Home / Family law / Inheritance

Back

Published: 08/08/2018

Reading time: 9 min

0

903

The procedure for entering into an inheritance after the death of the father can have two main options: if the father left a will for the apartment, or if there is no will. If there is a will, it is given priority, but even when there is no such document, the children have the first right to the father's property after his death.

- Who takes over the inheritance after the death of the father without a will first?

- How to receive an inheritance after the death of your father

- The procedure for accepting and registering an inheritance for an apartment without a will

- Documents for registration of inheritance for an apartment

- Features of inheriting property without a will

- Registration of inheritance through court proceedings

Deadlines for accepting an inheritance by law and will

Article 1114 of the Civil Code of the Russian Federation of 2001 provides for the concept of the period for opening an inheritance. This is the moment from which relatives can contact a notary with a handwritten application to open an inheritance. As a general rule, this is the date of death of the citizen. That is, the next day after receiving a death certificate, you can contact a notary, and the total period for entering into an inheritance begins to be counted from the day of the citizen’s death.

In addition to biological death, the second basis for obtaining inheritance rights is the recognition of a person as dead in court. When making a final decision, the court indicates from what day the person is considered dead. From this time on, the general inheritance period will begin, but you can use a court decision and contact a notary only after the document enters into legal force, that is, 30 days after the decision is announced.

If the testator and heir die at the same time, they cannot claim each other's property. The same applies to their legal successors. Only direct relatives of a person or other participants specified in the will are involved in inheritance.

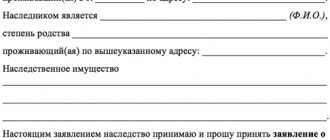

Registration of inheritance rights occurs only in relation to people who have submitted a handwritten application to the notary to open an inheritance. This must be done within 6 months from the moment the grounds for inheritance arise.

What affects the timing of inheritance registration?

The procedure for acquiring property rights to inheritance consists of several stages:

- opening of inheritance;

- accepting applications from potential candidates;

- receiving and processing documents;

- production of a notarial certificate for subsequent re-registration of property rights.

In practice, circumstances may arise in which at each of these stages a suspension of registration or an increase in time for it is required. The total duration of the process is influenced by the following factors:

- the date of filing the appeal of each of the heirs (each person has six months to prepare the appeal, without taking into account the situation when this time is extended by 3 and 6 months);

- increasing the period for collecting necessary documents that the testator or potential recipients of property did not have.

From what date is the inheritance case considered open?

The procedure begins when at least one of the deceased’s close relatives submits an application to the notary to open an inheritance. After receiving and registering the application by a notary, the inheritance is considered open. This can be done only after the death of the testator or recognition of him as deceased in court with the provision of supporting documents.

These rules are the same for receiving property by will and in accordance with the legal order.

Suspension of the inheritance period is possible if a child of the deceased testator is conceived but not yet born. The passage of time is suspended until the baby is born and a birth certificate is issued. Next, the child’s legal representative enters into the inheritance case and protects his rights.

Is it possible to receive an inheritance before 6 months?

Article 1163 of the Civil Code of the Russian Federation provides that a notary can prepare a certificate of inheritance earlier than six months only if there is accurate information that there are no other claimants to the property and there will be no disputes about the property and no one’s rights have been violated.

The heir himself must prove the absence of a dispute and the possibility of obtaining a certificate earlier.

Inheritance and its methods

The property rights of the testator are transferred according to the law, as well as the will. In addition, a legal successor may enter into the inheritance partially.

- Law. The real heirs accept the property based on the queue. The primary legal successors are the father and mother, children, husband and wife. The identified inheritance is divided into equal parts among the recipients. The heirs do not have advantages regarding the personal property of the testator. Together with the 1st line candidates, the inheritance is transferred to the dependents of the deceased citizen, who, by law, are entitled to the same share as the heirs. The legal successor will have to confirm this important legal fact. If the dependent is disabled, you will need to collect all documents indicating the status, being supported by the deceased and, accordingly, cohabitation.

