Ask a question Order a service

The departure of loved ones is always accompanied by strong feelings. And even several months after such a tragic event, many people cannot return their lives to their previous course. And if the deceased left an inheritance, then instead of joy, serious problems may arise. How to arrange it? When should you contact a notary? How much is it? And is this even necessary?

Notary Yuldasheva T.V. will help you formalize inheritance rights and tell you how to act in the current situation.

Inheritance services

- Urgent opening of a probate case by a lawyer;

- Updating the deadlines for receiving bequeathed property;

- Confirmation of the actual acceptance of the inheritance mass or part thereof;

- Assistance in preparing documentation;

- Recovering lost papers;

- Confirmation of relationship;

- Registration of proprietary rights;

- Search for heirs;

- Search for wills;

- Challenging in court previously drawn up wills;

- Registration of rights to inheritance with consideration of the case in the courts.

Benefits for paying for notary services

When accepting a certain inheritance, heirs with 1 or 2 disability groups pay 50% of the specific tariff for notary services. This benefit is provided to all similar categories of citizen applicants, regardless of the following parameters:

- degree of relationship;

- established share in the inheritance;

- line of official inheritance.

Important! Pensioners of the Russian Federation who do not have 1 or 2 disability groups are not provided with such benefits. In this situation, the state fee for issuing a new certificate of title to a car, private house, communal room or other inheritance is paid in full.

Prices for registration of inheritance

| Assistance in preparing a will | from 8 000 |

| Assistance in allocating a share and justifying the rights to it | from 12 000 |

| Assistance in confirming actual inheritance | from 15 000 |

| Help in dividing the estate | from 25 000 |

| Submission by a lawyer of a petition for the return of deadlines, entry into rights if they were missed | from 10 000 |

| Assistance in challenging a will through court | from 20 000 |

| Assistance in determining the procedure for exploiting common property inherited by citizens, but not divided | from 10 000 |

| Declaring the heir incompetent | from 15 000 |

| Assistance in invalidating a will in court | from 45 000 |

| A lawyer’s appeal in court against a notary’s decision to refuse to register an inheritance estate | from 7 000 |

| Assistance in including the property of the deceased in the estate | from 8 000 |

| Assistance in legal establishment of the fact of relationship | from 12 000 |

| Residential real estate or allocation of a share | from 12 000 |

| Land plots | from 10 000 |

| House and plot of land | from 15 000 |

| Commercial real estate | from 20 000 |

| Garages | from 10 000 |

| Vehicles | from 8 000 |

| Firearms, edged weapons | from 10 000 |

| Bank deposits | from 4 000 |

| Shares, bonds | from 4 000 |

| Share in LLC | from 10 000 |

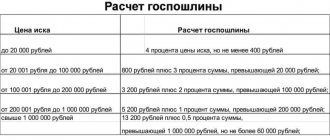

Examples of calculating state duty

When officially accepting a specific property as an inheritance, you need to know how the state duty is calculated in this situation.

Below are two examples. Read also: Place of opening of inheritance

Initial conditions: according to the will, the heir was left a one-room apartment and a dacha. The cadastral value of the first property is 1,000,000 rubles, and the second - 500,000 rubles.

Example #1

According to the will, the husband left his own apartment and dacha to his wife, who was with him until his death. In this situation, the following fee is paid for inheriting a dacha - 1,500 rubles. = 0.3% * 500,000 rub.

When re-registering legal rights to inherited real estate, the widow must go to Rosreestr and pay the following state fees to the budget: 2,000 rubles. - for a one-room apartment and 350 rubles. - to a dacha with an allotment. Total, in this situation, the heiress will pay 3,850 rubles for registration of specific inherited property. = 1,500 rub. + 2000 rub. + 350 rub.

Example No. 2

The deceased testator-grandfather bequeathed his apartment and dacha to his granddaughter, who lives in another city. In this situation, for the re-registration of property, the heiress must pay the following amount of state duty = 9,000 rubles. (to a notary) + 2,000 rub. + 350 rub. (to Rosreestr) = 11,350 rub.

