Author of the article: Lina Smirnova Last modified: January 2021 20503

Alimony can be calculated in different ways. When paying benefits, disputes often arise about whether alimony should be calculated as a tax deduction. Let's consider what a tax deduction is, when it can be assigned and in what order it is carried out, and also when, when paying alimony, it becomes necessary to take into account the tax deduction when calculating the amount of alimony.

What is a tax deduction and when is it available?

According to Russian law, all officially employed citizens are required to pay tax, which currently amounts to 13% of total earnings. In some cases, taxation may be reduced and part of the tax paid will be offset as a tax deduction.

A tax deduction refers to the amount by which an employee’s taxable income is reduced. The excess tax amount transferred is returned to the employee. Tax legislation provides for five areas in which it is possible to obtain a deduction. These include:

- the social sphere, which includes charity, education of citizens themselves and their children, treatment costs and pension savings;

- some types of professional activity, for example, private enterprise, award-winning authorship;

- property costs incurred when purchasing an apartment, payment of mortgage interest and other expenses related to real estate;

- standard direction, when the provision of a deduction is provided in a fixed amount for a certain category of people: citizens raising minor children, who have become partially disabled as a result of a serious injury, as well as persons with a special status;

- investment direction associated with income received from investments in securities.

Expert commentary

Leonov Victor

Lawyer

When collecting alimony, you most often have to deal with the need to take into account funds received from the property tax deduction, child social deduction, as well as the standard deduction.

Methods for calculating tax deductions

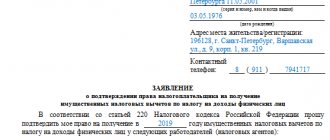

In order to receive a tax benefit, an employee must collect the necessary documents and submit them to the tax office along with the application. For example, when receiving a property deduction, you must present:

- agreement on the transaction for the purchase of housing;

- mortgage agreement;

- act of acceptance of purchased housing;

- documents confirming payments made for real estate and obtaining a mortgage loan.

After reviewing all submitted documents, the Federal Tax Service issues the applicant a Notice of confirmation of the right to a property deduction.

The tax deduction is returned to the employee in two ways:

- by compensating for overpaid tax in the form of a one-time amount, the funds are transferred to the payer’s bank account or his bank card;

- by canceling the collection of personal income tax for some time.

In the first option of receiving a deduction in a one-time amount, you will need to submit to the Federal Tax Service an income tax return with a monthly breakdown, which is issued by the company’s accounting department, and submit an application there for the refund of the excessively transferred amount of tax to the bank account specified in the application.

In the second method of obtaining a deduction, you should immediately contact the accounting department of the enterprise after receiving the Notification from the tax service about the right to a tax benefit to adjust the collection of VAT.

Expert commentary

Shadrin Alexey

Lawyer

You can receive a deduction only for the three-year period (for each year separately) preceding the year in which the application was submitted.

How can I appeal a penalty?

In this situation you need to know the following:

- the complaint is filed within 10 days from the date of the decision. If the alimony payer was not notified of such a decision, he is given 10 days to write a complaint from the moment he learned about it (Article 122 of Law No. 229-FZ);

- written in the name of a higher official who has the right to consider this issue: the senior bailiff or his deputy, the chief bailiff of the subject or the Russian Federation (Article 123 No. 229-FZ);

- the document is considered no more than 10 days (Article 126 No. 229-FZ);

- the decision is formalized in the form of a resolution, a copy of which is sent to the applicant within three days.

REFERENCE! If an official refuses to consider a complaint or the decision made does not satisfy the injured party, then the latter has the right to go to court (Article 128 No. 229-FZ).

The complaint is submitted in writing, taking into account the provisions of Art. 124 of Law No. 229-FZ :

- position and full name of the bailiff who made the withdrawal of money from the account to pay alimony;

- Full name of the person making the complaint or his representative;

- essence of the complaint. Indicate the unlawful action committed by the bailiff against the citizen;

- requirement for the return of written-off funds.

The document is signed by the applicant or his representative, who is required to attach evidence certifying his authority.

From what income is alimony paid?

In accordance with the Government Decree of the Russian Federation No. 841 dated July 18, 1996, which states that alimony for child support is calculated from all the payer’s income specified in the list established by law.

It includes the following types of income:

- official wages, as well as bonuses and various allowances calculated by the enterprise’s accounting department;

- payments in connection with vacation and illness (based on sick leave);

- pensions and scholarships;

- amounts paid in the form of financial assistance;

- funds from rental housing;

- other income.

The returned amount of the tax deduction is not directly included in the legally adopted list of income from which alimony is required to be paid.

Nuances of payments for children

Alimony can be awarded in kind or in cash. The second option is more common, however, in the absence of sufficient income, material support can be expressed in the transfer of a specific volume of natural products.

Alimony in cash format is prescribed as a fixed amount or a certain percentage of wages and other income. The first option is used if earnings vary greatly or a person hides real income. Fixed payments are usually calculated based on the average level of earnings in the region.