Note. Regarding property that was acquired jointly, it is divided into equal parts between the spouses. The allocation of the marital share is carried out before the actual division of property between legal successors. According to the recipient's application, the notary issues a certificate. The remainder of the assets is divided among relatives who timely submit papers to receive the inheritance.

- Will. The composition of citizens entering into inheritance is completely different. The first-priority candidates are by no means always listed among the legal successors. The testator has the right to exclude all relatives from the inheritance, both partially and completely. He is able to write off the inheritance to his wife, removing the children from this property. In addition, the owner can transfer his assets to the state or a legal entity.

Note. The testator has the right to draw up a will in accordance with the fulfillment of certain obligations, that is, the acceptance of property with a condition. To control the heirs, the owner of the assets is able to attract an executor.

The freedom of expression of a citizen is limited only by the rule of compulsory share.

Deadlines for actual inheritance

Article 1153 of the Civil Code of the Russian Federation provides for different ways of accepting an inheritance. The first is submitting an application to a notary, and the second is the actual acquisition of inheritance rights. Upon actual acquisition, the heir does not apply to the notary, but carries out one of the following actions:

- continues property management;

- uses measures to preserve property;

- protects property from attacks;

- independently covers the costs of maintaining the facilities;

- voluntarily and promptly repays the debts of the deceased testator that relate to the property.

The heir must begin to carry out these actions immediately after the death of the testator, that is, during the first six months. These actions must be documented in order to be able to obtain a notarized certificate for the re-registration of property rights in the future.

When actually accepting an inheritance, you can contact a notary for a certificate at any time, even after 6 months, provided there are no property disputes with other participants in legal relations.

If a person actually accepted the property, but the inheritance was opened on the initiative of another relative, who, after six months, received a notarial certificate for this property, then the conflict must be resolved in court.

Entry into inheritance after the death of a brother by will and by law

What documents does a notary need to enter into an inheritance according to law and will?

Is it possible to register an inheritance if the father got married before his death?

Registration of marriage relations leads to an increase in the number of heirs.

However, in practice, the distribution of property takes into account the following factors:

- existence of a will;

- minor and/or disabled children/parents/dependents;

- the presence of joint property of the spouses.

If the deceased father managed to acquire movable or immovable property together with his wife, then such property is their joint property. Consequently, the spouse's share is allocated from the inheritance mass.

The rest of the property is divided among the heirs who submitted the application. If the assets of the deceased citizen were his personal property, then it is all included in the estate.

Example. Citizen G. was a widower and raised a son. After some time, he remarried. 2 years later the man died. The testator had a personal apartment and a bank deposit. On the day of death, the man lived with his wife. His son was a 3rd year student at a university and lived in another city. The 1st line heirs according to the law include the spouse and child of the deceased citizen. The testator's parents died before he did. When filing an application with a notary, it was determined that the deceased person did not leave a will. Consequently, the property of an intestate testator is divided equally between his wife and son. If the testator left behind an administrative document and bequeathed the apartment to his son, and the contribution to his wife, then the woman’s claims to part of the apartment would have no legal basis.

Inheritance contract and terms of acceptance of inheritance

In 2021, a new mechanism for obtaining property rights to inheritance began to operate. This is the drawing up of an inheritance agreement. The agreement is drawn up before the death of the testator between him and the future recipient of the property. The agreement is signed and registered with a notary.

The execution of the agreement begins only after the death of the testator. The execution can be requested by the heir specified in the contract, the involved executor or legal successors of the heir, or the notary who opened the inheritance case.

Within 6 months from the date of death of the testator, the notary gets acquainted with the inheritance agreement, involves the heirs, acquaints them with the rights and consequences, and checks whether the deceased person has property rights to the property specified in the agreement. That is, it confirms the possibility of further implementation of the contract.

After this, the heir either refuses the agreement or completely accepts it and begins implementation. This can be done within six months allotted for opening the inheritance. In the absence of conflicts and disputes with other participants in legal relations, a notary can prepare a certificate of inheritance earlier than 6 months have elapsed.

