Article 220 of the Tax Code of the Russian Federation on property tax deductions is the main source that regulates exactly how the tax base is reduced in the case of the purchase of real estate and what conditions must be met.

However, most individuals still have some questions after reading this legislative act. In this regard, this article will describe as clearly as possible the procedure for obtaining a property-type tax discount.

Article 220 of the Tax Code of the Russian Federation

An individual who has incurred expenses for the purchase of various types of real estate - an apartment, room, house or land, has the right to return some of the money spent, but only if 13% of personal income tax is deducted from his income every month.

It should be noted that an income tax refund is possible even if the property was acquired with a loan, is in shared or joint ownership, as well as for expenses associated with the construction of housing or its repair.

If a taxpayer claims to receive financial compensation for the purchase of a land plot, then, first of all, he should understand that such a procedure can only be implemented if there is a house on the given territory.

In what situations is a property deduction not allowed?

The Tax Code of the Russian Federation, namely Article 220, stipulates that a tax discount for housing is not accrued in the following cases:

- If the transaction took place between relatives. Sometimes it happens that real estate is sold to each other by individuals related by close forms of kinship - husband and wife, parents and children, brothers and sisters. In this situation, tax legislation prohibits reducing the tax base. This also applies to property transactions concluded between a manager and his subordinate.

- If the taxpayer has already issued a property deduction. Today, there is a certain rule that states that the income tax refund for real estate is charged once. Therefore, if an individual has already received compensation, for example, for buying a house, then it will no longer be possible to return personal income tax for the land.

- If the applicant for deduction does not have the required package of documents. Sometimes individuals rush to apply for a tax rebate before they have received all the necessary documents. One of the main documents that gives the right to a personal income tax refund is the right to own housing, therefore, without this paper, submitting all other documents for verification is inappropriate.

When can you receive compensation?

Unlike most tax deductions, the accrual of which has time limits, reducing the size of the tax base associated with property is feasible regardless of the time frame. Thus, even if the housing or land was purchased quite a long time ago, the taxpayer still has the right to receive compensation. But it is worth remembering that income tax will be returned only for the last three years.

ATTENTION! Many taxpayers believe that by purchasing real estate this year, they can immediately apply for and receive a deduction. This opinion is incorrect, since you can fill out a declaration for a property discount no earlier than the next year after the purchase.

VAT

Federal Law No. 305-FZ dated July 2, 2021 introduces a new paragraph in Art. 146 of the Tax Code of the Russian Federation, which stipulates that services and work, as well as the transfer of property rights, are not objects of taxation if they are provided free of charge by state authorities and local governments as part of the exercise of their powers to support small and medium-sized businesses, and these the amendments apply from the beginning of 2021.

Regarding release:

The main direction is the exemption of public catering from tax from 2022, the change was made to paragraph 3 of Article 149 of the Tax Code of the Russian Federation, supplemented by subparagraph 38. In addition to restaurants, cafes, bars, fast food establishments, buffets, cafeterias, canteens, snack bars, culinary departments at the specified facilities and other similar public catering facilities, catering (offsite services outside public catering facilities) is also now exempt from VAT.

Naturally, not all taxpayers will benefit from the exemption, but only those who simultaneously fulfill special conditions, namely:

- the total income of such organizations or individual entrepreneurs in the year preceding the application of the exemption must be less than 2 billion rubles;

- the share of income from the above activities must be at least 70%;

-the average monthly income of employees, determined on the basis of these calculations for insurance premiums, must correspond to or exceed the regional industry indicator for OKVED 56 “Activities for the provision of food and beverages” of Section I “Activities of hotels and public catering establishments” in accordance with OKVED.

For newly created companies and individual entrepreneurs registered in 2022, the exemption can be applied from the beginning of registration without meeting the above conditions. For companies and individual entrepreneurs planning to register for this type of activity in 2023, 2024 and later, the conditions are specified separately.

