Spouses and children will be held accountable for bringing debtors to bankruptcy

In cassation appeals filed with the Judicial Collegium for Economic Disputes of the Supreme Court, the applicants demand that not only the controlling persons of the debtor companies, but also those to whom their property was transferred be brought to subsidiary liability for bringing them to bankruptcy. In particular, spouses and children. Meetings of the Collegium for Economic Disputes on these cases are scheduled for December 9 and 16, respectively.

A subsidiary of Rosneft appealed to the judicial panel for economic disputes after the court of first instance decided that the heirs should not compensate for losses through subsidiary liability. The appellate and district courts agreed with this conclusion, indicating that subsidiary liability to creditors for leading to bankruptcy is additional and cannot be applied in the case at hand.

The Federal Tax Service of Russia motivated its claims against the businessman’s wife and sons by the fact that at the end of 2021, at the end of 2021, he freely transferred to them expensive property belonging to him under a gift agreement. We are talking about eight real estate properties and two cars that were purchased using the withdrawn assets. According to tax authorities, these persons must pay compensation in the amount of the value of the donated property.

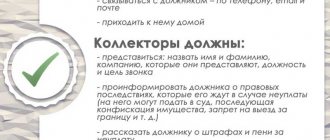

Make a newsletter on social networks, stick notices on the door, hang up a photo of the debtor

Collectors do not have the right to such actions. Only investigative authorities can openly search for people on the basis of a crime committed. Also, collectors do not have the right to write to the borrower’s friends about his debts on social networks, distribute leaflets with personal information, post advertisements, etc. Thus they violate Art. 137 of the Criminal Code of the Russian Federation “Violation of privacy”. For such actions, punishment is provided either in the form of a fine of up to 300 thousand rubles, or in the form of imprisonment for a term of up to 5 years.

According to Art. 152.1 of the Civil Code of the Russian Federation, you can intentionally use a photo of an individual only with his consent.

It will become impossible to avoid liability for bankrupt debts

Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy)” allows the transactions of bankrupts to be invalidated. For example, in case of unequal counter-fulfillment of an obligation by the other party to a transaction or preference given to an individual creditor or other person when completing it. However, in this case we are talking about inheritance and donation of property to relatives of the debtors’ leaders.

Attempts to collect debts from relatives of debtors are made regularly. They can be brought to subsidiary liability if they are recognized as controlling persons of a bankrupt organization. But kinship alone is not enough. It is not yet clear what the Supreme Court's position will be. If the complaints are satisfied, then it will be impossible for children and spouses to avoid liability for the debts of the debtor companies.

Let us recall that quite recently the Constitutional Court allowed the seizure of state property from persons familiar with officials and members of their families specified in the legislation on control over the expenses of civil servants. As the court explained, confiscation of property is possible if a person cannot prove the legality of its acquisition. In fact, this makes it possible to confiscate it from any citizen.

How to repay a debt if there is no receipt

If you borrowed money and didn’t think about a receipt, it will be difficult to repay the debt. But you can try two options for legal recovery:

- Contacting the police. Collect evidence: a bank statement about the transfer of money to the debtor, screenshots or photos of correspondence with the borrower. With all this, go to the police. Write a statement, employees are required to conduct an inspection. The borrower will be called to give explanations. As practice shows, the case is not initiated. If the debtor admits guilt, you can use this fact when going to court.

- File a lawsuit. First, write a letter to the debtor demanding a refund and threatening legal action. Perhaps he will get scared and try to negotiate with you. The problem with going to court in the absence of a receipt is that you need proof of the transaction. If the debt is less than fifty thousand, contact the magistrate at the borrower’s registered address. The main thing is to collect documented evidence. The outcome of the case depends on them.

They plan to radically expand the practice of property confiscation

The State Duma has decided not to stand aside and is preparing a bill that will allow the seizure of illegally obtained funds, similar to the explanation of the Constitutional Court. In particular, it is proposed to confiscate property from relatives of drug dealers if it is of illegal origin. In other words, if they prove the legality of the acquisition of property, it will be confiscated to the state.

For 2021, the budget included revenues of 76.7 billion rubles from fines, sanctions and compensation for damage to the state. Amendments made to the budget in November of this year increased the plan for collecting penalties from persons guilty of committing crimes, due to an increase in the number of court decisions on the collection of fines in criminal cases and damages to 709.4 million rubles.

