The right to a tax deduction appears in the case when you have carried out certain transactions with property (Article 220 of the Tax Code of the Russian Federation). It could be:

- buying a home - a house, apartment, room, etc.;

- sale of property;

- construction of housing or acquisition of land for these purposes.

To receive a tax deduction, you will need either a registration certificate and a purchase and sale agreement, or a transfer and acceptance certificate and a share participation agreement.

In this article we will look at the situation with purchasing an apartment.

- Who can receive a property tax deduction

- What documents are needed to receive a deduction?

- Amount of deduction and maximum expenses

- How to calculate the amount of deduction

- What is taken into account as expenses when calculating deductions

- Stages of obtaining a property tax deduction

- Obtaining a property tax deduction through an employer

- In 2021, it will be possible to receive a tax deduction without a declaration

Who can receive a property tax deduction

Firstly, only citizens of the Russian Federation who purchased an apartment in Russia can count on the benefit. It is important that you pay your own money for the housing or take out a mortgage.

Secondly, the deduction is provided to those taxpayers who have taxable income at a rate of 13%. To do this, you need to receive an official salary and pay personal income tax on it.

For example, if an individual entrepreneur uses a simplified taxation system, then he will not be able to receive a tax deduction, since “simplified” ones are exempt from paying personal income tax. On the same basis, self-employed people (payers of professional income tax) are deprived of this benefit.

However, both individual entrepreneurs using the simplified tax system and self-employed people can receive additional income subject to personal income tax. For example, they can earn money from their own activities and at the same time work officially in the company. In this case, they will have the right to receive a property tax deduction in the tax period in which income taxed at a rate of 13% was received.

If a taxpayer bought an apartment in 2021 and received a registration certificate in 2020, then starting from 2020 he has the right to a deduction. Therefore, as soon as you have received documents confirming your rights to real estate, begin collecting the necessary papers to receive a property tax deduction.

Algorithm for filling out sections 1 and 2 of the 3-NDFL declaration when purchasing an apartment

Vasiliev N.A. took the data for completing the title page of 3-NDFL from his passport, and found out the necessary codes at the tax office at his place of residence (see table):

| Field name | Meaning | Explanation | Link to regulatory document |

| Correction number | 0 | The declaration is submitted for the first time, therefore a zero value is entered | Order of the Federal Tax Service of Russia “On approval of the form of the tax return for personal income tax (form 3-NDFL), the procedure for filling it out, as well as the format for submitting the tax return for personal income tax in electronic form” dated 08/28/2020 No. ED-7 -11/ [email protected] |

| Tax period code | 34 | established by Federal Tax Service Order No. ED-7-11/ [email protected] for the 3-NDFL declaration | |

| Taxable period | 2020 | The year for which 3-NDFL is provided is indicated | |

| Tax authority code | 1838 | Code of the tax inspectorate at the place of residence of Vasiliev N.A. | |

| Code of the country | 643 | Digital code of the Russian Federation | |

| Taxpayer category code | 760 | Designation of an individual |

Next, Vasilyev N.A. proceeded to filling out section 2 “Calculation of the tax base and the amount of tax on income taxed at the rate...”.

To the right of the section name, Vasiliev N.A put the number “13”, which means the personal income tax rate (13%), and in paragraph 1 “Type of income” he indicated the number “3”, selecting the appropriate option from the list next to this cell .

In lines 010, 030 (intended to reflect income) and 040 (dedicated to deductions), he entered the same values - the amount of income received in 2021 (information taken from the 2-NDFL certificate) and the amount of deduction equal to it. In line 060 I put “0”, which means there is no difference between the income indicated in line 010 and the tax deduction amount reflected in line 040:

Lines 080 (personal income tax withheld) and 160 (subject to return from the personal income tax budget) reflect the amount of income tax withheld by the employer (its amount is indicated in certificate 2-NDFL and in this example is equal to 57,720 rubles):

