Renting out an apartment brings its owner income, which is subject to taxation. The amount of tax depends on which system the owner has chosen to calculate it. In any case, it is important to report to the tax authority on time, calculate and pay tax on the income received from renting an apartment, so as not to be punished with a fine.

The landlord calculates tax only when he rents out an apartment to an individual. If the premises are rented to a legal entity, individual entrepreneur, notary, lawyer, then the obligation to pay tax arises on their part.

What is the tax on renting out an apartment in 2021?

Income received by citizens of the Russian Federation is taxed. Any amount is the basis for the mandatory calculation of amounts for payment to the budget. In general, a rate of 13% is applied. But depending on the tax system that the tenant chooses for himself, other rates may be used.

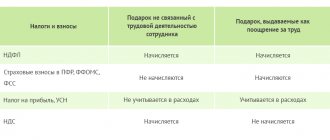

Each system has its own characteristics, requirements for the payer and the percentage of tax on the amount received from rental:

- Personal income tax . The most common tax regime, according to which a citizen calculates and pays income tax in the amount of 13%. The basis is the apartment rental agreement and the tax return submitted at the end of the year;

- patent tax system . The tax rate is 6% of estimated annual income. The landlord will need to register with the tax authority as an individual entrepreneur and acquire a patent. Patent term from 6 months to 1 year;

- simplified taxation system . The tax rate is 6% of the actual rental income. The simplified tax system applies only to individual entrepreneurs. The payer’s responsibility is to calculate and make advance tax payments;

- tax on professional income . The new tax regime for Russians allows them to pay only 4% of income for individuals, for individual entrepreneurs it is 6%. You must register as a self-employed person.

Example. A citizen of the Russian Federation, as a lessor, entered into a lease agreement. The amount of income received from this type of activity is 180 thousand rubles per year. Let's look at the tax amount for each tax system:

- Personal income tax at a rate of 13% - 23.4 thousand rubles;

- STS at a rate of 6% - 10.8 thousand rubles (the landlord registered as an individual entrepreneur) + mandatory contributions for himself;

- tax on professional income at a rate of 4% - 7.2 thousand rubles (as an individual).

Personal income tax payers

A taxpayer is a person who, in accordance with the Tax Code of the Russian Federation, is charged with the obligation to pay a particular tax ( Article 19 of the Tax Code of the Russian Federation

).

Taxpayers of personal income tax

are individuals who are tax residents of the Russian Federation, as well as individuals who receive income from sources in the Russian Federation who are not tax residents of the Russian Federation (Clause

1 of Article 207 of the Tax Code of the Russian Federation

).

Tax residents

are individuals who are actually in the Russian Federation for at least 183 calendar days over the next 12 consecutive months (

Clause 2 of Article 207 of the Tax Code of the Russian Federation

).

That is, in order to become a personal income tax payer , you do not need to take any additional actions, for example, register with any authorities or obtain various permits.

How can I pay tax?

The recipient of the income independently reports, calculates and pays tax. Based on the results of the past year, in which rental payments were received, a declaration is drawn up and submitted to the tax authority before April 30 of the next calendar year (until April 30, 2021 for income received in 2021). The deadline for paying the tax is determined by clause 4 of Art. 228 Tax Code - no later than July 15.

Payment is made in one of the convenient ways:

- by payment order at any banking institution (the order specifies all the necessary payment details);

- on the Federal Tax Service website in the payer’s personal account.

The tax base

The tax base is the cost or physical characteristics of taxation ( clause 1 of Article 53 of the Tax Code of the Russian Federation

).

For income received from rental property

, the tax base is defined as the monetary value of income reduced by the amount of tax deductions:

- standard ( Article 218 of the Tax Code of the Russian Federation

); - social ( Article 219 of the Tax Code of the Russian Federation

); - property ( Article 220 of the Tax Code of the Russian Federation

).

The possibility of obtaining tax deductions is one of the advantages in favor of paying personal income tax rather than tax under the simplified tax system. When applying the simplified tax system, an individual entrepreneur loses the right to receive personal income tax deductions, because is exempt from paying this tax.

The list of tax deductions is too long to list them all in this article, so we will dwell in more detail only on those that residents of large cities have recently most often applied for.

Tax deduction for tuition fees

In accordance with paragraph 2, paragraph 1 of Art. 219 Tax Code of the Russian Federation

When determining the tax base, the taxpayer has the right to receive a social tax deduction in the amount paid:

- for their studies in educational institutions;

- for full-time education of their children under 24 years of age in educational institutions.

To receive this tax deduction there are the following conditions and restrictions:

- An educational institution must have an appropriate license or other document confirming the status of an educational institution.

- The taxpayer must provide documents confirming the actual expenses for training (agreement, payment receipts).

- This deduction does not apply if tuition is paid for using maternity capital funds.

- When paying for a child’s education, a deduction is provided in the amount of actual expenses incurred for this education, but not more than 50,000 rubles for each child in the total amount for both parents; (that is, you can actually get 50,000*13%=6,500, 13% is the personal income tax rate).

- When paying for your education, a deduction is provided in the amount of expenses actually incurred, but in total, all tax deductions in the tax period cannot amount to more than 120,000 rubles in the tax period (that is, you can actually get 120,000 * 13% = 15,600, 13% is the personal income tax rate) .

When receiving a social tax deduction for paying for a child’s education, you should also pay attention to the following nuance. Often, payment receipts indicate a child as the payer, and only the taxpayer, that is, the parent, has the right to a tax deduction. In this case, a power of attorney should be issued to confirm that the child paid for education on behalf of his parent.

