non-residential, land plots.

- Vehicles, but cars purchased by proxy, are not subject to inheritance.

- Enterprises, property of a member of a peasant (farm) enterprise.

- Material objects that do not belong to real estate - paintings, furniture, dishes, collections, jewelry and precious stones.

- Limited negotiable items - weapons, potent and toxic substances, narcotic and psychotropic drugs.

- State awards - honorary, memorable and other signs, incl. awards and badges as part of collections.

- Securities and money, incl. located on bank deposits.

- Other property that is the personal property of the decedent.

- Property rights - the right of ownership, the right to claim debt, the right to receive remuneration, the right to compensation for moral damage awarded during the life of the testator and not received by him.

- Some moral rights are copyright, patent, invention, utility model, industrial design, etc.

Do not forget that along with assets, you can also inherit debts incurred by the testator to the state, individuals, and organizations (including loans, mortgages). Creditors of the deceased have the right to collect the debt from the heirs within 3 years from the date of delay.

Does not pass to heirs:

- The obligation to pay alimony, to pay compensation for damage caused by a deceased citizen.

- The right to claim compensation for moral damage caused to the testator.

- Intangible benefits that belonged to the deceased - honor and good name, business reputation, inviolability, personal and family secrets, the name of a citizen.

- Property and accounts included in a will or designated for inclusion in an estate.

How the inheritance is distributed among the primary heirs - basic rules

The following rules apply for distribution:

- The inheritance is divided among the first line heirs in equal parts. Do not forget about the need to allocate the marital share before dividing property.

- The distribution of the inheritance mass is influenced by the number of heirs in line. If there is only one contender, all the property goes to him, if there are several successors in the first line, everything is divided equally between them.

- The more heirs in line, the smaller the share of each.

- If the successor did not accept the inheritance, refused, or was found unworthy, his share will be divided among other heirs who have declared their intention to enter into inheritance rights. Those. there will be an increase in shares.

- If the heir has formalized a refusal of inheritance in favor of one of the legal heirs of the 1st-7th order, his share will go to the citizen indicated in the refusal.

- If the testator's children died before the inheritance was opened, their descendants receive a share in it by nomination, i.e. grandchildren. This share is divided equally among all descendants.

- If the heir was deprived of the right to inherit, then his descendants also cannot claim the property.

How does property division happen?

After determining the shares, a lot of disputes arise regarding the division of property between the heirs. The recommendations below will help you understand how to act and what you can demand from other assignees in different situations:

- When dividing an indivisible thing, the heir who, together with the testator, had the right of common ownership or constantly used it, receives the priority right. For example, the car is taken by the heir, who was its co-owner along with the deceased, while others receive monetary compensation or property of similar value.

- The rule of privilege also applies to the division of residential premises, when the allocation of a share is impossible. The priority for the apartment is acquired by the heir who lived in it on the day the inheritance was opened and does not have any other housing. The rest are entitled to payment of monetary compensation.

- If none of the heirs has a preemptive right to real estate, the housing is divided among everyone in equal parts. After this, the legal successors can determine the procedure for use by agreement or through the court.

- The heir who lived with the testator on the day the inheritance was opened can receive items of ordinary home furnishings and household items as part of his inheritance share.

- If the division of inherited property is possible in kind, then payment of monetary compensation to one of the heirs is allowed only if the consent of all other legal successors is obtained.

- The division of indivisible property is possible by selling it, and the proceeds must be divided in equal shares among the heirs of the 1st stage.

- The heirs have the right to enter into an agreement on the division of inherited property, independently distributing shares in the inheritance. Division by agreement is possible without taking into account the inherited shares due to them, i.e. with a deviation from the principle of equality.

- It is prohibited to enter into an agreement on the division of inherited property until the birth of a child conceived during the life of the testator.

- When exercising the preemptive right, the disproportionality of the share can be eliminated by transferring other property or providing any other compensation. But compensation should be provided before concluding an agreement on the division of inheritance.