The same amount must be transferred to section 1 of the 3-NDFL declaration (line 050) - this amount will be returned to N.A. Vasiliev from the budget. In line 040 enter 0 (nothing needs to be paid to the budget based on the conditions of the example). To fill out lines 020 and 030 with codes, the taxpayer used the information about KBK posted on the Federal Tax Service website, and specified the OKTMO code in the classifier:

| Line name | Meaning | Regulatory document |

| Budget classification code (line 020 section 1) | 18210102010011000110 | List of BCCs approved by the Russian Ministry of Finance for the corresponding year |

| OKTMO (line 030 of section 1) | 94740000 | All-Russian classifier of municipal territories, approved by order of Rosstandart dated June 14, 2013 No. 159-st. |

When filling out section 1, you should pay attention to line 010 - it consists of only 1 cell and is lost against the background of multi-valued lines dedicated to KBK and OKTMO. In this line, Vasiliev N.A. placed the number “2”, selecting from the list offered next to the necessary action with personal income tax for his case - “refund from the budget”:

As a result of the calculations performed, it turned out that for 2021 Vasilyev N.A. can return the tax only on part of the deduction, and its unused amount is transferred to subsequent periods. Find out how this happens in the next section.

What documents are needed to receive a deduction?

This kit includes:

- passport;

- income certificate in form 2-NDFL, which indicates income and taxes paid for the corresponding year;

- Declaration 3-NDFL, from which it is clear that property was acquired, taxes were paid and that a certain amount of property tax deduction is due.

For the apartment you will need:

- apartment purchase agreement;

- an act on the transfer of an apartment to the taxpayer or a certificate of state registration of the right to an apartment.

If the apartment was purchased through a shared participation agreement:

- an agreement on shared participation in construction or an agreement on the assignment of the right to claim;

- an acceptance certificate or other document confirming the transfer of the object from the developer to the participant;

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account).

If the apartment was purchased on the secondary market:

- agreement on the purchase of an apartment (for example, a purchase and sale agreement);

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account);

- documents confirming ownership of the apartment (for example, a certificate of state registration of rights).

If you bought a house and land:

- agreement for the purchase of a land plot with a residential building;

- copies of payment documents (for example, payment orders, bank statements about the transfer of money from the buyer’s account to the seller’s account);

- documents confirming ownership of a residential building (for example, a certificate of state registration of title);

- documents confirming ownership of a land plot (for example, a certificate of state registration of rights).

Until 2014, property tax deductions were issued for only one property, but now it can be received from several apartments. The limit on the amount remains the same - no more than 2 million rubles. For example, if an apartment costs 1.5 million rubles, then you can get a deduction of another 500,000 rubles. from the next apartment.

Until 2014, there were no restrictions on mortgage interest. For example, from an overpayment of 10 million rubles. it was possible to get a deduction for the entire 10 million rubles. Starting from 2014, a limit was introduced on the deduction of mortgage interest in the amount of 3 million rubles.

Tax deductions can be obtained not only for real estate, but also for mortgage interest.

For this you need the following documents:

- loan agreement with annexes and additional agreements thereto;

- documents confirming payment of interest on the mortgage (for example, a certificate from the bank).

The deduction is issued for the interest actually paid. For example, if a mortgage agreement was signed for 10 years 3 years ago, then a tax deduction is issued for the amount of interest paid for 3 years. Interest paid in the following year will be tax deductible in the following year.

Who is eligible for a tax refund?

To receive compensation for a mortgage loan, it is necessary for a citizen to meet the following requirements:

- Having Russian citizenship, or staying in the country for more than 6 months with the payment of personal income tax as part of official work.

- Availability of official employment with payment of the income tax required by law.

Persons who do not receive income and do not pay personal income tax to the budget are not entitled to receive compensation. If there is no income and no tax paid, there is nothing to return from the budget. Citizens working unofficially are also not entitled to a refund of interest. With a gray salary, the taxpayer has the right to issue a deduction only in the amount of the tax that is confirmed by the 2-NDFL certificate.

If the borrower is an individual entrepreneur, it is impossible to return personal income tax from the budget if a simplified taxation scheme is applied.

