According to Art. 80 of the Tax Code (TC) of the Russian Federation, a tax return is a document - a statement drawn up by the taxpayer in written or electronic form, recording the volumes and objects of taxation, income received and sources of their receipt, expenses, tax benefits, etc. This article states, that the declaration is drawn up by each taxpayer for each tax separately, after which it is subject to submission to the tax authorities at the place of residence (clause 2 of Article 229 of the Tax Code).

Additionally

According to clause 18.1 of Art. 217 of the Tax Code of the Russian Federation, some of the objects of taxation are vehicles received as a gift, shares, shares, interests and real estate. The actual market value of these objects, based on Chapter 23 of the Tax Code, is other income that an individual received by accepting a gift into his property (clause 10, paragraph 1, Article 208 of the Tax Code).

When receiving the specified donated items as a gift, the person who received them (the donee) is obliged to submit an income tax return to the tax authorities at the place of his residence within the time limits established by tax legislation, namely until April 30, which occurs after receiving the gift (clause 1 of Art. 229 NK).

To submit a declaration, the donee must, no later than the specified date, appear at the tax authorities, where he, in accordance with paragraph. 5 paragraph 3 art. 80 Tax Code will provide a free declaration form for filling it out. In addition, you can submit a tax return for a gift in electronic form by using the official website of the Federal Tax Service.

When filling out the declaration, the donee will need the following documents :

- passport;

- TIN;

- gift agreement;

- title documents for the subject of donation.

For your information

After completing and submitting the declaration, the tax authority calculates the amount of tax payable and notifies the taxpayer of this by mail.

Along with the notification of tax calculation, the donee receives a receipt , according to which he is obliged to pay personal income tax at any branch of any bank. The said notice also sets a deadline for paying the tax, after which violations will result in penalties .

Is a gift tax return required?

According to Art. 80 of the Tax Code of the Russian Federation, the declaration is a written or electronic application of the taxpayer. It reflects information about income received for calculating personal income tax.

The amount of personal income tax depends on the status of the payer:

- Resident - a citizen who has stayed in the Russian Federation for at least 183 days over the past 12 months;

- A non-resident is a person who has been in Russia for up to 183 days over the past year.

For residents, the rate is set at 13%, for non-residents – 30% (Article 224 of the Tax Code of the Russian Federation). Regardless of their location, military personnel performing military service abroad, as well as employees of state and municipal authorities residing in the territory of a foreign state are recognized as residents.

When making a gift, the declaration is submitted to the Federal Tax Service at the payer’s place of residence if he receives real estate, a vehicle, shares, shares or units as a gift.

When is it not necessary to provide a tax return for a gift?

Paying personal income tax and submitting a declaration is the responsibility of the donee: they receive income in the form of property. According to Art. 217 of the Tax Code of the Russian Federation, close relatives of donors are exempt from taxation: parents, children, full and half brothers and sisters, grandchildren, granddaughters. Even if they receive housing or a car through a free transaction, personal income tax is not paid.

Also, taxation does not apply when receiving money or a gift in kind under a gift agreement (hereinafter referred to as DD), regardless of the degree of relationship between the donor and the donee.

In the above cases, the declaration is not submitted and the tax is not paid. But if necessary, the document will be required if the Federal Tax Service suspects a citizen of intentional tax evasion. In addition to this, you will have to provide documents confirming your relationship with the donor. Such cases are extremely rare.

Determining the value of property received under a donation transaction

As you know, the value of the property received by the donee as a gift is of particular importance when calculating the amount subject to income tax, since it is his actual income - economic benefit. At the same time, based on the Information Letter of the Ministry of Finance of the Russian Federation, No. 03-04-05/3074 dated January 28, 2015, it is the market value (Article 7 of the Federal Law No. 135) of the subject of donation that is subject to determination for income tax purposes (Chapter 23 of the Tax Code), on the date of conclusion of the agreement under which this item was alienated.

Determination of the market value of the subject of donation is based on the market value of similar property benefits existing on the date of donation. Determining the specific size of the market value of a specific item of donation for the purpose of using this value for taxation can only be carried out by an authorized appraiser , acting on the basis of Federal Law No. 135 of July 29, 1998.

For your information

According to Art. 11 Federal Law No. 135, the final document containing the specific market value on the day of donation, determined in the order of assessment by the appraiser, will be a report drawn up in written or electronic form . It is from the value determined by the specified report that the donee should determine the amount of income tax to be paid.