Please note that culinary departments in retail outlets of organizations and individual entrepreneurs, as well as those engaged in procurement and other similar activities, do not apply the exemption.

The company has the right to refuse this benefit in accordance with the established procedure if the use of this benefit is unprofitable for the company. Benefits can be waived by application.

It should be noted that the abolition of VAT should, according to the plan of legislators, free up more resources for attracting new employees, as well as help in restoring business after the adverse consequences of coronavirus restrictions.

The rules for VAT tax agents have been clarified if Russian taxpayers purchase services from foreign companies that are registered in the Russian Federation only for real estate or vehicles, as well as if they have separate divisions registered, but the services are purchased directly from the parent foreign company, then the Russian buyer is obliged to calculate and pay VAT as a tax agent.

From October 2021, VAT must be restored in the event that property is transferred to a management company of a mutual investment fund for trust management, and the management company of the mutual fund that received this property has the right to accept the restored tax as a deduction.

Paragraph 1

The first part of the legislative act, to which we turned for help earlier, states that an individual can reduce the size of his tax base in the following cases:

- When selling a property. This can be not only the sale of an object that is entirely owned by the taxpayer, but also an object that is in shared ownership. Also, an individual may qualify for a tax discount when leaving the ranks of shared owners.

- In case of loss of rights to land territory. In some cases, the state seizes this property from the taxpayer, who is the legal owner of the land plot, as well as the housing facility located on it, for the purpose of municipal needs. In such a situation, a deduction is charged to the individual.

- When buying or building housing. If an individual decides to invest material resources in the purchase of a house or part of it, an apartment, a room in a communal apartment, a plot of land, or spend money on the construction of a property, then he automatically receives the right to a tax discount.

- When paying interest on property. Today, due to the fact that the cost of housing reaches quite high limits, individuals are increasingly using mortgage or loan services. When taking out a loan, the taxpayer undertakes to pay not only the full cost of housing, but also additional interest, for which personal income tax is also returned.

Income tax

Regarding reconstruction:

The initial cost of a fixed asset during retrofitting, completion, partial liquidation, as well as modernization or technical re-equipment, etc. varies regardless of the residual value.

Moreover, if in the above cases the useful life does not change, then only the depreciation rate changes.

Unaccounted income:

Taking into account the changes made, for tax purposes, income in the form of amounts by which in the reporting (tax) period there was a decrease in the authorized (share) capital of the organization in accordance with the requirements of the legislation of the Russian Federation or if the amount of the authorized capital became greater than the value of the company’s net assets at the end of reporting year.

Let us note that previously income in the form of amounts by which the authorized (share) capital of the organization was reduced in the reporting (tax) period in accordance with the requirements of the legislation of the Russian Federation was not taken into account.

The cost of work, services and property rights received from state authorities, local governments, small and medium-sized enterprise development corporations and its subsidiaries, organizations included under Law No. 209-FZ of July 24, 2007 in the unified register of infrastructure organizations is not included in income. support (clause 61, clause 1, article 251 of the Tax Code of the Russian Federation).

Basic settings

In addition to the above rules regarding the calculation of property and material compensation, the following provisions of Article 220 of the Tax Code of the Russian Federation require attention:

- Maximum deduction amount. An individual who has become the owner of an expensive property can apply for a deduction in the amount of no more than two million rubles, that is, receive the maximum possible compensation in the amount of 260,000 rubles. For example, if the cost of a house is 10,000,000 rubles, then 13% of it will be equal to 1,300,000 rubles, but this amount cannot be obtained. The taxpayer will be credited only 260,000 rubles.

- Repair costs. If the contract for the purchase of a housing property indicates that it requires repair work, then the new buyer can take advantage of a tax discount if money is spent on improving living conditions. As a rule, this includes finishing the premises, installing electrical supplies, gas supply, costs for design documentation, as well as some other services.

- Availability of necessary documents. In addition to the basic papers required for calculating a deduction of any type, in order to return personal income tax for property, you will need a contract for the purchase of a housing property, title to property, payment documents, as well as a number of additional papers, depending on the specific situation.