If you disagree with the division made, you have the right to file a claim in court. You can demand: division of property, separation of your share from the common property, proportionate compensation, transfer of an indivisible thing to your use, etc. The period for filing a claim must not exceed 3 years from the date of opening of the inheritance.

How the inheritance is divided between heirs of the 1st stage - examples

The division of inheritance between primary legal successors is influenced by the following factors:

- Who is the testator?

- Which of the first-line applicants filed a timely application to accept the inheritance?

- How many heirs are there in total?

- Did the testator have dependents?

I will give several examples of the division of property.

Example 1

The deceased's family consisted of his mother, father, son from his first marriage and daughter from his second marriage. Former wives are not included in the circle of heirs by law. Only the children of the testator approached the notary with an application to accept the inheritance.

If all the heirs came to the notary, then each would receive ¼ share in the property. And since only two people submitted an application, they received ½ share.

Example 2

The car was registered as joint ownership with my son. After the death of their father, his two daughters and son came to the notary. The latter has a priority right to receive the car, since it is the only one included in the OSAGO policy.

The car is an indivisible thing - the son will get it, and the daughters will be entitled to compensation.

Example 3

After the death of the mother, half of the apartment remained to her husband as a marital share, and half passed into the inheritance estate. Her husband and two children, one of whom was adopted, each received 1/6 of the apartment.

Since the living space is an indivisible thing, it will remain with the husband, and the children will receive compensation from the mother’s husband for their shares.

Inheritance by adopted children and adoptive parents

According to the law, a person who adopts a child is considered to be his blood relative.

If the question arises of who inherits first - natural children or adopted ones - adopted persons are equal in their inheritance rights with natural children, therefore they inherit the deceased at the same time as them and in equal shares.

At the same time, the adopted person (and his offspring) cannot legally inherit from his biological parents and other relatives. Also, the biological parents of the adopted child and his other relatives by origin do not enter into inheritance by law in the event of the death of the adopted child living in a foster family and his offspring.

An exception is the case when, in accordance with the Family Code of the Russian Federation, an adopted citizen, by a court decision, maintains a relationship with one of the biological parents or other relatives by origin. But this provision does not exclude inheritance to adoptive parents in accordance with Art. 1141 of the Civil Code of the Russian Federation.

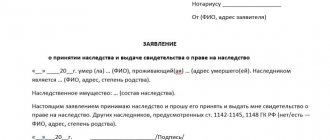

What documents should be prepared for the heirs of the 1st stage?

Be prepared to prove to the notary the fact of a family or marriage relationship.

In order to claim an inheritance, each potential heir or his official representative must provide the notary with evidence confirming the fact:

- Kinship or marriage relationships.

- Dependency.

Prepare originals of the following documents:

- Heir's identity card (passport).

- Certificate from the last place of registration of the deceased.

- Certificate of death of the testator, of the death of his son/daughter.

- Birth/marriage/divorce certificates.

- Certificate of change of surname.

- Certificate of adoption.

- Court decision to establish legal facts, incl. on recognition of paternity, on family ties.

If there is no evidence of a family relationship, the notary may include you in the certificate of inheritance.

To do this, you must obtain the written consent of all legal successors who have submitted documents confirming the relationship and have submitted an application for acceptance in a timely manner.

On a note. If the documents contain discrepancies in last names, first names, patronymics, the notary decides on their significance individually and, if necessary, independently makes a request to the civil registry office.

To confirm the fact of being supported and living with the testator, you will need:

- Certificates from housing authorities or local authorities.

- Income certificates for all family members.

- Documents confirming the regular transfer of money from the testator.

- A court decision establishing the fact of dependency.

The order of succession in the Civil Code of the Russian Federation

The heirs of the deceased are his living relatives, as well as persons conceived during the life of the citizen and born after the opening of the inheritance.