At the same time, if the subject of the donation is a real estate object, for tax purposes the cadastral value of this object specified in the agreement can be used, but only if it corresponds to the market value (Letter of the Ministry of Finance No. 03-04-05/21903). If the tax authority discovers a discrepancy between this value and the market value by more than 20% , it will assess additional tax and impose a penalty, which will be completely legal, based on the Determination of the Armed Forces of the Russian Federation No. 34-KG14-3.

Example

Citizen Lopukhov, according to a gift agreement concluded between him and citizen Akhmetov, received an apartment in a multi-storey building free of charge. Due to the fact that there were no family ties between him and the donor, Lopukhov was obliged to pay income tax to the state treasury, amounting to 13% of the cost of the housing he received. When filling out a tax return, the donee used the cadastral value of the specified property as a tax base - 1.5 million rubles, which was indicated in the certificate from the BTI and in the gift agreement concluded by the parties. Accordingly, 195 thousand rubles were subject to payment as personal income tax. Some time after submitting the declaration, Lopukhov received by mail a receipt for personal income tax payment, which he paid at the nearest bank branch. After some time, Lopukhov received a notice of a desk tax audit carried out against him. This audit identified some discrepancies in the amount of income he received in kind and in the amount subject to taxation. Thus, according to tax inspectorate employees, Lopukhov was obliged to calculate the amount of income tax based on the market, and not the cadastral value of the property received as a gift, which at the time of the donation was 2 million rubles. Lopukhov’s incorrect application of legislative norms, according to tax authorities, led to an understatement of the tax base by more than 20%, as a result of which they intend to recover from citizen Lopukhov the under-withheld amounts of income tax.

At the court hearing, a representative of the tax authority argued that, according to Art. 41 of the Tax Code, the specified property received by Lopukhov as a gift is his income in kind, which is an economic benefit. Such economic benefit is subject to taxation based on its market value, not its cadastral value. Such conclusions are based on the fact that the cadastral value does not indicate a real assessment of the value of the property based on the fact that it does not take into account all the characteristics required to determine it: the cost of other real estate, the demand for such objects in a particular region and other significant circumstances that determine real economic benefit received by Lopukhov at the time of donation.

Moreover, as evidence, a representative of the tax authorities presented to the court a report on the assessment of the said apartment, carried out by appraiser K. at the request of the tax authorities. According to it, the market value of the apartment at the time of donation was 2 million rubles, which proved that the tax base was underestimated by 25%, due to which the amount of tax paid should have been 260 thousand rubles, and the budget did not receive 65 thousand rubles.

After listening to the arguments of the representative of the tax authority, the court satisfied his demands and ordered the donee Lopukhov to pay additional amounts of personal income tax that were not withheld, and also ordered him to pay a penalty and a fine.

How to determine the value of a gift to fill out a declaration and calculate taxes?

Form 3-NDFL indicates the value of the donated object, it depends on the type of gift:

- Housing, commercial real estate, land, garage, other real estate. The cadastral value is used for calculation;

- Vehicle. If a price is indicated in the deed of gift, the contractual value is used. If not available, the tax is calculated based on the market price;

- Share in LLC. The actual value at the time of the transaction is applied.

Important! The payer calculates personal income tax independently and indicates all amounts in the declaration. If the tax office has questions, clarification may be required.

Do I have to pay gift taxes? Who is exempt from personal income tax?

How to draw up a gift agreement for a stranger?

List of additional papers

In addition to your tax return, bring the appropriate paperwork.

- Be sure to make a photocopy of your passport.

- Also, you must provide the gift agreement that was drawn up between you.

- If we are talking about a legal representative, then a power of attorney must be attached.

- It is also necessary to provide such papers as the received certificate of ownership of the donee.

Additionally, the tax authority may require other documents, as additional questions may arise.

Procedure for filing a tax return for a gift

The declaration is submitted during a personal visit to the Federal Tax Service, by registered mail with acknowledgment of receipt, through the MFC or personal account on the tax authority’s website, through “State Services” if you have a confirmed account.

The step-by-step order looks like this:

- Collecting documents and submitting a declaration to the Federal Tax Service.

- Conducting a desk audit by employees of the Federal Tax Service. The maximum period is 3 months.

- Sending a tax notice and payment document to the payer.

Payment of personal income tax according to the details of the payment document is made within the established time frame.

Legal advice: if you plan to submit a declaration in person to the MFC or the Federal Tax Service, it is better to make an appointment in advance through the website. This will avoid long waits in line.

