Enforcement proceedings are a process that is initiated after a lawsuit regarding non-payment of a debt. The creditor, IRS, or other payee has the right to sue. If the judge rules in his favor, enforcement proceedings will be opened against the person with the debt. The Federal Bailiff Service will intervene in the case. It has the right to seize a person’s property and sell it at auction, as well as block accounts and automatically withdraw up to 50% of income from them. All this is done to pay off the debt. Since the trial can be carried out without the presence of the defendant, the person himself may not know that the bailiffs are looking for him. Fortunately, if necessary, you can find out about this in just a few clicks - the FSSP itself provides this opportunity.

Ways to find out about open enforcement proceedings

Through the FSSP

The Federal Bailiff Service maintains a Data Bank of Enforcement Proceedings. This is a database in which you can see whether a person has a debt that is handled by bailiffs. The data bank has three tabs: search for individuals, individual entrepreneurs, organizations. To find out information about a specific person, you only need to enter his full name and date of birth. To find an organization, you must indicate its official name. You can access the Data Bank:

- through the corresponding page on the FSSP website;

- using the “FSSP of Russia” application for smartphones;

- through the application of the same name on the social networks Odnoklassniki and VKontakte.

You can also call the Federal Bailiff Service or visit the department in person. You should contact the branch at your place of registration.

Through State Services

The unified portal of public services can provide information on enforcement proceedings: the website has a page “Judicial debt”. On this page a person can fill out an application and leave a request. It will be sent to the FSSP, and the applicant will be sent information about open enforcement proceedings. To use the service, you will need to have an account on the portal. The result will be displayed in your personal account. The service is available for both individuals and legal entities.

Obtaining a writ of execution in an arbitration court

The issuance of IL based on the results of consideration of the case in the arbitration court of the 1st instance is carried out by the same court. If the case was considered by the courts of subsequent instances, the claimant can obtain IL in the appropriate court of the 1st instance (clause 2 of Article 319 of the Arbitration Procedural Code of the Russian Federation dated July 24, 2002 No. 95-FZ).

In many ways, the principle of obtaining an IL by an arbitration court is similar to the principle of obtaining an IL issued as a result of a court hearing a case in a civil suit.

You can read about how to obtain a writ of execution in an arbitration court on the official website of a particular court on the Internet. For example, many judicial authorities warn that the claimant must agree in advance with the secretary or assistant judge about the date of receipt of the IL and the method of its presentation. Recording for a specific time is also practiced.

What to do if open enforcement proceedings are discovered

If enforcement proceedings have been initiated against you, you should receive information about it: case number, date, details. You can use this information to pay off your debt. If you contacted the FSSP Data Bank, the information will be displayed in the form of a table: it contains links to receipts and to the online debt payment page. You can:

- print out a receipt and go to a bank branch to pay for it;

- pay the debt through the State Services portal, if you have an account on it.

If you have the opportunity to pay off your obligations, it is better to do so as soon as possible. This way you can prevent the visit of bailiffs and get rid of the restrictions associated with open enforcement proceedings. Once the debt is paid, the case will be closed and you will have no outstanding obligations.

The procedure for collecting debt under ID

After the ID is received by the FSSP, the document is transferred to the bailiff within three days. The specialist has 3 days to begin enforcement proceedings or issue a refusal order. If the decision is positive, a step-by-step procedure for forcibly collecting the debt begins.

Debt repayment period

5 days are allotted for voluntary repayment. If the debtor disagrees with the presented demands, he has the right to appeal them in the manner prescribed by law, that is, through the court.

After 5 days, the bailiff begins to execute the ID. He is given two months for this, but usually the period is extended. The Federal Bailiff Service sends all notifications by mail, so you have to wait a long time for responses.

Recovery amount

The amount specified in the executive document is formed from several components:

- The main body of the debt.

- Accrued interest, fines and penalties.

- Plaintiff's legal costs.

In addition, it will be increased by an enforcement fee in the amount of 7% of the collection amount, but not less than 1 thousand rubles. from debtors in the status of individuals. persons and at least 10 thousand rubles. from debtor organizations (Article 112 No. 229-FZ). The only way not to pay the enforcement fee is to voluntarily repay the debt within 5 days given by the bailiff.

What is the penalty applied to?

The easiest way to collect money is in cash or non-cash form. In the first case, we are talking about paper bills: for example, the bailiff came home with an inventory, and there in a visible place was a bundle of money in an envelope. He will be obliged to pick up the bills, include them in the inventory and transfer them to the creditor.

How to remove a seizure from a cardRelated article

But more often, funds are written off from the debtor’s bank cards, accounts and deposits, and if the creditor reports, then the bailiff has the right to take money from electronic wallets. If the debtor’s accounts do not have enough funds to fully execute the ID, the bank will block and write off the funds received there.

Regular income in the form of wages and pensions are also subject to partial withdrawal. In addition, the bailiff has the right to seize and sell the debtor’s property - a car, moped, real estate.

How often should you check for enforcement proceedings?

