Is there a deduction for medications?

Tax deductions for medicines are provided in accordance with subparagraph.

3 p. 1 art. 219 of the Tax Code of the Russian Federation. To receive a deduction for periods before 2021, it is necessary that the drugs be present on the government list (Decree No. 458 dated 04/08/2020). Starting from 2021, the requirement for drugs to be on the list of the Tax Code of the Russian Federation has been removed. Therefore, deductions for periods from 2021 onwards (that is, already now, if you receive a deduction for 2020 at work) can be obtained not only for drugs from the specified list, but also for all drugs prescribed by the doctor. The amount of social deduction annually can be the amount paid for medicines, but there is a maximum of 120,000 rubles. in year. That is, in a year you can return no more than 15,600 rubles from the budget. (13% of the maximum of RUB 120,000).

Important! The deduction for expensive treatment is not limited.

You can find out what limits are set for deductions here.

However, the taxpayer cannot claim a refund in the form of a social tax of a larger amount than was paid in personal income tax for the calendar year. Moreover, if you contact the tax authority, the money spent on medicines can be returned only next year after submitting a declaration based on its results. In 2020–2021, you can receive such a deduction from your employer without waiting for the end of the year in which medical expenses were incurred.

What social deductions can you get from your employer? What documents will be needed? Sign up for a free trial access to ConsultantPlus and study the recommendations prepared by K+ experts.

It is important that the medications were prescribed by the doctor who treated the patient and were purchased at the patient-taxpayer’s own expense. If the employer paid for the medicines, a deduction for this amount is not provided.

Read about what other personal income tax deductions there are here.

Let us remind you! You can receive a deduction for the 3 years preceding the year of filing 3-NDFL. That is, in 2021, when filing 3-NDFL for 2021, you need to take into account the list of approved medicines for applying for a social deduction.

Let's look at what medications are included in this list in more detail.

Document submission methods

The taxpayer himself chooses the most convenient method for submitting documents to the tax office. They can be submitted for verification in different ways:

- appearing in person at the Federal Tax Service;

- send in electronic form (with scanned copies of documents) using the “State” portal;

- by mail (the attachment list must be filled out).

- The 3-NDFL declaration is also accepted at the MFC, but it will be checked by the Federal Tax Service at the taxpayer’s place of residence.

Thus, by collecting receipts during the year for the purchase of medications prescribed by a doctor, you can receive 13% compensation from the budget at the expense of personal income tax. The Inspectorate of the Federal Tax Service is responsible for checking the documents and processing the return; you need to contact them either for a notification or for a 3-NDFL declaration.

List of medicines for deductible treatment (until 2021)

The list, approved by government decree No. 458 dated 04/08/2020, contains international non-proprietary names of medicines, the purchase of which, on the recommendation of a doctor, can count on a tax deduction. Moreover, each medicine may have many other synonymous names. The names of medications indicated in the list are contained in the state register, which the Ministry of Health is obliged to publish annually (see the regulation of the Ministry of Health dated December 1, 1998 No. 01/29-15). You can find out whether the medicine you are interested in is in the state register on the website grls.rosminzdrav.ru.

If a doctor prescribed medications that are not included in this list, the patient-taxpayer will not be able to count on receiving social benefits (for periods before 2021). This is clearly stated in the letter of the Federal Tax Service in Moscow dated June 1, 2010 No. 20-14/4/ [email protected] The register displays both prescription medications and those that can be purchased in over-the-counter departments.

Let's present this list in a slightly abbreviated form; At the same time, it contains all the names of drugs, only the forms of their release are not indicated:

1. Medicines used for anesthesia, as well as those that reduce the tone of skeletal muscles:

- medications used for anesthesia (injection powders hexobarbital and sodium thiopental, solutions for injections ketamine and sodium oxybate, gas in a can of dinitrogen oxide, diethyl ether in liquid form, solution for inhalation halothane);

- local anesthetic agents (injection solution of bupivacaine and lidocaine);

- drugs that reduce the tone of skeletal muscles (powder for injection, botulinum toxin; injection solution of atracurium besylate, albumin; vecuronium bromides, pipecuronium, suxamethonium).