Amount of deduction and maximum expenses

There are some nuances with the registration of deductions depending on the type of property.

- Sole proprietorship . When buying an apartment, you can return the property tax deduction, but not more than 2 million rubles. 13% of the cost is refundable. By purchasing an apartment for 2 million rubles, you can return 260,000 rubles. previously paid taxes, and for 1 million rubles. — 130,000 rub. If the purchase price is more expensive, the refund amount will not change.

- Common shared ownership . For example, when purchasing ½ share in an apartment for 3 million rubles. You can apply for a deduction of no more than 1.5 million rubles.

- Common joint property . Until 2014, spouses for two could receive a deduction of no more than 2 million rubles. Therefore, it was more profitable to issue a deduction for only one of the spouses, and the other could receive another tax deduction in the future. Since 2014, the limit is 2 million rubles. are established not per property, but per person. For example, if the cost of an apartment is 5 million rubles, then each spouse can receive a deduction of 2 million. If the apartment costs 3 million rubles, you can agree to make a deduction of 1.5 million rubles, and then each 500,000 rubles remain, which can be used for the following objects.

Preparation of 3-NDFL declaration sheets for the purchase of an apartment

Filling out 3-NDFL begins with special sheets - appendices 1, 6 and 7. The data reflected in these sheets is for informational purposes only:

- sources of income of the taxpayer (Appendix 1);

- the amount of property deductions (Appendix 6 and 7).

Appendix 1 contains a number of identical blocks (lines 010–080). For Vasiliev N.A. from our example, it is enough to fill out only 1 block, since last year he received income from 1 employer. If the taxpayer received income from several sources, for each of them it would be necessary to fill out a separate block 010–080 of Appendix 1.

To fill out the sheet, all data is taken from the 2-NDFL certificate, but you need to enter one more code correctly:

| Line name | Meaning | Regulatory document |

| Income type code (line 020 of application 1) | 07 | Appendix No. 3 to the Procedure approved by Order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

Code “07” means income received under an employment contract, tax on which is withheld by the employer.

Filling out Appendix 7 begins by indicating the encoded information (in the table, the codes are given based on the conditions of the example):

| Sub-clause name and line number | Meaning | Explanation |

| Clause 1.1 - object name code (line 010 of application 7) | 2 (apartment) | Appendix No. 6 of the Procedure, approved. by order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

| Clause 1.2 - taxpayer attribute code (line 020 of application 7) | 01 (apartment owner) | Appendix No. 7 of the Procedure, approved. by order of the Federal Tax Service of Russia No. ED-7-11/ [email protected] |

| P. 1.3 - information about the object - line 030 of Appendix 7 method of purchasing a residential building — line 031 of application 7 object number code | dash 1 (cadastral number) | When buying a house, indicate code 2, if the house is built - code 1 When buying an apartment, put a dash The code is selected from the list located to the right of the cell to be filled in |

Further filling out Appendix 7:

- pp. 032-033 - reflection of the cadastral number and address of the purchased apartment;

- subp. 1.4–1.6 - entering information about the date of the document (deed of transfer of the apartment, certificate of state registration of ownership of the property);

- subp. 1.7 - share in ownership;

- subp. 1.8 - when filling out this line, Vasiliev N.A. must keep in mind that the amount of his expenses for purchasing an apartment (2,750,000 rubles) exceeded the allowable tax deduction of the Russian Federation (2 million rubles), therefore, in the cells of this line he you must indicate the number 2,000,000.

Of all the subsequent subparagraphs of the application, Vasilyev N.A. filled out subparagraph. 2.5, 2.8 and 2.10 (see table below):

| Sub-clause name and line number | Meaning (for this example) | Calculation algorithm |

| P. 2.5 - the size of the tax base in relation to income, taxed at a rate of 13%, minus tax deductions (line 140 of Appendix 7) | 484 000 | Data is taken from certificate 2-NDFL |

| Clause 2.6 - the amount of documented expenses for the purchase of an apartment, accepted for the purposes of property deduction for the tax period (line 150 of appendix 7) | 484 000 | The amount indicated in this line cannot exceed the calculated tax base specified in clause 2.5 |

| Clause 2.8 - the balance of the property deduction carried over to the next tax period (line 170 of appendix 7) | 1 516 000 | The figure for this line is calculated using the formula: page 080 – page 150 = 2,000,000 – 484,000 = 1,516,000 rub. |

N.A. Vasiliev did not fill out Appendix 5, since he did not receive standard and social deductions in 2021.

