- Right of inheritance of relatives

- Inheritance by a minor child

- Inheritance by adopted children

- How is property divided after the death of a mother?

- Inheritance after the death of a mother without a will

- Inheritance after father without will

- Registration of inheritance after the death of the father without a will

- Spousal share of inheritance

- Grandmother's inheritance without a will

- Grandma's inheritance in order of transmission

- Refusal of the heir from his share

- In what cases can you be left without an inheritance?

- How to register an inheritance with a notary

- What documents will be required from the heir?

- Deadline for registration of inheritance rights

- Features of inheriting residential premises

- Cost of registration of inheritance

- Division of inheritance after the death of relatives

In the overwhelming majority of cases, Russian citizens do not draw up a will in the event of their death, hoping that by law it will pass to close relatives. Indeed, the inheritance after the death of a mother or father without a will is divided primarily between the children, parents of the deceased and his spouse, who make up the immediate family circle. The division of inherited property is carried out according to certain rules that the heirs should be aware of.

Almost all possible situations regarding inheritance of property are described in the Civil Code (Articles 1110–1185 of the Civil Code of the Russian Federation). However, each inheritance case has its own nuances; misunderstanding often causes disputes between family members regarding inheritance. The notary will explain some of the issues to the heirs, and those on which they do not have a common opinion are resolved in court.

general characteristics

The procedure for entering into an inheritance without a will means the voluntary and unconditional acceptance of values (Article 1152). Consent must be expressed documented or confirmed by the actual receipt of things, money, property rights. Previously, the family has the right to familiarize itself with the value of assets and the amount of debts. The decision must be balanced, since it cannot be changed later. Forcing relatives to participate in the procedure for registering an inheritance with a notary after the death of the debtor is not allowed.

It is also impossible to renounce part of the assets. The civil legislation of the Russian Federation provides for the receipt of the entire complex.

The issuance of a notarial certificate becomes the basis for forwarding creditor claims. Along with the deceased’s valuables, his debts are transferred to the new owner. If there are no applicants, repayment is made from the property estate. Unfulfilled claims are considered uncollectible and then written off.

When it is considered that there are no heirs of previous orders

This means the following:

- The successors of the previous queues did not exist at all.

- The heirs of these lines died before the opening of the inheritance or simultaneously with the deceased and there are no heirs by right of representation.

- Relatives of the deceased from among the heirs of previous lines of succession were born alive after the opening of the inheritance, but were conceived after his death.

So, for example, legal successors of the fourth priority inherit if there are no heirs of the first or third priority. Consider the situation:

- There are no first-line successors.

- The second-rank successor did not accept the inheritance.

- And the other third-priority applicant is deprived of the right to inherit.

Consequently, heirs of the fourth order will be called to inherit.

How is an inheritance distributed without a will?

Only relatives can take over rights without documenting the last will of the deceased. The basic rules are contained in Art. 1116 of the Civil Code of the Russian Federation. On the opening day of the case, all applicants must be alive. An exception is made only for the children of the testator. A child has rights from the moment of conception. The registration procedure is suspended. Babies born alive are given an equal share as everyone else.

The main feature is the order:

- Parents, children, spouses (Articles 1142, 1148 of the Civil Code of the Russian Federation). Immediate family members are called first. At the same time, dependents receive a share. The wife or husband loses the opportunity if the marriage has been dissolved by the time the citizen dies. The right to inherit property after the death of a former spouse arises from recipients of alimony (Article 90 of the RF IC). They must live together with the deceased owner for at least 1 year.

- Sisters, brothers, grandmothers, grandfathers (Article 1143 of the Civil Code of the Russian Federation). They can get the property secondarily. Claiming a share is allowed if there is at least one common parent. The fact of living together or maintaining close relationships does not affect the distribution.

- Uncles, aunts (Article 1144 of the Civil Code of the Russian Federation). In the absence of a will in the event of death, they are included in the third line of inheritance. To be included in the number of applicants, one blood relative is enough.

Subsequent queues are listed in Article 1145 of the Code. Conscription is carried out according to the number of generations. The list of applicants is opened by great-grandparents. He is completed by his great-nephews and nieces. The last to be called are stepdaughters, stepsons, stepfathers, stepmothers.