Cost: taxes and duties

When applying to the notary chamber, the applicant, in case of planning expenses, should take into account the payment for the services of a state representative who accepts documents and draws up a certificate of inheritance according to the law. The cost is formed in accordance with the internal established prices of the organization.

A mandatory payment to obtain the right to become the owner of real estate is a state duty, which is commensurate with the valuation of the property. Clause 22 of Article 333.24 of the Tax Code determines its size:

- heirs of the first and second stages are set at 0.3% of the value of the property, the amount does not exceed 100 thousand rubles;

- recipients of the remaining queues pay 0.6% of the property price, which does not exceed 1 million rubles, to the state treasury.

The main costs when carrying out the inheritance procedure are contained in property valuation (from 5 thousand rubles), state duty (0.3 or 0.6% of the cost of an apartment or house), notary services (from 2000 rubles).

Extension of the period of entry into inheritance

Circumstances that make it possible to change the period of inheritance:

- It is allowed to increase the time of inheritance by 3 months if the heir died before accepting the property, and his right is transferred to the successor. This applies to persons who received the right of inheritance due to the absence of an application for opening an inheritance on the part of other candidates, as well as second-degree heirs, provided that relatives of the first degree did not submit an application to receive the property on time.

- The time for receiving an inheritance is extended by six months for successors who acquired inheritance rights after the death of the failed heir, if at least 3 months remain before the end of the main period for acquiring inheritance rights. If the property of heirs of one line is abandoned, the values are transferred to relatives of the second degree of kinship, while the time of inheritance is extended by six months.

The interested heir prepares supporting documents and a handwritten statement and contacts the notary conducting the proceedings.

The lawyer checks the accuracy of the documents, confirms the possibility and legality of extending the established period. On such a decision, a corresponding decree of a notary is made, which is attached to the inheritance case and announced to other participants in legal relations.

How to take ownership of property not inherited by your father

After the death of parents, their property legally goes to their children. If children die before accepting the inheritance, then hereditary transmission or the rule of representation of heirs applies. It all depends on when exactly the relative who was entitled to the property died.

Example. The couple got into a car accident and died before doctors arrived. The house was left behind. Their son was the only heir. The man submitted the necessary documents to the notary on time. After 4 months, the heir died. The deceased citizen had 2 children. In such a situation, hereditary transmission operates. That is, the children of a deceased father inherit the property of his parents instead of him. Each child gets ½ of the house. The period for acceptance of the inheritance by the grandchildren of a deceased couple can be increased to 3 months.

Restoring a missed deadline for accepting an inheritance

If one of the heirs missed the allotted time to receive property, this can be resolved peacefully. To do this, the candidate collects a statement from each established heir stating that they are not against the recalculation of property. After this, all applications are transferred to the notary, who resumes enforcement proceedings and recalculates the property, taking into account the interests of all persons.

If one of the participants has already re-registered the property right to transport or real estate, then a new notary certificate of inheritance is sufficient grounds for making changes to Rosreestr and the State Traffic Safety Inspectorate.

If it was not possible to avoid a conflict, then the interested candidate prepares a statement of claim in a federal court of general jurisdiction located at the location of the property or in the region where the inheritance was opened by a notary. The claim is supported by documents indicating the existence of valid reasons for missing the deadline.

The court considers the appeal and makes a final decision. If the claim is satisfied, the judge revises the list of property and re-divides it taking into account the requirements of the law. The final decision is submitted to the notary, who confirms it for execution and prepares the notarial certificate.

Valid reasons for missing the deadline:

- the heir did not know and could not know about the person’s death;

- lack of information about the existence of a will;

- the heir is incompetent;

- the potential candidate for the property is a minor;

- long-term illness with hospital treatment;

- surgical treatment;

- military service under contract;

- emergency service;

- business trip;

- living in another country.

The court will consider the statement of claim only if, within six months after the expiration of valid reasons, the potential heir files a claim in court.

