27

Acceptance of an inheritance left after the death of a close relative occurs by contacting a notary office. The heirs will have to decide on the existence of a will, the number of applicants for the property of the deceased citizen, prepare a package of documents and pay the state fee. After receiving a certificate of inherited property, relatives will only have to register their ownership rights. Let's look at how to fill out an application for inheritance under the law after death.

Which statement to choose

The form of the application depends on the final position of the heir. A claimant to the testator's property may:

- Take your rights.

- Completely renounce the inheritance.

- Transfer property to another relative.

Each legal action is accompanied by the filing of a specific document. If the heir is interested in accepting the property, then he needs to submit a corresponding application.

Based on this document, the notary opens an inheritance case. Other heirs are also given 6 months to submit the necessary documents.

Where is the received property registered?

Until the opening, all inherited property remains the property of the testator, so it is impossible to claim it during this period. After the death of a person, his property (inheritance) requires determination of the owner within a regulated period (usually 6 months).

The inheritance, which has already been transferred to the status of property, is registered in the same way as in other transactions. Accordingly, first the data is entered into the database of federal services: state. registration, cadastre and cartography, traffic police, etc. To do this, a person, together with a portfolio of documents (personal and property), is required to submit an application for registration of such property.

How to correctly write an application for inheritance

The law does not contain a unified form of the document. Each notary office has its own sample application.

Design rules

| No. | Rules |

| 1 | The text can be typed on a computer and printed using a printer |

| 2 | It is acceptable to write the application by hand. The document form is filled out with a regular blue or black ballpoint pen. |

| 3 | The last name, first name and patronymic of the heir are written in full |

| 4 | Street names are not abbreviated. For example, “st. Leo Tolstoy" and not "st. L. Tolstoy." |

| 5 | There should be no blots or corrections in the text |

| 6 | The list of inherited property is described in a column |

| 7 | The document must be clear and free of ambiguity |

| 8 | The applicant's signature is not certified by a notary if the document is drawn up in his presence |

| 9 | If the form is sent by mail from another city, then the heir will need to visit any notary and have his signature certified |

Important! An application for acceptance of an inheritance can be issued individually or together with a request for the issuance of a certificate of inheritance rights.

By will

The presence of an administrative document gives the heirs an advantage over other claimants to the property. In effect, the will eliminates other heirs.

An exception is the obligatory share in the property of the deceased, which is due to socially vulnerable persons:

- young children;

- disabled parents;

- dependents of a deceased citizen.

The procedure for entering into inheritance under a will is the same as under the law. However, there are some peculiarities.

Interested parties need:

- Submit a written application to a notary.

- Pay the state fee.

- Order a property assessment.

- Obtain a certificate of inheritance.

- All that remains is to register ownership.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

An application for inheritance under a will can only be submitted if you have the original expression of will. The successor must confirm his exclusive rights to the property of the deceased, excluding relatives from the list of recipients.

In the absence of a document, the successor must contact a notary to search for the will in the Unified Notarial Register. The specialist will inform you of the location of the expression of will. The heir must apply for a duplicate.

If inheritance occurs under a will drawn up in emergency conditions, then a court decision establishing the fact of an emergency situation must be attached to the documents. In addition, the details of the court decision must be reflected in the application.

By law (without a will)

If the testator did not leave a will, then the inheritance of his property is carried out in order of priority. Close relatives – parents/children/spouse of the deceased person – have priority rights.

Documents are submitted to the notary in the general manner. To do this, relatives are given 6 months . If none of the applicants shows interest in the testator’s property, then the right of inheritance passes to the 2nd line relatives.

In an application for inheritance, according to the law, the heir must indicate not only his own data, but all citizens who have rights to the property.

Example. After the death of his father, his son turned to the notary office. In the application, he must indicate citizens who also have the right to enter into inheritance as legal successors of the 1st stage. These include the parents, children and spouse of the deceased. The man indicated the details and addresses of his mother, brother and grandmother.

Refusal to provide information about other heirs or concealment from them about the procedure for entering into inheritance may be regarded as an attempt at fraud in order to increase one’s share in the inherited property.

As a result, persons whose rights have been violated may go to court to declare such an heir unworthy. By court decision, the citizen will be deprived of inheritance.

