About the distribution of shares

The procedure for entering into an inheritance without a will is described step by step in Art. Art. 1142-1145 and 1148 of the Civil Code of the Russian Federation, these documents indicate the order of heirs and regulations. All people who are guaranteed obligatory shares, even if their interests are not taken into account by the last will of the testator, are listed in Art. 1149 of the Civil Code of the Russian Federation. If the will indicates in what shares the property is distributed among the heirs, this is how it will be divided. If the shares are not designated, everyone receives equal shares (Article 1122 of the Civil Code of the Russian Federation).

Important: all children (natural and adopted) from all marriages are equal before the law when dividing the inheritance.

How to register ownership of apartments after a notary?

The final stage of registering an apartment as an inheritance is registering ownership rights in Rosreestr.

You must contact the department after the notary, when you receive the certificate of inheritance. In some regions, Rosreestr does not accept citizens in person, so the application must be submitted to the MFC. A citizen will need to prepare the following documents:

- passport (birth certificate for minors);

- receipt of payment of state duty;

- certificate of inheritance;

- statement.

An official can independently transmit information to Rosreestr in electronic form. In this case, an extract from the Unified State Register with the changed information can be obtained from him. This service is provided free of charge.

Nuances

How to deal with non-privatized inheritance

Non-privatized real estate belongs to a municipal organization. If you inherited such an apartment, you can only use it for its intended purpose - live in it, but you will not have the right to dispose of it. To turn around the situation, you need to privatize it yourself through the courts.

If you are not registered in the bequeathed municipal housing, you cannot apply for it (Article 1112 of the Civil Code of the Russian Federation). If you are registered in it, in order to enter into inheritance rights for such an apartment, you need to sign a new social tenancy agreement (Article 672 of the Civil Code of the Russian Federation).

How to do it?

- Submit an application to the municipal office to which the property belongs.

- Collect certificates and statements confirming that you are registered in the apartment in question and have family ties with the testator.

- Submit an application to the arbitration court with attachments from your personal account and social tenancy agreement or warrant.

Inheritance tax in the Russian Federation has not been levied since the beginning of 2006 - you only need to pay a state duty.

What to do if the inherited apartment has a mortgage?

There are two ways to develop the situation:

- the creditor will agree to the sale of the property - with the proceeds you will be able to repay the debt not paid by the testator before you;

- if you need an apartment and do not want to sell it, after registering ownership of the apartment and entering into inheritance, the responsibility to make mortgage payments will fall on you.

According to Art. 1152 of the Civil Code of the Russian Federation, by accepting an inheritance, you also accept the obligations associated with it. In the case of obtaining a mortgage on an apartment or part of it, we are talking about a credit debt. You will not be able to take over your rights without resolving issues with the banking organization. If the decedent was insured and his death is considered an insured event, the mortgage encumbrance may be removed from you. Please check this point with your legal advisor.

Valuation of property after death

A state fee is paid for inheriting an apartment. Therefore, a housing assessment must be carried out. It has the right to perform:

- private expert organization;

- BTI of the capital.

In accordance with Article 333.25 of the Tax Code of the Russian Federation:

At the choice of the payer, to calculate... the duty, a document may be submitted indicating the inventory, market, cadastral or other (nominal) value of the property.... Notaries... do not have the right to determine the type of value of property (method of assessment) for the purpose of calculating... duties and require the payer to submit a document confirming this type of value of property (method of assessment).

But for Moscow there is a rule established by a letter from the Ministry of Finance of the Russian Federation dated December 26, 2013. It states that notaries can only accept acts with the market or cadastral value of the apartment. To order an assessment, Muscovites contact the following addresses:

| Name: | Central management apparatus of the State Budgetary Institution MosgorBTI |

| Address: | Maly Gnezdnikovsky lane, 9, building 7 (metro stations Pushkinskaya, Tverskaya, Chekhovskaya) |

| Telephone: | 629-02-80 |

| Name: | Second territorial department (main office) |

| Address: | Streletskaya st., 9a (metro station Savelovskaya) |

| Telephone: | Secretary: 656-29-50; 656-27-03 Answering machine: 656-22-19 Reception department: 656-23-16 Reception of individuals: 656-21-26 Reception of legal entities: 656-21-26 Issue: 656-26-52 |