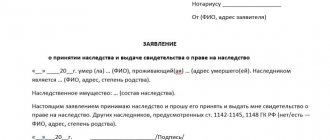

How to register an inheritance

Legal assistance in entering into inheritance rights includes a range of services and is gradual in nature:

- The testator is deregistered due to his death with confirmation of the place where the inheritance will be opened, in particular at the place of his residence before his death. It is expected to prepare documents, which include: an extract from the entry made in the house register, confirming the deregistration of a person, a death certificate, confirmation of place of residence issued by the passport office;

- The inheritance is accepted with the provision of collected documents to the notary's office;

- Preparation of technical, primary documentation, in particular cadastral and technical. real estate passports, purchase and sale agreements, USRN extracts. Lawyers visit the necessary government agencies, such as BTI, registry office, traffic police;

- Obtaining papers confirming the right of inheritance;

- Registration of inherited property when real estate, land, garages are indicated in the will.

Expenses in addition to state fees

In addition to paying a fixed state fee, you will need to pay the notary for services to provide them with legal and technical assistance. Prices for such services are set by the notary himself and are usually available to all visitors to the notary's office at the appropriate stand.

The amount of these services may vary, so it is recommended to check their cost in advance with a specific notary office. The size of these services greatly influences the costs when registering an inheritance.

Functions of a lawyer in inheritance registration

Contacting a lawyer allows you to receive basic assistance, which consists of consulting support, analysis of the current situation and choosing ways to achieve your goal. The lawyer will assist in calculating the share, find a notary, open an inheritance case and register the rights to the property. In addition, assistance is provided with registration, carried out in the following order:

- The heir, together with the lawyer, personally comes to the notary or sends the lawyer himself there, writing out a power of attorney in his name;

- Witnessing the signature in the application submitted by the lawyer by proxy;

- An indication in the power of attorney of the powers vested in the lawyer;

- The legal representative of the heir can represent his interests without a power of attorney.

The lawyer ensures compliance with the procedure for registering rights, guided by Art. 1110 and 1185 of the Civil Code of the Russian Federation, the law “On Notaries”, the Tax Code, in the part that talks about the payment of state fees charged for notarial acts. The lawyer will monitor compliance with the standards prescribed in local acts drawn up by notary territorial chambers regarding the cost of registering an inheritance in accordance with the tariff schedule.

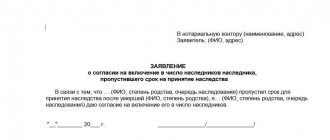

Payment period

Six months are given to register the inheritance, this is the same as the deadline for paying the state fee. But it should be paid only after writing an application for appropriation of the inheritance with a request to issue a certificate. Perhaps the notary will not let the heir through. In this case, as well as when transferring a larger amount than necessary, the client will be able to return his funds.

In some cases, the deadlines for accepting and closing state duty obligations by all participants are shortened or extended. The first is related to the final registration of the circle of heirs and the provision of evidence about this to the notary, and the second is related to legal proceedings between opponents or when challenging a will.

Registration of inheritance through court

Assistance in going to court is relevant in the following situations:

- It is necessary to establish the very fact of succession of inherited property;

- Return of missed deadlines with indication and justification of good reasons, confirmation of the fact of relationship between the deceased and the citizen claiming rights to the property left after him;

- Confirmation that the heir is dependent on the deceased, due to the fact that he is incapacitated or has not yet turned 18 years old;

- Division of property inherited by several people.

Property valuation

This procedure is necessary to determine the amount of the state duty. It is used in the process of conducting an inheritance case by a notary or for entering into an inheritance through the court. Market valuation of property must be carried out only by licensed specialists, otherwise the result of the examination will be invalid.

Why is this procedure needed?

Within the same case there are often several reasons for valuing transferred property. This can be avoided if there is only one heir, and he does not have to compete with other applicants.