Art. 1142 - 1145 and art. 1148 of the Civil Code of the Russian Federation determines the order of inheritance by law. The inheritance scheme applies to all family members of the deceased, who inherit one after another in accordance with their turn.

The order of inheritance according to law - the scheme in 2021 after the death of the testator:

1st stage - children (natural and adopted), parents, spouses;

2nd stage - brothers and sisters (full, half-blooded, half-brothers), grandparents (relatives);

3rd stage - uncles, aunts and cousins (cousins);

4th stage - great-grandparents (relatives).

5th stage - cousins' grandchildren (i.e. children of the testator's own nephews and nieces), as well as great-uncles and grandmothers;

6th stage - cousins, great-grandchildren, nephews, nieces, uncles and aunts.

7th stage - stepsons, stepdaughters, stepfather and stepmother.

How long must the heirs of the first stage accept the inheritance?

As a general rule, all applicants must contact a notary within 6 months from the date of opening of the inheritance (the day of death of the testator). But in some situations this period may shift.

For heirs of the 1st stage, the following time frames are legally established for submitting an application to a notary for acceptance of an inheritance - Art. 1154, Art. 1156 and Art. 1166 Civil Code of the Russian Federation:

- If there is no will, the basic period of 6 months applies.

- If the heir specified in the will refuses and there are no other heirs under the will, you will have 6 months from the date of refusal.

- The persons appointed in the will were recognized by the court as unworthy heirs - you are given 6 months from the date the court decision to remove the unworthy heirs enters into legal force.

- The heirs under the will did not enter into their rights on time - the law gives you an additional 3 months for registration, i.e. no more than 9 months must pass from the opening of the inheritance.

- The heir under the will died without entering into his rights, and there are no other heirs in the will - submit the documents within 6 months from the date of death of the testator. But if this period turns out to be shorter than 3 months, it is extended to a full 3 months.

- You are carrying the testator's child - it is advisable to immediately notify the notary about this and the division of the inheritance will be postponed. From the date of birth of such an heir, you are given 6 months to submit an application to accept the inheritance on his behalf.

Article on the topic:

What is the deadline for entering into inheritance this year according to the law of the Russian Federation - detailed answer

Is it possible not to share with those who are late?

The notary will divide the property among the heirs who submitted the application within the period established by law. However, late applicants can turn to you and all those who accepted the inheritance for consent to recognize them as heirs. You have the right to refuse their request without even explaining the reasons for such a decision.

You will have to share if the late heirs manage to:

- Prove to a notary or through the court the actual acceptance of the inheritance.

- Obtain a court decision to restore the missed deadline and recognize him as an heir.

All shares in the inherited property will be recalculated. If by this time it turns out to be impossible to return the property in kind, be prepared to reimburse the cost of the part established by the notary or court.

See also:

How to restore the inheritance deadline this year - step-by-step instructions

Inheritance terms for the first stage

The generally accepted period for entering into inheritance rights is 6 months. The countdown begins from the day of death of the testator, or from the date of the court decision declaring the citizen dead. There are a number of exceptions to this rule:

- The six-month period may be extended for valid reasons.

- An unborn heir of the first priority (a child of the testator who was not born at the time of his death) enters into the inheritance after his birth, even if 6 months have already expired.

- If there are no heirs of the first stage, the right to inherit passes to the second stage, and so on. After each transition, the six-month period starts anew.

You will find more detailed information about this in the article “The order of inheritance by law” posted on our website.

FAQ

Q : Who inherits after the death of the father?

A : All his children (including adopted and unborn at the time of opening of the inheritance), legal spouse, his parents and disabled dependents can claim their rights to the inheritance. In the event of the death of the testator's child before the opening of the inheritance, his grandchildren will inherit the share due to him.

Q : How is the inheritance divided between the brothers after the death of their mother?

A : Being the sons of the deceased, the brothers have the right to an equal share in the inheritance.

Q : Who are the first priority heirs if the husband, wife or children die?

