Buying a home with a mortgage involves significant expenses for the down payment, and then over the course of decades, the borrower is obliged to repay the debt to the bank along with interest. The return of mortgage interest will help cope with the mortgage burden by offsetting part of the costs in the form of tax amounts returned from the budget. The right to reimbursement of interest overpayment on a mortgage is fixed by tax legislation and can be used throughout the entire period of the mortgage, based on calculations of actually paid income tax.

Receiving a mortgage interest deduction

When purchasing residential real estate using mortgage money, the legislation of the Russian Federation offers the return of 2 tax deductions:

- Main deduction.

- Mortgage interest deduction.

The bottom line is that after purchasing and signing property documents, you have the right to return part of the money spent.

In case of official employment with a “white” salary, the accounting department transfers income tax (13%) to the budget. The employee receives a salary with the deduction of personal income tax - personal income tax. If you purchase a home, this money can be returned.

Attention!

If a citizen does not pay personal income tax or works as an individual entrepreneur under the simplified tax system, he has nothing to return from the budget. Only actual accrued or paid tax can be refunded.

The following categories of citizens who remit personal income tax can apply for a tax refund:

- Employees of enterprises and individual entrepreneurs with the main tax system.

- Pensioners who retired before 3 years.

The loan consists of two parts: the principal debt and the interest accrued on it. Accordingly, the tax deduction when purchasing real estate with a mortgage is calculated based on the size of each of these parts.

What is the main mortgage tax deduction?

The main deduction includes personal and credit funds spent on the purchase of any residential property.

The procedure for receiving a deduction when purchasing a home with a mortgage is the same as when paying with your own savings.

What is the mortgage interest deduction?

The amount of tax deduction for repaid interest on a home loan depends on the interest actually paid. The refund amount will be equal to the amount of the transferred interest multiplied by 13%.

Important!

If the value of the property specified in the contract is less than the amount of mortgage funds, then the deduction will be calculated based on the value of the home.

Declaration 3-NDFL: where to get it and how to fill it out

Tax return and calculation forms are constantly changing. In order not to make a mistake and not receive a refusal on a formal basis, it is important to ensure that the basis is indicated on the form: Order dated 10/03/2018 No. ММВ-7-11/ [email protected]

You can download and fill out the form manually on the Nalog.ru website by following the chain: Main page – Taxation in the Russian Federation – Taxes and fees in force in the Russian Federation – Personal income taxes – Forms of tax returns for personal income tax.

If you wish, you can contact a specialized company that provides accounting services.

Another option is to fill it out on the State Services website. Registration and receipt of digital signature are not required for this. Here the program is extremely simple and is designed for people without special education.

The filling procedure is as follows:

- on the main page, select the “Tax returns” section and the “Generate document” item;

- selection of the reporting year. As a standard, you can fill out a declaration for the three previous years;

- the next window is for displaying income. As a basis, you can use a 2-NDFL certificate issued by the employer. If there are several places of work, the data will have to be summarized.

Important! You need to pay attention to the earnings code. The State Services website provides tips to help you fill it out.

- at the next stage it is necessary to indicate the due deductions. They can be “property” or “social”. In the case of personal income tax returns, the first;

- Next, data is entered on the purchased apartment and the interest transferred to the lender;

- Once all the necessary data has been entered, the system will automatically calculate the amount of personal income tax to be refunded.

The declaration can either be printed for personal delivery to the Federal Tax Service, or sent via the website. The last option is available if you have an electronic signature.

Important! Before filling out 3 personal income taxes when refinancing a mortgage, you must indicate OKTMO on the main page. The code refers to the region. You can find it on the official website of the Federal Tax Service.

If we are talking about personal income tax returns, the 3-NDFL declaration can be submitted at any time.

When does the right to a tax deduction on a mortgage loan arise?

Both types of deductions are returned no earlier than the year following the year of registration of ownership of the property.

In most cases, the mortgage agreement is concluded before receiving housing documentation. This point is not related to the amount of the mortgage interest refund - the deduction includes the entire amount of interest you paid from the very first payment.

Attention!

If the total amount of your salary for the year and the amount of taxes transferred allow, you can apply for a one-time deduction.

You can return the tax on mortgage interest only in accordance with your actual payments to the bank - for the past year.

How long does it take to receive it?

The right to return the transferred money arises in the calendar year in which the ownership of it is dated and extends to subsequent years.

Important!

People who have retired are allowed to transfer the deduction 3 years before the emergence of ownership rights.

If the purchase of an apartment occurred in the past, and the deduction for it was not issued, then you can return it now - there are no restrictions on the return period. However, you can return personal income tax for a maximum of the last 3 years.