If the heir is a minor

The official guardian will receive the inheritance certificate. More often it is one of the parents. The right of inheritance involves receiving a mandatory share if the father or mother of a child dies. This is valid even if the will is in the name of another person. The peculiarity is that the manager of material wealth will be the guardian until the legal successor comes of age. And in order to renounce a share in the inheritance, you will have to write an application to the guardianship council, which must give permission.

If you involve a trusted person, you will have to draw up the appropriate paperwork. Until the age of 18, citizens do not have the right to sign legal documents, or rather, their autograph is considered invalid. A guardian who has sufficient rights must file the application. The reasons are indicated in the text. Relevant documentary evidence is attached. All operations are performed by the guardian, the child is exempt from paying taxes and duties.

Categories of legal representatives

There are several categories of persons who have the right to represent the interests of children:

- Parents . They act on the basis of family ties. Proof: birth certificate and passport. The authority is valid subject to legal capacity.

- Adoptive parents . They have the same rights and powers as their relatives. The evidence base and possibilities are similar.

- Guardians . They act on the basis of documents confirming the acceptance of guardianship and issued by the guardianship council.

- Specialized lawyer . Works on the basis of a notarized power of attorney with a list of powers.

- Trustees . Valid if the board of trustees gives permission for what is indicated in the documentation.

No one else can be responsible for a child, accept an inheritance, or write a statement of refusal.

Existing nuances

Registration on behalf of a child does not mean acceptance in one’s own name. The right of ownership is acquired by the heir, and the guardian is only a manager, and this is more of an obligation than a right. It is necessary to pay off rent arrears if you are registering housing, pay taxes if you are purchasing a car, etc. It is necessary to maintain the proper condition of the property, spend money on repairs and maintenance. Only the legal successor will be able to sell, donate, or exchange when he turns 18 years old.

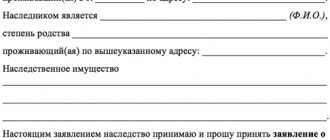

Sample application to a notary for acceptance of inheritance 2021

The document must indicate the following information:

- The name of the notary office where the inheritance is registered.

- Information about the heir (registration address, full name).

- The name of the document on acceptance of inheritance.

- The date of death of the testator and indicate where the deceased person lived.

- Information about the presence of family relations with the testator.

- Additionally, the residential addresses and details of other applicants are indicated.

- Inventory of property that remains after the death of a citizen.

- If there is only one heir, then below you need to write that there are no other heirs.

- Date, signature of the applicant.

Providing the notary with a package of documents

Documents for registering an inheritance should be presented to the notary both during the initial consultation and during subsequent visits. However, the complete package of papers must be provided precisely upon the discovery of the inheritance. This is explained by the need not only to verify one’s identity, but also to prove membership in the inheritance procedure, as well as the death of the testator.

Can this be done by proxy?

A trusted person is allowed to represent the interests of the heir. The most important requirement for such representation is the use of a power of attorney, which will specify the possible functionality. It must be formalized by a notary. There is no need to have serious difficulties for this (illness or long-term stay abroad).

Registering an inheritance through representation of interests is permitted in Russia by law, as specified in Art. 1153 Civil Code. At the same time, it is not necessary to make such a power of attorney to parents of minor children (natural or adopted) or to any established trustees of disabled people (with 1st and 2nd disability groups). They initially represent the interests of their clients for other reasons.

Where to submit an application for acceptance of inheritance

An application for acceptance of inheritance is submitted to a notary's office. This can be done within 6 months from the date of death of a close relative or testator.

The document can be submitted:

- By personal contact. Heirs can contact the notary at the same time or at different times.

- By post . It is advisable to send by registered mail with a description of the attachment. To have proof of sending a specific document.

- Through a representative . The only condition is the presence of a notarized power of attorney, indicating the relevant powers. The services of a representative are relevant if the heir is a busy person or lives in another region of the country.

When should you go to court?

It is rare to resort to this option, but there are also situations in which there is no other choice. Most often, this situation arises if you are the direct heir of the deceased, but you do not have all the necessary documents that would confirm this fact. Or these papers are available, but errors were found in them, which makes them invalid.

In this case, the only option is to file a lawsuit . His decision will secure your right to inheritance. For these purposes, it is worth drawing up an appropriate statement of claim for inheritance. Along with this, other heirs will be defendants to the lawsuit. If the court makes a positive decision, then the share of the inheritance will be distributed to the heirs by reducing their share of the inheritance.

In addition, you will have to confirm your relationship with the deceased. It can be proven both by certain documents and by genetic testing.

