From childhood, parents instill in their children various moral and spiritual values. Such values include family ties with brothers and sisters. In fact, these bonds accompany people throughout their lives. Brothers and sisters are indeed the closest relatives, since they all live in the same family and descended from the same parents. This is where the popular comparison “you are like a brother to me” came from.

But good family relationships in fact do not eliminate the rules of kinship that are prescribed in the law. By law, kinship is recognized not only between brothers and sisters, but also between parents and children and others. Moreover, the law distinguishes between kinship as more close and less close.

Intestate inheritance after the death of a brother

Inheritance by law is based on the relationship between the deceased and the recipient of the property. The order of transfer of rights is divided into lines of kinship.

Brothers and sisters are heirs of the second stage.

That is, they can claim a share in the property of the deceased only if all the heirs of the first priority refused the inheritance, missed the deadline for registration, did not begin to formalize it, or they simply do not exist.

The key to inheritance is confirmation of family ties. That is, in order to receive an inheritance after the death of a brother, it is necessary to document this fact.

So, for the purpose of receiving an inheritance, a brother or sister of the deceased is considered by law to be a child of one of the parents of the deceased. Moreover, the father or mother of the testator had to establish a family relationship with him through the registry office. Thus, not only blood, but also adopted children of common parents fall into the category of brothers and sisters.

Direct heirs after the death of a brother

In the event of the death of a brother, the heirs of the first priority according to law are:

- Mother and father. The exception is the situation when parents were deprived of parental rights in court and did not restore them until the child turned 18 years old.

- Children and grandchildren (natural and adopted). If the brother's child died before his death, then the right to the share passes to the grandchildren of the deceased. A prerequisite is the establishment of an official relationship. If the deceased parent did not register the relationship in the registry office, then paternity (maternity) will have to be confirmed posthumously through the court.

- Official wife. The right to inheritance remains with the spouse from the moment of registration of marriage until the moment of registration of divorce.

- Disabled dependents. Minors and disabled relatives or strangers who lived with the deceased and were supported by him for more than 1 year can also claim a share in the property on an equal basis with their closest relatives.

Each of the heirs by law has the right to an equal share of the inheritance. That is, all property is divided equally between all relatives who have declared their rights to the notary.

Step-siblings

Half-siblings are children who share only one parent in common. They are endowed with all the rights and responsibilities of full brothers and sisters.

To receive an inheritance, it is necessary that the relationship of each child with a common parent be confirmed in the registry office.

Example No. 1. In his first marriage, Ilya had a daughter, Valentina. In the second - son Sergei. Since the children were born in an official marriage, Ilya was listed as the father in the registry office.

Accordingly, Sergey and Valentina are half-brother and sister and have the right to inheritance in the event of the death of one of them (if there are no first-line heirs).

Example No. 2. In marriage, Victor had a daughter, Ulyana. After the divorce, the man cohabited with Irina without registering his marriage. They had a girl, Sasha. The man did not register paternity.

Accordingly, Ulyana and Sasha are actually half-sisters, but officially have no right to each other’s inheritance.

Dependent's share

A brother or sister may be included in the first-degree heirs if they were recognized as dependents of the deceased. To be considered a dependent, a brother or sister must:

- be a minor, disabled or pensioner;

- be supported by a deceased brother or sister for more than 1 year.

They do not have to live together for 1 year. It is enough to present evidence that the deceased regularly transferred funds or bring a witness who will prove that the deceased regularly brought food and bought clothes.

To receive a share as a dependent through a notary, it is necessary to present an order appointing guardianship, that is, the heir must be under the guardianship of the testator.

In other cases, confirmation of being in custody can only be done through the court.

Who can receive property

- Can the children of a deceased husband’s brother enter into inheritance if there is a legal wife? No, they can't. The wife is one of the heirs of the 1st stage.

- Can nephews inherit if there are grandchildren? No. Grandchildren act as heirs by the right of representation of their parents - heirs of the 1st stage.

- If the nephews did not accept the mother's inheritance within the prescribed period, can the sister of the deceased inherit? Yes maybe.

- Is it possible to accept the inheritance of a deceased uncle if his mother, who died later than him, lived in his apartment and was registered in it? Yes, it is possible if there are no other heirs. To do this, it is necessary to prove in court that the mother actually accepted the inheritance during her lifetime. You can receive property as a direct heir of your mother, but not by right of representation.

