TIN is a taxpayer identification number that the tax office assigns to individuals and legal entities. A unique taxpayer number is necessary in order to track the history of his tax payments, debts to the budget, and submission of reports.

Individual entrepreneurs, organizations and government employees must have a TIN number. Ordinary citizens, although they are not required to have one, are also faced with the fact that a TIN is requested when applying for a job, applying to a bank, or making transactions.

How many digits are in the TIN depends on who owns it. The number of an individual has 12 digits:

- the first 4 digits are the code of the Federal Tax Service that assigned the code;

- the next 6 digits are the serial number of the individual’s record;

- the last 2 are the control number.

The individual entrepreneur's TIN will be the same as that of an individual who has become an individual entrepreneur.

The TIN of a legal entity is shorter, it has 10 digits:

- the first 4 digits are the code of the Federal Tax Service that assigned the code;

- the next 5 digits are the serial number of the organization record;

- the last digit is the check number.

Example TIN - 563565286576

Why does a citizen of the Russian Federation need a TIN?

This is a unique number assigned to every citizen of the Russian Federation. Used by the state to account for the payment of taxes by both individuals and legal entities.

It is required when receiving any income, registering property, inheritance and in many other cases. Its timely receipt is very important for a citizen. The taxpayer identification number for individuals differs in the number of characters in the number, from legal entities. persons and consists of 12.

Let's figure out how and where to get it.

What is a TIN and why is it needed?

A taxpayer identification number, or TIN, is a 12-digit number that you (or your employer for you) uses to pay taxes.

You will also need it to check if you have any unpaid taxes and if you decide to register as a sole proprietor.

Importance of TIN

Even a newly born person has his own rights and obligations outlined in the Constitution of the Russian Federation. This is precisely why the need for a TIN is connected if certain situations arise:

- acceptance of inheritance;

- registration of ownership of real estate or vehicle;

- acceptance of property under a gift agreement;

- desire to get a job before adulthood;

- minors starting their own business.

Often the TIN is required to be presented in educational and kindergarten institutions.

Why might you need an INN ID?

A person acquires rights and responsibilities from the moment of birth. Their implementation requires obtaining official documentation, including TIN.

The latter may be needed in the following situations:

- registration of inheritance;

- acquisition of ownership of property;

- conducting transactions within the framework of a gift agreement;

- employment, including until adulthood;

- registration as an individual entrepreneur.

An identifier is often required when enrolling a child in a kindergarten or school.

Regulatory framework: why does a child need a TIN?

The regulations of the Russian Federation do not establish a specific age for issuing a TIN. The procedure is considered voluntary and is carried out at the request of the parents.

However, there are still cases when a municipal institution may request a certificate of registration of a child with the tax authorities. This:

- Entry into inheritance. A certain percentage of the value of the accepted property is paid to the state treasury.

- Registration of property rights. Since the property tax will be paid in the name of the baby.

- When applying for an official job/part-time job. The future employer is obliged to pay 13% personal income tax for its employees.

- When filing a tax deduction. For example, when buying a new apartment, where one of the shares belongs to a teenager.

- To register business activities. A 16-year-old individual entrepreneur is also required to pay tax.

- For admission to an educational institution. For example, kindergarten or college. However, providing a TIN in this case is not necessary.

The situations described above are suitable for minor children under and over 14 years of age.

It is worth noting that a taxpayer identification number is issued to a citizen once and for life. It is assigned at birth, for which the civil registry office transmits all information to the tax service. But whether a child needs to get a TIN on paper or not is decided only at the request of the parents or the minor himself.

Where can I get a TIN

To begin with, I would like to clarify that only one organization assigns TINs - the Federal Tax Service. Regardless of the registration method, only the Federal Tax Service issues and binds the number to an individual or organization.

At the moment, it is possible to submit documents and obtain a TIN in:

- At the Tax Service office at your place of residence.

- At the MFC branch (not all branches provide this service, find out by calling the selected branch).

Receipt at the moment occurs only in personal presence with the provision of a passport.

At what age can you get a TIN?

Many parents are interested in the age at which they need to obtain a TIN for their child. At the legislative level, there is no exact answer at what age a TIN should be provided to a child, since there are no mandatory requirements. Under 14 years of age, the document may not be required.

When applying for a job, the Taxpayer Identification Number (TIN) becomes mandatory, and in Russia children can start earning money after the age of 14.