We will tell you how N.A. Vasiliev prepared the remaining sheets of 3-NDFL in the next section.

For a sample of filling out Appendix 7, see here.

How to calculate the amount of deduction

The maximum deduction amount is: 2,000,000 x 13% = 260,000 rubles. This amount can be applied to several purchased residential properties if their total cost is less than 2 million rubles. (clause 3 of article 220 of the Tax Code of the Russian Federation).

If real estate is purchased by spouses, then each of them has the right to a maximum deduction amount of 2 million rubles.

If a loan was taken out to purchase property, you can receive a deduction of no more than 3 million rubles for interest. The maximum deduction amount is: 3,000,000 x 13% = 390,000 rubles.

What is taken into account as expenses when calculating deductions

If you purchase an apartment, then the costs take into account:

- the purchase of real estate itself;

- acquisition of rights to an apartment in a building under construction;

- spending on finishing materials;

- apartment finishing work, development of design and estimate documentation.

If you buy a house or build one, then the costs include:

- development of design and estimate documentation;

- purchase of building materials, as well as finishing materials;

- the purchase of a house itself, including at the stage of unfinished construction;

- house construction and finishing work;

- carrying out electricity, water and gas supply and sewerage.

Can the 3-NDFL sample when buying an apartment be used when selling it?

The 3-NDFL declaration when selling an apartment is somewhat different in composition from the 3-NDFL when buying it. The example discussed above can be used in such a situation, but only partially:

- You can leave only the title page without adjustments (by specifying the tax period);

- in section 1, similar codes KBK and OKTMO are filled in (the rest of the information changes);

- section 2 and appendix 1 are drawn up in a different way;

- Instead of Appendix 7, the calculation for Appendix 1 is filled out.

To fill out a 3-NDFL declaration when selling an apartment, the same methods can be used as when filing a 3-NDFL in other situations (you can use a special program, fill out the declaration form yourself, etc.).

Find answers to your questions in the materials in the “Personal Income Tax for an Apartment” .

Stages of obtaining a property tax deduction

So far the process consists of four stages. But most likely, already in 2021, a bill will be adopted that will amend the Tax Code in terms of introducing a simplified procedure for obtaining tax deductions for personal income tax. The deadline for submitting amendments is February 24, 2021.

Step 1. Collect copies of all necessary documents

Copies of documents confirming the right to housing:

- when constructing or purchasing a residential building - a certificate of state registration of the right to a residential building or an extract from the Unified State Register;

- when purchasing an apartment - a purchase and sale agreement, an act of transfer of the apartment to the taxpayer, a certificate of state registration of ownership or an extract from the Unified State Register of Real Estate;

- when purchasing a land plot for construction or ready-made housing - a certificate of state registration of ownership of the land plot and a certificate of state registration of ownership of a residential building;

- when paying off interest on a mortgage - a mortgage agreement, a schedule for repaying the loan and paying interest on the use of borrowed funds.

Until 2021, to receive a deduction, it was enough to provide a certificate of state registration of the right. But in 2021, there were changes in confirming the right to a property deduction when purchasing real estate (Federal Law dated July 3, 2016 No. 360-FZ). If you purchased real estate after July 15, 2021, then the right to a property deduction will have to be confirmed with an extract from the Unified State Register.

Copies of payment documents:

- confirming expenses for the acquisition of property (receipts for receipt orders, bank statements about the transfer of funds);

- evidence of payment of interest under the mortgage agreement (certificate of interest paid for using the loan).