It happens that the closest people - children, spouses, parents - treat a person much worse than the children of a sister or brother. In the event of the death of an aunt, her property will go to those closest to her according to the law, and those who are truly worthy of encouragement are left out of work. The situation can be corrected by drawing up a testamentary document. However, even in this case, “pitfalls” cannot be avoided, and the appearance of applicants for the obligatory share can cancel out all the plans of the manager of the acquired benefits.

You also need to enter into an inheritance with knowledge of the matter. If the aunt left not only valuables, but also loan obligations, the need to repay them will be perplexing, especially if the nephews knew nothing about the debts. To understand how to act in the event of the death of a relative, it is recommended to get a free consultation with lawyers on the portal ros-nasledstvo.ru. They will help you not to lose what you are owed and avoid troubles associated with ignorance of the laws.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 3.00 out of 5)

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

17

Statement of claim to establish the fact of acceptance of inheritance in 2021

Actual inheritance from a legal point of view is regarded as a full-fledged method...

49

Who repays the loan in the event of the borrower's death?

The basic law regulating relations regarding the transfer of property rights from the testator...

5

Who is legally a close relative?

In such a concept, obvious at first glance, as “close relatives”...

11

Buying an apartment received by inheritance

Buying an apartment is a responsible, long-awaited event for many, and it...

34

Terms of inheritance after death according to law

The procedure for receiving an inheritance or a share in it after the death of someone...

20

What is better, a deed of gift or a will for an apartment?

After choosing the next owners for your property, it’s time to decide...

How to receive an inheritance under a will after the death of a brother?

To become an heir under a will after the death of a brother, you do not need to confirm your relationship.

If the heir is indicated in the will, then it does not matter whether the relationship is properly established. However, when paying the state fee to a notary, brothers and sisters have a benefit. They pay 0.3% of the value of the property received. While other recipients pay 0.6% of the value of the inheritance.

To take advantage of the benefit, the heir must present documents confirming the relationship. Thus, if documents are missing, the heir cannot take advantage of the benefit. But this does not deprive him of the right to receive inherited property as a whole.

According to the will, the brother receives the share that the testator assigned to him. It can be either more or less than required by law.

Availability of a mandatory share

A brother may claim a mandatory share in the following cases:

- at the time of the deceased's death he had been under his care for 1 year;

- at the time of the deceased's death he was incapacitated and was supported by him.

As a compulsory heir, the brother can claim ½ of the share that he would have received without a will.

Terms and time of entry into inheritance under a will after the death of the testator

Does an ex-wife have the right to inherit after the death of her ex-husband?

Can nephews claim inheritance?

The law provides for the possibility of nephews receiving inheritance. However, this does not mean that the right of inheritance arises for the children of brothers or sisters immediately after the opening of the inheritance. First of all, the information is checked: whether a will has been left, whether there are any applicants of a higher priority.

Of course, nephews can claim the inheritance, but first you should make sure whether there are grounds for this.

Inheritance means everything that belonged to the deceased at the time of death: real estate and movable property, rights and obligations associated with them. Moral rights and intangible benefits are not part of the inheritance.

By receiving valuables, nephews can simultaneously inherit debts on loans and borrowings. This does not apply to obligations inextricably linked with the personality of the deceased, for example, alimony, compensation for moral damage.

By hereditary transmission

The parents of the deceased are the heirs of the first stage. But if the parent dies within 6 months after the death of the child, without having time to submit an application to the notary for acceptance of the inheritance, then the share of the deceased child passes to the heirs of the parent through hereditary transmission.

That is, if the brother died, and the mother or father did not apply to the notary and also died, then the share intended for the deceased parent will go to the brother or sister.

Example. Oksana was supposed to inherit after the death of her son, Gennady. But the woman took the loss of her son hard, fell ill and died. Gennady's inheritance was to be divided between Oksana and his daughter. Since the mother died before accepting her son’s property, her share passed to her daughter Olga. Thus, Gennady’s inheritance was divided between his daughter and sister, ½ share each.

Receipt of inheritance by full and half-blood relatives

Inheritance is a legal process that many citizens have to go through. One of the main issues in obtaining an inheritance is establishing the degree of relationship, since the possibility of receiving an inheritance depends on this.

Inheritance and inheritance law

Who has the right to inherit, in what order do full and half siblings receive inheritance? These and other current issues of inheritance will be described in detail in this article.

The Civil Code of the Russian Federation indicates that the right of inheritance is given to persons who are alive on the day of opening of the inheritance, citizens conceived during the life of the one who leaves the property, and those who were born alive after the process of opening it.