The order and scheme of inheritance of the rights and property of the deceased according to the law is supplemented by specific rules. Thus, it is necessary to take into account the presentation mechanism. If a family member has died by the time the case is opened, his children can take the share.

Heirs scheme

The order of inheritance by law becomes relevant in one of the following cases:

- when there is no will,

- when there is a part of the property that is not included in it,

- when one of the heirs wrote a refusal to enter into an inheritance.

Then the inheritance procedure established by law begins to apply. The queue number of heirs indicates the nature of family ties with the deceased. In the absence of priority applicants, the right to the property of the deceased is received by his relatives from the 2nd to 4th priority:

- brothers and sisters,

- uncles and aunts,

- grandfathers and great-grandfathers.

Then comes the turn for cousins (5th and 6th stages) and stepsons/stepdaughters or stepmother/stepfather (7th stage). Finally, the last, 8th stage has no blood ties with the testator, and the basis for inheritance is living together with him as his dependent for a period of at least a year.

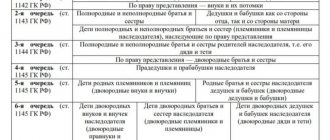

The diagram below shows the relationship between degrees of kinship and the order of inheritance of property.

The distribution of property is governed by two principles.

- In any order, the inheritance mass is divided equally.

- The next queue in order becomes active when there are no participants left in earlier queues.

What you need to know about deadlines

Registration of inheritance without a will is carried out within 6 months. The period is counted from the date of death of the previous owner. An exception is made for cases where the testator is declared deceased. The starting point is the date of entry into force of the judicial act (Article 1154 of the Civil Code of the Russian Federation).

A similar period is established for persons called up as a result of removal from the previous queue. The period is counted from the moment such right arises. If the property was not claimed by the parents, spouse and children of the deceased, other relatives can take advantage of the opportunity after them. Another 3 months are allotted for this.

The notary comments: Example: A widow expected an inheritance without a will from her husband (first priority). However, during the investigation, her involvement in the man’s death became clear. After the verdict was passed, the convicted woman could not lay claim to the assets. Since the testator had neither parents nor children, his brother was called to the procedure. The relative was given an additional 3 months for registration.

The period for entering into inheritance rights without a will after death can be restored. The notary will redistribute the shares if the remaining participants give written consent. If a dispute arises, you will have to go to court. The condition is that the applicant has valid reasons. An exhaustive list of such circumstances has not been established. The following arguments are considered valid:

- Lack of information about the death of a relative, as well as the objective impossibility of obtaining it. The period of inheritance according to the law is not restored to spouses, parents, and adult children if the omission was a consequence of the cessation of communication. Personal hostility is not recognized as a valid reason.

- The incapacitated citizen does not have the opportunity to exercise his rights to register an inheritance according to the law with a notary. This circumstance can be invoked by children under 18 years of age and warded adult citizens.

- Long-term illness associated with stay in a medical organization.

- Misleading a person, deception, threats, violence leading to disruption of order.

The practice of restoring deadlines remains controversial. Thus, not all courts satisfy the demands of persons in correctional institutions. According to the law, deprivation of liberty does not prevent the entry into inheritance rights without a will and the execution of documents. However, in practice, filing an application can be difficult. The servants of Themis approach the consideration of such cases in a comprehensive manner.

FAQ

Q : What is the legal heir of a cousin?

A : The cousin will be the heir of the third priority by right of representation, provided that his parents are not alive at the time of opening of the inheritance.

Q : In what order does the brother of the deceased belong?

A : The brother belongs to the second order of succession.

Q : Is it possible to receive an inheritance by law after death if there is a will?

A : It is possible in the following cases: 1) the will is declared invalid; 2) not all property is bequeathed, but part of it; 3) successors miss the deadline for entering into inheritance; 4) recognition of the heirs under the will as unworthy; 5) refusal of legal successors to inherit under a will; 6) when a person has the right to an obligatory share.

Q : If there are heirs in the first line, what will the second one get?

