Author of the article: Lina Smirnova Last modified: January 2021 22943

When inheriting, property objects do not always go to only one heir. In practice, property, especially real estate, often has to be distributed to several heirs. Each of the applicants gets a certain share of one real estate property. After receiving his share in a common apartment or house, the heir often has the desire or need to donate it to other persons. In this regard, they are concerned with the question of how to donate their share of the inheritance to another heir.

In this material we will consider situations related to the donation of an inherited share of the inheritance, the features of such a process and options for its implementation.

Features of inheritance of shared property

The law establishes the procedure for the shared division of the entire inheritance that goes to several heirs. Each share must include property the value and value of which is equal to the share of each heir.

| Features of inheritance of shared property | Shared ownership is formed when the inheritance includes an object for which several heirs of the same priority are claimants. This situation can arise, for example, when dividing an apartment. The best way to divide it into shares is by agreement between the heirs. To register their share, the heirs are required to document an “Agreement on the division of inheritance into shares.” If the heirs do not come to an agreement, the object of inheritance is distributed equally between them. |

| Formation of shares in inheritance under a will | Usually the testator, when drawing up a document, indicates the shares of each heir on which the will is drawn up. By default, according to Article 1122 of the Civil Code of the Russian Federation, it is considered that the shares of all heirs are equal. An exception to this rule is the allocation of a mandatory share for certain categories of heirs. If they are not included in the will, they will still be provided with a share of no less than half of what would be due to them by law. There are also features of the distribution of inheritance between husband and wife. If the testator executed the document not for the spouse, but for another close relative, while the property was acquired during marriage, then the surviving spouse must receive ½ share of their common property, regardless of the will. |

Inheriting an apartment using a deed of gift

after the death of the donor is a very relevant and interesting question. During his life, any person acquires a certain amount of material wealth. Using them at your own discretion is a normal desire and opportunity for everyone. Often, a person’s property achievements are passed on to his family and friends after the death of their owner.

But relationships between people do not always work out normally.

Disagreements and conflicts are not uncommon. In such situations, a person can transfer benefits to other people and leave his family with nothing.

This is quite logical. After all, expression of will is often based on emotions rather than a practical approach. The owner of the property has several ways to dispose of all his assets:

- transfer according to the last will;

- die without making a decision on the delimitation of achievements;

- give someone a gift.

In the latter case, outsiders may appear in the expression of will.

The concept of shared ownership

Since the question most often arises whether it is possible to donate your share in the inheritance of a house or apartment, you should determine what is meant by a share of real estate. Based on Article 244 of the Civil Code of the Russian Federation, a property owned by several owners, if the size of the shares of each is specifically determined, is their shared ownership. If dividing the object into shares is impossible, then it belongs to all owners and is their common property.

Expert commentary

Leonov Victor

Lawyer

The impossibility of distributing an object into shares is caused by the reasons for the discrepancy between the size of the shares with the norms established by law or the technical characteristics of the object itself.

Shared ownership can be expressed:

- quantitatively in fractional form or as a percentage of the total size of the object, for example, ½ or 50%.

- also, shared ownership can represent a specific part of a common object, highlighting its boundaries, separate communications, a separate entrance, etc.

- if the object of inheritance is money, shares and other securities, then the share is determined in monetary terms.

By becoming the owner of a share, expressed as a percentage or fractionally, the heirs do not receive the right to dispose of any specific part of the object of inheritance, but acquire the right to use this object on an equal basis with other owners, regardless of the share received.

He can allocate the share belonging to the heir with the consent of the remaining owners of the object or, if they give consent, then by court decision. If it is impossible to allocate a share, the heir may be awarded compensation for it and deprivation of the right to this property.

sovetnik36.ru

You don't have to pay extra tax or calculate interest, just know the basics.

- If the transaction amount is more than one million rubles, the tax is calculated based on the excess amount and is 13% for citizens of the Russian Federation and 30% for foreigners.

- According to Article 220, Part 1 of the Tax Code of the Russian Federation, when selling an apartment that has been owned by the owner for more than three years, no tax is charged. The period of three years must pass from the death of the testator and does not depend on the date of actual adoption.

- If the transaction amount is less than one million rubles, no tax is charged.

- If the apartment has been owned for less than three years, income tax must be paid.

Personal consultation Thank you very much for your detailed and clear answer!

Do you have an answer to this question?

You can leave it by clicking on the Reply button Similar questions How long after joining

When can you donate your share of real estate?

The inherited share of the common shared property can be donated under the following circumstances:

- renounce your share with the condition of transferring it to another heir during the period of acceptance of the inheritance;

- after entering into an inheritance, allocating your share and registering it in the unified real estate register;

- after entering into inheritance of a share, designated in quantitative terms in the form of a fraction, percentage or monetary value without separating it into a physical real estate object.

The first option is possible only if there is a limited number of applicants for a gift in the form of a share. In the event of her inheritance by will, they can be only the remaining heirs indicated in the testamentary document, and if there are none, then the heirs of the corresponding order. When receiving a share in accordance with the law, it can only be transferred to relatives upon renunciation of their share. The refusal is drawn up by a notary, and after that it serves as an official document for registering the share in the name of the new owner.