| Name: | Territorial Administration for TiNAO |

| Address: | st. Grina, 12 (metro Starokachalovskaya Street) |

| Telephone: | Secretary: 501-38-30 Expert department: 501-38-32 Deputy Chief: 501-38-33 |

| Name: | First territorial administration |

| Address: | Preobrazhenskaya square, 4 (metro Preobrazhenskaya square) |

| Telephone: | Secretary: 748-13-54; 748-13-73 Answering machine: 748-13-79 Reception administrator: 748-14-73; 748-13-65 Reception of individuals: 748-13-75 Reception of legal entities: 748-13-70 Issue: 748-13-78 |

| Name: | Second territorial department (additional office) |

| Address: | st. Krzhizhanovskogo, 20/30, building 5 (m. Profsoyuznaya) |

| Telephone: | Answering machine: 125-44-14 Department for receiving and issuing orders: 125-21-38 Secretary: 125-87-77 Fax: 719-04-19 |

Additional information can be found on the organization's website.

What to do if you don’t agree with the testator’s decision

Any of the heirs or a notary can challenge a will if the rights of interested parties are violated or the deceased was incapacitated at the time of drawing up the will. You can also challenge the contents of this document if the people in whose favor it was drawn up are recognized as unworthy heirs or missing. It is possible to exclude such people from the order of inheritance even in the absence of a will. Read more about this category of heirs in Art. 1117 of the Civil Code of the Russian Federation. Claims must be addressed to a notary, and then go to court. This requires serious reasons and evidence. Unfounded accusations and suspicions that are not supported by the testimony of witnesses and official papers (certificates, extracts, receipts related to the case) will be few.

Only a court can assign the heir the status of unworthy inheritance of an apartment and other property.

What documents are checked by a notary?

An inheritance case is considered a set of documents necessary to protect the rights of those citizens who act as heirs.

List of required documentation:

- death certificate;

- passport of each applicant;

- certificate from the place of last registration of the deceased;

- documents confirming relationship with the deceased;

- a will (if any) certified by a notary or other persons entitled to do so;

- title documents for property.

The notary must authenticate all documents, register them, then collect them in a separate folder, which is signed according to legal requirements.

The place of opening of the inheritance becomes the address of the last registration of the deceased, regardless of where he died. If he has not been registered, the case is opened at the location of his property.

How not to be left with nothing

Follow the regulations prescribed by law and immediately contact a notary. Consistency and timeliness of actions ensures that your rights are respected. An experienced specialist will help you prepare the documents correctly and take into account all the formalities and nuances. The success of the event directly depends on how complete the package of papers you have and how quickly you collect it. Even if disputes and litigation arise regarding inheritance rights, do not be at a loss, consult with a lawyer. With the right approach, you will get what is due to you.

How to accept an inheritance?

The notary issues a certificate of inheritance, which will become the main document for re-registration of property rights. If there are minor citizens among the legal successors, then their interests are represented by legal representatives.

Which notary should I contact?

The heir must contact a notary in the area where the deceased lived.

If it is unknown, then the case can be opened in the office at the location of the property. When the heir lives in another city or region, he has the right to contact a notary at his place of residence. The official will accept the package of documents and forward it to the office where the inheritance case has been opened.

What documents should I collect?

Before visiting a notary, you must prepare the following documents:

| Target | Name |

| Confirmation of the heir's identity | Passport, birth certificate |

| Documents establishing relationship | Birth certificate, marriage certificate, divorce certificate, adoption certificate |

| Confirmation of the death of a citizen | Death certificate of the testator, court decision |

| Title documents for the apartment | Sale and purchase agreement, donation, certificate of inheritance, privatization documents |

| The value of the cadastral value of the apartment | Extract from the Unified State Register, technical passport, certificate from the BTI |

| Obtaining information about the place of opening of the inheritance case | Certificate about the last place of residence of the deceased, the composition of his family |

The list of documents may be supplemented, depending on each specific case. The notary requests some documents independently via the electronic interdepartmental interaction system.

