What is a tax deduction for treatment?

According to the legislation of the Russian Federation (Article 219 of the Tax Code of the Russian Federation), when paying for treatment or medications, you can count on a tax deduction and return part of the money spent on treatment .

A tax deduction is the portion of income that is not subject to tax. Therefore, you can return the tax paid on the expenses incurred for treatment. If you officially work and pay income tax, have paid for your treatment or the treatment of your relatives , you can get back part of the money in the amount of up to 13% of the cost of treatment .

Who is eligible

Not everyone is afforded the opportunity being explored. To make any claim related to deductions, you will have to verify that the person meets the established criteria. Otherwise, it will be impossible to bring the idea to life. The potential recipient needs:

- be a citizen of the Russian Federation or a resident of the country;

- carry out an operation after which the right to issue a deduction arises;

- Pay for the services entirely using your own personal money;

- transfer income tax of 13% to the state treasury.

The last point is extremely important. A tax deduction for treatment (the statute of limitations for applications to the Federal Tax Service will be specified later), like any other refund, is issued against the 13% personal income tax paid. If a citizen does not pay the specified tax, he cannot claim a tax-type deduction from the state.

In what cases can you get a tax deduction for treatment?

You can take advantage of the social tax deduction for treatment and get part of your expenses back in the following cases:

- You can get a tax deduction when paying for medical services, If:

- paid for services for their own treatment or treatment of close relatives (spouse, parents, children under 18 years of age) provided by medical institutions in Russia;

- paid services are included in a special list of medical services for which a deduction is provided. The list of services is defined in Decree of the Government of the Russian Federation dated March 19, 2001 N 201.

- the treatment was carried out in a medical institution licensed to carry out medical activities;

- You can get a tax deduction when paying for medicines, If:

- paid at their own expense for medications for themselves or their immediate relatives (spouse, parents, children under 18 years of age) prescribed by the attending physician.

- You can get a tax deduction when paying for voluntary health insurance, If:

- paid insurance premiums under a voluntary health insurance agreement or insurance for immediate relatives (spouse, parents, children under 18 years of age);

- the insurance contract only provides for payment for treatment services;

- the insurance organization with which the voluntary insurance agreement has been concluded has a license to conduct the corresponding type of activity.

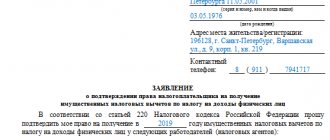

Deduction for treatment: documents, procedure

General list of required documents:

- Copy of Russian passport;

- Tax return in form 3-NDFL (to be completed by the taxpayer);

- Certificate of income from the main place of work (form 2-NDFL), certificates of part-time income (if any, issued by employers);

- An application to the Federal Tax Service with details (on bank letterhead with a stamp) to which the tax will be refunded.

When treated in a hospital or clinic:

- Agreement with a medical institution (there must be an exact amount paid for treatment) - original and copy;

- A certificate from the hospital/clinic/medical center confirming payment under the contract (must contain the patient’s medical card number and TIN, as well as the treatment category code: “1” - ordinary, “2” - expensive);

- A copy of the medical institution's license.

When purchasing medications:

- The original prescription with the stamp “For tax authorities”, issued by a doctor or the administration of a medical institution;

- Checks, receipts, payment orders confirming payment for drugs;

- If a patient purchased expensive medications necessary for treatment because they were not available at the medical institution, a certificate about this must be drawn up from the administration of the medical organization.

When concluding a voluntary health insurance agreement by an individual:

- A copy of the voluntary insurance agreement;

- A copy of the insurance company's license;

- Receipt for payment of insurance premium.

Procedure (when contacting an employer):

- Write an application to receive a notification from the tax authority about the right to a social deduction.

- Prepare copies of papers confirming the right to deduction (see above).

- Submit an application to the tax authority at your place of residence for notification of the right to a social deduction.

- After 30 days, obtain a notification from the tax authority about the right to a social deduction.

- Submit a notice issued by the tax authorities to the employer; it will become the basis for non-withholding of personal income tax from the amount of paid income until the end of the year.

