Delay of wages from the legal point of view

The procedure and timing of settlements with employees are regulated by Art.

136 Labor Code of the Russian Federation. According to parts 5 and 6, the salary must be issued directly to the employee at the location of the enterprise or transferred to a bank account. The frequency of payments is at least once every 15 days. Accordingly, the employee must receive two or more payments each month. The norms of the Labor Code of the Russian Federation do not determine the percentage of payments. Therefore, one of them may be larger in size than the other. For example, the system for paying employees may be as follows: the first payment includes only the salary at the tariff rate, and the second, in addition to the salary, includes bonuses and other additional payments.

Specific dates for payment of wages, in accordance with Part 4 of Art. 136 of the Labor Code of the Russian Federation, are determined in the collective labor agreement for all employees equally or are stipulated directly in the contract with each employee. Moreover, if the payment date falls on a weekend or holiday, then the calculation is made the day before.

For individual payments, special deadlines may be established within which the administration of the organization must make them. So, for example, vacation pay, according to Part 9 of Art. 136 of the Labor Code of the Russian Federation, are transferred to the employee no later than three days before the start of the vacation.

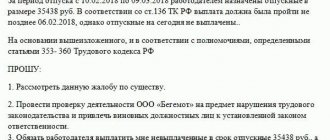

Accordingly, if an enterprise does not comply with these requirements and pays the employee at the wrong time or does not pay the due money at all, then we are talking about delayed wages.

Responsibility for delayed wages lies in the application of financial and other sanctions to the administration of the enterprise in accordance with the norms of the Labor Code, Code of Administrative Offenses and the Criminal Code of the Russian Federation - depending on the timing and amount of accumulated debt.

If necessary, you can go to court to collect wages.

Payments upon dismissal: calculating the duration of unused vacation

In most cases, resigning employees have unused vacation days. Their number is determined by the formula:

NDO = YEARS × 28 + 28 / 12 × MONTHS – HOLIDAYS,

Where:

NDO - compensation for unused vacation days;

YEARS - the number of full years of work in the company;

MONTHS - the number of months in partial years of work in the company;

LEAVES - the number of vacation days granted (compensated) by the time of dismissal.

Moreover, if a person has worked for a company for 11 full months from the date of signing the employment contract, then it is considered that he has worked for a full year (clause 28 of the Rules on Leave, approved by the People's Commissariat of Labor of the USSR dated April 30, 1930 No. 169).

If your work experience in the company does not exceed 11 months, then the 2nd part of the above formula is used to calculate the number of vacation days:

NDO = 28 / 12 × MONTHS – HOLIDAYS.

If the employee has worked for the company from 5.5 to 11 full months and his dismissal is due to:

- liquidation of the enterprise;

- staff reduction;

- reorganization, temporary suspension of work;

- conscription of an employee into the army;

- unsuitability for work,

then the NDO indicator, subject to the conditions specified in clause 28 of the Leave Rules, will be calculated according to the formula (letter of Rostrud dated 04.03.2013 No. 164-6-1):

NDO = 28 – HOLIDAYS.

Let us now consider how compensation for unused vacation is calculated.

Material and administrative responsibility

The first sanction applied to the administration of an organization is financial liability under Part 1 of Art. 236 Labor Code of the Russian Federation. For each day of delay in payment of money to the employee, interest is charged on the amount owed. Starting from the day following the day on which wages are due and ending with the day the debt is actually repaid.

Important! The amount of interest is determined by Part 1 of Art. 236 of the Labor Code of the Russian Federation and is 1/150 of the key rate of the Central Bank of the Russian Federation for each day of delay.

The second sanction that an employer must be subject to for delaying wages and other payments due to an employee is a fine, defined in Art. 5.27 Code of Administrative Offenses of the Russian Federation. When brought to administrative responsibility, the period of delay and the amount of unpaid wages on time do not matter. That is, to qualify the actions of an organization as an administrative offense, a delay in payments of one day is sufficient.

The amount of the fine for non-payment of wages depends on whether the employer committed the violation for the first time or repeatedly within a year. For first-time violators of Art. 136 of the Labor Code of the Russian Federation regarding the timing of settlements with individual entrepreneurs, the amount of the fine under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation will range from 1 to 5 thousand rubles, for organizations - 30 to 50 thousand.

If an individual entrepreneur or organization has repeatedly accumulated salary debt during the year, the amount of the fine for unpaid wages will be greater and will amount to 10 to 30 thousand rubles for individual entrepreneurs, and from 50 to 100 thousand for organizations (Part 7 of Article 5.27 Code of Administrative Offenses of the Russian Federation).

The ConsultantPlus system has many ready-made solutions, including information about what happens if wages are delayed. If you don't have access yet, you can get it for free on a temporary basis. For further use of the system, obtain the current K+ price list.

Calculation of severance pay

In general, severance pay is not paid upon dismissal. But the law provides for its registration in the following 4 situations.

1. When the benefit is paid in accordance with the agreement between the employer and the employee.

The amount of such benefit is determined in the agreement itself. At the same time, the employer has the opportunity to successfully challenge its too large amount, despite the preliminary consent to the payment (appeal ruling of the Moscow City Court dated February 18, 2014 No. 33-3069).