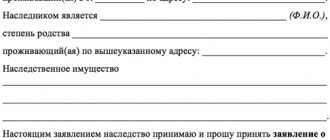

How to write an application?

An application for inheritance is written in a notary's office.

The official may offer a sample document. The legislation does not establish a uniform form. The application must contain the following information:

- testator's data;

- information about legal successors;

- information about the apartment;

- list of attached documents.

A sample application can be viewed here:

Download a sample application for acceptance of inheritance

A notary can issue a certificate to all heirs together or to each of them separately (Article 1162 of the Civil Code of the Russian Federation). Successors may request a document for all or part of the property.

How much do you need to pay?

The cost of the procedure consists of several expense items.

The assignee will need to pay the notary:

- state duty for the apartment;

- services of a property valuation specialist;

- payment to the notary for the actions performed.

The state duty for a property registered as an inheritance depends on its cadastral value. For close relatives (spouses, children, parents, brothers, sisters) it is 0.3% of the apartment price. The maximum amount of state duty is 100,000 rubles.

All other legal successors will have to pay 0.6% of the cadastral value of the estate, but not more than 1,000,000 rubles. The cost of notary and appraiser services depends on the tariffs established in the region.

When registering the transfer of ownership in Rosreestr, you will need to pay a state fee in the amount of 2000 rubles.

Acceptance of an apartment as an inheritance by law

The assignee must bring to the notary a statement indicating that he is an applicant included in one of the eight lines of inheritance. The first one has priority. If there is no representative, and this could be a son, daughter, mother, father, spouse, then the inheritance is transferred to the second stage. Then the third one comes into play, and so on. to the seventh. The share of the apartment is allocated to obligatory heirs.

When registering an inheritance for real estate, it is taken into account that it is impossible to divide the apartment in kind. Equal shares are assigned. Anyone who wants to keep their home completely receives the cash equivalent of their competitors' shares. But this is not the only thing you need to know in order to calculate all the options. Mandatory heirs are:

- Young, minor children. This refers to legitimate children when paternity (maternity) is proven. Also, the apartment is inherited by adopted children after adoption.

- Disabled parents. As a rule, these are pensioners who are unable to continue working due to old age and lack of health. For registration you will need a pension certificate and a certificate from the Pension Fund.

- Dependents who are supported by the testator for at least a year before his death. These are disabled people of the first or second group who do not have a job. This is how the state takes care of citizens in need of social protection.

A lawyer can best tell you how to properly register an inheritance if it is a share in an apartment. The main thing is to understand that each of the listed subjects is in the eighth line of inheritance. When redistributing parts of the inheritance, the obligatory share is equal to that which would have been assigned if the applicant had been the primary legal successor.

First priority assignees

This category includes citizens who have a close blood connection with the deceased. Children inherit the apartment without fail if they are under 18 years of age. In this case, until adulthood, the property is managed by a guardian. Often this is a living spouse. But it is they who must inherit the apartment. They are not given the right to sell, gift, exchange or inherit.

In addition to the child, parents, who are also the first-priority successors, can obtain a certificate of inheritance. Proof of the legality of the claims is the passport and birth certificate of the testator. Adoption is regarded by law in the same way as motherhood and paternity. The stepfather and stepmother are the legal heirs of the first stage, which allows them to enjoy privileges when receiving a share in the apartment.

The wife or husband can register ownership rights. We are talking about legal marriage. At the time of the death of the testator, the bond should not be dissolved. The so-called civil marriage does not provide grounds for the claim. But the presence of a joint child allows you to enjoy inheritance rights, even if for the deceased it is a stepson or stepdaughter. The presence of a marriage contract may imply special conditions that do not allow the apartment to be re-registered, which must be taken into account when contacting a notary.

The first steps of the legal successors

As soon as the life of the apartment owner is cut short, applicants for the property write a statement that must be brought to the notary. Contact the office at the place of residence of the testator. Based on the document, an inheritance case is opened. The legislation allows six months to determine the full circle of persons entitled to claim real estate. The claim is accepted by the court if the notary office refuses to accept the appeal.