In addition to the above-mentioned citizens, legal entities that are valid on the day of its opening also have the rights to receive it.

To establish the circle of heirs, the notary must be based on family and kinship principles, since in order to include citizens in the list for receiving it by law, at least one of the following conditions must be proven:

- relationship with the testator. Kinship is a biological connection by origin between certain persons and a legal connection in cases where this is provided for by the norms of the Family Code of the Russian Federation;

- if the testator is adopted;

- if the testator's child is adopted;

- if a marriage was concluded with someone who leaves property;

- if there is a property between the recipient and the testator provided for by law;

- if the recipient is a dependent under certain conditions established by law.

The principle of priority

Taking into account the principle of kinship, the legislator sets priorities for receiving according to the principle of priority. The law establishes eight queues, each of which is distributed in descending order into groups according to priority. According to the Civil Code of the Russian Federation, Art. 1142 to, the priority group includes the spouse, children, parents. According to Art.

1143, the second stage includes full and half-sisters and brothers, maternal and paternal grandparents. According to the purpose of our study, we will dwell on full and half-blood relatives in more detail. Full brothers and sisters come from the same parents.

A brother is a boy or a man in relation to other children, an older brother is a boy or a man in relation to younger ones, a younger brother is a boy or a man in relation to older ones. This also includes a married brother - a boy born before marriage and recognized by them.

These are children of one woman who developed and were born from one pregnancy. Half-siblings are children who have only one common parent: mother or father. They are divided into: Single-uterine (one-uterine) - descending from the same woman, but from different fathers. Consanguineous (homogeneous) - descending from the same man, but from different mothers.

Such brothers and sisters are called half-blooded if they come from the same father. They are called half-bred if they have the same mother.

The above categories should not be confused with stepbrothers, which are not considered relatives because their relationship is not kinship, but is based on property relations. Therefore, step relatives are not included in the second line of heirs. According to the Civil Code of the Russian Federation:

- If the deceased does not have heirs of the first stage, the heirs according to the law of the second stage are the half- and full-blooded brothers and sisters of the person leaving the inheritance.

- Modern legislation does not emphasize the differences between such relatives. Both (half-born and half-blooded) have the right to receive it.

As noted above, heirs of the second priority can receive it if there are no citizens of the first priority, and there are no persons who can inherit instead of them by right of representation, or all persons on any other grounds, which are provided for in the second paragraph of paragraph 1 of Article 1141 of the Civil Code, will not be called upon or will not accept the property. They note that their children, nieces and nephews, can receive it by right of representation.

https://youtube.com/watch?v=ffUE0043Ppo

Issues of inheritance are quite complex, therefore, on the advice of specialists, to resolve issues of obtaining it, it is best to contact certified specialists. Considering that there is a possibility of unforeseen situations when other applicants may appear, it is best to entrust this issue to professional lawyers.

Top

How to enter into an inheritance after the death of a brother?

In order to obtain rights to the brother’s property, it is necessary to accept the inheritance within the period provided for this. You can accept an inheritance:

- actually;

- through a notary.

Let's look at each procedure in more detail.

Actually

Art. 1152 of the Civil Code of the Russian Federation provides for the possibility of accepting an inheritance without official registration. It is enough for the heir to use the property of the deceased brother for its intended purpose: live in an apartment, cultivate a summer cottage, carry out repairs, pay rent or a loan.

Note! The action must be carried out within the period established for accepting the inheritance.

However, upon actual acceptance of the inheritance, the successor can only use the property. He is unable to sell or rent it out because he does not have title documents. At the same time, you can register ownership at any convenient time. It is enough to collect evidence of inheritance and contact a notary or court.

But in fact, you can enter into an inheritance after the death of your brother under a will or in the absence of first-line heirs. You cannot take property and use it if the period for another line of heirs to enter into inheritance continues during the current period.

Through a notary

Another option for entering into inheritance is the notarial method. In this case, the heir visits the notary office at the place of registration of the deceased brother.

As a result, the heir receives a certificate of inheritance rights. This is a document of title that makes it possible to re-register ownership of inherited property in your name. From the moment of re-registration, the heir becomes the full owner of the property.

The advantage of this option is the receipt of supporting documents for the property. Other heirs will not be able to claim it.

The disadvantages include the high cost of re-registration. In the process of receiving an inheritance, the successor will have to pay a large amount.

Algorithm of actions:

- Preparation of documents for a notary.