Amount of tax deduction for treatment

The amount of tax deduction for treatment is calculated for the calendar year and is determined by the following factors:

- You cannot return more money than you transferred to the income tax budget (about 13% of the official salary).

- You can return up to 13% of the cost of paid treatment/medicines , but not more than 15,600 rubles . This is due to the restriction on the maximum deduction amount of 120 thousand rubles (120 thousand rubles * 13% = 15,600 rubles). The limit of 15,600 rubles applies not only to deductions for treatment, but to all social deductions. The amount of all social deductions (training, treatment, pension contributions) should not exceed 120 thousand rubles. You can return a maximum of 15,600 rubles for all deductions).

- There is a certain list of expensive medical services to which the limit of 15,600 rubles does not apply . You can receive a tax deduction and get 13% back on the full cost of such services in addition to all other social deductions. The full list of expensive services is defined in Decree of the Government of the Russian Federation of March 19, 2001 N 201. You can find it here: List of expensive types of treatment

Example : In 2021 Ivanov A.A. paid for a course of dental treatment worth 140 thousand rubles and a paid operation related to expensive treatment costing 200 thousand rubles. At the same time, in 2021 he earned 500 thousand rubles and paid income tax of 62 thousand rubles.

Since dental treatment is not an expensive treatment, the maximum tax deduction for it is 120 thousand rubles (which is less than 140 thousand rubles). Since the operation of Ivanov A.A. refers to expensive types of treatment, there are no restrictions on tax deductions for it.

Total in 2021 for 2021 Ivanov A.A. will be able to return to himself (120 thousand rubles + 200 thousand rubles) * 13% = 41,600 rubles. So Ivanov A.A. paid taxes more than 41,600 rubles, he will be able to return the entire amount.

Additional and more complex examples of calculating a tax deduction for treatment can be found here: Examples of calculating a tax deduction for treatment

We count the amounts

The law allows deductions for income tax in the amount of a maximum of 13%: that is, more than personal income tax was paid cannot be returned. The largest refund amount could be 13% of the funds spent.

Another limitation is related to the established maximum tax refunds - 120 thousand rubles. Therefore, you will be able to return no more than 15,600 rubles. (13% of the maximum allowed amount).

This applies to all deductions in total, and not just to compensation for treatment costs. Percentage of personal income tax from the maximum 120,000 rubles. includes the amount of all required social deductions (for studies, contributions to the pension fund and, accordingly, treatment).

There are no restrictions for expensive medical services

There is an additional list of expensive medical services that are reimbursed without a limit. That is, for them you can achieve a 13% deduction from their full cost, in addition to other deductions other than treatment.

FOR EXAMPLE. Enterprise employee V.O. Klimenko with a salary of 40 thousand rubles. per month paid for dental treatment for his wife for 150,000 rubles, and he himself underwent an operation costing 300,000 rubles. We will calculate the personal income tax deduction due to him. Income Klimenko V.O. for the year amounted to 40,000 x 12 = 480,000 rubles. The tax on this amount will be 13% - 62,400 rubles. Dental treatment is not included in the list of expensive medical events, so the largest deduction for it can be from the amount of 120 thousand rubles. (13% return, that is, 15,600 rubles). The operation is included in this list, therefore it will be compensated in full, that is, in the amount of 13% of the amount paid: 300,000 x 0.13 = 39,000 rubles. The amount assigned for return is 15,600 + 39,000 = 54,600. Since the amount of personal income tax paid by V.O. Klimenko amounted to a large figure (62,400 rubles), he will be able to make the entire deduction at a time.

The process of obtaining a deduction for treatment

The process of obtaining a deduction for treatment consists of collecting and submitting documents to the tax office, checking the documents by the tax office and transferring money. You can learn more about the process of obtaining a tax deduction, indicating the deadlines, here: The process of obtaining a tax deduction for treatment.

The process of obtaining a deduction can be simplified by using our service. We will fill out the 3-NDFL declaration for you, tell you what other documents you will need for the deduction, and also give detailed instructions on submitting documents to the tax authorities. Or we will send your documents ourselves, without your participation. If you have any questions while working with the service, tax experts will be happy to advise you.