A : Acceptance of property by successors of the first priority excludes the possibility of inheritance for the second. Except for cases where such heirs are recognized as unworthy, do not accept the inheritance or refuse it.

Q : Is a child a legal heir if his parents were divorced?

A : The child will be the heir of the first priority, regardless of who he remains to live with after the divorce. Divorce of parents does not affect the rights of the child in any way.

Q : After the death of a husband, who inherits without a will?

A : First-degree successors will be involved in the inheritance: his children, surviving spouse, his parents, as well as grandchildren by right of representation (if their parents are not alive).

Q : How is the inheritance divided by law between the first priority heirs?

A : The property will be inherited by the first priority successors in equal shares. An exception to this rule is heirs by right of representation. They inherit only the share due to their deceased parent.

Methods for registering an inheritance without a will

Regulatory documents mention two options. To receive property, it is necessary to submit an application or actually accept the property of the testator after death (Article 1153 of the Civil Code of the Russian Federation). Each method has its own characteristics.

Contacting a notary

If we are talking about real estate, the application procedure is mandatory. Transactions with such objects are subject to state registration. Documents will have to be notarized if you have transport, registered securities, bank deposits, or investment account balances. Family members will be able to use them only after receiving a certificate.

The order is as follows:

- Definition of an authorized official. Registration of inheritance without a will is carried out at the place of residence of the deceased (Article 1115 of the Civil Code of the Russian Federation). In large cities, division into microdistricts, districts, and blocks is being introduced. If there is no information about the address of the testator, the case is opened taking into account the location of the property. If other relatives have previously contacted the notary, you can find information on the official website of the Federal Tax Service of the Russian Federation.

- Submitting an application. Interested parties simply need to come to the office, present identification and voice their intentions. Representatives must act on behalf of minors and incapacitated persons. A document for receiving an inheritance without a will after death can be drawn up in advance or using a notary form. If the application is sent by mail or transmitted through an intermediary, the authenticity of the signature is verified.

- Registration of a certificate. Following the procedure, confirmation of rights is issued. The presence of a notarial certificate allows new owners to register property in state registers.

Inheritance by fact: entry procedure

Acceptance of values can be confirmed by performing certain actions. Their list is given in Art. 1153 of the Civil Code of the Russian Federation and clarified clause 36 of Resolution of the Supreme Court of the Russian Federation No. 9 of May 29, 2012.

To comply with the procedure for entering into an inheritance without a will, moving into an apartment and paying for utilities after the death of the owner is sufficient. Transport is accepted if family members bear the cost of repairing it. The procedure is also observed when filing a claim for the protection of valuables from attacks and repayment of debts. But receipt of a funeral benefit for the testator cannot be considered as confirmation.

The notary comments: Example: A citizen died, leaving behind a comfortable apartment. The testator's adult daughter received benefits and arranged the funeral. The son moved into the premises, paying bills for electricity, gas, and water supply. After 6 months, a dispute arose between the children. Since the inheritance for the apartment was not registered with a notary after the death of his father, he had to go to court for confirmation. The “Servants of Themis” satisfied the son’s demands. It was his actions that evidenced the acceptance of the testator’s property.

You can do without contacting a notary if the existing valuables are not subject to state registration. Personal belongings, household appliances, cash, jewelry - the relatives of the deceased divide them independently by mutual decision.

What evidence will be needed to confirm the notary’s relationship with the testator?

The existence of relationships giving rise to inheritance by law must be documented.

Next, we will consider the nuances of such confirmation.

- Marriage and family relations are usually confirmed by birth/marriage/divorce certificates issued by the civil registry office. If such documents are lost, the civil registry office issues a repeat certificate or a certificate in the prescribed form.

- If the citizen in respect of whom such a record was made has died, then such a repeated certificate may be issued to the relatives of the deceased or to another person.

- When a marriage is dissolved or declared invalid, a certificate is issued confirming the fact of the marriage, which indicates the premarital surnames of the persons who entered into it. Such certificates confirm the fact of family relations between the deceased and the successor if the surname was changed due to marriage.

- If there were errors or inaccuracies in the civil status acts that do not allow one to confidently confirm marital/family relationships, corrections or changes are made to them.