2. Analgesics:

- narcotics (injection solutions and tablets morphine, piritramide, trimeperidine; injection solution fentanyl and a mixture of morphine + narcotine + papaverine + codeine + thebaine);

- non-narcotic and non-steroidal medications (tablets: aspirin, diclofenac sodium, lornoxicam, ibuprofen, tramadol, nalbuphine, ketoprofen, meloxicam);

- medicine for gout - allopurinol;

- other drugs in this group (penicillamine, colchicine).

3. Antiallergic (antihistamine) drugs: ketotifen, quifenadine, chloropyramine.

4. Medications that affect the central nervous system:

- against seizures (carbamazepine, phenytoin, valproic acid, clonazepam, phenobarbital, phenytoin, ethosuximide);

- for the treatment of Parkinson's disease (biperiden, trihexyphenidyl, levodopa + carbidopa, amantadine, levodopa + benserazide);

- medications for the treatment of psychotic diseases (haloperidol, clozapine, medazepam, perphenazine, thioproperazine, phenazepam, chlorpromazine, diazepam, levomepromazine, nitrazepam, pipothiazine, thioridazine, fluspirilene, chlorprothixene, zuclopenthixol, lorazepam, periciazine, sulpiride, trifluoperazine, flufen azine);

- antidepressants (amitriptyline, clomipramine, maprotiline, moclobemide, tianeptine, citalopram, imipramine, lithium carbonate, mianserine, sertraline, fluoxetine);

- medicine for sleep disorders - zolpidem;

- medication for multiple sclerosis (interferon beta and glatiramer acetate);

- anti-drug drugs (naltrexone and naloxone);

- anticholinesterase medications (neostigmine methyl sulfate, distigmine and pyridostigmine bromides);

- other drugs from this group (nimodipine, vinpocetine, hexobendine + etamivan + etophylline).

5. Anti-infective:

- antibiotics (azithromycin, ampicillin, vancomycin, doxycycline, clarithromycin, meropenem, norfloxacin, sulfacetamide, cephaperazone, ceftazidime, ciprofloxacin, amikacin, benzathine benzylpenicillin, gentamicin, imipenem, co-trimoxazole, mesalazine, pefloxacin, chloramphenicol, cefipime, ceftriaxone, erythromycin, amoxicillin + clavulanic acid, benzylpenicillin, josamycin, carbenicillin, lincomycin, mupirocide, spiramycin, cefaclor, cefotaxime, cefuroxime);

- medicines for the treatment of tuberculosis (isoniazid, prothionamide, streptomycin, lomefloxacin, rifabutin, ethambutol, pyrazinamide, rifampicin, ethionamide);

- medications for the treatment of viral infections (acyclovir, zidovudine, lamivudine, ganciclovir, indinavir, nevirapine, didanosine, efavirenz, stavudine);

- antifungal drugs (amphotericin B, itraconazole, amphotericin B + methylglucamine, clotrimazole, griseofulvin, terbinafine);

- medicines for the treatment of malaria and other antiprotozoal medications (hydroxychloroquine, chloroquine, metronidazole);

- other medications from this group - bifidumbacterin;

- means for vaccination: immunobiological preparations, AIDS diagnostic test;

6. Immunosuppressive and antitumor drugs:

- cytostatic medications (azathioprine, bleomycin, vincristine, hydroxycarbamide, daunorubicin, idarubicin, calcium folinate, clodronic acid, methotrexate, oxaliplatin, prospidium chloride, tretinoin, chlorambucil, cytarabine, aranose, busulfan, vinorelbine, dacarbazine, doxorubicin, irinotecan, carboplatin, chalk falan, mitoxantrone, paclitaxel, thioguanine, fludarabine, cyclophosphamide, epirubicin, asparaginase, vinblastine, gemcitabine, dactinomycin, docetaxel, ifosfamide, carmustine, mercaptopurine, mitomycin, procarbazine, thiotepa, fluorouracil, cisplatin, etoposide);