The allocated share can be gifted as an independent piece of real estate.

The heirs of a common object, divided into shares, the sizes of which are determined only by documents, also have the right to dispose of their share as they wish, including donating it as a gift.

Expert commentary

Shadrin Alexey

Lawyer

In any case, to make a donation, the share of real estate must be registered with the Rosreestr authorities.

Deed of gift after inheritance

- Is it possible, after entering into an inheritance, to draw up a deed of gift to avoid taxes?

- Registration of a deed of gift after a non-resident of the Russian Federation inherits an inheritance.

- Is it possible to draw up a deed of gift for a share immediately after entering into an inheritance?

- Is it possible to make a deed of gift for my wife after entering into an inheritance?

- Is it possible to draw up a deed of gift on the same day after entering into an inheritance?

- How long after entering into an inheritance can a deed of gift be made?

The procedure for registering an inheritance share as a gift

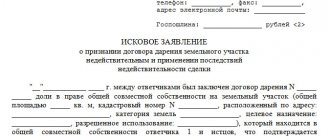

The procedure for donating a share is basically no different from donating any entire piece of real estate. However, all transactions related to the alienation of shares on the basis of common shared ownership must be confirmed by a notary. Such changes have been made to the law since June 2021. To carry out his intention to donate his share of the common inheritance, the donor must do the following:

- declare to a notary about your right to a share and receive from him a certificate of right to it and register shared ownership in Rosreestr;

- prepare a package of documents and contact a notary to draw up a gift agreement. In the case of donating your share to minor citizens, involve guardianship representatives or a legal representative in the procedure;

- after issuing a deed of gift certified by a notary, receive from him the original document in 3 copies, which is issued after payment of the fee;

- submit a package of documents along with the deed of gift to the registration authorities to re-register the property to the new owner;

- receive an extract on the re-registration of the owners of the property.

If the heir intends to donate his share immediately, then he needs to: obtain a certificate of right to the share from a notary, immediately formalize the deed of gift in writing and, having received 3 copies of the registered agreement with a notary certificate, contact Rosreestr. There, two operations will be carried out at once: registration of the heir’s property rights and their re-registration to the new owner on the basis of a gift agreement.

Registration of a gift transaction

The gift agreement, as well as the ownership rights to inherited property, must be registered with Rosreestr. In this case, both parties to the transaction must appear at Rosreestr and submit:

- Donation agreement;

- Passports;

- Documents about the donor's ownership of this apartment;

- BTI documents (technical passport);

- Receipt for payment of state duty.

The state duty for gift transactions is 1000 rubles. In addition, the recipient of the apartment will be required to pay a tax of 13%, since the law perceives this as an additional source of income.

An exception to this taxation scheme is the situation when a deed of gift is issued between close relatives.

Gifts to family members are not taxed. Facebook

Entry into inheritance by deed of gift

and additional, intro. In force from 06/09/2019) Housing Code of the Russian Federation Article 31. Rights and obligations of citizens living together with the owner in residential premises belonging to him 3. Members of the family of the owner of residential premises who are legally capable and limited by the court in their legal capacity are jointly and severally liable with the owner for the obligations arising from the use this residential premises, unless otherwise established by agreement between the owner and members of his family.

2. My grandfather died. Within 6 months I submitted documents to the notary to enter into an inheritance. Grandfather had an apartment, which he got as a gift.

Accordingly, the apartment passes to me from him. The question is: can I sell it right away without paying 13 percent or do I need to use the apartment for 5 years? Thanks for the answer. 2.1. In your case, to sell an apartment without taxes, you need to be the owner for 3 years.

All the best. 2.2. If the apartment

When can you issue a deed of gift after entering into an inheritance?

When executing such a transaction, you must be aware that you will not actually be able to manage or dispose of property or deposits, since you voluntarily donated them.

It is difficult to change or cancel a gift agreement in practice, only in court in a number of cases provided for by law. A will provides for the transfer of all property rights after the death of their actual owner. Photo No. 2 Civil Code of the Russian Federation, Chapter 62, Articles 1118-1140 A will provides that a person bequeaths the management and ownership of his property to an individual or group of persons, including legal entities, after his death. The document can be revised and redone at will an unlimited number of times.

The latest will will be considered valid. Ownership rights remain with a person until death. Thus, you can change your will and make adjustments depending on the circumstances.

Without entering into an inheritance, draw up a deed of gift

If you want to give something to someone, transferring it for the use of another person immediately after registering the agreement, then the best solution for you would definitely be to draw up a deed of gift.

If at the moment you need the property in question, then it is better to write a will, in which you should clearly indicate what exactly will go to whom and when. Remember: a will will come into force only after the death of its author.

Unlike a deed of gift. Try to clearly define why exactly you need to transfer the property into someone else’s possession and only after that draw up an agreement. You should also know that it is very difficult to challenge or rewrite a deed of gift after it has entered into force. And a will can be rewritten as long as its author is alive. The main thing is to register it with a notary on time.