Taking this into account, it can be argued that the authorities are preparing to radically expand the practice of confiscating property from persons suspected of committing crimes. At the same time, law enforcement officers will be able to seize property for the state’s benefit not only from direct offenders, but also from their close relatives. But will the legality be observed in this case?..

If you need a qualified and experienced lawyer in cases of bringing to vicarious liability, contact the Kirpikov and Partners center.

Coming home (entering the apartment)

Collectors have the right to arrange personal meetings with the borrower. They can take place on neutral territory or at the office of a collection agency. Of course, they can, on their own initiative, “visit” the borrower at his home address, but whether or not to let them into the apartment is a personal decision of the debtor. If he does not want to talk to them, he has the right not to open the door for them.

If the collectors begin to behave aggressively (ringing the doorbell, shouting at the entire entrance), then the debtor has the right to call the police. The law on the inviolability of the home is the same for everyone, including debt collectors. Only bailiffs who have the right to seize property have the right to enter his apartment without the owner’s permission.

How does the bank's collection department violate your rights?

In this article I would like to highlight the topic of disputes with banks, namely, what is associated with collection agencies and the collection department.

Often

, in attempts to return money, banks resort to a wide variety of methods, including intimidation with courts, sanctions, seizure of property, criminal liability, calling home, work, relatives. Basically, the person gets scared and pays off the loan by getting into even greater debt.

Of course, sometimes it happens the other way around: a person tries to ignore all these calls and threats, sends creditors to all 4 sides and stops paying altogether. But most people do not even suspect that the bank is violating the laws by these actions.

Similar actions are described in Article 26 of the Federal Law:

“On banks and banking activities”: A credit organization, the Bank of Russia, an organization performing the functions of compulsory deposit insurance, guarantee the secrecy of transactions, accounts and deposits of their clients and correspondents. All employees of a credit institution are required to keep secret transactions, accounts and deposits of its clients and correspondents, as well as other information established by the credit institution, unless this contradicts federal law.

There are a number of cases

in which personal information is transferred to third parties, but non-payment of the loan is not included in them. More details in Article 857 of the Civil Code of the Russian Federation:

1. The bank guarantees the secrecy of the bank account and bank deposit, account transactions and client information.

2. Information constituting bank secrecy can only be provided to the clients themselves or their representatives, and also submitted to the credit history bureau on the grounds and in the manner prescribed by law. Such information may be provided to government bodies and their officials only in cases and in the manner prescribed by law. 3. If the bank discloses information constituting a bank secret, the client whose rights have been violated has the right to demand compensation from the bank for the losses caused.

The bank employee who notified relatives and friends about the late payment may well be brought to criminal or civil liability:

-Ch.

2 tbsp. 183 of the Criminal Code of the Russian Federation: Illegal disclosure or use of information constituting commercial, tax or banking secrets, without the consent of their owner, by a person to whom it was entrusted or became known through service or work. — Part 2 tbsp.

137 of the Criminal Code of the Russian Federation: Illegal collection or dissemination of information about the private life of a person, constituting his personal or family secret, without his consent, using his official position. According to these articles

Under the Criminal Code of the Russian Federation, punishment can be either a fine or imprisonment. Usually a small fine and additional charges are imposed. punishment in the form of a ban on work in certain positions for a period of 2-3 years.

Art. 15 Law of the Russian Federation:

“On the protection of consumer rights”: Moral damage caused to the consumer as a result of violation by the manufacturer (performer, seller, authorized organization or authorized individual entrepreneur, importer) of consumer rights provided for by the laws and legal acts of the Russian Federation governing relations in the field of consumer rights protection is subject to compensation the causer of harm in the presence of his guilt. The amount of compensation for moral damage is determined by the court and does not depend on the amount of compensation for property damage.

According to Article 15 of the Law of the Russian Federation, a bank employee deliberately disseminates confidential information to relatives in order to thus put pressure on the defaulter. Of course, this causes moral suffering and all that is needed is to document it. Below is an example of one of the applicants:

One day my parents received a call from the bank and said that I was in debt on the loan and soon all my and their property would be seized. Such actions made my mother feel ill, and my father’s blood pressure rose. I was very worried about them and felt strong moral suffering. Relatives began to avoid meeting with me, and problems began in the family, I felt guilty.