A : The wife and children are the heirs of the first turn and they inherit at the same time. The wife's marital share (half of the property acquired during the marriage) must initially be allocated from the inheritance mass. The notary will divide the remaining half between his wife and children in equal shares.

Q : Is the brother of the deceased the first-degree heir?

A : No, brothers and sisters belong to the second priority. After the death of a brother, his children inherit (if one of them died earlier, then his share goes to his grandchildren), wife and parents. Another brother can accept the inheritance along with the first line by proving the fact of his incapacity for work and being dependent on the testator for the last year.

Q : Who inherits property after the death of an unmarried son?

A : If the testator was not married, had no children and did not provide systematic assistance to any of the disabled dependents, his only heirs will be his parents. The mother and father will receive equal shares of the inheritance.

Q : Can a common-law wife receive an inheritance if she has a group 3 disability?

A : Maybe as a dependent. But only if she manages to prove a combination of factors: 1) cohabitation with the testator for 1 year; 2) the amount of one’s own income is insufficient to meet the needs of life.

Q : What will happen to the property if the heir of the first priority does not contact the notary in time and does not declare his rights?

A : Accepting an inheritance is a right, not an obligation. The share of such an heir will be divided equally among other first-line applicants. If there are no such successors, the right to inheritance will pass to the second-order heirs.

Q : Is the wife entitled to a share of the inheritance if the spouse dies during the divorce process?

A : If the decision has not been made or has been made, but has not entered into legal force at the time of death, the wife is considered the official spouse and is the heir of the first priority.

Q : Can a retired cohabitant aged 65 years receive an inheritance after the death of his common-law spouse?

A : Only if he lived with her during the last year of her life, they ran a joint household, and her income significantly exceeded his pension.

Q : Will the only son, after the death of his father, have to share an apartment with his stepmother and her children from another man?

A : Yes, if the stepmother was officially married to her father at the time of death, and her children are minors, and your father supported them.

What to do if a will is written on the property of the deceased?

There are situations when, when opening an inheritance case, it turns out that a will has been written for property or part of the inherited property and one of the parties does not agree or does not recognize such a will and believes that it has full right to the property.

In this case, do not be upset, since you have 2 options:

- invalidate the will;

- receive an obligatory share in the inheritance.

In the first case, it is extremely difficult to invalidate a will, but it is possible, and it is better to do this with an experienced specialist. And the reasons must be very significant.

In the second case, you will still receive the inheritance, but not in full, as if the will had not been drawn up.

Remember

- The first priority heirs are parents, children and spouse.

- All children of the testator, incl. illegitimate and adopted children have equal rights to inheritance.

- If the testator's child dies earlier, his right to inheritance passes to his grandchildren.

- The property is divided equally between all candidates. Grandchildren who inherit the share of their deceased parent divide this share among themselves.

- The surviving spouse should contact a notary and allocate a spousal share in the amount of 50% of the property acquired during the marriage before dividing the inheritance.

- Cohabitants and former spouses can only claim a share of the inheritance as a dependent.

- Disabled dependents of the testator will inherit first if they confirm this status.

Rights of the testator's dependents

Legal heirs are considered disabled persons included in one of the 7 lines of inheritance, who were fully dependent (supported) of the deceased for at least a year before his death. If there are heirs of previous orders, such dependents are called up along with them. For example, such persons include the testator’s sister (2nd stage), a disabled person of group 1, whom he supported at his own expense. She will receive property on an equal basis with the heirs of the first stage, while the inheritance is divided between them in equal shares.

Dependents who are not included in the list of heirs (distant relatives, strangers) have similar rights, but a condition must be met for them: they must live with the deceased citizen at the time of his death. If there are no heirs of stages 1–7, then these persons form an independent 8th stage of inheritance.

How property is divided during inheritance: main points

The heirs are the living relatives of the testator and those conceived during his lifetime. They may also be other persons in respect of whom a will has been drawn up.