Form and content of tax return 3-NDFL for donation

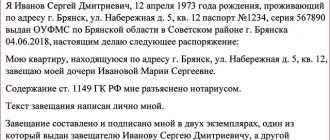

Form 3-NDFL was approved by Order of the Federal Tax Service of Russia dated October 3, 2018 No. ММВ-7-11/ [email protected] The payer fills it out independently; information will be required:

- Full name, date of birth, registration address, passport details of the citizen;

- Taxpayer status code;

- Phone number;

- Number of sheets;

- KBK, OKTMO, amount of tax payable;

- The total amount of income received as a gift;

- Amount of tax to be paid;

- TIN;

- Cadastral value of real estate.

All sheets are signed with a transcript.

Tax return (3-NDFL) for donation:

General rules for filling out the declaration

When registering 3-NDFL, you must adhere to general recommendations, otherwise the Federal Tax Service may refuse to accept the document:

- Corrections and errors are not allowed.

- If the declaration is stapled, the barcodes must not be deformed.

- Rubles are used to calculate income.

- The fields are filled in from left to right.

- If there are free cells left when filling out the OKTMO code, they are filled in with dashes.

- At the bottom of each page, the completeness and accuracy of the information is confirmed by the taxpayer’s signature with a transcript.

- Information in the document is entered in capital letters and in legible handwriting.

Legal advice: if possible, it is better to use the “Declarations” program to fill out form 3-NDFL. It can be downloaded from the official website of the tax service. This will significantly simplify the registration procedure.

Tax return filing deadlines

The declaration is submitted to the Federal Tax Service by April 30 of the year following the date of registration of the deed of gift. After reconciliation, the tax is paid by July 15. If the specified dates fall on weekends or holidays, the deadline will be moved to the next weekday.

Documentation

Along with the declaration, a passport and a gift agreement are provided to the Federal Tax Service. No other documents are required.

When do you need to file a 3-NDFL declaration in 2021?

To pay income tax on gifted real estate to the new owner, simply provide the appropriate declaration (3-NDFL). However, he needs to do this no later than April 30 of the year following the year of the transaction. For example, if a citizen took ownership in February 2021, then he must submit a tax return by April 40, 2021.

We remind our readers once again that when registering a gift the subject of which is a house, apartment or other real estate - the donee becomes the owner not at the time of signing the gift agreement, but after the state registration established by the legislator with the bodies of Rosreestr. Thus, the calculation of the tax period begins from the moment the donated property passes into the ownership of the donee, after he receives an extract from the Unified State Register of Real Estate.

Example from a lawyer

The donor completed the transfer of the house on December 13, 2021, after which the parties to the transaction went to the registration authority to transfer the package of necessary documents for re-registration of ownership. At the same time, the registration process was completed only by mid-January of the following year. According to the current tax legislation of the Russian Federation, a new home owner must file a 3-NDFL declaration in 2021.

Responsibility for late submission of a tax return

According to Art.

119 of the Tax Code of the Russian Federation, if the deadline for submitting the declaration is violated, the payer is held accountable. He is charged a fine of 5% of the unpaid amount for each month of delay. The minimum fine is 1,000 rubles, the maximum is 30% of funds not transferred to the budget. Case study:

The citizen received an apartment as a donation, the cadastral value is 2,000,000 rubles. The amount of personal income tax payable is 260,000 rubles. at a rate of 13%. He was 1 month late in paying his taxes, for which he was held accountable and ordered to pay a fine of 5%. The total amount was 13,000 rubles.

Due to missing the deadline, instead of 260,000 rubles. he had to pay 273,000 rubles.

Important! For failure to provide a document, there is also administrative liability under Art. 15.5 Code of Administrative Offenses of the Russian Federation. Sanctions include a warning or a fine of up to 500 rubles.

What are the consequences of late declaration or non-payment of tax?

Many citizens neglect the rules to pay taxes. They believe that if they violate the requirements of the law, they will save their money. But this is far from true.

In a situation, if you neglect the requirements of the law, it is likely that you will not find yourself in the most pleasant situation.

Namely, be prepared for the fact that the tax authority may take you to court.

The court will most likely take the side of the tax authority if you do not have compelling reasons for non-payment. This means that you will be forced to pay the amount.

So, you will need to either pay the amount of tax, and if penalties were accrued, then they too, or the collection will be applied to your property. Agree, this is unpleasant, so try to avoid such situations.

All in your hands. Do not delay payment, because a three-month period is a very realistic period for paying the cost of the donation transaction.

Lawyer's answers to frequently asked questions

Is it possible to submit 3-NDFL through another person if it is not possible to do it yourself or via the Internet?

Yes. You need to draw up a power of attorney, it is provided along with the declaration. Information about it is indicated in the document itself.

Who files a declaration and pays tax when making a gift from a legal entity to an employee?