- antihormones and hormonal drugs (aminoglutethimide, goserelin, triptorelin, anastrozole, medroxyprogesterone, flutamide, ganirelix, tamoxifen, cetrorelix);

- drugs accompanying treatment (interferon alfa, ondansetrion, lenograstim, filgrastim, molgramostim);

7. Anti-osteoporosis drugs - stimulants (alendronic acid, calcitonin, alfacalcidol, calcium carbonate + ergocalciferol).

8. Medicines that affect the blood:

- anti-anemia agents (sucrose iron hydroxide complex, folic acid, iron sulfate, cyanocobalamin, iron sulfate + ascorbic acid, epoetin beta);

- medications that affect blood clotting (alpostadil, nadroparin calcium, streptokinase, enoxaparin sodium, alteplase, pentoxifylline, ticlopidine, sodium heparin, protamine sulfate, phenindione);

- plasma substitutes and solutions (amino acids for parenteral nutrition, dextrose, hemin, pentastarch);

- plasma medications (albumin, coagulation factors VIII and IX);

- lipid-lowering medications (phospholipids + pyridoxine + nicotinic acid + adenosine monophosphate, simvastatin).

9. Drugs that affect the cardiovascular system:

- antianginal drugs (isosorbide dinitrate and mononitrate, nitroglycerin);

- drugs that treat arrhythmia (allapinin, metoprolol, quinidine, amiodarone, procainamide, etacizin, atenolol, propafenone);

- drugs that lower blood pressure (azamethonium bromide, verapamil, nifedipine, amlodipine, doxazosin, propranolol, betaxolol, methyldopa, fosinopril);

- medications to treat heart failure (valsartan, captopril, enalapril, digoxin, quinapril, irbesartan, perindopril);

- anti-shock medications (dobutamine, phenylephrine, dopamine, ephedrine).

10. Diagnostic equipment:

- X-ray contrast agents (sodium amidotrizoate, gadopentetic acid, iopromide, barium sulfate + sodium citrate + sorbitol + antifomsilan + nipagin, galactose, gadodiamide, iohexol);

- fluorescent drugs (sodium fluorescein);

- radioisotope medications (albumin microspheres, pirfotech, technefor, bromezide, pentatech, technefit (for all - 99mTs), isotonic solution of strontium-89-chloride).

11. Antiseptics:

- antiseptic - iodine;

- disinfectants (hydrogen peroxide, ethanol, chlorhexidine).

12. Medicines for gastrointestinal diseases:

- antacid and antiulcer medications (omeprazole, famotidine, pirenzepine);

- antispasmodics (atropine, platyphylline, drotaverine);

- enzymes - paccreatin;

- medications for liver failure (lactulose, artichoke leaf extract);

- antienzyme agent - aprotinin.

13. Hormonal drugs:

- antihormones and hormones that do not affect the reproductive system (betamethasone, human chorionic gonadotropin, desmopressin, levothyroxine sodium, lutropin alfa, nandrolone, somatropin, triamcinolone, follitropin beta, bromocriptine, deoxycortone, dihydrotachysterol, levothyroxine + potassium iodide, menotropins, octreotide, tetracosact id, fludrocortisone, choriogonadotropin alfa, hydrocortisone, dexamethasone, clomiphene, liothyronine + levothyroxine + potassium iodide + sodium propyloxybenzoate, methylprednisolone, prednisolone, thiamazole, follitropin alfa, cyproterone);

- androgenic drug - methyltestosterone tablets;

- estrogen drugs (hydroxyprogesterone, progesterone, dydrogesterone, ethinyl estradiol, norethisterone);

- insulin and others for diabetes (acarbose, gliclazide, glucagon, pioglitazone hydrochloride, insulin DlD, KD, Comb SrD, glibenclamide, glimepiride, metformin, gliquidone, glipizide, repaglinide).