- In the absence of a dispute between the parties, such adjustments are made by decision of the civil registry office upon the application of a citizen in which errors were made. In relation to a deceased person - at the request of his relative or interested party. If there is a dispute, such amendments are made on the basis of a judicial act.

- Documents issued by authorities of foreign states to certify acts of civil status are recognized as valid on the territory of Russia if they are legalized or affixed with an apostille. Legalization means confirmation of the compliance of such documents with the legislation of the state of their origin.

- The property of the heir and testator is confirmed, if stepsons (stepdaughters) inherit - by the Certificate of marriage of their parent with the deceased; if a stepfather or stepmother inherits - a marriage certificate with the parent of the deceased.

- Also, evidence of relationships can be: certificates of these relationships, which are issued by organizations at the place of residence or work; entries made in passports about children and spouse. However, such documents can be accepted as evidence by the court, but not by the notary.

- If it is not possible to confirm the relationship, the fact of its existence can be proven in court. In the absence of a dispute about the right, by filing an application to establish a legal fact (for example, family relations with the deceased, being a dependent). Such cases are considered by the court in accordance with the procedure of special proceedings, and in the event of a dispute - in accordance with the procedure of claim.

Important! Evidence of the relevant relationship will not be required if all other co-heirs who confirmed the relationship agreed to include in the certificate persons who do not have such documents - Art. 72 Basics In this case, consent is formalized in a written statement, which is certified by a notary.

What documents should the heirs prepare?

When contacting a notary, you should prepare a basic package of documents:

- Passport or other identification document.

- Certificate of death of the testator and the death of his relatives.

- Certificate from the last place of registration of the testator.

- Documents confirming relationship with the testator (birth/marriage/divorce certificates, passports with notes on the birth of children, marriage, etc.).

- Certificates of incapacity for work, disability (to confirm the fact of being a dependent).

- Pensioner's ID.

- Court decisions on alimony.

- Bank statements for personal accounts confirming regular transfers of funds by the testator to the heir for a year or more.

- Receipts confirming receipt of funds.

- Certificate from the civil registry office confirming the change of surname.

- Certificate of adoption.

- Judicial acts establishing legal facts.

How to register an inheritance without a will according to law

Notaries adhere to the Methodological Recommendations of the Federal Tax Service of the Russian Federation No. 03/19 dated March 25, 2019. The basis for opening a case is a document indicating the death and the need to distribute the property of the testator. To start the proceedings, a statement from the interested party, someone’s refusal to receive valuables or other requests is sufficient.

The procedure for registering an inheritance case by a notary involves collecting and recording information. Information about assets and potential recipients is analyzed. The corresponding entry is made in the unified register of the Federal Tax Service of the Russian Federation. As part of the proceedings, requests may be sent to banks, tax authorities and other authorities. Telecommunication channels are now actively used. At this stage, the testator is checked for bankruptcy.

Application and attachments to it

This is a mandatory stage of acquiring an inheritance without a will. A written appeal becomes the basis for including a person in the list of property recipients.

A single sample has not been approved. However, the application must contain information about the applicant, date, consent to accept the inheritance, grounds for claims, signature (clause 5.16 of Methodological Recommendations No. 03/09).

The following circumstances and facts will need to be confirmed:

| Presence and degree of relationship |

|

| Composition of property |

|

| Grade |

|

How much does it cost to enter into an inheritance without a will in Moscow and when can you not pay?

The price consists of the state fee for individual notarial acts, as well as remuneration for technical, consulting and legal assistance. The costs of obtaining an intestate estate depend on the valuation of the estate left after death and the number of applicants.

The size of the state duty is established by Art. 333.24 Tax Code of the Russian Federation. To accept money as a deposit you will have to pay 0.5% of the amount, but not more than 20,000 in domestic currency. A certain amount is also collected for protective measures.

The cost of obtaining a certificate of inheritance rights is determined taking into account the type of relatives. From parents, spouses, children of full brothers and sisters, 0.3% of the value of assets is withheld, but not more than 100,000 rubles. When inheriting by other heirs, you will have to pay 2 times more - 0.6% with a limit of 1,000,000.