Recovery procedure

Algorithm of actions of an interested person in the judicial restoration of inheritance terms:

- preparation of a claim detailing the circumstances and indicating valid reasons for missing the time of inheritance;

- preparation of the necessary documents, including passports, death certificate of the testator, a document confirming the relationship of the deceased and the plaintiff, a notarial certificate of refusal to engage as an heir due to missed deadlines;

- filing a claim with the district court, which can be done in person, through a representative or by mail;

- actual consideration of the dispute;

- making a final decision;

- entry into force of the decision;

- implementation, which is carried out by the notary who initially opened the inheritance proceeding.

Read more about the procedure for restoring a missed deadline for accepting an inheritance.

Limitation periods

The general statute of limitations for disputes related to inheritance is 3 years. This time begins:

- from the day when valid reasons ceased to apply;

- from the day when a person learned about the violation of his property rights.

Is it possible to partially enter into or refuse an inheritance?

The Civil Code of the Russian Federation determines the likelihood of partial inheritance or refusal of it by the following provisions:

- Art. 1110 - inheritance is the transfer of property from the deceased to his successors in a single and unchanged form.

- Art. 1152 (clause 2) - acceptance of part of the inheritance entails the automatic acquisition of the remaining property due to him, wherever it is located and whatever it is expressed in; entry into the property rights of the deceased with reservations or under conditions is unlawful.

- Art. 1158 (clauses 2 and 3) - renunciation of succession is absolute and cannot be supplemented by any requirements or conditions on the part of the renouncer; refusal of a separate component of the inheritance is unacceptable.

It is possible to partially enter into an inheritance and also refuse it, but only in the case when this part is all that a particular successor inherited. All property of the deceased, if there are several heirs, is divided between them in certain shares by the testator himself or by law. That is, in essence, there is an acquisition or renunciation of part of the inheritance. But in fact, the principle of unity of inheritance is not violated, since its part in this case represents the entire volume of property rights entitled to the heir.

The law also provides for the possibility of accepting or renouncing inherited property due to one heir on various grounds - by will, law, by way of transmission, etc. In this case, the successor can choose one or more grounds for himself, or refuse all ( accept everything).

Opening an inheritance

The calculation of the period begins from a specific date.

According to the norms of Article 1113 of the Civil Code of the Russian Federation, the time for opening an inheritance is the date of death of a person, registered in the funeral home and the registry office.

In some cases, the last day of a person's life cannot be determined. The situation must be reviewed by the court.

His decision states the estimated date of death of the deceased, based on the conclusion of a forensic medical examination. This day is considered to be the start time of the inheritance company in such a situation.

The place of opening of the inheritance is considered to be the last official residential address of the individual.

Is it possible to partially enter into or refuse an inheritance?

The Civil Code of the Russian Federation determines the likelihood of partial inheritance or refusal of it by the following provisions:

- Art. 1110 - inheritance is the transfer of property from the deceased to his successors in a single and unchanged form.

- Art. 1152 (clause 2) - acceptance of part of the inheritance entails the automatic acquisition of the remaining property due to him, wherever it is located and whatever it is expressed in; entry into the property rights of the deceased with reservations or under conditions is unlawful.

- Art. 1158 (clauses 2 and 3) - renunciation of succession is absolute and cannot be supplemented by any requirements or conditions on the part of the renouncer; refusal of a separate component of the inheritance is unacceptable.

It is possible to partially enter into an inheritance and also refuse it, but only in the case when this part is all that a particular successor inherited. All property of the deceased, if there are several heirs, is divided between them in certain shares by the testator himself or by law. That is, in essence, there is an acquisition or renunciation of part of the inheritance. But in fact, the principle of unity of inheritance is not violated, since its part in this case represents the entire volume of property rights entitled to the heir.

The law also provides for the possibility of accepting or renouncing inherited property due to one heir on various grounds - by will, law, by way of transmission, etc. In this case, the successor can choose one or more grounds for himself, or refuse all ( accept everything).