Step-by-step instructions for receiving

Social tax deduction can only be obtained by completing the appropriate documents.

This can be done through the employer or by directly contacting the Federal Tax Service at your place of registration. Let's look at the nuances of both options.

Through the Federal Tax Service

Money can be received in cash or on a salary card

To apply for a tax deduction through the tax office you need:

- During treatment, obtain a certificate or check indicating that the documents are intended for tax purposes.

- Obtain a 2-NDFL certificate from the accounting department, which indicates the amount of salary and taxes paid.

- Fill out the 3-NDFL declaration.

- Provide these documents to the Federal Tax Service employee.

The deduction is not returned immediately - the tax authorities need time to check the correctness of the information and calculate the deduction amount, which takes about 1 month.

Money can be received in cash or on a salary card.

Sample application for a tax deduction – in word format.

Through the employer

This is a method for those who do not want to spend a lot of time queuing at the tax office.

To do this you need:

- Obtain certificates during treatment.

- Write an application for the deduction, submit it to the tax service along with copies of documents (this can be done by registered mail, note that you do not need to prepare a 2-NDFL certificate and a 3-NDFL declaration).

- Receive a notification from the Federal Tax Service about the right to deduction.

- Provide notification and copies of documents to the accounting department at the place of work.

In this case, the money goes to the salary card or for several months the salary is accrued without taking into account income tax. Consult your accounting department on this issue.

Documents required to apply for a tax deduction for treatment

To apply for a tax deduction, you will first need:

- declaration 3-NDFL;

- agreement with a medical institution;

- certificate of payment for medical services;

- documents confirming your expenses;

- documents confirming the paid income tax (certificate 2-NDFL).

You can view the full list of documents here: Documents for tax deductions for treatment.

Procedure for registering a deduction

- You need to collect the necessary package of documents and submit them to the INFS.

- The tax authority reviews and verifies documents (the law allows up to 3 months for this).

- After the audit is completed within ten days, the taxpayer receives a notification about the results of the procedure.

- If the decision is positive, the applicant will receive a money transfer within 1 month.

Package of documents for tax deduction for treatment

If copies of documents are submitted, it is recommended to have the originals with you so that tax officials can certify them. The following documents are required, prepared in accordance with the requirements:

- 3-personal income tax declaration;

- certificate from the accounting department about actual annual income (form 2-NDFL);

- ID card (original and copy of passport);

- an application requesting a deduction, which specifies the details for crediting funds;

- a certificate from a medical institution (sanatorium) confirming payment for treatment;

- license of the medical institution or sanatorium where the treatment was carried out;

- payment documents confirming payment for services or medicines (checks, strict reporting forms).

FOR YOUR INFORMATION! The list of required documents also includes an agreement for the provision of medical services, concluded by the taxpayer or his close relative with the medical institution. But, if you don’t have it on hand, if you have all the other documents, the refusal to deduct will be unlawful - the letter of the Ministry of Finance No. 03-04-05/10-1239 dated November 1, 2912 explains that its presence is not necessary.

When and for what period can I receive a tax deduction?

You can get your money back for treatment only for those years in which you paid directly. However, you can submit a declaration and return the money through the tax office only in the year following the year of payment or later. That is, if you paid for treatment in 2021, you will be able to return the money no earlier than 2021.

If you did not file a deduction immediately, you can do it later, but you can return the tax for no more than the last three years. For example, if you paid for treatment in 2016-2020 and did not receive a tax deduction, then in 2021 you can get your tax back only for 2021, 2021 and 2021.

The entire procedure for obtaining a deduction usually takes three to four months. Most of the time is spent checking documents by the tax office.

Note: from January 1, 2021, a social tax deduction for treatment can be obtained through an employer, and there is no need to wait until the end of the calendar year. You can find details about receiving a deduction through an employer in our article: Obtaining a tax deduction for treatment through an employer.

