Separate housing is the cherished dream of many. Students, newlyweds, large families and retirees are looking to improve their conditions or buy an apartment for rent.

Often, a mortgage turns out to be a large financial burden. First, we save for a long time for a down payment, ask our family for help, or even take out a separate loan. And then we spend years paying off the debt with overpayments.

A tax refund will help smooth out the situation. Let's figure out what it is, how much money can be returned and what documents are needed for this.

Main deduction

When purchasing an apartment/house using mortgage funds, you can receive two tax deductions: the main deduction (clause 3, clause 1, Article 220 of the Tax Code of the Russian Federation) and a deduction for mortgage interest (clause 4, clause 1, Article 220 of the Tax Code of the Russian Federation).

The main deduction when purchasing an apartment with a mortgage is no different from the deduction for a regular purchase. We will not consider it in detail, but will only recall the main points:

- The maximum deduction amount is 2 million rubles. You can return 13% of this amount - 260 thousand rubles. Read more “Amount of deduction when purchasing a home.”

- The right to deduction arises after receipt of the Acceptance and Transfer Certificate of the apartment (when purchasing under an equity participation agreement) or the date of registration of ownership according to an extract from the Unified State Register (if purchasing under a purchase and sale agreement). You can submit documents for a deduction to the tax authority at the end of the year in which the right to it arose. Read more “Information on property deduction”, “When the right of deduction arises”.

- You can include both your own and borrowed funds in the deduction. From a legal point of view, loan funds are also considered your expenses.

The list of required documents and the process of obtaining a deduction are described in the articles: “List of documents for obtaining a deduction” and “The process of obtaining a deduction.”

Example: In 2021 Dezhnev G.S. took out a mortgage loan from the bank in the amount of 2 million rubles and bought an apartment worth 2.2 million rubles. The certificate of registration of ownership was also issued in 2021.

In 2021 Dezhnev G.S. filed a 3-personal income tax return for 2021 with the tax office and declared the main deduction in the maximum amount of 2 million rubles (towards a return of 260 thousand rubles) despite the fact that Dezhnev spent only 200 thousand rubles of personal funds. He can also claim a deduction for mortgage interest.

Ways to return 13% from a mortgage

At the discretion of the taxpayer, the following options are available on how to receive a refund of interest:

- Through the Inspectorate at the place of residence.

- By filling out a tax return form through State Services.

- Through the employer.

- By submitting a package of papers through the MFC.

Intending to receive compensation through an organization, a person is spared the need to wait for the expiration of the annual period - he can receive compensation immediately, with a tax refund when receiving a monthly salary. Other design options are possible after the end of the year in which the transaction took place.

How to get mortgage interest back through the tax office

You can find out which inspection you should contact to coordinate the return of interest from the information on the State Services website by writing your Taxpayer Identification Number (TIN) and place of registration.

The tax registration process in 2021 is presented in the following steps:

- Collection of documents. Order a certificate of the amount of interest paid for the year.

- Preparation of the 3-NDFL report.

- Submission of the complete package to the tax authority at the place of registration.

- Verification of documents and consideration of the legality of providing a deduction.

- Notification of a positive decision and writing an application indicating the details for the transfer.

It takes several days to prepare the package, but it takes the tax authorities 2-3 months to review the application. It takes another 2 weeks to organize payment according to the taxpayer’s details.

Refund through employer

The process of compensation through the Federal Tax Service is lengthy - you need to wait until the end of the year and prepare all the necessary certificates. It is much easier to agree on an income tax refund for interest as wages are paid - the employer will pay the wages without deducting personal income tax.

The matching algorithm looks like this:

- Agree on the right to receive a tax deduction at your place of residence.

- Receive a notification from the tax authorities and submit it to the accounting department at your place of work.

- From the next salary they stop deducting 13%, i.e. The amount of the salary transfer increases by the amount of income tax.

The monthly return authorization lasts for a period of 1 year. Next, the taxpayer needs to apply for approval again.

Through the government services website

Registered users of their personal account on the government services website have access to a simplified form for filing an income tax return remotely. Refund of interest requires the preparation of an online form 3-NDFL and the attachment of scanned documents.

Step-by-step instructions are presented below:

- Authorization in the system, transfer of taxpayer data (passport data, TIN, registration, SNILS number).

- After checking the accuracy of the data, the user will be able to exercise the right to submit 3-NDFL remotely.

- You can find the required section through the Service Catalog by going to the Taxes and Finance section, accepting declarations.