Unfortunately, there are situations when a person himself does not know that he has debt. For example, he has not lived at his registered address for a long time and has not received official notifications. There can be many reasons for this: an unpaid and forgotten fine or tax, an overdue loan, even the actions of fraudsters - a person may be given a microloan or a loan, which he will not even be aware of. To avoid situations where collection has already been filed in court, and the defendant does not even know that he has a debt, it is recommended to periodically search for your name in the FSSP lists. It’s free and doesn’t require registration, but in difficult situations it will allow you to notice the catch in time. Businessmen and self-employed people are advised to check new clients and partners through the service: if it turns out that enforcement proceedings have been initiated against a partner, it may not be worth doing business with him.

EOS recommends: if you have a debt, it is better to avoid a situation where a creditor or authorized body takes the case to court. Judicial proceedings and enforcement proceedings may entail the seizure of accounts and property, the seizure and sale of valuable items at auction. If you have the opportunity to pay the existing debt, it will be more beneficial for everyone to settle the issue out of court. And if your debt is in EOS, do not be afraid to contact us for help. We will help you organize a repayment schedule convenient for you, and if necessary, offer a discount.

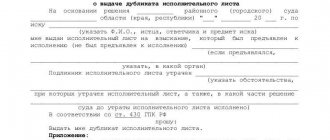

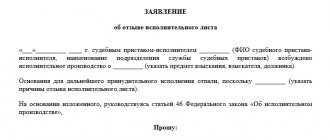

Application for obtaining a writ of execution

The template for an application for obtaining IL is not regulated by law, so it is usually written in free form. The application must include the following information:

- the name of the court to which the said application is addressed (in this case, the court that made the decision in the case);

- name of the claimant, his residential address and contact details;

- the case number on the basis of which the IL was compiled, details of the case;

- a request for the issuance of IL or its referral to the FSSP for execution;

- date of application;

- compiler's signature.

If it is more convenient for the claimant to receive the IL by mail, this must be indicated in the application, as well as the exact address to which the judicial authority should send the enforcement document.

Such an application must be filed with the office of the court that made the decision in the case.

It is recommended to agree in advance with the specialist issuing the IL on the date and time of receiving the IL or submitting the application.

Debt identification

To find out whether a citizen is recognized as a debtor, you need to identify his outstanding obligations. This information is contained on the website https://fssprus.ru/. Official information is presented there, including execution proceedings.

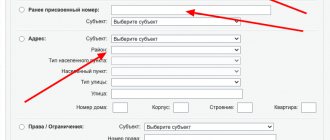

Website https://fssprus.ru

There is a form on the main page, after filling it out the search will begin. To check information on court cases, you need to open the “database” section. Based on known parameters (individual or legal entity, subject of the federation, etc.), the corresponding cells are filled in.

When the production according to the execution list is entered into the system, the following information will be provided:

- the name of the judicial authority that issued the execution list;

- date of issue and number;

- the presence of additional productions and their dates and numbers;

- amount of debt, period of occurrence;

- name and address of the FSSP body that is handling the case.

Thus, we have identified the main ways to familiarize yourself with the executive document: through the FSSP website and through the service of arbitration courts.

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 697) (Moscow) +7 (ext. 281) (St. Petersburg) +8 (ext. 198) (Russia) It's fast and free!

I have the right

It's fast and free!

From this article you will learn how to view the arbitration case and the writ of execution issued as a result of its decision. Bailiffs work openly and transparently. Any citizen, whether the claimant or the one who owes, has the right to become familiar with the progress of enforcement proceedings. The FSSP has a special website on which official information regarding debts and initiated enforcement proceedings is published. Every citizen has the right to find out whether he has a debt to the bailiffs.

Related article: Judicial notice: how to find out what case it is about

How and in what amount is income written off?

Withholding debt from salary

The grounds for collecting the debtor's income are established by Article 98 No. 229-FZ. These include three types of situations:

- if periodic payments are collected under the ID, for example, alimony;

- if the amount collected is less than 10 thousand rubles;

- if the money in the accounts and property is not enough for the full execution of the ID.

The maximum amount of deduction from wages and other payments is 50%. In some cases, for example, for alimony payments, it can be increased by the decision of the bailiff up to 70%.

Sample application to the bailiff to reduce the amount of deductions from wages - 15.2 KB

Pension deductions in 2021

In 2021, the state is concerned about the debts of pensioners. A pensioner has the right to extend the loan debt up to a million rubles over 24 months if the pension is less than 2 minimum wages (that’s 24 thousand rubles). This applies to all types of pensions - old age, loss of a breadwinner, and disability.

To do this, you need to submit an application and a repayment schedule to the FSSP. The bailiff will agree on the schedule, and the person will transfer a fixed amount.

If the amount of debt is more than a million, think about declaring bankruptcy for the individual. faces. A competent lawyer will help you write off unaffordable debts without losing property, and you will receive a full pension during and after the procedure.

Bailiffs and self-employed

Bankruptcy of the self-employedRelated article

The procedure for collecting ID debt from a self-employed person deserves attention. If a self-employed person has debts on a loan or, for example, alimony, enforcement proceedings are opened against him.