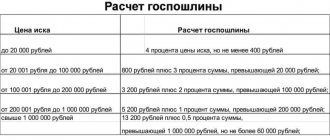

The value of the claim cannot be determined, since it is of a non-property nature. But you will have to pay a state fee of 200 rubles.

It is also possible to go to court with claims to establish the fact of acceptance of an inheritance and to recognize property rights through inheritance.

Which notary should I apply for acceptance of inheritance?

The choice of a notary office for opening a hereditary business depends on a number of conditions. Which notary to contact:

- Typically, heirs need to contact a notary at the place of residence of the testator.

- If the residential address of the deceased citizen is unknown, then you can contact the notary office at the location of the property that belongs to the deceased citizen.

- If the property is located in different places, then it is allowed to submit documents at the location of the most valuable property.

- If there are several notaries in the area of residence of the deceased citizen, the application can be submitted through one of them. You can clarify the details of submitting an application by calling any notary. The addresses of notary offices are published on the website of the Federal Notary Chamber.

- If the notary refuses to accept the application. Then the successor must apply to the court with a claim to establish the place of opening of the inheritance. After which, you need to contact the office determined by the court decision.

Underwater rocks

Relatives of a deceased citizen may face various problems:

- Drawing up a statement of claim requires legal knowledge. Citizens are not always able to correctly motivate their demands on the defendant. Therefore, it is recommended to consult with specialists before filing a claim in court.

- An inheritance case is opened after one of the legal successors writes an application. The notary's duties do not include searching for other citizens claiming the property of the deceased. He can notify other heirs about the opening of a case only if he has information about them. If a deadline is missed without a good reason, citizens may lose their part of the inheritance.

- If there is a will, those who are entitled to an obligatory share can also apply. These are minors and incompetent relatives of the deceased. The obligatory share is allocated to citizens who were dependent on the deceased for at least one year before death. The remainder of the property is distributed among the legal successors specified in the will.

Submission deadline

The countdown begins:

- from the date of death of the testator;

- from the date of entry into force of the court decision.

However, each category of heirs has its own rules. Let's consider several situations:

- 1st line relatives, by law or will, must submit documents no later than 6 months later .

- Heirs of the 2nd stage come into their rights after the deadline for accepting the inheritance for the previous stage has expired. They are also given a 6 month period .

- If the inheritance occurs by transmission and the heir has less than 3 months to submit documents, then the deadlines are increased by another 3 months .

- If inheritance of property occurs as a result of the refusal or elimination of a first-line relative, then applicants for the inheritance are given 6 months from the moment such a right arises.

Missed deadlines can only be restored in court. The only exception is the consent of all participants to include one more relative among the heirs. In this case, you can enter into an inheritance even after the expiration of the 6-month period .

Nuances of inheritance

Receiving an inheritance is good news for many until they are faced with certain conditions for entering into property rights. Thus, Article 1110 of the Civil Code of the Russian Federation states that the hereditary mass passes to the heirs in the order of universal succession. But many people don’t know what this term means.

Meanwhile, by this term, legislators understand the acceptance of the entire hereditary mass, no matter what it is expressed in, and no matter where it is located. In turn, an inheritance, by virtue of Article 1112 of the Civil Code of the Russian Federation, can include both movable and immovable property, as well as certain obligations, debt, for example.

That is, the heirs cannot choose from the common property of the deceased what they like. If they agree to enter into property rights, they will also have to accept obligations. For example, if the testator executed a mortgage agreement during his lifetime, but did not manage to repay it in full, the heirs will have to close the loan if they do not want to lose the apartment, which is pledged to the bank until the loan is repaid.

Also another feature is the inheritance legal relationship between the testator and unworthy heirs. After all, the situation can develop in several directions.

Thus, some relatives may go to court to recognize the same son of the deceased as an unworthy heir, citing conflicting relations between son and father and refusal of financial assistance. But in pursuance of Part 2 of Article 1117 of the Civil Code of the Russian Federation, malicious evasion of obligations must still be proven. In other situations, it is necessary to confirm the illegality and intentionality of actions directed against the testator in court.

Also, the same son may have committed unworthy acts in the past during his father’s lifetime and was even found guilty, for example, of assault, but then the father, after unfavorable events, still included him in the will, determining a share in the property. In such a situation, within the framework of Article 1117 of the Civil Code of the Russian Federation, a young man can claim an inheritance on completely legal grounds.