For example, if an apartment was purchased in 2021, and the deduction is issued in 2021, then the tax will be refunded for 2021, 2021 and 2021.

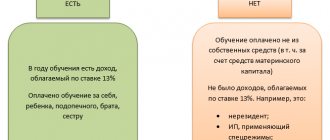

No deduction available

There are situations in which you cannot use a property tax refund:

- The property was purchased from related parties. The deduction is not provided if housing was purchased from relatives or an employer. These categories of people are stakeholders.

- The person received the available deduction limit. You can return the money 1 time if the apartment was purchased before 2014. After 2014, adjustments were made; if the amount of the deduction received is less than the maximum limit, then the remaining funds can be received by purchasing another property.

Rules for obtaining mortgage interest deductions

Significant changes occurred on January 1, 2014:

- until 01/01/2014 There is no limit on the amount of interest deduction.

- estate after 01/01/2014 The maximum amount for tax deduction on mortgage interest is RUB 3 million. That is, if the interest rate on the mortgage exceeded this amount, you can return 13% only with 3 million rubles.

Conditions for refund of property tax on mortgage interest:

- Purpose of the loan. An agreement concluded between a person and a company providing a loan must contain a line with information that resources are issued for the purchase or construction of a specific home.

- Refund of interest actually paid. It is allowed to indicate in the declaration only interest on mortgages repaid in previous periods.

- Receipt of money in the year following the year in which title to the property is acquired. If an apartment was purchased in 2021, the right to it was received in 2021, then you should apply for the deduction no earlier than 2021.

- Receiving a deduction from mortgage interest paid before registration of the property title. Interest paid before the title date is not included in the tax refund calculation.

- Single document 3-NDFL for principal and interest deductions on mortgages. When applying for both deductions at once, you do not need to fill out two declarations - the information is provided in a common form. If a deduction on the principal debt has already been received, the amount must also be written down in the document as a separate item.

Is it necessary to submit documents for deduction every year?

Often a situation arises when the main deduction has already been exhausted, and the amount of interest paid on the mortgage is small. To save time, you can not submit documents to the tax authority every calendar year, but submit them once every few years, including in the declaration all interest paid for these years.

Example: In 2021 Detnev L.P. I bought an apartment with a mortgage. According to the terms of the mortgage, he annually pays mortgage interest in the amount of 100,000 rubles. Income of Detnev L.P. per year exceed 2 million rubles. In 2021, Detnev filed documents with the tax authority and received a basic deduction and a deduction for interest paid in 2021. In 2021, Detnev may not file a return, but wait a few years and declare all the interest at once: for example, file documents in 2023 and receive a deduction for interest paid in 2021, 2021 and 2022.

Receipt procedure

There are two ways to get your property tax refunded:

- Through the employer this year. Income tax is not returned separately, but is included in subsequent salary payments.

- Through the Federal Tax Service next year or later. 13% of the property tax is returned to the person in the total amount for a year or several years.

Through the employer

The interest deduction can be partially transferred to your account every month: the Federal Tax Service stops withholding personal income tax, and the salary increases by this amount.

To receive a refund from the employer and avoid remitting income tax in the current year, you must request a notification from the Federal Tax Service Inspectorate confirming the possibility of receiving a deduction.

Applying for a mortgage interest deduction through your employer is not entirely convenient. Periodically, you need to request confirmation from the lender and again take a notification from the tax office.

Attention!

If you apply for a refund at the end of the year - for example, in September, the Federal Tax Service will refund the tax from the beginning of the year. 3-NDFL is not submitted when returning through the employer; an application is sufficient, which is considered within 30 days.

Through the Federal Tax Service

The tax refund procedure includes: collection and submission of documentation, inspection by the Federal Tax Service and transfer of funds. Each specific case has its own characteristics, and therefore it is advisable to clarify the exact requirements for filing a deduction.

Attention!

Copies of documents intended for submission to the tax service must be notarized.

You can submit documents in one of the following ways:

- Personally. If, when checking the certificates, the inspector reveals inconsistencies or shortages of any of the documents, you will know about it immediately on the spot.

- By post. Referring to paragraph 4 of Art. 80 of the Tax Code of the Russian Federation, documentation must be sent by valuable correspondence with an inventory of investments. The prepared documents are placed in an envelope (without sealing) and a postal inventory is drawn up in two copies. It lists all sent documents. The Federal Tax Service has 3 months to check the received documents, and another 1 month is provided for transferring the tax amount.

Important!

If the Federal Tax Service discovers an incomplete package of documents or errors in filling out, you will find out about this only after 2-3 months, when the desk audit is completed.