Reasons for appointing an examination as one of the expense items when entering into an inheritance:

- drawing up a notarial consent on the division of inheritance (if this does not contradict the will of the testator);

- compensation for the lost share for various reasons (due to the inclusion of a preemptive right, distribution without taking into account the heir, who subsequently defended his right through the court, etc..;

- determination of the amount of state duty.

Inventory and cadastral values were initially intended for other purposes (taxation), but no one directly prohibits using them when calculating state duties.

Where to go

A cadastral extract is issued upon application to the Federal Service for Registration, Cadastre and Cartography, and an inventory extract is issued to the Bureau of Technical Inventory. This can also be done in electronic format on the official websites of institutions. To find out the price for your property, you need to provide the information requested by the service about it.

It is worth knowing how you can apply for information. Alternative methods in Moscow and other regions:

- through the portal “State Services”;

- in MFC departments.

Contacting professional expert services is important if you intend to identify the market value. Professionalism is assessed from the point of view of the existing state license, how long the organization has existed, guarantees for high-quality performance of work (for example, the willingness to defend the result of the work done in court).

Timing of assessment work

The duration of the assessment depends on the volume of work, as well as on how much the private activities of the expert company cost (its tariffs). Regarding the criteria for the assessed inheritance, its actual scope and the method of its production/construction directly affect the timing.

If an object is included in the spectrum of wide consumption and has a lot of analogues on the market, then its assessment is simplified. Exclusive real estate and movable objects, things, jewelry (made to order or produced by the manufacturer in small quantities) are much more difficult to analyze. Often in this situation, the involvement of highly specialized specialists is required.

Registration of inheritance for an apartment

The peculiarity of the procedure is that the apartment can be transferred to the heir only in its entirety, since residential real estate is physically indivisible. Difficulties arise in situations when several people apply for it at the same time. It is expected that the object of inheritance will be registered as shared common property, but at the same time disputes arise related to the procedure for using the housing. Lawyers solve such problems in several ways:

- Establishing a procedure for the use of real estate, fixed in a special agreement or established by the court;

- The shares of other participants in the process are redeemed in favor of one heir with the payment of monetary compensation to them;

- Sale of housing and division of money in accordance with the size of shares due to all interested parties.

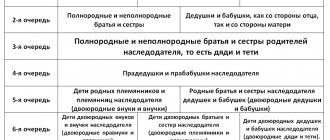

If relatives apply for an apartment, then special rules apply to them:

- Spouses of deceased people, by default, inherit 50% of the property acquired during marriage, and the remaining part of the property can be received by people indicated in the will or who have the right to claim it by law;

- First-degree relatives who always live with the testator in privatized housing and remain there after his death have a preferential right of inheritance in comparison with other claimants to the share who do not belong to the category of owners.

When calculating the price of registering an inheritance, one must take into account that when selling property that is claimed by several people, in order to pay them compensation in accordance with the size of the shares, you will have to pay personal income tax in the amount of 13% of the amount of the signed agreement.

Who is exempt from paying state fees?

For a number of categories of citizens, full or partial exemption from payment of state duty is provided.

Thus, Article 333.35 of the Tax Code of the Russian Federation provides for a benefit according to which disabled people of groups I and II, regardless of the order of inheritance and share, pay 50% of the established tariff.

The same article exempts from full payment of state duty:

- heroes of the Russian Federation;

- heroes of the USSR;

- participants and disabled people of the Second World War;

- Knights of the Order of Glory;

- persons living with the testator at the time of death on the land plot, in the house, apartment or room that are subject to inheritance;

- persons who inherit property from citizens who died in the performance of public official duties or who died before the expiration of a year from the moment of injury, injury or illness received as a result of the performance of these duties;

- heirs of persons repressed for political reasons;

- persons inheriting bank deposits and accounts, insurance amounts, salaries, pensions and monetary rewards for copyright work;

- minors;

- incompetent.