Remuneration for services is calculated according to tariffs. They are approved taking into account Art. 22.1 Fundamentals No. 4462-1 and rates of the regional chamber.

According to Art. 333.38 of the Tax Code of the Russian Federation, a notary applies a preferential procedure for entering into inheritance. The following are exempt from duty:

- Government bodies. Before transferring rights to public structures, a search for family members and relatives is organized. Only in their absence does the property pass to the authorities.

- Disabled people. The benefit is provided to citizens of groups 1 and 2. They will have to pay only 50% of the established amount.

- Individual. For inheritance without a will in the form of a privatized apartment, as well as a house and land under it, state duty is not withheld. The condition for the norm to come into force is living in such premises before and after the death of the owner. The distribution of property of testators who died in the performance of military, civil, or public duty or who died no later than 12 months after receiving injuries in these circumstances is excluded from taxation. The rule applies to bank deposits, insurance payments, labor and royalties. The benefit applies if the testator received only a pension.

- Incapacitated relatives. Inheritance is recognized as free for minor children and wards with mental disorders.

The benefit applies only to state fees. Related services will have to be paid according to the tariffs.

Issuance of a notarial certificate

Based on the results of the property distribution procedure, each family member is issued a title document. Its form was approved by order of the Ministry of Justice of the Russian Federation No. 313 of December 27, 2016. The law allows a general certificate to be issued for a shared inheritance. The rights of new owners are indicated in the form of simple fractions.

After receiving the document, you can freely use and dispose of the assets. If we are talking about real estate, you will first have to enter information into a unified federal database

The notary comments: Example: After the death of a grandmother who died without a will, the inheritance in the form of an apartment went to her grandson. However, the young man was unable to sell the premises after taking ownership. The notary explained what additional documents he must prepare. Before concluding the transaction, the grandson should have registered the transfer of real estate from the testator.

Other assets may require additional action. Thus, depositories transfer securities to the name of the new owner and pay dividends only after presentation of the certificate. The operation of a vehicle involves registration with the traffic police.

Remember

- Legal successors are invited to inherit not at once, but according to priority.

- The heirs of each subsequent order inherit if there are no successors of the previous orders, as well as heirs by right of representation.

- Hereditary property is inherited in equal shares between successors of the same order. The exception is heirs by right of representation.

- Disabled dependents of the deceased inherit together and equally with the heirs of the order that is called.

- Adopted children and their children, as well as adoptive parents and their relatives, are considered equal to blood relatives and have equal rights with them.

Did you enter into inheritance according to the law and in what order? What difficulties did you face?

Inheritance of part of the property by close relatives, children, guardians, former spouses

The deceased's assets are distributed among family members in equal amounts. Regardless of the call-up order, disabled dependents have the right to count on a share (Article 1148 of the Civil Code of the Russian Federation).

Parents or adoptive parents, biological or adopted children are considered first priority applicants. Lack of blood relationship does not matter. But guardians are not included in the circle of applicants. Ex-spouses are not granted the same rights. Only recipients of alimony who have lived with the deceased under the same roof for at least 1 year can count on a share of the inheritance after the death of an ex-husband/wife without a will.

Joint ownership deserves special attention. The transfer of an indivisible thing to several citizens is permitted. Rights are calculated in the form of simple fractions. The management and disposal of such assets is regulated by Chapter 16 of the Civil Code of the Russian Federation.

If joint ownership is not possible, it is permitted to enter into an agreement on the payment of compensation. The mandatory share of spouses in inheritance by law gives an advantage. According to Art. 1168 of the Civil Code of the Russian Federation, a widower or widow may demand sole use of a thing. Priority is also given to relatives who constantly exploited the property. In addition, household members have the right to claim household items or furnishings of the testator’s living space. In this case, the benefit holders will pay compensation in full.

Spousal share of inheritance

Particular attention should be paid to the situation when the deceased person was legally married.

When inheriting after the death of a wife to a husband (or vice versa), the surviving spouse has the right to allocate half of the jointly acquired property even before the division of the inheritance. It does not include what belonged personally to the deceased mother (father): property received under a gift agreement, acquired before marriage, inherited from parents. This does not deprive the widow (widower) of the right to receive her share of the inheritance after the death of her spouse without a will in the first place.