As a general rule, inheritance is opened at the last known place of residence of a person on the day of his death.

You can inherit - Art. 1111 Civil Code of the Russian Federation:

- things;

- money;

- securities;

- duties and rights of the deceased.

Unworthy heirs (Article 1117 of the Civil Code of the Russian Federation) who are deprived of parental rights in relation to their deceased child are deprived of the opportunity to receive anything.

There are two types of inheritance and some nuances.

Legally

According to the law, the relatives of the deceased inherit, taking into account the order of priority (Article 1141 of the Civil Code of the Russian Federation). There are 8 lines of inheritance, depending on the closeness of the relationship.

Heirs of 2-8 lines appear only when there are no relatives of the previous lines, or they do not accept the property or refuse it.

To enter into an inheritance, you must submit an application to the notary’s office no later than six months after the death of a relative and attach a copy of your passport. Next, the notary will explain what additional documents need to be provided.

Then, with the issued certificate of the right to inheritance and an application for registration of the right, they turn to Rosreestr.

You can also:

- Contact the MFC in person.

- Send documents to Rosreestr by mail with a list of attachments and notification of delivery.

- Submit an application and documents through the official website of Rosreestr.

The period for registering the right will be 3 working days from the date of receipt of documents by Rosreestr, and when applying electronically - 1 working day. When applying through the MFC, the registration period will be 5 days.

State registration of the right is confirmed by an extract from the Unified State Register, which is valid for 30 days from the date of receipt.

If there is a written will of the testator

A will reflects the persons and the property that a person wishes to leave behind. Relatives are not always recorded on this paper.

It is also possible to indicate sub-designates if the heir:

- will not have time to enter into inheritance;

- will not want to take it;

- will lose such right;

- will be found unworthy.

Those whose name is not in the will do not receive the inheritance, except for those entitled to a compulsory share. The scheme of actions in the presence of a will is similar to legal inheritance.

Who has the right of compulsory share

Not always everything bequeathed goes to the person the deceased wanted, even when he, while alive, formalized his wish in writing.

A group of people defined by law is protected from situations where they may be left without an inheritance. This is due to the degree of their relationship, age and physical capabilities.

The right to a compulsory share (Article 1149 of the Civil Code of the Russian Federation) is secured:

- for children under 18 years of age or older, but due to their health condition are unable to work;

- unable to work as husband, wife, father, mother;

- dependents unable to work.

These individuals will receive at least 50% of what they would have received if there had been no will. This 50% is provided from property that is not specified in the will, and if it is not enough, from the will. The procedure for contacting a notary is similar.

Through the court, you can achieve a reduction in the size of the mandatory share and even deprivation. This will happen if the heir under the will lives in the house or apartment that is bequeathed to him.

However, due to the obligatory share of the above persons, he cannot register them as property, or the property through which he receives his only profit is also subject to division with these relatives.

How to fairly divide an inheritance: shares of heirs of the same order

One of the main principles of civil law is the principle of justice. A fair division of property is between one line of close relatives, persons living together and caring for the deceased.

In the same amount, the inheritance is divided between persons of the same priority. To avoid quarrels and misunderstandings, you should analyze possible situations.

After the death of parents between children

Children are considered the closest relatives of their parents, so they are the first priority heirs. But good relations do not always develop between them.

Therefore, you need to know the rules that determine the order of division of the hereditary mass between brothers and sisters.

Children inherit:

- relatives, from all marriages;

- adopted;

- born out of wedlock, when paternity is established.

If by a court decision the deceased was deprived of parental rights in relation to one or more children during his lifetime, they will still be the first heirs.

Children will divide everything received from their parents equally if their grandparents are not alive. The exception is if one of the children has an advantage, which was mentioned earlier.

It is possible to recognize an heir, including a child, as unworthy. The decision is made by the court when it is proven that the heir deliberately caused harm to health or killed the parent in order to quickly inherit the inheritance. If such a decision is made, the person will not inherit anything.