14. Medicines for the treatment of diseases of the kidneys and urinary system:

- for prostate adenoma (finasteride, alfuzosin, tamsulosin, creeping palm extract);

- in case of renal failure and after kidney transplantation (antithymocyte immunoglobulin, solution for peritoneal dialysis, ketoanalogues of amino acids, cyclosporine);

- diuretics (hydrochlorothiazide, mannitol, furosemide, indapamide, spironolactone).

15. Drugs used in ophthalmology:

- anti-inflammatory agents (azapentacene, pyrenoxine, lodoxamide, cytochrome + sodium succinate + adenosine + nicotinamide + benzalkonium chloride);

- miotic and antiglaucoma medications (dorzolamide drops, timolol and pilocarpine).

- agents that stimulate regeneration - emoxipine.

16. Uterine preparations:

- hormonal agents (methylergometrine, pituitrin, oxytocin, ergometrine);

- other drugs that affect the uterine muscles (dinoprost, hexoprenaline, dinoprostone).

17. Medicines for the treatment of respiratory diseases:

- against asthma (ambroxol, budesonide, disodium cromoglycate, theophylline, epinephrine, aminophylline, ipratropium bromide, nedocromil, terbutaline, beclomethasone, ipratropium bromide + fenoterol hydrobromide, salbutamol, fenoterol);

- other drugs from this group (acetylcysteine).

18. Electrolytes, nutrients:

- nutritional mixtures (phenyl-free powders and lofenalac);

- electrolytes (potassium chloride, iodide, aspartate; calcium chloride; sodium citrate and bicarbonate; magnesium aspartate; electrolyte solutions).

19. Vitamin preparations - thiamine and menadione.

Is it possible to get a deduction for dietary supplements if they are prescribed by a doctor and contain a medicinal substance previously mentioned in the List? The answer to this question was explained by Ph.D. FGBOUD PA "Privolzhsky Institute for Advanced Studies of the Federal Tax Service" A. V. Telegus. Get free trial access to the ConsultantPlus system and find out the expert’s opinion.

For information on how to draw up an application for a tax refund from the Federal Tax Service, read the material “We are preparing an application for a personal income tax refund (sample, form)” .

List of which drugs will be refunded

There is a legal list of medications for which you can get a refund. There are 18 of them in total, but since 2021 another group has been added, let’s list them all:

- anesthetics and muscle relaxants;

- analgesics;

- antihistamines;

- drugs affecting the central nervous system;

- for the treatment of infectious diseases;

- antitumor and immunosuppressive;

- medications for the treatment of osteoporosis;

- drugs affecting blood;

- for cardiovascular diseases;

- medical preparations for diagnostics;

- antiseptics;

- medications for diseases of the gastrointestinal tract;

- hormones;

- for the treatment of the kidneys and urinary system;

- ophthalmic drugs;

- uterine products;

- medications for the treatment of respiratory organs;

- electrolytes, nutritional medications;

- vitamins.

It is for these medications that the law allows compensation to be issued.

How to get a deduction for medications

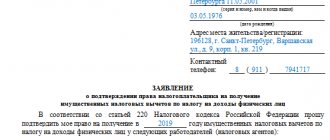

In order to receive a deduction for medicines from the tax office, you will need to provide them with a package of documents, including:

- declaration in form 3-NDFL;

Note! For reporting for 2021, Form 3-NDFL must be completed on an updated form, approved. by order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

ConsultantPlus experts told us what has changed in the form. Get free demo access to K+ and go to the Review Material to find out all the details of the innovations.

- a certificate from the employer in form 2-NDFL;

Read about the specifics of issuing a 2-NDFL certificate in this article..

You will find the main codes of social deductions in the material “Tax deduction codes for personal income tax - table for 2020-2021”.

- prescriptions filled out by a doctor indicating that they were issued for the tax authorities;

- checks or payment receipts confirming the fact of payment for medicines.