- Next, they choose to provide an electronic service to fill out the form.

- During the filling process, the user’s personal data from the passport and from a certificate from the employer will be required.

- To confirm the information, upload a scanned 2NDFL.

- Select the tax deduction option that you want to apply for.

The transfer of information is confirmed by an electronic signature. Before submitting the form, you must carefully check the correctness of the information entered, since further corrections will not be possible.

A similar online service is provided for taxpayers registered in the LC on the Federal Tax Service website.

Mortgage interest deduction

When purchasing a home with a mortgage, in addition to the main deduction, you can also receive a deduction for the loan interest paid and return 13% of the actual mortgage interest paid.

Note: Your mortgage payments are divided into two parts: principal payments and loan interest payments. You can receive this deduction only for payments on credit interest (payments on the principal debt will not be included in the deduction).

Wherein:

1. The right to deduct mortgage interest arises only at the moment the right of the main deduction arises. If the mortgage was issued earlier than the year in which the extract from the Unified State Register (or the Transfer and Acceptance Certificate) was received, then the deduction can still include all the interest you paid on the first mortgage payments.

Example: In 2021 Belsky G.I. took out a mortgage and entered into a share participation agreement for the construction of an apartment, and in 2021 he received an Apartment Acceptance Certificate. Despite the fact that the mortgage has been paid since 2021, contact the tax office minus Belsky G.I. maybe only in 2021. But he will be able to receive a deduction for all interest actually paid since 2018.

2. The maximum amount of deduction for mortgage interest is 3 million rubles (to be returned 390 thousand rubles).

Note: if the loan agreement was concluded before January 1, 2014, then the old rules apply and the amount of credit interest deduction is not limited.

Example: In 2021 Ulanova N.N. took out a mortgage loan of 10 million rubles from the bank and bought an apartment worth 12 million rubles. For 2010-2020 Ulanova N.N. paid 4 million rubles in mortgage interest.

In 2021 Ulanova N.N. filed a 3-NDFL declaration for 2021 with the tax office and declared the main property deduction in the amount of 2 million rubles. (to be returned 260 thousand rubles), as well as a deduction for credit interest in the maximum amount of 3 million rubles. (to be returned 390 thousand rubles).

Only mortgage interest actually paid for previous calendar years can be claimed as a deduction.

Example: In June 2021 Grechikhin S.D.

took out a mortgage and bought an apartment. In 2021, he can submit a 3-NDFL declaration for 2021 to the tax office to receive a basic deduction and a deduction for interest paid from July to December 2020. In 2022 Grechikhin S.D. will be able to submit documents for 2021 (add interest paid in 2021 to the declaration), in 2023 - for 2022, etc.

Refunds under special bank programs

This happens sometimes in the market. For example, the bank is ready to return to the borrower part of the interest paid, subject to certain conditions and mandatory repayment of the loan without omissions or even the slightest delay. In this case, there may be additional requirements, for example, the purchase of insurance or some kind of service.

A striking example is the return of part of the interest on a loan at Sovcombank. The Bank invites all borrowers to activate the “Guaranteed Rate” service. According to its terms, after payment, the bank will recalculate at the minimum rate, for example, 4.9%, and return the money to the borrower.

If you consider what the catch is, you need to carefully look at the conditions of such offers. For example, in Sovcombank this is the fee for connecting to the “Guaranteed Rate” service and the terms of recalculation:

- there were no delays on all loan products of the bank;

- In addition to the loan, the client uses a Halva installment card and has made at least 1 purchase using it every month;

- insurance was included for the entire loan term;

- the client did not make partial or full early repayment.

So, if the bank promises to return part of the interest after repaying the loan, there are definitely some conditions, and quite serious ones. Study them carefully before agreeing: in fact, not all borrowers end up receiving this refund.

For what loans and borrowings can you get an interest deduction?

A deduction for credit interest can be obtained not only under mortgage agreements, but for any targeted loan aimed at the purchase/construction of housing (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation).

For example, if you took out a loan from an employer and the contract states that the loan will be used to purchase a specific apartment, then you will be able to receive a tax deduction on the loan interest paid. If there is no such entry in the agreement, then despite the fact that you spent the loan on the purchase of housing, you will not be able to receive a deduction (Letter of the Ministry of Finance dated 04/08/2016 No. 03-04-05/20053).

Example: In 2021, Shilova K.O. I took out a loan from an organization to buy an apartment. The agreement clearly states that the loan was spent on the purchase of a specific apartment, therefore Shilova K.O. will be able to receive a credit interest deduction.