When assigning percentages, the number of children is taken into account. For one child, a quarter of the individual’s income is withheld, for two – 33%, for three or more – half of the income. Alimony is also awarded to adoptive parents.

Important! When parental rights are deprived and a child is sent to an orphanage, two parents act as payers of alimony.

Receiving tax refunds and paying alimony at the same time has a lot of nuances. The main thing that the payer should know is that the presence of debt for child support can lead to deprivation of the right to a tax refund.

Mechanism for calculating alimony

Alimony can be paid in a constant amount, the amount of which is determined in a joint agreement of the parties, drawn up on the basis of voluntary wishes.

Another basis for the payment of alimony is a court decision or court order setting the calculation of payments as a percentage of the payer’s income. By the way, a fixed amount of alimony can also be imposed by a court by force if the payer has unstable earnings or is generally looking for work.

When alimony is paid in a constant amount, independent of the payer’s income, there are no further questions regarding the determination of their amount. Difficulties arise when the amount of alimony is tied to his earnings, and is calculated as a percentage of it. Withholding of alimony from wages is carried out by the accounting department of the enterprise upon the presentation of a writ of execution or an application from the employee himself.

To calculate the alimony amount to be paid, tax-exempt income is taken, i.e. First, personal income tax is withdrawn from the employee’s total income, and then the required percentage of alimony is taken from the remaining amount of income.

Expert commentary

Kolesnikova Anna

Lawyer

If part of the tax is returned to the payer in the form of a deduction, then the question arises where to include this amount: to his income, from which alimony should be paid, or considered simply as compensation for overpaid tax. Let's figure it out.

Alimony withholding before or after personal income tax withholding

At what point should child support be withheld: before or after personal income tax withholding?

Correct distribution

The law requires both parents to provide for their minor children. When a child lives with one of the parents, the other pays child support for his maintenance.

In practice, in most cases, children remain to live with their mother, and the father pays child support. But recently this trend is not so clear. Many fathers raise children, and mothers pay the amount for their maintenance.

Everyday nuances

For those citizens who raise their children together, the issue of alimony and the intricacies of paying it is not at all interesting. But many fathers who have to pay money to support their offspring do not know how and in what amount to pay child support. In addition, the experience and competence of the employer also play a big role here. Therefore, let's look at this issue.

Grounds for deduction of alimony

An order to withhold and transfer alimony through the company’s accounting department is sent to the employee at his main place of work. The basis may be:

- performance list;

- court order;

- alimony agreement certified by a notary;

- resolution of the bailiff.

Accountants should be aware that alimony payments should only be withheld after income taxes have been withheld. That is, they are, as it were, second in line (Part 1 of Article 99 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”, hereinafter referred to as Law No. 229-FZ).

Deduction amounts

The writ of execution does not always indicate the specific amount of a fixed amount of alimony. Then the unfortunate spouse and his employer should know that they will have to pay:

- for one child – 25 percent of the amount of calculated earnings excluding personal income tax;

- for two children - a third of the same income according to the same calculations;

- for three or more children, you will have to share half of your income.

When does the amount of alimony include tax deductions?

The issue of collecting alimony from this amount causes a lot of controversy. It is indirectly explained by letter No. 2261-6-1 dated June 2012, issued by the Federal Labor and Employment Service. It states that the tax deduction provided when paying a monthly salary should be classified as income received periodically, because with this method of returning it, the citizen’s taxable income decreases, and, consequently, the salary he receives increases.

If the received increased salary is attributed to the income of the alimony payer, then alimony should be collected from it. This is what happens in practice.

With another method of receiving a deduction in the form of a one-time transfer to a bank account of the entire amount accumulated during the reporting year, it will not be possible to classify it as periodically received income. It is especially difficult to attribute a lump sum of property deduction received when purchasing an apartment to income. It significantly exceeds the payer’s basic income, because deductions can be calculated not only on the cost of the apartment itself, but also on interest on the mortgage.

Expert commentary

Gorbunova Olga

Lawyer

Alimony can be collected from this amount in each situation individually. For example, if the payer has a large debt for alimony, then his bank account may be seized and the deduction amount transferred to him may be collected to pay off the debt.

One child

In our case, with a salary of 36,000 rubles while supporting one child, income tax is taken not from the indicated amount, but from the amount:

36,000 – 1400 = 34,600 rub.

The tax from this amount will be equal to 4498 rubles. (34,600 x 13:100), and not 4,680 rubles without taking into account the deduction.

Then alimony will be calculated based on the amount of 31,502 rubles. (36,000 – 4498).

The amount of alimony is 7875.50 rubles. (31,502 x 25:100).

The employee will receive: 36,000 – 4498 – 7875.50 = 23,626.50 rubles.

Let's compare the amounts received by the worker in different cases: 23,490 and 23,626.50 rubles.

The difference with the tax deduction refund is only 136.50 rubles. (23,626.50 – 23,490).

Thus, with a tax deduction, a person will receive 136.50 rubles more than without its use.