The tax return must be filed by an individual who pays income tax by April 30 of the year following the reporting year.

However, taxpayers who file returns only to receive a deduction (that is, are not required to file reports to declare their income) are not tied to the deadline for filing a return. True, you need to apply for a deduction no later than 3 years from the end of the year in which the right to a deduction arose (Clause 7, Article 78 of the Tax Code).

The tax deduction is returned to the taxpayer after a desk audit of the data specified in the declaration and the documents submitted with it. The money will be returned one month after the end of the verification. The inspection itself is carried out within 3 months from the date of filing the declaration and the documents attached to it.

Read about the timing of a desk audit in our article “What are the deadlines for a desk tax audit?” .

In addition to the option considered, there is another way to receive a deduction for medications through your employer. This can be done without waiting for the end of the year in which the expenses were made. To do this, the employee must contact the employer with an application for a deduction and a notification from the tax authority, which confirms the employee’s right to receive a social deduction. A notification confirming the employee’s right to receive a social deduction is issued within 30 calendar days from the date the taxpayer submits an application to the tax authority. The application must be accompanied by documents confirming the right to deduction (prescription marked for tax authorities, cash receipts).

Deadlines

The statute of limitations for receiving benefits is 3 years from the date of purchase of medicines. If more time has passed, money is not refundable.

When applying for subsidies through the employer, the employee has the right, after approval, to “instant” payments that will be accrued with the next salary. If the registration took place through the tax office, then the waiting period and transfer is 120 calendar days (90 for consideration, 30 for transfer, but in practice this happens faster).

The nuances of receiving a deduction: payment by relatives

If medications were purchased for the treatment of a wife or children, then to the above package of documents you will need to attach a copy of the marriage certificate, birth certificate of children (who were under 18 years old at the time of treatment) or your own (if medications were purchased for parents).

However, then when submitting to the tax office you will also need to present the originals of these documents. The tax inspector, after checking the originals with the copies, will put the appropriate mark and date on the latter.

Since 2013, it has become possible to claim social benefits from funds spent on the treatment of adopted or cared for minors under the age of 18 years. But you cannot claim social benefits from funds paid for medicines for the taxpayer’s grandparents.

The fact that spouses are allowed to pay each other for medicines, and therefore one of them can apply for social benefits, is indicated in the letter of the Federal Tax Service dated October 1, 2015 No. BS-4-11 / [email protected]

If for a number of reasons the patient is not able to purchase medications on his own, and friends or relatives do this for him, then options are possible. If the medications were purchased by the patient’s spouse or child, then the person who made the payment will be able to receive a deduction for these funds.

If a friend/acquaintance or a common-law husband/wife bought the medicine, then you can confirm your right to a deduction using a little trick. It will be necessary to issue a power of attorney for such a close acquaintance/friend that the patient trusts him to purchase medications at the pharmacy for him. Such a power of attorney does not have to be notarized (letters from the Federal Tax Service in Moscow dated March 10, 2010 No. 20-14/4/024732 @, Federal Tax Service of the Russian Federation dated May 17, 2012 No. ED-4-3/8135).

About recipe forms

In prescriptions, the names of drugs are displayed in Latin, and the method of using the medicine must be indicated in Russian, and general phrases like “internal” are unacceptable. It is allowed to prescribe medications only on prescriptions issued on forms No. 148-1/u-88, No. 107-1/1, No. 148-1/u-04 (l) or No. 148-1/u-06 (l).

When writing prescriptions, doctors follow the procedure prescribed in the order of the Ministry of Health dated January 14, 2019 No. 4n. Recipes can be made on the computer. You cannot make changes to recipes; if an error is made, it is better to fill out a new prescription form.

For more information about handling strict reporting forms, read the material “Procedure for recording and storing strict reporting forms” .

To confirm that the purchased medications were prescribed by a doctor, the taxpayer must be prepared to present a prescription, which will be marked with an indication of the payer’s tax number. Such a prescription is issued on the basis of the order of the Ministry of Health dated July 25, 2001 No. 289/BG-3-04/256 (Appendix 3).