- Payment of state duty.

- Submitting an application.

- Obtaining a certificate of inheritance rights.

If the brother can confirm his relationship, then he pays a fee of 0.3% of the value of the property received. If supporting documents are lost or a family connection is not established (in case of inheritance under a will), then the duty will be 0.6% of the value of the inheritance.

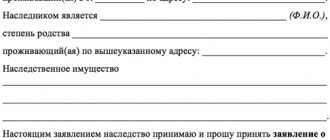

What documents are needed?

Before contacting a notary, you must prepare documents that confirm your relationship. In case of inheriting a brother's property, the heir must present:

- your birth certificate;

- birth certificate of the deceased;

- parent's marriage certificate (if the parent changed his last name during marriage);

- certificates of change of surname or marriage of the heir and testator (if available).

List of documents for the notary:

- passport;

- will;

- death certificate of the deceased brother;

- certificate of last place of registration;

- receipt of payment of state duty;

- appraisal report on the deceased's property;

- certificates of cadastral value for real estate included in the inheritance;

- title document for property (purchase and sale agreement, privatization, exchange, gift);

- extracts from the Unified State Register of Real Estate for each property owned by the brother.

To calculate the state duty on all movable property of the deceased, an assessment is carried out. To do this, you need to contact a specialized company that has a license to carry out assessment work.

The notary must prepare an application for acceptance of the inheritance and the issuance of a certificate of inheritance rights. In order not to pay a notary fee for preparing a draft application, it is advisable to write it yourself.

Deadlines

Brothers enter into inheritance at the following times:

- According to the will. Within 6 months from the date of death of the testator.

- According to the law, if there are heirs of the first priority. Within 6 months from the moment they are recognized as unworthy or formally refuse the inheritance.

- According to the law, if there are heirs of the first priority, but they did not apply to the notary or missed the deadline. Within 3 months from the date of expiration of the 6-month period for entry into inheritance for first-degree successors.

- By hereditary transmission. During the general period - if the parent died within 3 months after the death of the deceased child. If the parent died 3 months after the death of the child, then the brother must register the inheritance within 3 months after the death of the parent.

When a nephew inherits

When, after the death of the owner of the property, there is no will left, it will be inherited by law. There is a certain order of heirs, where the closest relatives first receive the right to dispose of the property of the deceased. They were ranked as the first order of kinship.

Distant relatives take the last positions. But it often happens in life that loved ones become much further away than they should be. Thus, we can talk about unfair distribution of inheritance. Unfortunately, the law cannot predict the development of events in an individual family.

As an example, let's look at a situation that developed in one family.

One elderly woman had a serious illness. Surgery was required for her recovery. The woman did not have funds for it, since she did not have any savings.

Her family didn't care about her. Closest to the woman was her niece, who took upon herself all the costs associated with the operation, care, and the purchase of medications.

When the woman died, her niece took care of the funeral herself. After the funeral and the opening of the inheritance, the deceased’s relatives unexpectedly appeared, namely her children and grandchildren. These citizens, by law, are in the first line of inheritance, which is why they received the inheritance. The niece, as a distant relative, received nothing.

Inheritance by nephews of property under a will

If the aunt had left a will and included the name of her caring niece there, everything would have been different. So the niece could rightfully become the heir to the deceased’s property. Without a will, the inheritance procedure occurs according to law.

What line of succession do nephews belong to?

- The primary heirs are the spouses, parents and children of the deceased owner. Grandchildren can also be considered primary heirs, since they inherit by right of representation. This occurs in the event of the death of their parents, which occurred before or together with the death of the main testator. The procedure is that the grandchildren “represent” their deceased parent in the inheritance and become the owners of the inheritance;

- The second priority includes the testator's grandparents and his brothers and sisters. They can exercise their right if there are no relatives who could be in the first line of inheritance;

- In the second stage there are also persons who have the opportunity to receive an inheritance through the presentation procedure. These include nephews and nieces of the deceased owner. The children of the deceased's siblings become representatives of their parents, who are also no longer alive.

Let's look at a clear example of such inheritance.

There was an accident in which two brothers died. The first brother had neither wife nor children, but the second was married and had two sons. The sons and wife are the heirs of the first order of their father and husband. Children become heirs of their uncle by nomination, since their father, who was in the second line of inheritance, also died. The wife of one of the brothers cannot become an heir to the property of her husband's brother.

In what cases can nephews and nieces inherit the property of an uncle or aunt?