In any case, a document confirming the emergence of inheritance rights is provided. But there is a procedure that allows you not to apply to notaries and courts. When actually joining, the fundamental factor is registration under a certificate of the right to inheritance, which is issued by regional, municipal, and district self-government bodies. Prove that you lived in the registered living space, paid rent for the apartment, and maintained its condition during the life of the testator.

After the allotted six months, a certificate is issued giving grounds for re-registration of the apartment. Contact Rosreestr to have its employees make the appropriate notes. In this case, the registering person must pay the state fee and attach the receipt to the application. All provided documentation has legal force. Only in this way is it a sufficient basis for entering into an inheritance and re-registering the apartment as a property.

Paperwork

The transfer of ownership of an apartment by inheritance is carried out on the basis of documentary evidence of the legitimacy of the claims. A number of securities have a limited validity period. Lost documentation will have to be restored. It is important that:

- The text contained comprehensive information without discrepancies or errors.

- There were signatures of authorized persons and seals of authorities.

- Official forms had degrees of protection if the paper required it.

Dates are compared. Part of the documentation package dates back to the owner’s lifetime, other papers are issued after death. The absence of one of the required attributes makes the document void. Even a certificate of the right to inheritance is disputed if there is reason to believe that it was issued in violation of the current legislation, infringes on the interests of the legal heirs, and does not correspond to the rights of the now deceased.

Contacting a notary to open an inheritance case

Registration of an apartment is carried out based on the results of the inheritance case. Only if the grounds are undeniable can it be re-registered in your name. Registration of an inheritance for an apartment begins with the opening of an inheritance case. The importance of the date is that 6 months are allotted for submitting all necessary documents, after which you can receive a certificate of ownership. And the moment of initiation of the case is determined by the date:

- death of the owner of the apartment indicated on the death certificate;

- issuing a judicial act declaring the subject dead;

- specified in the judicial act recognizing the fact of death.

In order for the notary to accept the application, you need to bring papers proving the existence of family ties and an official appeal. The state duty is paid, and the receipt is attached to the papers.

Registration of ownership

The procedure involves contacting Rosreestr. Without this, the apartment cannot be disposed of at your own discretion, since a property right does not arise. This means that without registration, real estate cannot be sold, donated, exchanged, bequeathed, or inherited by law. Those who join write the appropriate application, pay the fee, attach the necessary documents and apply to the district registration authorities.

After 10 days required to verify the information provided, the property is registered under the new owner. Registration of ownership ends on the day the corresponding mark is entered in the register, which indicates a change of owner. The owner is considered to be the successor who has received a notarized certificate based on the results of the inheritance case.

Confirmation of intention to accept inheritance

To obtain the right to an apartment or any other inherited assets, you need to officially confirm the acceptance of the inheritance by performing, as stated in the law, some kind of unilateral action - confirming your consent to accept the inheritance. An alternative is a documentary refusal to accept the inheritance. Everyone is free to decide what to do: accept what is due to them, ignore the fact of inheritance, or draw up a refusal, thereby increasing the share of other claimants to the inheritance.

The accepted apartment is considered officially inherited from the date of notarial acceptance of the inheritance, regardless of when it was actually accepted or registered.

However, the right to accept an inheritance applies only to fully capable citizens who are subject to a will or legislation regulating inheritance issues.

If we are talking about persons under the age of majority or people with limited legal capacity, the very possibility of accepting inherited property depends on whether their parents or guardians provide their consent on time and in writing. On behalf of children under fourteen years of age and incapacitated citizens, inheritance documentation is drawn up by parents or guardians who are responsible for the timeliness of the procedure. The child’s legal representative must come to the notary’s office with the application, and, by the way, in this case, permission from the guardianship authorities or any other services is not required.

- It is worth remembering that babies who were conceived earlier but were born after the death of their father have full inheritance rights (if the baby turns out to be stillborn, the right of inheritance does not apply to him in any way)

.

- If inheritance rights are exercised by citizens of other states or people who do not have Russian citizenship, the same procedure applies to them as to other official applicants.

The first step is to submit a corresponding application to the notary's office. The application can be brought to the notary in person, sent by mail or transmitted through a representative, however, in the last two cases, a notarization of the signature will be required. In addition, you need a document that confirms your representative powers.