Otherwise, you can only disinherit your children by bequeathing your property to someone else. Children are then disinherited if they do not have a compulsory share.

Between spouse and children from first marriage

The share of his official spouse is deducted from the property of a deceased man. We are talking about property acquired by a husband and wife.

The notary allocates half to the wife, and the remaining half is divided among other heirs, including the widow.

Sons and daughters from a first marriage have equal rights as primary successors, as does the wife of the deceased. They and their parents will share the remaining half of the inheritance in equal shares.

Between heirs of the first and second order

When there are heirs of the first two orders, priority rights are given to the closest relatives - father, mother, children, spouse. Everything acquired by the deceased will be distributed among them.

Those second in order receive the inheritance if:

- there are no priority successors;

- they refused to accept the property;

- they were found unworthy;

- they are deprived of parental rights.

Under these circumstances, they can write a notarized statement. The same procedure will apply to them. The recognition of an applicant for inheritance as unworthy is proven during a judicial hearing of a claim from an interested person.

After the death of a wife between husband and child

After the death of a woman, her husband and child become the first in line heirs. The man gets half of the joint property (Article 1150 of the Civil Code of the Russian Federation), and it does not matter whether other names are named in the will.

If a woman wrote a will exclusively for her husband, only minors or disabled children will have a mandatory share, otherwise they will not receive anything after their mother.

In case of legal inheritance, the spouse and child become the primary heirs with the same rights and amount of property, of which half of the jointly acquired property has already been allocated.

Special cases when dividing inherited property

At first glance, everything is spelled out quite clearly in civil legislation. However, life is unpredictable, and many heirs have problems taking possession of items.

It happens that property cannot be physically divided. For example, this applies to a car that is part of an inheritance.

There are some nuances that need to be taken into account in order to have time to realize your own rights to your benefit. Let's list typical cases.

Joint property of spouses

Registration of inheritance of property acquired during a marital relationship has certain features. And the Civil Code of the Russian Federation gives clear instructions in this regard.

It is necessary to take into account what is inherited from the property acquired by the husband and wife during the existence of the marriage.

The assets included in the inheritance mass are divided into two large groups:

- Property of a deceased person described by law as personal property.

- The part (usually half) that is in the common property acquired during the marriage.

The allocation of the spousal share in the inheritance may cause additional difficulties. The process depends on the composition of the property, its value, and the presence of debts on issued loans.

Before submitting documents to a notary, it is advisable to conduct an inventory of assets. Having a list of them in hand, it will be easier to draw up an application for inheritance. It is possible that the process of obtaining a certificate will speed up.

Indivisible things

Their fate can be decided in several ways. The most correct of them is the signing of an agreement, by virtue of which one party receives property, and the counterparty receives monetary compensation in the amount of the market value of its share.

In addition, the preemptive right of one of the heirs to the property may be declared in court. Then the court still decides the fate of monetary compensation.

It can be replaced by the provision of other property that is important to the heir. For example, these could be things necessary to realize professional abilities.

If one of the heirs refuses the inheritance

Reluctance to receive property at your disposal must be documented. The refusal can be made both in favor of applicants of the same line, and for persons at the lower levels of legal heirs.

For example, if an heir from the first degree of kinship officially refused, his share is distributed among citizens from this category. Accordingly, there will be an increase in shares.

The easiest way to properly formalize a waiver of inheritance is with the help of a notary. After all, the heir may subsequently change his mind, which will only complicate the inheritance procedure.

By right of representation

This mechanism is used when the heir dies before the main testator or at the same time as him. In this case, the corresponding part of the property is divided among the descendants of the heir.

Here is a visual prime minister. The son predeceased his mother, but left behind two children. Then his share in the future inheritance will pass to her grandchildren and will be divided in half between them.

By right of representation, grandchildren (first priority) and nephews and nieces (second priority) are allowed to inherit. Cousins together with sisters can be heirs in the third stage.