There are several situations for accepting the inheritance of an uncle or aunt:

- Inheritance by will, if the names of nephews are included in the document;

- Inheritance by law in the case of:

- absence of heirs belonging to the first line of inheritance (they did not want to accept the inheritance, they are no longer alive, I have the status of unworthy heirs);

- the first-degree heirs were not alive at the time of the testator's death, or they died at the same time. The inheritance passes to the children by right of representation.

How is the inheritance divided after the death of a brother?

The procedure for dividing inheritance under a will:

- The shares are determined by the testator. In this case, each heir receives a part of the property established by the owner when drawing up the will.

- The shares were not determined. In such a situation, all property is divided among all heirs specified in the will in equal shares.

- Obligatory heir. The minimum share cannot be less than 1/2 share of the share provided by law.

The procedure for dividing property according to law:

- In the general order (as heirs of the 2nd stage or dependents). The property is divided among all recipients of one queue in equal shares.

- By hereditary transmission. Brothers and sisters share equally the share due to the deceased parent. And the legal successors of the first stage each receive a share.

First and second stage applicants

When determining the order of inheritance, the law is based on the closeness of family and blood ties between the deceased and the successor. Thus, Section 5 of the Civil Code of the Russian Federation establishes that the heirs of the first priority include spouses, children and parents of the deceased. Then the question arises: “Does a brother have the right to inherit from his sister, and vice versa?” Yes, this is possible. Brothers and sisters are classified as second-order heirs, and in the absence of first-order heirs or a will, they will certainly receive their share of the inheritance.

Let's consider this case. After his death, the man had no children or wife, and his parents refused the inheritance. Therefore, the order passed to the second-order successors - his brother and sister. The property of the deceased was divided equally. Therefore, the sister and brother each received ½ of the deceased’s inheritance.

Lawyer's answers to private questions

My brother has a daughter. He divorced his wife 10 years ago. All this time he lived with my family. I am his only sister, my parents died. He was sick, we looked after him. Now he is dead. And his daughter filed documents for inheritance. Can I claim his property?

As a sister, you cannot claim the inheritance since you have a daughter. The only option is to recognize the daughter as an unworthy heir. This is possible if alimony was collected from her for the maintenance of her father, but she did not pay.

My brother died. Can I claim his property without a will if he only has an official wife. They had no children.

No. In this situation, the wife inherits all the property as the heir of the first turn.

My brother died a month ago. Every month he transferred money to me for medicine (I have a group 2 disability, my pension is not enough for medicine). The father will enter into the inheritance as the only heir of the first stage. But my father abandoned us many years ago. Can I receive an inheritance instead?

You need to go to court and recognize yourself as a dependent of the deceased. In this case, all property will be divided between you and your father in ½ share.

My brother made a will for me. His wife wants to contest the will. Will I be able to claim an inheritance if the will is declared invalid?

No. In this case, the inheritance will go to the wife of the deceased.

My husband died 2 months ago. He has a brother on his father's side. Can he claim the inheritance?

The brother is the heir of the second stage. If there are children, a wife and parents, then they are the first to claim the inheritance.

My brother had a car loan. After his death, the bank constantly calls me and demands money. But the brother's children received the inheritance. Can the bank claim the debt from me?

After the death of the debtor, the debt is paid off by his heirs. In this situation, the children of the deceased.

Documents to confirm kinship with a distant relative to enter into inheritance rights

The evidentiary package may include the following documents:

- Copy of the passport. If it contains notes about the spouse and children, then copies of these pages are also made. If there are no marks, you should contact the passport office, the Federal Migration Service of your city or district. The application must be made in person with an identification document.

- Certificate of marriage/divorce. You can get it at the registry office by coming in person or by writing an application asking for the paper to be issued by sending it by mail.

- Birth certificate. Also issued by the Civil Registry Office. Apply in person or by mail.

- Certificate of paternity. You can get it at the registry office. But, please note, if paternity has not been established before, then you must contact the child’s mother together and ask for paternity to be established. The mother must also write a statement.

- Medical papers, DNA test results. A special procedure called “DNA analysis for distant relationships” is carried out. Performed by licensed legal agencies. Not only the distant relative, but also the testator must apply. If he died, then one of their relatives will take his place.

- Certificate of family ties. May be issued by the legal agency that performed the genetic examination.

The list of documents may be different, depending on your case. The main thing is that the documents can confirm the relationship with the deceased relative - or his direct successor by law, that is, a relative of the 1st or 2nd stage.