Documentation

To apply for a tax deduction for real estate purchased on credit, certain documents must be submitted to the tax office in accordance with your place of residence:

- Agreement with the company that issued the loan. It can be a banking institution or an employer company.

- Original certificate of interest paid for the year. The document is issued in the place where the loan was received.

- Identity document. It is allowed to present a passport or other equivalent document. A copy of the first page and registration will be required.

- Original certificate 2-NDFL. Issued by the employer's accounting department. If a person worked at different enterprises during the year, you need to request certificates from all places of work.

- The original application for a deduction in the established form. The document specifies the details for transferring funds from the budget.

- A certified copy of the share participation or purchase and sale agreement.

- Copies of documents confirming payment for the transaction.

- A copy of the transfer and acceptance certificate, if the property was purchased under an equity participation agreement.

- A copy of an extract from the Unified State Register of Real Estate, if the property was purchased under a sales contract.

- Original tax return 3-NDFL.

Some tax offices require proof of payment of principal and mortgage interest. You are not required to provide these certificates.

Attention!

In this case, act as you wish - prepare the required documentation or refer to the letter of the Federal Tax Service of the Russian Federation dated November 22, 2012. It states that to receive a property tax refund, a bank certificate is sufficient.

How many times can you use a refund?

The law does not limit a person in terms of the frequency of applications to the Federal Tax Service. If the mortgage was issued for a small amount and the amount of 390 thousand rubles was not used in full, the borrower retains the right to receive a tax deduction for interest on other mortgage loans.

There are no restrictions on how many years you can receive payments from the budget. However, a general limitation period of 3 years from the date the right arose applies. If 4 years have passed since the transaction and the taxpayer has applied to the Federal Tax Service, he will be able to return the mortgage tax for the last three years. The right to repayment of interest is valid for the entire repayment period of the mortgage loan with a frequency of once a year.

If compensation is organized through the employer, payments are received throughout the entire period agreed with the Federal Tax Service while working for a specific employer.

Registration of a tax deduction for % is a way to reduce the amount of debt to the bank and make monthly payments smaller, however, the legislation does not limit the borrower’s right to dispose of the amount received at his own discretion. You may need it to renovate your apartment or make another expensive purchase.

Obtaining a tax deduction when refinancing a loan

Refinancing a loan agreement with a third-party banking institution gives you the right to receive a deduction on interest on both the original and the existing loan.

To request a deduction for the interest on a loan received to refinance a mortgage transaction, the package of documents is supplemented with a copy of the current loan agreement.

Attention!

You can refinance a loan unlimitedly; this does not affect the right to return personal income tax on mortgage interest.

However, there are two limitations:

- the new agreement must contain information that it was concluded to refinance the previous mortgage loan;

- the loan must be refinanced in a bank licensed by the Central Bank.

The process of processing a personal income tax refund from mortgage interest through the Federal Tax Service:

- Registration of a personal account on the website nalog.ru. The service makes filling out easier since all limits, periods and balances are entered automatically.

- Preparation of documents. To receive a tax refund on interest, a certificate from the lender is required. The form from the online application will do.

- Filling out a declaration in your personal account.

- Attachment of documents - scans or photographs.

- Attachment of an application for a deduction with the obligatory indication of details for the transfer of funds.

- Waiting for the completion of the inspection by the Federal Tax Service.

Is it possible to return overpaid interest if repaid early?

According to research, more than half of mortgage loans are repaid twice as fast as the term stipulated in the contract. Turning to the current legislation, it becomes clear that the demand for the return of interest already paid is justified. According to regulations, payment is made only for the period of actual use of the service. Annuity payments involve payment of remuneration to the bank in advance for the entire period. Therefore, in case of early repayment of the mortgage, a refund of the paid interest is possible at the request of the client.

There are often situations when a clause prohibiting such an action is spelled out in the loan agreement. This is not justified by law; even in this case, you can contact the creditor with an application for a refund. If the credit institution does not comply with the meeting, the client should file a claim.

To ensure that the bank does not make a negative decision on the return, you should carefully study all the nuances of the process. Let's look at the procedure step by step using Sberbank as an example.

What is the relationship between the return on the purchase of a home and the interest on the mortgage?

Until 2014, it was possible to return tax on interest only on housing for which the principal debt was returned. If the principal repayment was not issued for the borrowed property, then interest payments were also denied.

Since 2014, property tax refunds for the purchase of housing and the amount of interest repaid are issued in two separate deductions. Now they can be consistent across different objects.

But subject to the following conditions:

- the right to receive a refund from interest arose after the expiration of 2014;

- the right exists, but was not declared later.

If the right to a refund arose before 2014, then when applying for a deduction in 2021, it is also associated with the main one.