Stage 2. Take certificate 2-NDFL from work

Just contact the accounting department - they will prepare it.

Step 3. Fill out the 3-NDFL declaration

You will need data from your passport, 2-NDFL and other documents.

Please note that Form 3-NDFL is updated annually, but you must use the one that corresponds to the year for which the personal income tax is being returned.

On its website, the Federal Tax Service provides an example of filling out a tax return in Form 3-NDFL.

If the property was purchased as a common joint property, you must provide:

- a copy of the marriage certificate;

- a written statement on the agreement of the spouses on the distribution of the amount of property tax deduction.

Please note: the new form 3-NDFL includes a statement for a refund of the amount of overpaid tax. It also needs to be filled out so that the tax office can transfer the amount to you.

Until 2021, the application had to be filled out separately using a special approved form (Order of the Federal Tax Service of the Russian Federation dated February 14, 2017 No. ММВ-7-8 / [email protected] ).

In your application please indicate:

- Name of the bank;

- bank account details to which the amount must be transferred (the amount in the application must match the amount indicated in the declaration).

Step 4. Submit a set of documents to the tax office

The package of documents is submitted either to the tax office at your place of residence in person, or through your personal account on the Federal Tax Service website. Specialists check documents within 3 months. If any questions arise, you will be contacted and asked for original documents. If everything is in order, the money will be credited to your account. In general, the procedure for obtaining a property tax deduction takes a maximum of 4 months.

Results

The right to apply a property deduction for personal income tax arises when acquiring housing through its purchase or construction. The scope of the deduction includes all actual costs incurred in connection with the emergence of the corresponding object, and interest costs on the loan taken for the purchase (construction).

The deduction becomes applicable after acquiring ownership of the property and completing the investment in it. The Federal Tax Service must be notified of the emergence of the right to it either in the year of its occurrence or upon its completion. In the first case, you can start receiving the deduction at your place of work immediately, in the second, its amount attributable to the past year will be returned by the tax authority.

Since the amount of the deduction usually exceeds the employee's annual income, the tax refund in connection with it is carried out over several years. In this regard, an application for the use of a deduction is submitted several times until it is fully used. To fill out an application, the Federal Tax Service of Russia has developed a recommended form.

Sources:

- tax code

- Order of the Federal Tax Service of Russia dated January 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Obtaining a property tax deduction through an employer

If you contact your employer, you can receive a property tax deduction before the end of the tax period. In this case, filing a 3-NDFL declaration is not required.

What do you need:

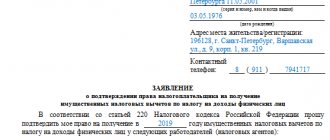

- Write an application (in any form) to receive a notification from the tax authority about the right to a property deduction. You can use the form that the Federal Tax Service recommends in Letter dated October 6, 2016 N BS-4-11 / [email protected] But it is much easier to submit an application through the taxpayer’s personal account, since there is already a special form there.

- Make copies of documents confirming your right to receive a deduction. Upload them to the taxpayer’s personal account and sign with an electronic signature (there is no need to specially obtain it, it is generated automatically).

- Submit to the tax authority an application to receive notification of the right to a property deduction, attaching copies of documents confirming this right.

- After 30 days, receive a notice of the right to deduction from the tax authority and give it to your employer.

- Provide a notice issued by the tax authority to the employer, which will be the basis for not withholding personal income tax from the amount of income paid to an individual until the end of the year.

A notification from the Federal Tax Service is the basis not to withhold personal income tax from the salary paid to an employee in the current tax period, and the main document confirming the right to deduction, therefore, upon receiving the notification, you must check whether all your data and details are correct.

Yulia Rybalko Leading payroll specialist in legal

note

- There is no statute of limitations for obtaining a property tax deduction. For example, you can receive a tax deduction even 10 years after purchasing an apartment.

- If you file a deduction yourself, then at the tax office, after the end of the tax period, you can count on a one-time full amount of 13% of your income earned during the year. If the deduction is issued through the employer, then the personal income tax refund will occur before the end of the tax period if the tax office confirms the right to the deduction. This will allow you to receive your salary without personal income tax withholding, starting from the month in which you received the notice from the tax office.