Waiting period

It is clear what characterizes the tax deduction for treatment. The statute of limitations, design features and procedure for obtaining are also not mysteries.

The next question of interest to the population is: “How long to wait for funds?” It's difficult to answer. Much depends on the speed of document verification at the Federal Tax Service. It is safe to say that this procedure takes a lot of time. By law, the waiting period for a response when applying for a deduction is 3 months.

In this case, the funds will not arrive to the applicant immediately after receiving the corresponding response from the Federal Tax Service. Typically, this operation takes about 1-2 months.

List of medical services for which a tax deduction is provided

According to Decree of the Government of the Russian Federation No. 201 of March 19, 2001, the following medical services can be taken into account in tax deductions:

- Diagnostic and treatment services when providing emergency medical care to the population.

- Services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

- Services for diagnosis, prevention, treatment and medical rehabilitation when providing inpatient medical care to the population (including in day hospitals), including medical examination.

- Services for diagnosis, prevention, treatment and medical rehabilitation when providing medical care to the population in sanatorium and resort institutions.

- Health education services provided to the public.

List of expensive types of treatment for which a tax deduction is provided

According to Decree of the Government of the Russian Federation No. 201 of March 19, 2001, the following medical services are expensive and are taken into account in the tax deduction in full (without a limit of 120 thousand rubles) :

- Surgical treatment of congenital anomalies (developmental defects).

- Surgical treatment of severe forms of circulatory system diseases, including operations using artificial blood circulation machines, laser technologies and coronary angiography.

- Surgical treatment of severe forms of respiratory diseases.

- Surgical treatment of severe forms of diseases and combined pathologies of the eye and its appendages, including the use of endolaser technologies.

- Surgical treatment of severe forms of nervous system diseases, including microneurosurgical and endovasal interventions.

- Surgical treatment of complicated forms of diseases of the digestive system.

- Endoprosthetics and reconstructive operations on joints.

- Transplantation of organs (complex of organs), tissues and bone marrow.

- Replantation, implantation of prostheses, metal structures, pacemakers and electrodes.

- Reconstructive, plastic and reconstructive plastic surgeries.

- Therapeutic treatment of chromosomal disorders and hereditary diseases.

- Therapeutic treatment of malignant neoplasms of the thyroid gland and other endocrine glands, including the use of proton therapy.

- Therapeutic treatment of acute inflammatory polyneuropathies and complications of myasthenia gravis.

- Therapeutic treatment of systemic connective tissue lesions.

- Therapeutic treatment of severe forms of diseases of the circulatory, respiratory and digestive organs in children.

- Combined treatment of pancreatic diseases.

- Combined treatment of malignant neoplasms.

- Combined treatment of hereditary bleeding disorders and aplastic anemia.

- Combined treatment of osteomyelitis.

- Combined treatment of conditions associated with complicated pregnancy, childbirth and the postpartum period.

- Combined treatment of complicated forms of diabetes mellitus.

- Combined treatment of hereditary diseases.

- Combined treatment of severe forms of diseases and combined pathologies of the eye and its adnexa.

- Complex treatment of burns with a body surface area of 30 percent or more.

- Types of treatment associated with the use of hemo- and peritoneal dialysis.

- Nursing premature babies weighing up to 1.5 kg.

- Treatment of infertility using in vitro fertilization, cultivation and intrauterine embryo insertion.

Compensation for dental expenses

Part of the costs in the form of 13% of dental treatment can be reimbursed according to several rules. Legislators classified orthopedic services and sealing as inexpensive services, so compensation can be issued in the amount of up to 120 thousand rubles. If the client paid more than 120 thousand for treatment, then he has the right to receive compensation of 13% only within the legally established framework. Mathematical calculation shows that the largest amount of compensation will be 15.6 thousand rubles.

Prosthetics are also not included in expensive types of treatment, and the same rule applies to them. But if patients undergo dental implantation, this will already be an expensive medical service. In this case, 13% will be reimbursed from any amount of costs incurred.

This rule applies not only to dentistry. The list of expensive medical services is indicated in the same RF Regulation No. 201.