A person independently determines the order in which deductions are processed. Most often, the first to apply is for the main refund issued upon purchasing the apartment, and then for the mortgage interest.

Attention!

If a consumer loan is concluded and a private house is built for its amount, it will not be possible to receive a deduction for mortgage interest due to the lack of a designated purpose specified in the agreement.

Features of refunds from the legal point of view

The legislative norm requiring the return of funds to the taxpayer who took out a mortgage loan is fixed in the provisions of Chapter. 23 of the Tax Code of the Russian Federation and a number of separate acts explaining the process of obtaining compensation from the state.

As established by law, a citizen who purchased real estate with the help of a mortgage loan has the right to apply to the Federal Tax Service to return the money from part of the funds paid in the form of income tax (i.e., in the amount of 13% of total income for the year). Mortgage repayment is limited by 2 parameters: the amount of interest paid and the tax deducted. To compensate for the cost of interest on a loan to purchase an apartment, you will need to contact the Federal Tax Service and agree on the possibility of payment by submitting documents and declarations.

The property deduction is drawn up in accordance with the provisions of Art. 220 of the Tax Code of the Russian Federation, allowing you to receive compensation from the budget when purchasing any type of housing - a house, an apartment, regardless of the source of financing. In addition to compensation for expenses related to the transaction itself, a citizen has the right to receive compensation for interest.

The borrower will be able to use the deduction for the first time after the end of the first reporting year in which the transaction was registered.

There is no need to immediately contact the Federal Tax Service. The law allows for filings over a subsequent three-year period. Sometimes it’s easier to apply for deductions for 3 periods at once in one application. The frequency of applications is regulated by the borrower himself.

An important limitation is that buyers of real estate located within the Russian Federation can reimburse the 13 percent tax, provided they purchase housing from third parties. Transactions with relatives are considered questionable and do not allow for deductions. There are other restrictions regarding the maximum amount and category of citizens who have the right to deduct.

How to apply?

Documentation for deduction is submitted in person through the Federal Tax Service or using the Sberbank service.

The application is convenient if a person does not want to learn all the intricacies and fill out the forms themselves.

Attention!

The service for filling out 3-NDFL and preparing documents is 1,499 rubles.

First, an online application is submitted, after which a tax consultant calls and informs about the necessary documents. You can use a scanner or smartphone camera to send images of certificates to the consultant. After receiving the documents, the consultant independently fills out the declaration and sends you the complete package, which you only have to submit to the Federal Tax Service. To use the service, you do not have to be a client of Sberbank.

How to calculate deductions and tax due on refund?

The refund reduces the tax base—the amount on which tax is withheld. The deduction amount can be up to 13% of the interest actually paid. For example, if you paid interest on a mortgage of 10 thousand rubles to the bank, the deduction will be 1,300 rubles.

At the same time, they will not be able to pay you more than the amount that was transferred in taxes. For example, you transferred 10 thousand rubles for 2021. – mortgage interest. 13% of this amount - 1,300 rubles. You will receive 1,300 rubles. in case the employer transferred (withheld from the salary) for 2021 1,300 rubles. Personal income tax. If in 2021 the budget received only 1,000 rubles from your salary. income tax, you will also receive 1,000 rubles back based on the results of 2021. 300 rub. will be carried over to next year.

Attention!

The mortgage interest deduction can be carried forward to subsequent years.

Maximum amount

The legislation of the Russian Federation provides for maximum limits on property deductions:

- to calculate the main deduction - 2 million rubles;

- to calculate the interest deduction - 3 million rubles.

This means that up to 260 thousand rubles. It is allowed to request up to 390 thousand rubles from your transfers in case of purchasing housing. - for repaid interest. That is, you can become the owner of an apartment for 5 or even 10 million rubles, but the Federal Tax Service will pay only 13% of 2 million rubles.

Attention!

The maximum deduction limit for real estate purchased before 2008 is RUB 1 million.

The total amount of the allowed deduction for housing and mortgage interest is RUB 650,000.

If the tax base is small, you can return the tax over several years until the amount is fully compensated.

The Annuity Payment Trap

With this method, the debt is paid in the same amount every month for the entire duration of the loan. The only exception is the last payment, which is a corrective payment. From the payment schedule, which is an integral part of the mortgage agreement, you can see how the amount contributed is distributed, how much goes to repay the principal debt, and how much goes towards payment for the use of money. From the same document it is clear that for the first few years, a large share of the monthly payment goes to paying interest, while the principal debt is reduced very slightly.

This is the main trap of this type of payment. Because the interest provided for the entire loan term is paid for the first few years. The lender receives payment for using the loan in advance. It is this feature of annuity payments that allows you to count on a return of overpaid interest if you repay your mortgage early.