In accordance with the order of the Ministry of Health dated January 14, 2019 No. 4n, form No. 148-1/u-88 is used for discharge:

- psychotropic drugs from List III or registered medications (and narcotic and psychotropic drugs from List II are prescribed on a special prescription form in Form 107/u-NP);

- anabolic steroids;

- medications with low contents of narcotic and psychotropic drugs (precursors);

- individually prepared medicines containing narcotic substances and psychotropics from list II in a small dose (not more than the highest single dose).

On forms No. 148-1/u-04 (l) and 148-1/u-06 (l) medications are prescribed for free receipt, as well as for citizens entitled to a discount.

The following medications are prescribed on prescription form No. 107-1/u:

- subject to control, which, in addition to small psychotropic and narcotic doses, contain other pharmacological components;

- all other medications not listed above.

The validity period of issued prescription forms varies - from 10 days to 3 months (noted by the doctor). Completed prescription forms in form No. 107-1/u are valid for 2 months, and in special cases (for chronic diseases) - up to a year. The standard deadline for each of the forms is indicated in clause 21 of the procedure approved by Order of the Ministry of Health dated December 20, 2012 No. 1175n.

It is also important to pay attention to the fact that on the completed prescription form, at the top left, there is a stamp of the medical institution indicating all its contact information. On the forms No. 148-1/u-04(l) and No. 148-1/u-06(l) there is a space allocated for applying a special code. You can decipher the recording yourself if you read clause 5 of Appendix 3 of Order No. 1175n of the Ministry of Health dated December 20, 2012.

A prescription on forms No. 148-1/u-04(l) and No. 148-1/u-06(l) is drawn up by a doctor on 2 identical forms (same numbers and series): one is issued to the patient - for the pharmacy, and the second - remains in the medical record. At the pharmacy, notes are made on the prescription about the dispensing of medications in full/incomplete quantities. The entry is dated.

Due to the fact that for a large number of medications that are purchased with patients’ money, prescription form No. 107-1/u has been established, it is this prescription that is recommended to be written out in order to receive social benefits. A prescription in form No. 107-1/u for tax authorities can be issued by the attending physician at the request of the taxpayer within 3 years after the end of the tax period (calendar year) in which expenses for the purchase of medicines were incurred, indicating the date of the actual prescription of the medicine. Such prescriptions are issued on the basis of entries made in the medical record (letter of the Ministry of Health of the Russian Federation dated February 12, 2002 No. 2510/1430-02-32).

What to do if there are no medications

The necessary medications are not always available. To provide the beneficiary with prescribed medications, the pharmacist enters prescription data into the unsatisfied demand log.

Delivery time

The Ministry of Health has set the following deadlines:

- 10 days – for items from the VED lists;

- 15 days – for delivery of unregistered titles;

- 5 days – drugs from the standard range;

- 1 day – marked “statim” (immediately);

- 2 days – marked “cito” (urgent).

Within the specified period, the pharmacist leaves a request to the supplier and informs the client about availability. If the required medicine is not available, the pharmacy organization purchases it with its own money and then receives compensation.

Where to contact

Not all pharmacies dispense discounted goods, but only those with “Social” status or operating at hospitals. If the drug is not available, but can be purchased at another pharmacy chain, upon purchase, the beneficiary may request compensation from the social insurance fund. Violation of delivery deadlines should be reported to the Department of Health, the prosecutor's office or other regulatory authorities.

Deduction for medical supplies for expensive treatment

The Federal Tax Service, in a letter dated May 18, 2011 No. AS-4-3/7958, explained the special situation in the case of a taxpayer receiving expensive treatment, the amount for which is not limited for receiving a deduction. That is, it is accepted for deduction based on actual costs. Expensive treatment means a medical service from the list approved by Decree No. 201 dated March 19, 2001; in addition, the medical institution must have the appropriate license to provide this type of service.