- According to paragraph 9 of Art. 220 of the Tax Code of the Russian Federation, if property tax deductions cannot be used in full during a tax period, their balance can be transferred to subsequent tax periods until they are fully used. Depending on the taxpayer’s earnings, personal income tax refunds may take several years.

Help fill out 3-NDFL: where to start compiling

You can fill out 3-NDFL in several ways:

- use the electronic program on the Federal Tax Service website - the program itself will calculate the personal income tax based on the input data and check the correctness of filling out the declaration;

- turn to the services of special consultants - in this situation, you will not have to enter information into the cells yourself and count nothing, you just need to collect and make available to the consultant all supporting documents, as well as pay for his services;

- independently prepare all the papers for the tax office - our material will help you cope with this process.

NOTE! The declaration for 2021 must be submitted using the new form from the Federal Tax Service order dated August 28, 2020 No. ED-7-11/ [email protected] you can here.

To confirm your right to a personal income tax refund when purchasing a home, you must fill out several sections in the 3-NDFL declaration:

- title page;

- 2 sections (1st - containing information about tax, 2nd - with calculation of the tax base and personal income tax);

- 3 sheets (Appendix 1 - information on income received, Appendix 5 and 7 - calculation of standard, social and property deductions).

Let's consider the scheme for filling out 3-NDFL when buying an apartment using the following example.

Example

Vasiliev Nikolay Antonovich in 2021 purchased an apartment for 2,750,000 rubles using accumulated funds. The 2-NDFL certificate received from his employer indicates taxable personal income tax (13%) income for 2021 in the amount of 484,000 rubles. (Personal income tax withheld by the employer - 57,720 rubles).

Let us dwell in detail on filling out the 3-NDFL declaration when purchasing an apartment using the example data in the following sections.

How to fill out 3-NDFL if housing was purchased using maternity capital? The answer to this question is in ConsultantPlus. If you do not yet have access to the system, get trial online access for free and proceed to the material.

In 2021, it will be possible to receive a tax deduction without a declaration

Already in the spring of 2021, the process of obtaining a deduction can be automated and therefore simplified. On January 26, the State Duma adopted in the first reading a bill on providing personal income tax deductions online.

The Federal Tax Service promises that in order to return personal income tax, it will be enough to simply fill out an electronic application generated in your personal account on the Federal Tax Service website. You won’t have to worry about filing declarations and certificates. And tax authorities will be able to receive information about the right to deduction without the participation of taxpayers. For example, if the purchase of an apartment is carried out with the participation of a bank, then the information necessary for a tax deduction will be received by the tax authority from the bank.

The law will make life easier for many.

The pandemic has shown us how important it is to develop digital technologies, to make access to government services remote, so that people can use them in any situation. Vyacheslav Volodin Chairman of the State Duma

Earlier, the press service of the Federal Tax Service explained to Rossiyskaya Gazeta that the improved procedure will reduce the time required to receive deductions - from 3 to 1.5 months.

Repeated declaration 3-NDFL: will additional documents be needed?

The concept of “submission of a repeated declaration” is not used in tax legislation. From the taxpayer’s point of view, this may mean re-applying to the tax authorities for the balance of the unused deduction - a situation where several 3-NDFL declarations are filed for one-time expenses incurred related to the purchase of an apartment (primary and subsequent - for income received in the periods following for the first year of receiving the deduction).

Some information in each subsequent declaration will be repeated (data about the taxpayer and the purchased property), and information about the income received and personal income tax will change.

In this case, you will have to start collecting documents again - you need to:

- fill out an application for a personal income tax refund;

- request new 2-NDFL certificates;

- issue 3-NDFL.

Copies of other documents (for example, an apartment purchase and sale agreement) do not need to be provided again.

The video tutorial will help you correctly write an application for an income tax refund: “We are preparing an application for a personal income tax refund (sample, form) .