Example: In 2021 Tamarina E.M. I bought an apartment for 2 million rubles with a loan for consumer purposes in the amount of 1 million rubles. Since the loan is not intended for the purchase of an apartment, Tamarina E.M. will be able to receive a property deduction in the amount of 2 million rubles (for a return of 260 thousand rubles), but will not be able to take advantage of the interest deduction.

Possible problems and nuances

In the current 2021, as in the previous year, you can choose for yourself exactly how you will return the funds - the entire amount at once or using a monthly % deduction without underpaying tax. Naturally, you can use the first method only if the loan taken from a financial company is repaid in full.

If the case comes to trial in court, then the highest judicial authorities in 95% of cases side with the borrower, and the financial company that is the defendant bears the legal costs. In addition, you can request compensation for moral damages.

You can find out exactly how to return the interest from the video.

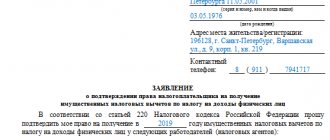

Documents for processing mortgage interest deductions

To receive a deduction for mortgage interest, in addition to the main documents for the transaction (see “Documents”), you must submit to the tax office a copy of the loan agreement and a certificate of interest paid.

The certificate can be obtained from the bank where you took out the mortgage. Some banks issue a certificate immediately, and some - a few days after a written request (it is better to check with your bank).

Sometimes the tax authority may also request payment documents for payment of mortgage interest (payment orders, bank statements, receipts, etc.). In this case, you can either provide documents (if available) or refer to the letter of the Federal Tax Service of Russia dated November 22, 2012 N ED-4-3 / [email protected] , which states that a certificate of interest paid from the bank is sufficient and additional payment No documents are required to receive a deduction.

Registration procedure

Returning taxes through Sberbank is quite simple. Instructions:

- Go to the official website of the bank.

- In the “Insurance” or “Investments” section, find the item “How to return taxes” and click on it.

- A new page will open containing brief information on the topic.

- Select package option.

- Log in to the system through Sberbank Online or register using the form that appears.

- Wait for a connection with a specialist (this takes up to half an hour).

- Discuss all the features of the future tax refund.

- The specialist will provide a list of necessary documents.

- Collect documents, scan them and send them to the bank manager.

- Wait for the required paperwork to be completed.

- Depending on the service package you choose, you can either wait for the transfer (the bank will do everything else on its own) or receive a completed declaration and take it to the Tax Office yourself.

Is it necessary to claim credit interest deduction immediately?

If you have not yet exhausted the main deduction, then you may not immediately claim a deduction for mortgage interest, so as not to submit additional documents to the tax authority. Once the main deduction has been exhausted, you can add information about the credit interest deduction to your return and attach the relevant documents.

Example: In 2021, Khavina M.V. I bought an apartment with a mortgage for 3 million rubles. Income of Khavina M.V. amount to 800 thousand rubles per year (the amount of tax withheld for the year is 104,000 rubles). In this case, in 2021 she will be able to claim the main deduction (since it makes no sense to claim interest).

In 2022, Khavina M.V. will continue to receive the main deduction. In 2023, since the main deduction will be exhausted, she will add to the declaration information about the interest paid from the beginning of payments (from 2020).

What costs can be reimbursed?

A tax deduction on the cost of housing or a property deduction is a benefit that allows you to reduce the tax burden on individuals who purchase residential real estate in the Russian Federation. This benefit also applies to interest on a mortgage taken out for the purpose of purchasing this property. An individual has the right to use these deductions once in his life.

The specifics of obtaining a deduction for the cost of housing and interest paid on a mortgage are regulated by Article 220 of the Tax Code (TC) of the Russian Federation - “Property tax deductions”. According to the provisions of this article, using a tax deduction you can compensate for:

- funds paid for the purchase of a residential building, apartment, room or shares thereof;

- expenses for finishing the premises if it was purchased without it;

- costs of developing projects and estimates;

- payment for installation work and building materials necessary for the construction of a residential building;

- purchase of land if it serves as the basis for the construction of housing or is purchased together with the house;

- deduction of interest on a mortgage, provided that the intended purpose of the loan is the purchase or construction of housing.

The above expenses are not compensated if:

- they are financed from the state budget;

- they were incurred by other individuals, institutions, organizations;

- the parties to the transaction are relatives, family members or other interdependent persons.

Is it necessary to submit documents for deduction every year?