Tax deduction for the purchase of housing

In accordance with paragraph 2, paragraph 1 of Art. 220 Tax Code of the Russian Federation

When determining the tax base, the taxpayer has the right to receive a property tax deduction in the amount of expenses actually incurred for:

- new construction or acquisition on the territory of the Russian Federation of a residential building, apartment, room or share in them;

- repayment of interest on targeted loans spent on new construction or the acquisition of a residential building, apartment, room or share in them.

The total amount of this deduction cannot exceed 2 million rubles without amounts used to pay off interest (that is, in fact, you can get 2.0000.000 * 13% = 260.000, 13% is the personal income tax rate, calculation excluding interest).

Please note that this tax deduction can be provided to the taxpayer only once

.

To receive a tax deduction for the purchase of housing, you will need to provide the following documents to the tax authority:

- a written application for a deduction;

- apartment purchase agreement;

- apartment acceptance certificate;

- other documents confirming ownership;

- payment documents confirming the fact of payment;

- tax return.

This deduction does not apply if expenses for purchasing housing are paid using maternity capital funds.

Tax deduction for home sales

When selling real estate, you receive income that is subject to personal income tax. But in accordance with paragraph 1 of paragraph 1 of Art. 220 Tax Code of the Russian Federation

, the taxpayer has the right to receive a property tax deduction in amounts received from the sale of residential houses, apartments, rooms owned for less than 3 years. The amount of this deduction does not exceed 1 million rubles.

That is, when calculating tax, you can subtract 1 million from the amount you received from the transaction and pay tax on the remaining amount. If the deduction is greater than or equal to the amount of income, then there is no need to pay tax.

We remind you that income received from the sale of property that was owned by the taxpayer for 3 years or more is not subject to personal income tax ( clause 17.1 of Article 217 of the Tax Code of the Russian Federation

).

Assistance in preparing tax deductions

What are the consequences of not paying taxes on renting an apartment?

The Tax Code provides for measures of influence on citizens who evade timely payment of tax payments to the budget:

- the declaration is not submitted or submitted late - 5% of the lost tax for each month of delay (the minimum fine is 1,000 rubles, the maximum is 30%);

- the amount of tax was not paid on time - 20% of the arrears or 40%, provided that the intent to evade is proven;

- For each day of debt, penalties are charged - 1/300 of the Central Bank rate.

Collection of uncollected amounts of tax, as well as penalties, must be carried out voluntarily (at the request of the tax authority) or compulsory when the case is brought to court.

How to rent an apartment without intermediaries for a long time from the owner?

How can the tax office find out about the rental of an apartment?

The Federal Tax Service, using its powers, can establish the fact of renting out an apartment in the following way. In response to a message from neighbors, a local police officer or a management company:

- the number of residential premises of the owner is determined by requesting information from Rosreestr databases;

- the number of registered citizens in apartments is specified (permanently and temporarily);

- the use of housing for personal purposes and apartments that can be rented are clarified;

- statements of movement on the citizen’s accounts are requested from the bank to clarify regularly received payments.

Based on such an investigation, tax officials have the right to carry out an on-site inspection at the owner’s addresses.

Summary

As you can see, calculating personal income tax when renting out an apartment is not particularly difficult. Especially when you compare it with taxes paid by legal entities and individual entrepreneurs from various types of activities.

To calculate personal income tax, you do not need to maintain specialized records; you just need to have documents confirming receipt of payment.

If we compare personal income tax and simplified taxation system (6%), then each of these tax regimes has both its pros and cons. Of course, a 6% rate is less than 13%. But only individual entrepreneurs can apply the simplified tax system of 6%, which means it is necessary to register as an individual entrepreneur. Then you will need to keep a book of income and expenses and pay insurance premiums “for yourself.” In addition, an individual entrepreneur does not have the right to deductions for personal income tax (since he does not pay this tax).

When deciding on choosing a tax regime, we recommend that you analyze the features of the simplified tax system 6% and personal income tax 13% from the point of view of your specific business conditions. Have questions? – ask them to the portal’s lawyer

The “Correct Rent” project is ready to provide a full range of services for owners of apartments (houses) renting out real estate:

- Absolutely free

- Buy rental and rental agreements for all occasions and additional items. agreements with comments from our lawyers in the agreements store (from 100 rubles)

- Is your case “more complex” and the standard contract template does not suit you? – our lawyer will draw up a lease agreement for you, tailored to all your needs.

- We will also advise you, help you apply for a tax deduction, decide on the form of taxation and much more. Our services for landlords and tenants

Do I need to pay tax for renting out an apartment for 11 months?

The validity period of the contract, when its registration in Rosreestr is required, should not be confused with the payment of tax on rental income. Agreements concluded for a period of less than one calendar year must be registered. But registration and tax calculation are different concepts.

Any income becomes subject to taxation. Even daily rent brings profit to the apartment owner and he is obliged to report and pay tax on it.

The exception is when the apartment is rented free of charge, i.e. the owner has no income from it. For this purpose, another type of agreement is used - a contract for free use, which stipulates the condition for the free provision of premises. The second party to the contract may be relatives, friends or other persons in need of temporary housing.

Interesting article: All the intricacies of the daily apartment rental business!

Object of taxation

Object of taxation ( Article 38 of the Tax Code of the Russian Federation

) is what will actually be taxed. In general, this can be the sale of goods (work, services), property, profit, income, expense.

With the presence of an object of taxation, the taxpayer becomes obligated to pay tax.

Object of personal income tax taxation

is income, both received in the Russian Federation and outside its aisles (

Article 209 of the Tax Code of the Russian Federation

).

In accordance with paragraphs. 4 clause 1 of article 208 of the Tax Code of the Russian Federation

Income from sources in the Russian Federation also includes income received from leasing or other use of property located in the Russian Federation.