The procedure for collecting funds from a self-employed person is the same as for ordinary employees. The bailiff will seize the self-employed person's account, savings from debit cards and deposits will be written off to pay off the debt, and then 50% of the self-employed person's income will be withheld for ordinary debts and 70% for alimony payments and compensation for health damage.

If the entire income of a self-employed person has been written off for debts, contact the bank first. In 2021, it is not the bailiffs, but the credit institution that determines which category the receipts to the account belong to, so it is the bank that needs to be notified that you are receiving income from a professional. activities.

What income and property are not taken under ID

Bailiffs have at their disposal a wide range of tools for the forced collection of debt under ID. But the law limits the possibilities for recovery both in terms of property and income.

Article 446 of the Code of Civil Procedure of the Russian Federation directly prohibits the seizure of the following types of property in favor of the creditor:

- the only housing (excluding mortgage) and the land on which it is located;

- personal belongings and items of daily use, products;

- funds within the subsistence level (for the debtor and each dependent);

- fuel used to heat an apartment or house;

- property used for professional activities worth up to 10 thousand rubles;

- seed, livestock, agricultural buildings;

- prizes, plaques and personal awards;

- vehicles, and equipment of the disabled person.

The list of income not subject to recovery under ID is determined by Article 101 No. 229-FZ. Bailiffs have no right

seize and seize the following types of payments:

Termination of recovery under enforcement proceedings - grounds and consequencesRelated article

- for the loss of a breadwinner;

- compensation for harm to health;

- compensation for caring for disabled persons;

- alimony and child benefits, maternity capital;

- contributions for compulsory insurance;

- compensation for medicines and travel on public transport;

- social benefit for funeral;

- amounts paid by the employer and not related to wages;

- material assistance to victims of natural disasters, emergencies, terrorist attacks, any humanitarian assistance.

If a person receives only income that cannot be written off, and he has no property other than a single apartment, then the bailiff will conduct an inspection and close the proceedings. End of the case under Part 4, Clause 1, Art. 46 Federal Law No. 229 gives citizens the right to extrajudicial bankruptcy in the MFC.

Reasons for searching: when do you need to check information about the progress of a case?

Production progress information may be required in the following cases:

- A trip abroad is planned . In this case, it is recommended to first make sure that there are no writs of execution, because debtors are prohibited from traveling outside the country.

- To eliminate additional expenses . If the debtor does not make payment on time, penalties in the amount of 5% of the debt amount are applied to him. Therefore, it is recommended to check the established payment deadlines.

- To make sure there are no debts . You should periodically check information about the presence or absence of writs of execution in the FSSP database in order to avoid problems with bailiffs.

Sometimes bailiffs are not able to notify the debtor about the occurrence of a debt, because... do not have information about his place of residence or due to other circumstances. For this reason, it is recommended to periodically check the data yourself.

Information about the availability of writs of execution may be relevant not only for debtors, but also for counterparties of legal entities. This information will help you form an opinion about the reliability and reputation of a legal entity and make a decision on the advisability of cooperation with it.

In addition, the FSSP database is often used by financial institutions when reviewing loan applications to determine the degree of financial responsibility of a potential client.

The system does not find information

When figuring out how to find a case by enforcement proceedings number, remember that the system does not always work correctly. Sometimes technical problems occur. Information may be missing if there is no debt or the case is still under consideration.

In the latter case, the following conditions exist for reviewing the data:

- the court made a decision and it entered into legal force;

- the defendant did not appeal the verdict and the period allowed for the action expired;

- the defendant tried to appeal the decision, but the appeal was not satisfied, and the period provided for appealing to the authorized body expired.

From the above it follows that even if the court has already considered the case, information will be provided only after the passage of time.

Deadlines for receiving a document and ways to reduce them

The writ of execution is issued within 30 days. In practice, this period turns out to be shorter. As a rule, the wait takes 7 – 14 days. If you need to obtain a document urgently, it is better to submit an application as soon as possible after the decision comes into force.

To do this, you will have to find out whether the other party has filed a complaint. As soon as the period established by law has expired, the decision will become valid and, accordingly, it will be possible to issue a writ of execution.

Interested parties are advised to:

- regularly check the information on the website of the FSSP of the Russian Federation, as described earlier;

- find out news about the case by calling the court office;

- monitor compliance with deadlines established by law. If they are violated, file a complaint against the actions (inaction) of the employees responsible. It is even possible to go to court with a statement of claim if such delay in the case leads to negative consequences.

On a note! It is recommended to apply for the issuance of a writ of execution on the day when the sheet itself has already been issued.

Features of debt payment

To deposit funds after receiving a debt collection order, it is not necessary to personally visit the authorized body. It is enough to use payment systems.

It is acceptable to transfer funds using the following methods:

- using the Sberbank Online system or ATMs of a financial institution;

- depositing money through Qiwi terminals;

- using the capabilities of the FSSP mobile application;

- depositing amounts through terminals installed in the FSSP division, MFC and other government organizations;

- use of an electronic wallet, if it supports such a function;

- translation according to details.

The system may charge a commission. There is no need to pay the amount if the official system of the bailiff service and Sberbank is used. When depositing money, you need to check the data and make sure that the name of the court and the case number are indicated correctly.

Video