Parents can obtain a tax identification number for their newborn child, but this is not mandatory. The solution to such an issue is voluntary, therefore even children's clinics and educational institutions cannot require the presentation of an additional document.

How to obtain a TIN - a detailed description of possible methods

There are several ways to submit documents to obtain a TIN. The documents required for registration are the same: application and passport. Let's first look at conservative options when you need to be present in person:

In the MFC "My Documents"

Some free time is required for two visits to the facility. Make sure by phone that your MFC branch provides the service “registration of an individual with the tax authority.” If the answer is positive, the procedure for receiving it is extremely simple:

- Find out the opening hours of the MFC branch.

- We come to the branch (necessarily with a passport) and take an electronic queue coupon at the terminal.

- We go to the specialist’s window and, with his help, fill out and submit an application for a TIN (form No. 2-2-accounting).

- All you have to do is wait 5-7 business days and receive it in the same place where you issued it. Personal presence and passport are required.

If the MFC office is not far from you and you have some free time to visit it, then this option is acceptable. Please note that the waiting period is 2-3 days longer compared to registration with the Federal Tax Service, due to transfers between them.

Receipt from the tax office

This method differs from the previous one only in fewer days of waiting for the result. By law, it cannot exceed 5 working days. In many more tax office branches, the application for registration is filled out by the employees themselves, and not by you. Otherwise, everything happens identically with the MFC:

- Arrive at the pre-determined working hours of the Federal Tax Service;

- Join the electronic queue;

- Present your passport and sign the application;

- Come back in five days to receive your completed TIN certificate.

Why is this necessary?

Let's consider in what cases a TIN may really be needed by a child or his parents.

On the one hand, this document will definitely be useful for entering into inheritance rights, and also if the child is the owner of a home, for example. In all these cases, he is formally obliged to pay taxes, and therefore, being a taxpayer, must have a TIN.

On the other hand, when employing a minor, the employer may ask to provide a TIN for the child. As a rule, this request is motivated by the presence of an internal LNA for recording information about taxable income.

Of course, the employer cannot demand anything in this case. A TIN for employment is required only when entering the civil service (Article 26 of Federal Law No. 79 of July 27, 2004), and minors are not hired for civil service (Article 21 No. 79-FZ).

For all other categories, the Labor Code of the Russian Federation does not contain provisions on the need to present this document, and the Ministry of Taxes and Duties clearly writes that the tax office cannot refuse an employer to accept reports due to the lack of information about the TIN of individual individuals - recipients of income due to its absence (Letter of the Ministry of Taxes and Taxes of the Russian Federation dated February 27, 2001 No. BG-6-12/).

But here the question arises: is it worth sorting things out with a potential employer and getting your way through appeals to the prosecutor’s office or the courts? This is time, and most importantly - nerves and missed opportunities for your child. It’s easier to make a TIN, especially since it won’t hurt anyone.

Registration of TIN via the Internet

You can also submit an application for a TIN online. Thanks to the Internet, we can save time on the initial trip to the tax office or the MFC and fill out an application on a specialized website. In any case, you must appear in person to receive a certificate.

On the website of the Federal Tax Service

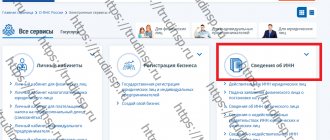

To fill out an application for a TIN online, go to the website of the Federal Tax Service of Russia www.nalog.ru. On it, select the “Individuals” section, and in it, in the right column, select the item as in the picture below:

Next, register in your personal account, fill out the form with your personal information and confirm it via E-Mail. After successful registration, you will receive an application. We fill it out point by point carefully and without errors, be sure to check the data before sending.

Click the next button. Your application is assigned a registration number, with the help of which you can track the readiness of registration and receive the TIN itself using it.

At the bottom of the page, look for the application registration item and click on the “Register an application and send it to the Federal Tax Service” item in it.

The registration process is complete, all you have to do is wait for an email notification that registration is complete. After which, at a convenient time, you can pick up your TIN certificate from the Federal Tax Service specified during registration.

Get a TIN through the State Services portal

Unfortunately, at the moment this function is not available on the government services portal; you will simply be redirected to the tax service website.