When sending an application by mail, it is worth considering the fact that the corresponding letter must be sent before the end of the period allotted for those who want to accept their inheritance in time. Please note that the day of sending will be taken into account, not the day of receipt.

Search for heirs

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The inheritance is divided between claimants who were identified within 6 months after the death of the testator. If the heir did not know about the death of the citizen or did not have time to submit an application, then he loses his property rights.

Extension of deadlines is carried out by the court if there are compelling reasons. For example, a person was abroad or was ill for a long time or was in a hospital. An application for reinstatement of deadlines must be submitted within six months after the reason for absence ceases.

The procedure for searching for heirs:

- Initially, information about known applicants is provided by the heirs. This includes the residential address or place of work of the assignees. You can also find out the necessary information from the will.

- If the initial information is available, the notary sends them a written notice of the opening of the inheritance (Article 61 of the Law on Notaries).

- If such information is not available, the notary can publish it in the media. However, searching for legal successors is not the responsibility of the notary representative.

- As a last resort, a specialist can post information about the search for heirs in the public registry Search for heirs, located on the website of the Federal Notary Chamber.

Allocation of spousal share

On the eve of the division of property, the notary first checks the documents. If it turns out that the property is the joint property of the spouses, then the notary must allocate half of the husband/wife from the total estate.

The right to demand the allocation of the spousal share is granted to the official spouse who was married to the testator at the time of death and the former spouse, if at the time of the death of the citizen 3 years have not passed from the date of divorce.

Example. Citizen M. learned about the death of her ex-husband. At the time of his death, the parties were in the process of signing an agreement on the allocation of shares in joint property. However, they could not come to a common opinion regarding the car purchased during marriage. The document provided for the transfer of 2/3 shares of property to the ex-wife. However, at the time of the death of the second party, the document was not notarized. The woman turned to a notary to allocate the marital share. The notary did not accept the draft agreement as evidence. Citizen M. received ½ share in joint property. The rest of the property was divided among the heirs.

Important! The marital share of property is not included in the inheritance.

Procedure for allocating a spouse's share

| No. | Procedure |

| 1 | The spouse must apply for the allocation of the spousal share |

| 2 | The notary allocates ½ share in the jointly acquired property (if there is an agreement on the allocation of shares or a marriage contract, the size of the shares can be changed) |

| 3 | The specialist issues a certificate of allocation of the marital share |

| 4 | The remainder of the assets is divided among identified heirs |

How does the division of shares occur during inheritance?

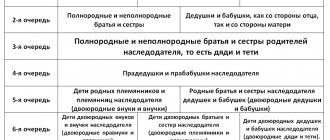

The law of the Russian Federation provides for only 8 succession lines, which must be observed by all applicants for inheritance:

- The first to enter into the right of inheritance are the parents of the deceased, children or spouses;

- The second priority is provided for by blood ties - brothers, sisters, grandparents;

- Uncles and aunts;

- The fourth stage is the right of inheritance through the tribe - the ancestors;

- Cousins in the queue are distributed in the same way as blood relatives - first grandchildren, grandmothers;

- Cousins - great-grandchildren, nephews, aunts, uncles;

- Non-blood relationships - stepsons, stepdaughters, stepfathers, stepmothers;

- Dependents.

Shares are distributed depending on whether relatives at the top of the order have claims to the property. For example, if the natural children of the deceased refused the inheritance or did not express their claims to real estate, the brothers and sisters of the deceased can enter into the right of inheritance with equal rights to share participation. Those. if the deceased had 5 brothers, and each of them claims a part of the property, the court's decision will be to divide the ownership of the apartment between the five claimants. The law does not provide for benefits or preferences for the right of inheritance (disability, retirement age, minors).

| Registration of property rights | Prices in rubles | |||

| Moscow | New Moscow | Moscow region | ||

| Donation | apartment, room, share | 7 000 | 7 000 | 14 000 |

| plot | 12 000 | 13 000 | ||

| plot with house | 21 000 | 21 000 | ||

| parking space | 12 000 | 12 000 | 15 000 | |

| STATE DUTIES WILL BE PAID SEPARATELY | ||||

Stages and subtleties of the procedure

Registration of an inheritance through a notary is carried out based on Fundamentals No. 4462-1 dated February 11, 1993, methodological recommendations of the Federal Tax Service of the Russian Federation and letters from the Ministry of Justice of the Russian Federation. The clarifications of the higher courts are of great importance. For example, the resolution of the Plenum of the Supreme Court of the Russian Federation No. 9 of 05/09/2012 is devoted to the issue. The servants of Themis eliminated many legal gaps and ensured uniformity of practice.