Example. The father's inheritance (without a will) includes a plot of land and a house, which he received after the death of his mother. Their cost is 2 million rubles. In addition, the apartment and car purchased during the marriage remained. Their prices are 6 million and 1.6 million rubles, respectively. The heirs include a wife and two children. The widow turned to the notary with an application to allocate her marital part and received a certificate for ½ share in the right to an apartment and a car. Thus, the estate included property in the amount of: 2 million rubles. + 3.8 million rub. The widow and two sons of the deceased received a share in the right to inherited property worth 1.9 million each.

What rules of inheritance apply to relatives?

Having a blood connection is far from the only condition for obtaining property. Thus, citizens who tried to prevent the legal distribution of the assets of the deceased are excluded from the list of applicants (Article 1117 of the Code).

Before claiming a part of the inheritance without a will, it makes sense to evaluate your good faith. Parents, adoptive parents, guardians, and trustees who are removed from raising children by decision of a government agency or court will not be able to receive the valuables. Persons who maliciously evaded the obligation to support the testator are subject to exclusion from the circle of applicants.

If one relative evades/refuses to receive property, the shares of other family members increase proportionally. Exceptions include cases of targeted refusal. In this situation, the part of the person in whose favor the document was drawn up is subject to increment (Article 1161 of the Civil Code of the Russian Federation).

Conditions for inheritance by dependents

The very fact that the dependent was supported by the testator must be proven. The following documents are required:

- Documentary evidence of incapacity for work (pension certificate, disability certificate)

- Documentary proof of residence with the testator (if the dependent is not a relative or a relative so distant that he is not included in any line, it is also necessary to prove that he lived with the testator for a year or more, until the day of his death)

Briefly about the problems

The notary not only checks the basis of inheritance rights according to the law among relatives, but also searches for potential recipients. Once the case is opened, written notices are sent. Notifications are given to relatives whose place of residence is known. Additionally, an announcement is published in the media (Article 61 of the Fundamentals No. 4462-1). Thus, even children who have stopped communicating can find out about the death of their parents (father, mother) and, after their death, claim rights to a part of the inheritance without a will. Responsibility for timely treatment falls entirely on family members. In practice, public posting of information is not always sufficient.

Creditor claims remain a serious problem. Thus, not all citizens conduct a preliminary assessment of the testator’s obligations. The result is numerous lawsuits over debts. The solution is to thoroughly check the testator.

Another difficulty is the high level of conflict in relationships. The procedure for inheriting rights to property after death by law (without a will) is supplemented by numerous legal mechanisms. The scheme for transferring things is not transparent. The notary has to remember about transmission, mandatory shares, and work with applicants on the right of representation. Relatives are not always ready for such a multifaceted process. Thus, when taking over their rights after the death of their husband, widows often face claims to part of the inheritance from illegitimate children. The result is heated debate. The solution is dialogue between all participants.

Refusal of the heir from his share

If one of the heirs renounces his share and does not indicate in whose favor the refusal (unconditional) was made, then the property shares of all other legal successors of the called-up order increase. The refusal can also be directed - it can directly indicate to whom the inheritance share of the refusal goes. At the same time, its recipient must be included in the circle of heirs - no matter what the queue is. Refusal of inheritance is made at the notary and is irrevocable - you cannot later change your mind and take your application back.

In what cases can you be left without an inheritance after the death of a parent?

The legislation provides for two grounds, in the presence of which relatives are deprived of the right to inherit.

- The testator himself disinherited one of them. This is stated in the will. Actually, its entire content can be reduced only to this indication.

- The heir is declared unworthy based on a court decision (sentence).

This entails unpleasant consequences for the children of the heirs; they are also deprived of the right to inherit by right of representation. For example, grandchildren cannot inherit from their grandmother if their parent is found unworthy. In this case, they can only receive her property through a will. To recognize an heir as unworthy, compelling reasons are needed.

- He committed an unlawful act (or even a crime) against the testator or other heirs in order to obtain property or increase his inheritance share.