What you need to do at the Federal Tax Service office when you come to receive the service

You must arrive at the inspection at the selected time and register the ticket in the terminal. To do this, you need to select the “Acceptance by appointment” item and enter the PIN code specified in the coupon, which will form a portal at the end of the online registration. After this, tax specialists will receive you at the time specified in the coupon, or as soon as possible after it.

It’s better to come to your appointment with the Federal Tax Service a little early, because... if the applicant is late by more than 10 minutes, the online registration is no longer valid. Then you will have to stand in a general queue.

Registration of a TIN for a child

Let's look at the main reasons why a minor child needs a TIN:

- Registration of inheritance;

- Registration of property, in whole or in part;

- Part-time employment.

Naturally, minors receive a TIN only with a parent or guardian. To obtain a TIN, a child will need the following documents:

- Child's birth certificate;

- Document confirming registration;

- Statement;

- Passport of the parent or guardian signing the application.

Important: When a child reaches 14 years of age and receives a passport as a citizen of the Russian Federation, he receives a TIN personally, without representatives.

The process of submitting documents and obtaining a TIN certificate for a child does not differ from the methods described above for adults.

Application form

Now about how to fill out an application for registration with the Federal Tax Service. The new form 2-2-Accounting differs from the previous one, which was approved back in 2011. The fields about the previous place of residence and change of surname (if such a fact existed) were removed from the form.

The application is quite simple; to fill it out you will need a passport and a little time. On the title page, indicate the code of the tax office you are applying to. If you don’t know it, find the code using a special service on the Federal Tax Service website.

In the following lines, enter your last name, first name and patronymic. Below you need to select the number corresponding to your gender:

- "1" for male;

- "2" for female.

Next, indicate the date and place of birth, exactly as in your passport.

Let's move on to citizenship data. Any person, including a foreigner or stateless person, can obtain a TIN in Russia. In a single-cell field, citizens of any country select “1”, and stateless persons – “2”. The code of the country of citizenship must be found in the Classifier of Countries of the World (OKSM), this document is freely available. For citizens of the Russian Federation, we will tell you that the Russian code is “643”. Stateless persons enter the code “999”.

At the bottom left you need to select the status of the person submitting the application:

- “1” – the taxpayer personally;

- “2” – representative.

If the application is submitted in person, you do not need to indicate your full name; these fields are intended for submission by proxy. Next, the applicant must enter his phone number, date of submission and sign. The representative must also enter the details of the power of attorney: date and number, or clarify that it is without a number. The power of attorney is submitted along with the application.

At the top of the second page, enter the surname and initials of the taxpayer and the details of the identity document. In the appendix to the order you need to find the document type code. The most popular are “21” (internal passport of a citizen of the Russian Federation) and “03” (birth certificate for minors). In the “Series and number” field, the No. sign is not entered; the series and document number are separated by a space.

When filling out the “Address information on the territory of the Russian Federation” cell, select the desired value:

- “1” – for permanent registration;

- “2” – for temporary registration;

- “3” – in the absence of an official place of residence in the Russian Federation.

The applicant's address, if available, is filled out in accordance with the FIAS classifier for municipal division. It does not always match the passport, so be careful.

Answers to common questions about TIN

At the end of the article I would like to briefly answer frequently asked questions regarding TIN.

Is it necessary to change the TIN when changing your last name?

The number itself does not change, but if you change your last name, you must re-issue the certificate with a new last name. This is done at the Federal Tax Service office upon written application.

Restoring TIN in case of loss or damage

Restoration of the TIN is carried out at the tax office, after paying the fee for re-issuance and providing documents as for the initial receipt.

How to find out your TIN

If it is assigned to you, then your personal INN can be found through the service on the official website of the Federal Tax Service https://service.nalog.ru/inn.do.

How to register with the tax office through the website: the whole article in 30 seconds

- A specially created website for recording visitors - https://order.nalog.ru/

- To register, you will need your full name, tax identification number, email and telephone number.

- You can make an appointment with the tax office 2 weeks in advance, but no more than 3 times for one service.

- You can sign up for several services on one day, but at different times.

- The tax office will not accept you if the data in the registration coupon does not match the real (passport) data.

- If you are more than 10 minutes late for your appointment, your appointment will be lost and you will have to stand in a general queue.

This article was prepared for you by DeloBank specialists. Our bank creates services that allow small businesses to easily operate and develop. If you want to find out how to free yourself from routine tasks and what bank services will help you solve your current problems more effectively, leave your contacts and our specialists will contact you: