When purchasing housing under construction, as a rule, they enter into equity participation agreements in construction or share accumulation agreements with a housing construction cooperative (HBC). But between the moment of concluding the contract and receiving an extract from the Unified State Register of Real Estate (certificate of registration of property rights), quite a lot of time can pass, sometimes even several years.

So when can you apply for a property deduction when purchasing an apartment in a building under construction? Immediately after concluding an agreement to purchase an apartment or after paying the full cost of the apartment? Or maybe after concluding the Acceptance and Transfer Certificate of the apartment or receiving an extract from the Unified State Register of Real Estate?

Below we will answer these questions in detail.

Amount of tax deduction when purchasing an apartment 2021: no change

The amount of the deduction in 2021 remains the same:

- 2 million rub. for acquisition, construction and repair;

- 3 million rub. interest expenses on the target loan.

However, in the near future it is possible that the tax deduction for purchasing an apartment will increase. Recently, a bill on this matter was introduced to the State Duma. Its authors ask to raise up to 3 million rubles. deductions for the purchase and construction of housing and up to 4 million rubles. when paying interest.

Legal grounds

The right to receive a deduction when purchasing an apartment on the primary market is provided for by the Tax Code of the Russian Federation (Article 220). In addition, the issue is regulated by a number of letters from the Federal Tax Service and the Ministry of Finance of the Russian Federation.

Only citizens of the Russian Federation who are officially employed, as well as private notaries, lawyers, individual entrepreneurs and other persons paying income tax (NDFL) to the budget have the right to apply for payment.

The purchase amount from which the deduction is calculated should not exceed 2 million rubles in this case. Thus, the maximum deduction amount cannot be higher than 260 thousand rubles. If a mortgage loan was taken out to pay for the DDU, then you can additionally apply for a deduction for interest, but not more than 390 thousand rubles (from a maximum amount of 3 million rubles).

Additionally, you can receive a deduction for the amount of expenses for finishing the apartment, purchasing materials , developing design and estimate documentation for these works.

Example 1.

The young family entered into an agreement for shared participation in construction in the amount of 1.5 million rubles (1.2 million rubles of personal savings and 475 thousand rubles of maternity capital).

Since no deduction is provided for maternity capital, the family has the right to a deduction in the amount of: 1,025,000 x 0.13 = 133,250 rubles. In this formula, 13% is the amount of personal income tax. If another 100 thousand rubles were spent on finishing the apartment, then you can additionally receive 13 thousand rubles (100 thousand rubles x 0.13).

Example 2.

The family registered a private trust using bank loans. Of the 1.5 million rubles spent on the apartment, 500 thousand rubles were personal savings, and 1 million rubles were taken on credit. Due to the mortgage, you can get a double deduction: 1.5 million rubles x 0.13% = 195,000 rubles.

The calculations in these examples are rather arbitrary, since the size of the deduction directly depends on the amount of 13% income tax paid on wages. If the applicant’s official income is low, then the tax amount will also be small, because the deduction cannot exceed the amount of personal income tax paid.

Conditions for tax deduction when purchasing an apartment 2021: there are changes

Law No. 325-FZ has introduced two innovations for property deductions when purchasing an apartment in 2021:

- A parent or guardian can receive a housing deduction for children and wards recognized by the court as incompetent, without an age limit (previously there was a limit of up to 18 years).

- When refinancing a loan under borrower assistance programs, you can receive a tax deduction in the amount of interest, even if the mortgage loan was refinanced not by a bank, but by another organization.

Changes to the tax deduction when purchasing an apartment for children or dependents

Purchasing housing in the name of a child (in whole or in part) allows the parent to receive a property deduction within the limits of the child’s or ward’s share. The child retains the right to the benefit; the amount of the property deduction limit used is issued to the parent. In previous years, this rule only applied to children under 18 years of age. From 2021, a tax deduction for the purchase of an apartment applies to children (including adopted or guardianship children) of any age if the court has declared them incompetent. An important condition for receiving benefits is that housing must be purchased at the expense of the parent or guardian. If the parent invested his savings or took out a corresponding loan, then a deduction will be provided; If state support funds are used, the tax will not be refunded.

Is it possible to get a refund on an apartment under construction: legislation

There are no legislative exceptions that would impose a ban on issuing a return in the case of DDU. By purchasing housing under construction, everyone can get back part of the money spent.

The law allows this procedure subject to the following requirements:

- the applicant must have a white salary and tax deductions for personal income tax to the budget for the last 3 years;

- the apartment was paid for with own or credit funds;

- the right of return has not been exhausted;

- In relation to the apartment, there must be documents confirming its receipt of ownership.

The key document will be the transfer deed. It is with its presence that the legislator associates the emergence of the opportunity to issue a refund. When there is an act, there is no need to wait for the construction to be completed.

In essence, a tax deduction for DDU is a reduction in the tax base for personal income tax by the amount of the purchase of an apartment, and a tax refund is a transfer to the taxpayer from the budget of contributions previously paid from his salary.

This tax benefit should not be confused with sales deductions - fixed and expense. These are different tax concepts.

Tax deduction for an apartment loan - features of refinancing in 2021

In 2021, receiving a deduction on interest when refinancing was allowed only if the new lender was also a bank. In 2021, an exception appeared to this rule - non-bank organizations according to the list of the Government of the Russian Federation. A prerequisite when preparing documents for a tax deduction when purchasing an apartment for the amount of interest paid is that any refinancing agreement must contain a direct reference to the original loan agreement. In turn, the initial loan agreement must be targeted, that is, the text of the document must indicate the purpose of the money issued - for a specific apartment.

The requirement for a mandatory reference when refinancing to the original loan agreement applies to all possible situations for obtaining a deduction:

- initial or subsequent refinancing at a bank;

- refinancing using state support in other organizations.

Unfortunately, it is easy to lose the right to a tax deduction on interest on the purchase of an apartment when refinancing:

- if the on-lending agreement was concluded before 2021 not with a bank, it could be various financial organizations without a banking license, individuals or employing organizations;

- if such an agreement was not concluded in 2021 with a bank, and the new creditor is not included by the Government of the Russian Federation in the list of organizations through which state support is provided;

- if the new document does not directly mention the very first loan agreement as a source for financing the purchase of housing - even if refinancing is carried out for the second or third time, it is still necessary to refer to the first loan agreement.

Where to receive

There are two options for receiving:

- at the employer;

- through the Federal Tax Service.

The difference is:

- from your employer you will be able to receive a monthly personal income tax refund based on a tax notice received from the tax authority within a month from the date of your application;

- through the Federal Tax Service in a single payment for the whole year within a month after the end of a desk audit lasting up to 3 months.

In cases where you apply for a benefit from your employer, there is no need to fill out a declaration of your income, but you must submit a notification from the tax office about the right to a deduction; for more information about how to obtain it, read the article “What is the best way to get a deduction through your employer or the tax office”

Determining the amount of tax deduction when purchasing an apartment in 2021 for spouses

If the marriage is officially registered before the purchase of real estate, then both spouses have the right to receive a property deduction, but there are nuances.

Depending on the type of ownership of the apartment, the amount of tax deduction is distributed as follows:

- Common shared ownership is proportional to the share in the purchase price . For example, an apartment was purchased for 6 million rubles. spouses in shares: husband 1/6 and wife 5/6. Potentially, everyone has a benefit in the amount of 2 million rubles, however, upon completion of the transaction, the amount of tax deduction when purchasing an apartment will be:

- for husband - 1 million rubles. (6 million rubles * 1/6),

- for the wife - 2 million rubles. (6 million rubles * 5/6, but not more than 2 million rubles).

With a more equal proportion, the husband would be able to receive the full amount of the benefit.

- Common joint property - in accordance with the agreement on the distribution of deductions between spouses . If such an agreement has not been formalized, then the property deduction is divided equally. Having concluded an agreement, you can change the proportion of distribution of the benefit amount - for example, if the income of one of the spouses allows you to receive a refund faster than the income of the other.

When submitting subsequent declarations, it will be possible to change the ratio of shares in the amount of the tax deduction for the purchase of housing only in terms of interest costs. The remaining costs will be allocated according to the original agreement. If, for example, the wife waived her share of the deduction in favor of her husband in the first year of the tax refund, then when filing a return for the second year, her share will still be 0%. The husband will not be able to transfer the rest of the deduction to her if for some reason he himself is unable to receive it.

- The sole property of one of the spouses - in the absence of a marriage contract, all property acquired during marriage is considered common . Consequently, the amount of tax deduction when purchasing an apartment is divided similarly to the previous option. In this case, it is necessary to conclude an agreement on the distribution of shares; the rule of equal proportions will not work by default.

Restrictions

Regardless of how you buy personal property, Article 220 of the Tax Code of Russia sets limits on the amount from which you will be reimbursed 13%.

- The maximum amount is 2,000,000 rubles, i.e. You can return up to RUB 260,000.

- And if property is acquired in shared ownership by several family members, then all of them have the right to claim a tax refund.

- Receiving this benefit is possible once in a lifetime, but if the price of the purchased property is lower than the limit amount, you have the right to take advantage of the benefit until it is completely exhausted on the next purchase and return up to 260,000 rubles. Your personal income tax.

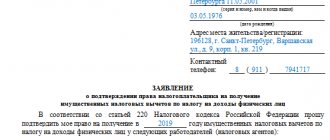

What documents are needed to obtain a tax deduction for the purchase of an apartment?

- Form 3-NDFL. The easiest way is to fill it out in a program that can be downloaded from the Federal Tax Service website. No special knowledge is needed for this.

- 2-NDFL certificates from all sources of income. It is not necessary to contact all employers if there are several of them. After March 31, 2020, income certificates for 2021 can be downloaded for free on the State Services portal.

- Property document. After 2021, its role is played by an extract from the Unified State Register of Real Estate. A legally significant extract from Rosreestr can be ordered via the Internet on the official EGRN.Reestr for any real estate property.

- Application for distribution of deductions between spouses.

- Applicant's passport.

- Marriage certificate.

- Transfer and acceptance certificate or DDU agreement .

- Payment documents, including receipts and receipts. Acts on the purchase of materials for repairs, indicating the full passport details of the supplier, if this is an individual.

- Application for transfer of funds from the budget to a bank account. To prevent your money from hanging up on unexplained payments, it is better to take a statement of account details from your bank in advance. Any account is suitable, even a bank deposit. You don't need to take a card for this. The main condition is that the account is not closed until the money arrives (the period can take up to 3-4 months).

With the exception of declarations, 2-NDFL certificates and applications, documents are transmitted in the form of copies. However, you must have the originals with you, since the authenticity of the copies is checked by the inspector.

What is DDU

You can purchase an apartment by choosing different ways - buy it on the secondary market, take a ready-made new apartment, or use an equity participation agreement (DPA). The latter involves participation in the construction of a house in which you buy a share. According to it, you will be provided with an apartment in the future.

The parties to such an agreement are us and the developer, who has the rights to the house and land. Typically, the developer is a legal entity that owns the land and is engaged in construction, but there are exceptions. The contract looks something like this:

- we undertake to pay the developer a certain amount of money;

- the developer undertakes to use this money for construction;

- the developer undertakes to transfer to us the rights to the finished property in the future.

The real estate in such an agreement can be not only an apartment, but also a room in it or some kind of non-residential premises. Only one thing is important - the property must be part of the house in which we are buying a share.

Previously, we gave the developer money, and he immediately used it, investing in construction. Now we also transfer money to the developer, but he cannot use it until his obligations are fulfilled. Not every house construction under DDU ends successfully; the situation was especially sad before the adoption of the 2021 law.

In fact, the DDU did not give us practically any guarantees, because in the event of a banal bankruptcy of the developer, money was lost. It was not possible to return them, because the share participation agreement itself provided for such risks.

Now everything has changed - the developer is obliged to deposit the money received into a bank account, where it will be stored until the house is put into operation. That is, now the developer receives money only after he allocates the property due to us. In case of bankruptcy and other problems, our investments will simply be returned to us from this same bank account. In general, the new law has made DDU much more attractive for ordinary citizens, because the transaction itself has become more reliable.

How to get a tax deduction for an apartment

How to get a tax deduction when buying an apartment

After you have prepared a package of documents, calculate the amount of deduction and tax to be refunded. Then it will be checked by the tax office, but the applicant himself must count it. You can get back 13% of the amount actually spent. The limit for purchasing housing using your own funds is 2 million rubles, that is, the maximum refund amount will be 260 thousand rubles.

Interest on a mortgage has its own limit - 3 million rubles, they will return up to 390 thousand rubles. In your calculations, take into account all the nuances, including those that we wrote about above. You may have your own preferences for purchasing a home. For example, maternity capital was used. It is impossible to obtain a property deduction from this amount, so it must be deducted from the cost of the apartment.

There are two ways to receive a tax deduction for purchasing an apartment:

- From the employer this year . To do this, you must submit a declaration in form 3-NDFL. The employer does not withhold personal income tax during the year, but pays it to you as part of your salary.

- According to the declaration next year. An option for those who do not have an employment contract or are planning to return personal income tax for previous years. Several declarations are sent to the tax office - one for each year.

All collected documents must be sent to the tax office - in person or online through the nalog.ru portal. The wait usually takes three to four months. The tax deduction will come to your account.

Nuances of the procedure

There are no particular difficulties in this procedure. We collect the necessary documents, submit them to the tax office, complete the investigation, complete it, and contact the tax office again. The only thing is that the developer should not be your close relative. This is because the state does not provide a tax deduction for property transactions between related parties. This applies only to relatives of the first category - father-in-law, mother-in-law, wife's brother and similar persons are not included in this list.

It is also worth remembering that the tax deduction is provided from the taxes that you paid in the year the trace was issued. In our case, we are talking about the act of transferring an apartment into your ownership.

Why they may not give a tax deduction when buying an apartment in 2021

- The amount of expenses is not documented.

- The documents were completed incorrectly. Possible options: the seal on the contract is not readable, the seller’s passport details are not indicated in the purchase act, the intended purpose is not indicated in the loan agreement.

- Other people's funds were used. Classic options are purchasing an apartment using maternity capital, a military mortgage, or purchasing housing by an employer for employees. There is judicial practice regarding claims by the Federal Tax Service against citizens who managed to receive a tax deduction for an apartment when budget funds were allocated to them, but did not inform the tax authorities about this.

Sometimes payment by another person is still allowed:

- purchase of housing by spouses;

- registration of residential real estate in the name of children or wards.

- A citizen has no taxable income from the year of acquisition of real estate. In this case, he will have nothing to return from the budget, since it is impossible to receive money for the period before purchasing the property. The only exception is pensioners, who are allowed to receive a tax deduction when purchasing an apartment based on income documents for the three previous years.

- There is a subordinate position or influence between the seller and the buyer. Here are some examples of such situations:

- close relatives;

- superior and subordinate;

- organization and its founder.

Text: Natalia Petrakova, Olesya Moskevich

Registration procedure

Due to the fact that the deduction is available only upon the fact of our purchase and receipt of the property, we cannot receive anything from the state during the construction process. First, we conclude a contractual agreement and pay the developer the required amount of money. Then we wait for the completion of the construction of the house.

After the house is ready for commissioning, the developer begins to transfer apartments and other real estate from the site to the shared owners. As soon as we sign the deed of acceptance and transfer of the apartment into our ownership, we can contact the tax service to receive a tax deduction. To do this, we will need to collect a special package of documents.