For many Russian citizens, a mortgaged apartment is the main purchase in life. Today we will answer you such frequently asked questions as: is it possible to bankrupt a co-borrower on a mortgage, what to do if a co-borrower on a mortgage goes bankrupt, what will happen to the mortgage and general acquired property in such situations.

Let’s say right away that a co-borrower on a mortgage can go bankrupt! But we’ll tell you below how to do this and what consequences arise. Let's start in order.

Who is a mortgage co-borrower? When the financial capabilities of the main mortgage borrower do not fully meet the lender's requirements, the law provides him with the opportunity to share his obligations with third parties. These are the co-borrowers.

Most often, married couples apply for such bankruptcy, in which one of the spouses is a borrower and the other spouse is a co-borrower. However, in practice there may be more than one co-borrower. There can be up to 4-5 co-borrowers in one mortgage agreement. For example, in addition to the spouse, co-borrowers can be the borrower’s mother or father or both parents, as well as other relatives (brother, sister, children).

If one of the co-borrowers shows signs of insolvency, then the current situation makes all debtors under the mortgage agreement worry. And not in vain.

Today you will learn what you need to be prepared for if a borrower or co-borrower (or one of the co-borrowers) under a mortgage agreement applies to an arbitration court with an application to declare him financially insolvent (bankrupt). Forewarned is forearmed!

First, let's figure out what rights, obligations and responsibilities arise for co-borrowers after signing a mortgage agreement.

Who is a co-borrower

Involving co-borrowers when applying for a mortgage loan may affect the size of the final amount under the agreement. This happens because when reviewing documents, the bank will take into account the total income of all persons who are participants in the credit relationship.

A loan involving other persons implies an equal division of debt obligations. However, the decision about who will make the monthly payment remains at the discretion of the borrowers. However, in case of delay in the regular payment, the bank may demand full repayment of the issued amount from any of the existing parties.

A co-borrower is not a guarantor. His obligations to the credit institution are higher. There are situations in which both the co-borrower and the guarantor are tied to the loan agreement. If a delay is detected, the debt obligations are transferred first to the co-borrower and then to the guarantor.

How to increase your chances of approval

Do they give mortgages to co-borrowers or is it better to immediately initiate withdrawal from the loan? Let's look at what significantly increases the chances of getting a mortgage approved, and then assess the situation.

Reliable information. You should not attribute to yourself a salary or experience that is greater than it actually is. When applying for a mortgage, all data is carefully checked. Intentional misrepresentation of information may result in blacklisting of the bank.

Recommended article: How to avoid being scammed when renting an apartment

Good credit history. If the title borrower pays regularly on the first loan, the presence of obligations may not affect the consideration of the mortgage application.

Can you get a mortgage with a bad credit history?

Sufficient income. The co-borrower’s salary (or other income) should be enough to provide minimum support for himself, his family and repay all loan obligations. When calculating your solvency, the bank assumes that the main borrower can stop making payments at any time, then the credit burden will fall on your shoulders. It is for this reason that a loan where you are a co-borrower is taken into account when assessing the mortgage application.

The balance of debt and the amount of payment on the first loan. If the debt is still large, the monthly payment will be deducted from your income and only then will the maximum mortgage amount be calculated. The presence of obligations of a co-borrower can significantly reduce the possible amount of your home loan. In this case, you need to either seek financial support yourself or exit the existing deal.

After considering all the circumstances, the bank will decide whether the co-borrower can take out a mortgage for himself. To increase your chances of loan approval, you need to check your banking history. See if there are any late payments and what your credit score is.

After this, calculate what amount will remain of your income after deducting the cost of living for yourself and dependents (children, pregnant or unemployed spouse), and payments on your existing loan. If the resulting balance allows you to pay off the mortgage, you can try to apply. If not, it is better to get out of the loan where you are a co-borrower.

Advice! The second option is preferable, because there is no exact answer to the question of whether a co-borrower on a mortgage can get a mortgage. You will only find out after reviewing your loan application. You are allowed to reapply to the same bank for a housing loan only after a while, usually after 1-2 months.

What to do if the bank refuses a mortgage

What to do after your mortgage is approved

Who can be involved as a co-borrower?

Banks are more favorable towards a client who involves his relatives as a co-borrower. However, this is not a requirement. This role can be played by any person who meets the requirements of the credit institution.

It is important to understand that a co-borrower, when participating in lending, receives not only responsibilities, but also rights. In addition to the responsibility to pay the loan, he automatically becomes a co-owner of the purchased property. Moreover, if the client is officially married, many banks make it mandatory that the spouse act as interested parties.

There is a small exception. If a marriage contract was concluded between the spouses, which provides for separate rights to property, then in this case the obligation to act as a co-borrower becomes irrelevant.

The bank also welcomes parents or close relatives as interested parties. There are often cases when employees of one organization, by agreement, draw up loan obligations.

Existing risks

A co-borrower on a loan risks exactly the same as the main recipient of funds. If we are talking about spouses, there is a risk of losing real estate if the couple is unable to continue paying off the loan. Additionally, there is a possibility of ruining your credit history. The financial burden on the budget may increase significantly. In practice, the co-borrower himself may feel the need to obtain a loan. However, most banks will refuse to provide it.

Some financial institutions force individuals acting in this role to insure their life and health, which requires additional financial costs.