Employer. Gifts with a total value of up to 4,000 rubles. per year are not subject to tax.

Is there a tax deduction for gifts?

No, the donor does not receive income or pay taxes, and the recipient does not spend the money.

I was given a share in the apartment, the contract was certified by a notary. Will the Federal Tax Service find out about the transaction if I do not file a declaration?

Yes, he will. Information to the Federal Tax Service on all certified transactions with citizens' property is transmitted by notaries.

How to determine the market value of a car for tax purposes?

You need to indicate it in the deed of gift, based on the average prices for a car in the region, or order an independent assessment.

The donor never pays tax

There are situations when the tax authority sends a letter to the donor, demanding that he declare income and pay tax. When receiving such a letter, there is no need to worry - the tax authority sometimes receives only data on the alienation of property, assuming that a sale has been made and you have received income. You can ignore the letter from the tax service or write an explanatory note and attach a copy of the gift agreement to it.

In the future in this article we will only consider situations where you received property or money as a gift.

Where to find the names of income type codes

The codes for types of income given in Appendices 1 and 2 to Section 2 are fundamentally different. For Appendix 1, they are listed in Appendix No. 3 to the Procedure for filling out 3-NDFL, contained in the Federal Tax Service order No. ED-7-11/ [email protected] , which also approved the declaration form. And for Appendix 2, these codes are given in Appendix No. 4 to the Filling Out Procedure.

The codes related to Appendix 1 are divided into 10 types and numbered from 01 to 10. Among them, income arising from:

- when selling real estate or shares in it and determined as the sale price - code 01;

- when selling real estate or shares in it and determined as the cadastral value multiplied by 0.7 - code 02;

- sale of other (other than real estate) property - code 03;

- transactions with securities - code 04;

- rental of property - code 05;

- donation of money or property - code 06;

- payment for labor (under an employment or civil contract), the tax on which is withheld by the tax agent - code 07;

- payment for labor (under an employment or GPC contract), the tax from which the tax agent could not withhold (including partially) - code 08;

- payment of dividends - code 09;

- other operations - code 10.

For Appendix 2, codes 21 to 32 are provided:

- CFC profit - code 21;

- dividends - code 22;

- interest - code 23;

- royalty - code 24;

- income from the alienation of property - code 25;

- income from the alienation of shares and similar rights, more than 50% of the value of which is represented by real estate located in another state - code 26;

- income from the provision of independent personal services - code 27;

- income from employment - code 28;

- directors' fees and other similar payments received as a member of the board of directors or any other governing body of the company - code 29;

- income from personal activities as a theater, film, radio or television artist, musician or athlete - code 30;

- income from public service - code 31;

- other income - code 32.

Reflection in the program

In order to reflect the issuance of a gift to employees in the program, you must first set the flag “Gifts and prizes are given to employees of the enterprise” in the “Payroll Settings” (“Settings” - “Payroll Calculation”).

After this, you will have access to the document “Prize, gift” in the “Salary” section. It is this document that registers the issuance of non-monetary gifts to employees for the purpose of calculating tax and insurance contributions from their value.

The required details in the document are:

- month in which the gift is issued;

- the organization on whose behalf the gift will be given;

- the “Gift” switch is set by default, but you can also select the second option “Prize, winning in a competition”;

- the date of issue is the date of actual receipt of income in the form of the value of the gift;

- in the “Contributions” section, set the “Gift (prize) provided for by the collective agreement” flag if it is necessary to calculate insurance premiums from the cost of the gift. In this case, the income is recorded as income entirely subject to insurance premiums. In this case, insurance premiums are calculated using the document “Accrual of salaries and contributions” (section “Salary” - “Accrual of salaries and contributions”).

- in the tabular part of the document, filling is done using the “Add” button or using the “Selecting a list of employees” button (fill in the employee, the amount of income, deduction codes. If the value of the gift is more than 4,000 rubles, the deduction amount and the tax amount).

- In the “Promotion motive” field, you can indicate the reason for issuing the gift.

After recording and posting this document, you can print order No. 11-T.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

How to prepare a declaration

The declaration form changes every year, so when filling it out you need to make sure that it is up to date .

Basically, the procedure for filling out the declaration is as follows:

- All codes are indicated on the initial page (their meaning can be found in specialized code directories or in the Federal Tax Service department).

- All personal information of the taxpayer is indicated.

- Section 1 provides information about the amount of tax and the source of income received.

- In section 2, the tax is calculated - the data of the gift agreement is indicated.

- Sheets E and D display the information that must be filled in when receiving a tax deduction (it is not available for donations).

- The last section contains information about all calculated amounts.

2021 Tax Return Form