What deadlines must be met?

Article 1154 of the Civil Code of the Russian Federation limits the right to accept property to 6 months. Interested persons must take actions that directly indicate entry into the inheritance after the death of the owner. The decision is made voluntarily. It is prohibited to put pressure on family members and close people of the deceased. There are two ways:

1. Actual receipt of valuables. Confirmation is the incurrence of expenses for maintenance and operation, security, payment of debts of the deceased, and the exercise of powers of management or ownership.

2. Contact a notary. Acceptance of the inheritance is evidenced by the submission of a written application. The document is drawn up in any form and signed personally. A representative can handle the registration if this is expressly provided for by the power of attorney (Article 1153 of the Civil Code of the Russian Federation).

The disadvantage of the first method is the lack of documentary evidence. It will not be suitable if the deceased has real estate, intellectual property, transport, bank deposits, accounts, or securities.

If inheritance rights are subject to state registration, you will have to contact a notary. You cannot do without issuing a certificate if disputes arise between family members or the need to allocate a mandatory share.

The period of 6 months is counted from the date of death. If a citizen is declared dead, the starting point is the entry into force of a judicial act. However, the law provides for special cases:

| Basis of the right to inheritance | Acceptance deadline | Counting rules |

| Refusal or removal of representatives of the previous queue | 6 months | From the moment the decision or certification of refusal comes into force. |

| Evasion of direct heirs | 3 months | After six months from the date of death. |

The court may restore the deadline for accepting the inheritance. However, the person concerned will have to provide a valid reason. The RF Armed Forces recognizes as such a serious illness, illiteracy, and a helpless state. The list is open, but the servants of Themis remain extremely strict in their assessments. References to a quarrel and cessation of communication with the deceased will not be taken into account.

After the expiration of the period, you can take over your rights through a notary with the written consent of the other heirs. In this case, there is no need to go to court (Article 1155 of the Civil Code of the Russian Federation).

Which notary issues the certificate?

The place of registration of the inheritance is determined by the citizen’s registration on the day of death. In the absence of permanent registration, you should rely on the temporary residence address. In exceptional circumstances, the issue is resolved by the court. In Resolution No. 9, the Supreme Court of the Russian Federation recommends taking into account the length of stay of the deceased in one room.

If the address cannot be established, the determining factor will be the location of the real estate or the most valuable movable property. The value of the inheritance is determined by market indicators (Article 1115 of the Civil Code of the Russian Federation). A similar rule applies when the deceased resides outside the country.

Notaries will advise you free of charge on the place of registration of rights. We recommend that you first check whether the case has been opened by other relatives. This information is available on the website of the Federal Tax Service of the Russian Federation. The “Search for Inheritance Case” service will help you obtain a certificate.

What documents will the notary require?

Interested persons are notified of entering into inheritance after the death of a citizen by means of a statement. At this stage you will have to present (Methodological recommendations of the Federal Tax Service of the Russian Federation No. 03/19 dated March 25, 2019):

- identification;

- death certificate.

Sometimes additional documents are required. Thus, when submitting an application on behalf of minors, you must confirm the status of a legal representative. If a notary has doubts about the visitor’s sanity, he has the right to ask for a psychiatrist’s certificate, as well as send a request for legal capacity to Rosreestr.

The next stage of registration of inheritance will be the issuance of a certificate. To do this, interested parties will have to submit an application and annex to it:

1. Grounds for the emergence of rights. You can inherit valuables by will or law. In the second case, you will have to confirm your relationship with the deceased. These include marriage certificates, birth certificates, adoption certificates, and certificates from civil registry offices.