In no case

there is no need to agree to offers from bank employees to come to a certain address, talk and sign some papers.

All communication with employees must take place only within the walls of the bank itself and be documented. Also, the bank is obliged to send all proposals in writing, but not via telephone or personal conversation.

Intimidation by suing the borrower, arrest and confiscation of property, distribution of personal information to friends, relatives, colleagues, bosses, as well as their favorite “it will be worse for you” - all this is a reason to write a statement to the police and bring such an employee to criminal responsibility under Part 1 of Article 163 of the Criminal Code of the Russian Federation:

Extortion, that is, the demand for the transfer of someone else’s property or the right to property or the commission of other actions of a property nature under the threat of violence or destruction or damage to someone else’s property, as well as under the threat of dissemination of information disgracing the victim or his relatives, or other information that could cause significant harm harm to the rights or legitimate interests of the victim or his relatives.

Protect loved ones

from calling with an offer to put pressure, persuade to pay, etc. This is possible by writing an application to the main branch of the bank and the prosecutor's office. You have every right to do this because by such actions the bank violates the Law “On Personal Data”. You can submit an application either in writing or electronically by sending an email. The type of document (written or electronic) does not matter because Our Government considers all requests.

Data and addresses of the main regulatory authorities: • Central Bank of the Russian Federation (Bank of Russia) 115035, Moscow, st. Balchug, 2 tel. 950-21-28 (Carries out direct supervision over the banking activities of credit institutions) you can write any complaints here, they answer clearly with instructions, even if the complaint is not directly related to violations of banking legislation. Link to the Internet reception of the Central Bank • To the Prosecutor General of the Russian Federation, complaints and written requests are accepted by mail at the address: GSP-3 125993 Moscow, st. Bolshaya Dmitrovka, 15a. Internet reception of the General Prosecutor's Office • Federal Service for Supervision of Consumer Rights Protection and Human Welfare, 127994, Moscow, Vadkovsky Lane, building 18, buildings 5 and 7 Internet reception • Roskomnadzor, 109074, Moscow, Kitaigorodsky proezd, 7, building 2 Internet reception

From my side

, within the framework of the law, the bank can do the following:

- send an application to the borrower with a request to pay the debt or repay the entire loan amount with interest. Threats and other methods of pressure are unacceptable. At most, a warning about collecting the debt amount through the court.

- if the borrower does not respond to the bank’s written application, the bank has the right to submit an application for a court order to the court. The application is considered without the participation of the parties, but the court order is necessarily sent to the borrower by mail. The most important thing is to file a timely application to challenge the court order. In this case, the case will be considered according to the same rules as a regular lawsuit: both sides of the dispute will be called, arguments will be heard, evidence will be examined and a decision will be made. If a verdict is rendered in favor of the court, the borrower has 1 month to file an appeal. If it is not received within a month, the court sends the decision and writ of execution to the bank, and the bank to the bailiffs. They begin enforcement proceedings and provide the opportunity to voluntarily repay the debt. If the debt is not repaid, bailiffs come to the address of residence or registration and seize the property because have every right to do so. An interesting point is that they can only seize the borrower’s property. So if you take care in time to transfer all the property to your parents or close relatives, the bailiffs will be forced to leave with nothing.

- the bank has the right to “sell” the debt to a third party. In this case, the new claimant can start the whole process from the very beginning. However, the borrower must be notified in writing of the transfer of debt. Usually they “sell” the debt to collection agencies, whose methods are rarely legal. The police and prosecutor's office will help in disputes with debt collectors. You should not enter into debates with such agencies; it is better to simply warn that you will write a statement of extortion to the prosecutor’s office, this will cool their ardor.

We hope

that this article helped you understand the issue of the legality of the actions of the bank and its employees. Despite the fact that the borrower violates the contract by failing to pay the loan debt, he has the right to demand that the bank act within the law and respect its rights. Intimidation and threats towards the borrower's family and relatives is the point beyond which responsibility falls on debt collectors.

If you have any questions

or need advice, you can always call

8-800-700-14-42

or ask a lawyer a question here.

03/10/2015