Often a situation arises when the main deduction has already been exhausted, and the amount of interest paid on the mortgage is small. To save time, you can not submit documents to the tax authority every calendar year, but submit them once every few years, including in the declaration all interest paid for these years.

Example: In 2021 Detnev L.P. I bought an apartment with a mortgage. According to the terms of the mortgage, he annually pays mortgage interest in the amount of 100,000 rubles. Income of Detnev L.P. per year exceed 2 million rubles. In 2021, Detnev filed documents with the tax authority and received a basic deduction and a deduction for interest paid in 2021. In 2021, Detnev may not file a return, but wait a few years and declare all the interest at once: for example, file documents in 2023 and receive a deduction for interest paid in 2021, 2021 and 2022.

Comments: 6

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Irina

08/23/2021 at 14:56 Is it possible to return interest if the loan is paid early, but the bank kept silent about the need to write an application for early repayment? And what is the deadline for filing an application for interest refund? Is it possible to apply for a refund after 2-3 years? The client was not informed by the bank about this possibility.

Reply ↓ Anna Popovich

08/23/2021 at 15:35Dear Irina, for this you will have to go to court. Substantial evidence will be required for the court to consider your claim.

Reply ↓

05/30/2021 at 23:02

Hello, could I return the interest on early repayment of a loan from an eastern bank, I paid it off for a year and the amount remained the same and has not changed

Reply ↓

- Olga Pikhotskaya

05/30/2021 at 23:12

Julia, hello. Log in to your personal mobile or Internet banking account and contact the operator via chat. An employee will check your receipts and answer your questions. You can also call the hotline - 8800 100 7 100.

Reply ↓

05/27/2021 at 11:49

Good afternoon, dear specialists! My husband and I made FULL early repayment to Tinkoff Bank. Having previously communicated with a bank specialist about the exact amount of debt on that day in order to completely close the loan. The amounts have been deposited. 6 months have passed. It turns out that we had to not only repay the entire amount, but be sure to call the bank and ask to write off this amount for full repayment. BUT THE BANK SPECIALIST DIDN'T WARN US ABOUT THIS. Now, in 7 months, large interest has accrued. Why doesn't the bank impose fines for incorrect work of employees? Please tell me what to do. Can I insist that this is not our fault and I will not pay. Thanks in advance for your feedback

Reply ↓

- Olga Pikhotskaya

05/27/2021 at 13:59

Svetlana, good afternoon. You can send a complaint about the work of Tinkoff Bank employees to the following address. You can resolve the issue of interest payments by calling a toll-free number or with an operator in the chat of a mobile or Internet bank.

Reply ↓

Interest deduction for refinancing (loan refinancing)

If you refinance a loan with another bank, you can receive a deduction for interest on both the original and the new loan (clause 4, clause 1, article 220 of the Tax Code of the Russian Federation). At the same time, it is important that the new agreement clearly states that it was issued to refinance a previous targeted loan.

Example: Golovanov I.V. I bought an apartment in 2019 worth 3 million rubles (of which 1 million rubles were my own funds, and 2 million rubles were borrowed). In 2021, he refinanced the loan with another bank. Then, upon receipt of the interest deduction, Golovanov I.V. will be able to take into account the interest paid on the first and second loans.

Registration cost

The cost of the service mainly includes assessment of the client’s actions, preparation of a list of necessary documents, as well as filling out a declaration. In addition, it is possible to send the declaration to the Tax Office by bank employees. It's more convenient, but a little more expensive.

Packages from Sberbank:

There are several basic packages: maximum, optimal and minimum. The latter is practically not used and is not even on the list of currently relevant services. Thus, only the optimal and maximum packages remained actually active.

Maximum

This package costs RUB 2,999.00 for regular customers. In addition, there are discounts of up to 30% for salary clients. And for package owners, the return price is always fixed: 1500.00 rubles. In addition to the usual list of actions, in this case, bank employees themselves will send the declaration to the tax office. In fact, the client is only required to prepare documents and send them to a Sberbank specialist.

Optimal

A cheaper package, the cost of which is only 1499.00 rubles. For Premier clients it is absolutely free, and for salary clients it will cost 30% less. The only difference between it and the maximum is that you will have to submit the tax return yourself.

Minimum

This package is no longer relevant at the time of writing this article. Previously, it was possible to obtain a list of documents for only 499 rubles, but the service did not include filling out a declaration. Considering the fact that this is precisely what most applicants have problems with, Sberbank simply removed this option of the package, leaving only the most popular ones.