- The claimant to the inheritance maliciously avoided fulfilling his responsibilities for the care and maintenance of his relative. For example, he did not pay his mother alimony ordered by the court.

To confirm the above facts, the notary must be presented with a court decision. Based on this document, he excludes the person from the circle of heirs. If the case of declaring an heir unworthy is considered in court, notarial actions are suspended.

How to obtain inheritance rights without a will through transmission

The mechanism is described in Art. 1156 of the Civil Code of the Russian Federation. The rule applies in the event of the death of a potential recipient of property. The death must be recorded before the end of the 6-month period after the death of the testator. Human rights are transferred to his children, parents, and spouses.

The notary comments: Example: The owner of the apartment had an adult son and daughter. After the funeral, only the man submitted an application to register an inheritance with a notary after the death of his mother. His sister died during childbirth. By way of transfer, a newborn baby was recognized as the recipient of part of the real estate.

The norm establishes a limitation of the implementation of the mechanism to one generation. This means that in the event of the death of the transmission heir, the right to receive the valuables ceases.

Who is the first priority heir?

In the face of the law, the closest bearers of blood ties for the testator are:

- legal spouse;

- children;

- parents;

They constitute the group of first-line heirs. All material assets are divided between them, unless, of course, the deceased bequeathed his property to a third party. Then the first-priority heirs will own the untested part of the property.

Spouse

The marital share is much larger than the shares of the remaining heirs. The spouse retains the right to ½ of the joint property. When dividing the second half of the inheritance, he (she) participates on an equal basis with all other applicants. It should be noted that the law recognizes the rights of only registered spouses. Church and civil marriage, being divorced do not provide the opportunity to receive a spousal share.

Children

If the deceased person supported both natural and adopted children, then both categories have equal rights to receive a share in the inheritance. At the same time, adopted children can no longer claim the property of their biological parents. Unadopted children are not primary heirs - the law classifies them as 7th priority.

A child who has not reached the age of majority has inheritance rights even if he was born after the death of his father.

Parents of the testator

Sometimes it happens that a person’s father or mother was at one time deprived of parental rights and did not raise him. Such parents cannot claim the property of their adult children.

Please note: the law protects the interests of parents who have fulfilled their duty, but are offended by their children: if the testator did not include in the will the father or mother who lost their ability to work, they will in any case receive an obligatory share of the inheritance.

Escheat

Assets unclaimed within 6 months acquire a special status (Article 1151 of the Civil Code of the Russian Federation). After the death of the testator, the property is transferred to the municipality or the state. The condition is the complete absence of relatives or their refusal/removal from the procedure.

The existing real estate becomes the property of the locality. Money, jewelry, and other things go to the state. The transfer of assets to regions is determined by separate laws.

In conclusion, we note that each inheritance case has its own nuances. Before making a decision or going to court, you should consult a notary. Our office receives clients until 9 pm, as well as on weekends and holidays. You can make an appointment by phone or by filling out the application form on the website.

Legal advice

Inheritance under the law is a complex and controversial topic. At the stage of division, disputes often arise regarding the allocation of marital parts, contradictions between natural and adopted children, and other irreconcilable differences. It is very difficult to defend your rights alone. In order not to lose to more “prepared” relatives and to achieve justice during division, contact the lawyers of the portal https://ros-nasledstvo.ru/ for a free consultation

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

123

State duty upon entering into inheritance in 2021

According to the legislation of the Russian Federation on taxes and fees upon entry into...

4

How to restore the missed deadline for accepting an inheritance

The law limits the period allotted for accepting an inheritance to 6 months from...

99

How to enter into an inheritance after death without a will according to law

A will is an act of unilateral expression of the will of the testator, allowing one to determine the future fate...

9

How to enter into an inheritance after the death of a husband

The rules and procedure for entering into inheritance are regulated by the third part of the Civil...

30

What documents are needed to bequeath an apartment in 2021

The reason for drawing up a will is the desire of the testator to clearly identify the future owners...

21

Inheritance of a privatized apartment after the death of the owner by law and will

After privatization, the apartment used on the basis of a social tenancy agreement passes...