2. When benefits are assigned in the event of staff reduction or liquidation of an enterprise.

The amount of such benefit is 1 average monthly salary. This payment is supplemented by:

- another monthly salary if the person does not find a job within a month after dismissal;

- monthly earnings after 2 months after dismissal, if the person applied to the employment center (within 2 weeks after dismissal), but was not employed.

3. When the benefit is paid in the amount of 2 weeks' earnings, if the dismissal occurred due to the reasons mentioned in Art. 178 Labor Code of the Russian Federation. For example, due to:

- deterioration of the employee’s health;

- conscription into the army;

- return to work of the replaced employee;

- employee refusal to transfer when the employer moves to a remote area.

4. When benefits are provided in the amount of average monthly earnings in the event that a person is dismissed due to the employer’s violation of the rules for concluding an employment contract - in the manner prescribed by Art. 84 Labor Code of the Russian Federation.

Benefits are paid that can be calculated at the time of dismissal, along with the remaining salary and compensation for unused vacation. The second and third payments under redundancy benefits are made in agreement with the employee (based on the documents provided by him certifying the legality of receiving such payments).

Employee rights when wages are delayed

Norms Art. 142 of the Labor Code of the Russian Federation gives the employee the right to independently seek payment of the due salary by suspending work. However, this right can only be used if the salary delay is more than 15 days.

Important! To legally begin the suspension of work, the employee must notify the employer about this in writing (Part 2 of Article 142 of the Labor Code of the Russian Federation). The corresponding application (notification) can be submitted to a representative of the administration either in person against a signature or sent by mail, with a list of the contents and a receipt.

If the employee complies with the stipulated requirement of written notification to the enterprise, then disciplinary sanctions cannot be applied to him (for example, dismissal for absenteeism). In addition, the employee retains his average salary for the entire period of suspension of activities. This obligation of the enterprise is another measure of the employer’s liability for non-payment of wages.

At the time of suspension of work, the employee is not required to be present at the workplace (Part 3 of Article 142 of the Labor Code of the Russian Federation). However, he is obliged to go to work the next day after receiving written notification from the enterprise of his readiness to repay the debt on the day he goes to work.

According to Art. 142 of the Labor Code of the Russian Federation, not all employees have the right to suspend work. Thus, if an employee is employed in the sphere of life support for the population (ambulance, heating, water and gas supply enterprises, etc.), he does not have the right to suspend work due to the specifics of his professional activity.

Dismissal during vacations without pay: nuances

It is possible that during the period of work the employee took leave without pay - dismissal in this case can be compensated under special conditions.

The fact is that days of vacation at your own expense, starting from the 15th day of such vacation in the working year, are not included in the length of service used in determining the duration of vacation (Article 121 of the Labor Code of the Russian Federation). This means that with a sufficiently long vacation at your own expense, the indicators in the formulas we discussed above can change significantly.

For example, the YEARS indicator in the first formula for calculating the duration of compensated leave will be applied only if the person has worked for at least 1 working year (at least 11 months from the date of signing the employment contract). If a person worked exactly that much, but at the same time took 15 days of vacation at his own expense, then 1 month will not be taken into account. This will reduce the number of unused vacation days paid upon termination.

For example, an employee worked for 10 months, but took 16 days of unpaid leave. The number of days of unused vacation for calculating compensation upon dismissal will be 21 days (28 / 12 × 9).

Criminal punishment and the peculiarities of its application

The most severe measure of liability for non-payment of wages on time is the application of criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation. This provision presupposes the presence of two independent elements of a crime. Thus, for Part 1 to apply, two conditions must exist:

- Salaries are paid partially for three or more months in an amount less than half of what the employee is entitled to.

- The reasons for incomplete payment are the selfish interest of the employer. That is, if an enterprise cannot pay its employees in full due to objective reasons, for example, there is simply no money in its accounts and there is no way to replenish them, then it is impossible to bring the management to criminal liability.

The penalty for this act varies from a fine to 120 thousand rubles to a year in prison.

To use Part 2 of Art. 145.1 of the Criminal Code of the Russian Federation it is necessary that:

- the enterprise did not pay wages at all or paid less than one minimum wage per month;

- the debt period exceeded two months;

- the reason for the debt is the employer’s self-interest.

The severity of the sanctions in this situation will be greater: a fine of up to 500 thousand rubles or imprisonment for up to three years.

If, in the presence of any of the specified parts 1 or 2 of Art. 145.1 of the Criminal Code of the Russian Federation, if additionally serious consequences occur, for example the death of a person, then the employer will face a fine of up to 500 thousand or imprisonment for up to five years.

Features of bringing to criminal liability for non-payment of wages

In Art. 145.1 of the Criminal Code of the Russian Federation also has a note that allows the management of the enterprise to avoid a fine or imprisonment. If the committed act did not entail serious consequences, was committed for the first time and within two months from the date of initiation of the criminal case the debt to the employees was fully repaid, the guilty person is released from liability under this article.

Results

Thus, in Russia there is a clear system of sanctions for non-payment of wages, the severity of which is determined by the timing and size of the debt to employees.

Sources:

- Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ

- Code of the Russian Federation on Administrative Offenses

- Criminal Code of the Russian Federation dated June 13, 1996 No. 63-FZ.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.