Due to hereditary transmission

It will take place in the case when the heir dies, having submitted documents to the notary on time, but the certificate has not yet been issued. This scenario assumes that the right to a share in the property of the main testator goes to the relatives of the deceased heir.

The notary handles two inheritance cases. One for the property of the first testator, and the second for the assets of the deceased heir.

At the same time, it is possible that two notary offices will deal with inheritance issues. This moment should not be forgotten.

When is a trial needed?

There are several situations in which distribution of inheritance is possible through a judicial procedure. First of all, it is necessary to file a claim for division and materials in court in the case where a citizen missed the deadline for entering into an inheritance.

Along with their restoration, the judge also divides the property. A court will also be required if the task is to confirm the priority right to property. The claim may also concern the recovery of monetary compensation equal to the value of the share.

It may happen that someone will be able to prove the fact of their relationship with the deceased. A court decision will certainly become a reason for the redistribution of inheritance.

How is the division of inherited housing carried out?

How to divide the inheritance? In many cases, the main object of disagreement is real estate (house, apartment, dacha). It is therefore not surprising that residential real estate is particularly controversial.

They may relate to the ownership of the property and the amount of compensation for it. It is not always possible to restore and put in order the title documents, for example, an agricultural land plot, which complicates the process.

The location of the living space, the number of rooms, and the market value matter. And also, you should not lose sight of the number of heirs who submitted documents to the notary.

What needs to be taken into account?

Preemptive right

In relation to real estate, it is enshrined in part three of Article 1168 of the Civil Code of the Russian Federation. It’s worth mentioning right away that the rules on advantages are valid in cases where it is impossible to allocate a share within the residential premises that are the object of inheritance.

Their essence boils down to the fact that the heirs who lived in the disputed premises at the time of the death of the testator have privileges. Moreover, on the day the inheritance was opened, they did not own any other residential real estate.

The benefits of inheritance are confirmed by the court after considering the claim of the interested party. In his decision, he decides the issue of ways to protect the interests of the remaining heirs.

If none of the heirs has a priority right

This situation assumes that real estate between citizens is divided in equal parts. Then they can, by agreement or by virtue of a court decision, determine the procedure for using the housing.

It is possible to provide monetary compensation in exchange for obtaining rights to use the property in full. This option requires a preliminary assessment of the cost of the apartment or house.

You should decide in advance on the procedure for providing compensation. Everything can be spelled out in an agreement between the heirs.

Example of division of real estate between heirs

Let's consider a typical situation in relation to a country house with an area of 70 square meters. m. As a rule, its layout allows for the allocation of an independent share in the future.

Let's say that after the death of a mother, her two children, son and daughter, got a house with three living rooms, a kitchen and a corridor. Due to the rules of inheritance by law, the heirs receive ½ each. For these parts, the notary issues each citizen a certificate of right to inheritance.

Then each of the owners has the right to allocate their share in kind, reconstruct the house and sell it. In this case, the other heir has a priority right to purchase. Cash compensation may be provided.

The meaning and role of a notary

A notary has the most important function when conducting an inheritance case, since it is he who, after collecting and checking the papers, issues a certificate of the right to inheritance.

Within half a year after the death of the testator, an application for the issuance of this certificate is submitted to him, and if the deadline is missed, an application for acceptance of the inheritance.

At the end of 6 months, the notary issues a certificate if during this period he does not identify grounds for refusal to issue.

After completing all the notary’s actions, you can enter into an agreement on the division of inherited property between the identified heirs and define your own conditions in it, taking into account personal interests. The rights of the heirs will be registered by Rosreestr on the basis of an agreement on the division of inherited property and a certificate.

Until all certificates are issued, the notary can protect and manage the inheritance, but not longer than 6 months. When the notary is far from the property, he sends the order to another notary.

An inventory is made, cash is deposited with the notary, currency, securities, and jewelry are sent to the bank for storage. It is possible to draw up a trust management agreement.