This means that if medical materials are not available in a medical institution that provides expensive treatment services, the patient can purchase them separately and subsequently receive a social benefit for them. An important condition is mandatory confirmation that the purchased medical materials were used specifically for this expensive treatment.

To confirm the right to social payments for purchased medical materials, the patient will have to provide to their Federal Tax Service:

- a certificate from a medical institution providing expensive treatment stating that the attending physician prescribed these medications;

- a receipt or other payment document confirming payment for medications prescribed by a doctor;

- a certificate of payment for expensive services (if they were received free of charge, the amount should be 0 rubles).

For more information about documents confirming treatment expenses, read the article “Documents for obtaining a tax deduction for treatment”.

Types of benefits for pensioners

The list of support measures depends on economic status and region of residence. Municipal health programs can provide vaccinations, medical examinations, and special conditions for people with disabilities.

Free medicines

In-kind assistance to the NSO includes:

- Payment for medicines and medical products by the insurance fund;

- Sanatorium treatment (if indicated)

- Free travel to the place of medical examination or sanatorium;

- Sometimes they provide free travel on commuter trains.

More information about medications: list of free medications for pensioners.

With 50% discount

A discount on medicines is available to pensioners receiving a minimum pension, disabled people of groups I, II, III. Sometimes, federal beneficiaries receive a discount if there are no opportunities to use full payment for treatment from budget funds.

Compensation

The cost of the NSO is included in the EDV; in case of refusal of one type of social services or all at once, pensioners are assigned payments. To do this, you must submit an application to the Pension Fund to receive compensation in cash equivalent.

An example of a refund for medicines through social tax payments to the Federal Tax Service

In 2021, Sergei Petrovich Sidorov suffered from bronchitis and spent money on treating his mother, who suffered from high blood pressure and cataracts, on disinfectants and hormonal drugs for his 17-year-old daughter, and on “beauty injections” for his wife.

In the tax period, Sidorov earned 350,000 rubles. From this amount, income tax was withheld in the amount of 45,500 rubles.

For information on how personal income tax is calculated, read our article “General procedure for calculating and paying personal income tax .

To treat bronchitis, he bought aspirin and erythromycin prescribed by a doctor. Sidorov spent 200 rubles on medicines. For treatment, he bought amlodipine and pyrenoxine for the mother for the amount of 600 rubles, and for his daughter - chlorhexidine, iodine and betamethasone for the amount of 300 rubles. Botox injections for my wife cost 15,000 rubles.

Sidorov S.P. has the right to receive a deduction from amounts spent on medications purchased according to prescriptions for himself, mother and daughter. In total this amounted to 1,100 rubles. (200 + 600 + 300). But he will not be able to return the money spent on purchasing cosmetic products for his wife in the form of social benefits.

By submitting doctor's prescription forms, checks, copies of his birth certificate and his daughter's birth certificate along with the tax return and other documents, Sidorov will be able to claim a refund of 143 rubles from the budget. (13% of 1,100). The money will be transferred to his current account based on the submitted application.

Results

The taxpayer has the right, in relation to the personal income tax withheld from his income, to take advantage of a social deduction in the amount of expenses spent on treatment (for himself or for family members). In particular, he may bear the costs of purchasing medications. Until 2021, deductions are possible only for medications according to the list from the Decree of the Government of the Russian Federation dated March 19, 2001 No. 201. From the deduction for 2021, incl. for 2021, this restriction is lifted. There are certain requirements for documents confirming that a doctor has prescribed this particular medicine.

To receive a deduction with all the documents confirming your right to it, you need to contact the Federal Tax Service either in the year of treatment expenses (then the deduction can be taken into account at the place of work), or at the end of this year (then the Federal Tax Service will return the tax). In the latter case, along with documents confirming the right to deduction, you will also have to submit a declaration in form 3-NDFL and certificates in form 2-NDFL confirming the amount of tax withheld for the year.

Sources: Decree of the Government of the Russian Federation dated March 19, 2001 N 201

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.