2. Composition of the inheritance. The notary will need documents confirming that the property belongs to the deceased. These include agreements of purchase and sale, privatization, donation, exchange, entered into force court decisions, savings books, passports of technical equipment, copyright patents. If there is real estate left after the death of a citizen, information is requested from Rosreestr. Exceptions include objects acquired by the testator before 1998. The rights to them are certified by contracts, orders, and acts of transfer of ownership. If the objects were built independently, you will have to present a permit. Unauthorized buildings are not included in the inheritance. If necessary, you can search for property through a notary. The service involves sending requests to banks, investment companies, traffic police and other organizations (Article 1171 of the Civil Code of the Russian Federation, letter of the Central Bank of the Russian Federation No. 015-55/8106 dated 10/09/2017).

3. Characteristics of assets. To register an inheritance for apartments, rooms, houses, the notary needs certificates about the residents and technical inventory documents. A cadastral passport must be issued for the land. To issue a transport certificate, you will need a registration card and PTS (if you have a paper document). The amount of savings will be confirmed by bank statements.

4. Cost. Before registration, the inheritance must be assessed. Referring to cadastral indicators is permitted in relation to real estate. In other cases, you will have to rely on market rates. Opinions are issued by independent appraisers.

There is no universal list of documents for registering an inheritance through a notary. The list is compiled individually based on a comprehensive analysis.

How much does it cost to register an inheritance with a notary?

The cost of registering an inheritance consists of a state fee and a fee for legal assistance. Both components are fixed by regulations. The notary cannot increase or decrease the size at his own discretion. The rules for collecting duties are enshrined in Art. 333.24 Tax Code of the Russian Federation. You will have to pay for the following legal actions:

- announcement of a closed will after the death of a citizen;

- issuance of a certificate of inheritance;

- taking protective measures;

- certificate of waiver of rights, application sent by mail, other documents.

The fee will depend on the degree of relationship with the deceased and the value of the property. Tax laws set the interest rate. For siblings, parents, adoptive parents, spouses and children, it is 0.3%. The remaining recipients of the inheritance will have to pay 0.6% of the valuation of the assets. The maximum limits are set at 100 thousand and 1 million rubles, respectively.

The amount of remuneration for legal and technical assistance is established by the Moscow Notary Chamber. The scope of services is also strictly defined. You can find current tariffs in a special section of the website.

Associated costs can increase the cost of registering an inheritance through a notary. Applicants will have to pay for market valuation, production of a passport for technical inventory of real estate, and issuance of certificates.

Article 333.38 of the Tax Code of the Russian Federation exempts individuals from state duty: they do not have to pay if we are talking about premises in which the heir lived together with the deceased. No fee is withheld as part of the registration of rights to bank deposits, unpaid earnings, royalties, pensions. A certificate for the property of a person who died while performing a public, state or civil duty will also be free. For minors, incapacitated people, disabled people of groups 1 and 2, the fee is not withheld, regardless of the composition of the inheritance.

Inheritance of an apartment by will

In general terms, the procedure is similar, with the exception of a key point. When determining the circle of persons, before registering the rights of an heir, notary employees check whether a will has been drawn up. This is a declaration of will, drawn up during life, which contains orders regarding property in the event of sudden death. The document has priority because it expresses the personal wishes of the testator. And within the framework of legislation, the protection of freedoms is the main task.

Many people ask about how to inherit an apartment to obligatory successors. Submit your application to a notary. If he refused to accept it, then file a lawsuit. It is necessary to register ownership of an apartment under any circumstances. Cases that deserve special consideration are:

- The heir died before registering ownership of the apartment. The inherited estate is transferred to his relatives regardless of the number of subjects indicated in the expression of will.

- The successor refused without appointing anyone. This is also possible if it is ignored. The result is a redistribution of the due share in equal parts among the receiving persons within the framework of the expression of will.

- The assignee assigned the property to a specific citizen. The distribution process is carried out in accordance with the expression of will and the conditions of refusal. The exception to the above is sub-appointment.

- The testator provided for such situations and included in the text a sub-designated successor, who becomes an heir if situations conducive to this arise. Then the designated person becomes the owner of the apartment after registration of the inheritance.

In any case, the determining factor in registering ownership rights is the voluntary desire to obtain an apartment, re-register the inheritance, and become its owner. A written expression of will is required.