Based on the above, it turns out that the co-borrower risks in exactly the same way as the main recipient of the mortgage. There is nothing wrong with sharing credit obligations with anyone. However, it is worth understanding all the existing risks before agreeing to participate in a transaction. In another situation, a person may be faced with the need to repay someone else’s loan.

Requirements for co-borrowers

As with the borrower, the bank also imposes requirements on the co-borrower. These are certain criteria that must be met without fail:

- the person must be a citizen of the Russian Federation;

- reaching a certain age. Different banks set their own minimum age parameters. This could be 18, 21 or 25 years old;

- the person must be officially employed, and his work experience at his last place of work must be at least 6 months;

- a positive credit history is a fundamental factor in any lending;

- it is possible to have family ties with the borrower (optional).

The number of persons involved as co-borrowers is established by the rules of the banking organization, but cannot exceed six people.

When applying for a mortgage loan, the interested party is most often a spouse. At the same time, banks even allow the fact that a given person may not have any work activity. In this situation, under any conditions, the acquired object becomes joint property.

If, while using a mortgage loan, one of the spouses does not pay the required payments, the bank can completely appropriate the property and subsequently sell it to cover its losses. This fact will not be affected at all by the fact that both spouses are the owners of the property. If the other spouse intends to return the loan housing, he must fully assume all obligations under the loan agreement. If such conditions are met, he will automatically be obliged to pay regular payments.

Loan agreements that involve real estate are subject to insurance. As a result of an insured event, all costs of this loan will be covered by insurance compensation.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Michael

04/08/2021 at 06:32 Hello, question: I am a co-borrower on my spouse’s mortgage, she is bankrupt, the case has been declared closed, and now the bank is demanding the missing amount from me. Through the bailiffs, all the property was sold legally, they are doing what to do. Should I file for bankruptcy or what?

Reply ↓ Anna Popovich

04/08/2021 at 20:07Dear Mikhail, in accordance with the law, if spouses have common obligations secured by their joint real estate, its implementation occurs in the bankruptcy case of the spouse. If you are financially insolvent, then you can initiate bankruptcy proceedings against yourself.

Reply ↓

Rights and obligations

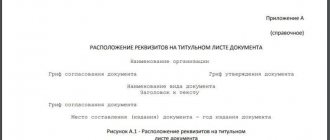

The rights of a co-borrower under the terms of a mortgage loan must be stated in the loan agreement.

This person will be the full owner of the purchased property, along with the borrower. Also, such a person has the right to apply for a property deduction, which is realized when purchasing real estate.

The responsibilities assigned to the additional borrower must also be specified in the agreement. The main point here will be the timely and high-quality fulfillment of debt obligations. It is possible to indicate in the documents who will make monthly payments. This can be the borrower or all participating parties in equal shares. Failure by the borrower to fulfill its obligations will result in all responsibility being placed entirely on the co-borrower.

Applying for a mortgage loan with the participation of a co-borrower

When applying for a mortgage loan, attracting co-borrowers will not only have a positive effect on the bank’s decision, but also allows you to increase the size of the loan.

Rules for obtaining a mortgage:

- First of all, you need to consider offers from credit institutions. It is worth choosing a program in which the terms of lending with the participation of co-borrowers are favorable.

- Decide how many stakeholders will be needed. This point depends on what amount the client is considering and what income he must provide.

- When preparing documents, it is worth concluding an internal agreement between the borrower and the co-borrower, which will establish the responsibilities of each, especially in terms of paying monthly payments. This document has nothing to do with the bank. However, in the event of disputes and litigation, such an agreement will resolve the issue.

- Collecting a package of necessary documents for the borrower and co-borrower. As a rule, this is a standard set of documents. There may be exceptions provided for by the internal regulations of banking organizations.

- Registration of an insurance policy. This procedure will allow you to avoid consequences that may arise due to unforeseen circumstances.

The procedure for drawing up a questionnaire for the bank

A separate application is not submitted for the co-borrower. All data is entered into the borrower’s application form on the official DomClick website or at a bank branch, together with an employee.

In the online version of the application, the paragraph with information about the co-borrower is final. After filling out all the fields and attaching the required documents, the applicant can submit the application for review.

After registering the application, the document will be reflected in your Sberbank Online account. Each applicant will be able to track the status of their application here.

Change of the current contract

Sometimes cases arise in which the co-borrower decides to withdraw from the agreement. In such a situation, the bank’s policy involves revising the loan agreement. The bank's requirement will be to replace the specified person with another co-borrower.

The bank does not always give permission to change contractual terms. There must be a good reason for this. For example, if one of the spouses acted as a co-borrower, then in the event of a divorce he has the right to relieve himself of the loan obligations. However, in any case, the final decision remains with the bank.

Important! All parties involved must be present when the contract is reviewed. The change of co-borrower is formalized by an additional agreement.

In what cases does a spouse not participate in the mortgage?

However, there are cases when one of the spouses wants to take out a mortgage only for themselves, without involving their spouse in this process. A mortgage without a spouse may have the following reasons:

- division of property of spouses, the desire to protect real estate from division in the event of a possible divorce;

- one of the spouses works unofficially and his income is not confirmed;

- one of the spouses has a bad credit history;

- the wife, for example, is a housewife and has virtually no income.

Very often, a family has to take out a mortgage only for the wife if the husband already has several loans.

It is possible and quite legal to take out a mortgage without the consent of your spouse.