Excise taxes

New excise rates have been approved for 2022-2024. for cars, gasoline, ethyl alcohol, some tobacco products, including electronic and others.

In particular, the excise tax rate is:

- for ethyl alcohol in 2022 - 589 rubles per liter, in 2023 - 613 rubles, in 2024 - 638 rubles;

- for grapes from January 1, 2022 - 32 rubles per 1 ton;

- for wines, fruit wines in 2022 33 rubles per 1 liter, in 2023 - 34 rubles, in 2024 - 35 rubles (for wine drinks, cider, sparkling wines, beer and other rates are set separately);

- passenger cars from 90 to 150 hp - in 2022 - 53 rubles, in 2023 - 55 rubles, in 2024 - 57 rubles.

- Class 5 gasoline in 2022 - 13,793 rubles per 1 ton, in 2023 - 14,345 rubles, in 2024 - 14,919 rubles.

Rules have been established for the application of excise tax deductions in the event of irretrievable loss of customer-supplied raw materials (materials) that are excisable goods.

Standard tax deductions

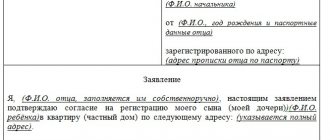

Article number 220 relates not only to tax discounts of the property type, but also of the standard type. We are talking about situations when parents decide to register a property in the name of their son or daughter, who is currently a minor.

In such a case, if a child is the owner of the property, his father or mother also has the right to return income tax. To do this, you must include a certified copy of the birth certificate in the main documentation package.

If the property was transferred into the ownership of the child not by his natural parent, but by the adoptive one, then in addition to a copy of the certificate, a document issued by the guardianship authorities will be required, which confirms the taxpayer’s right to education.

Payment deadline:

For cultural organizations engaged in creative activities, the tax payment deadlines for 2021 and 2021 have been extended, and now the payment date should not be later than March 28, 2022. Also, such organizations now have an exemption from calculating and paying advance payments for the tax periods 2021 and 2021 and from filing the declaration itself for this period.

The relaxations apply to organizations engaged in creative activities: activities in the field of art and entertainment, the activities of libraries, archives, museums and other cultural objects. The tax authorities will determine the types of economic activities for the application of preferential rules according to the OKVED code of the main type of activity of the organization as of December 31, 2021.

That is, they do not pay advance payments, declarations for 2021 and 2021. do not file, tax may be paid in 2022. These changes are intended to improve the situation of such companies affected by the pandemic.

Donation of real estate.

The amount of personal income tax on income in the form of real estate received as a gift is calculated by the tax authority as corresponding to the tax rates established by Art. 224 of the Tax Code of the Russian Federation, percentage share of the tax base.

In this case, the taxpayer’s income is assumed to be equal to the cadastral value of this object entered into the Unified State Register of Real Estate. When donating a share, the taxpayer’s income is assumed to be equal to the corresponding share of the cadastral value of this object entered into the Unified State Register of Real Estate.

In the event of failure to submit a tax return within the prescribed period in relation to income received as a result of the donation of real estate, a desk audit is carried out based on the documents (information) available to the tax authority.

Additional Notes

Both pensioners and ordinary taxpayers will be interested in knowing in advance the list of required documents from reliable sources. This information is also found in article 220 in one of its subparagraphs. For example, the first step is to prepare title documents or a contract for the sale of property. It is also worth making sure that you have copies of the child’s birth certificate, guardianship documents if adopted children under 18 years of age are involved, and everything that confirms the expenses incurred by the taxpayer.

Thus, paragraph 10 of Article 220 of the Tax Code of the Russian Federation is very important for those who, being a pensioner, decided to purchase housing. Even a non-working citizen can count on receiving a property deduction by contacting the inspectorate, filling out a declaration and providing supporting documents.

This is important to know: General and simplified tax system: differences

Property tax

If an object is destroyed or destroyed, the tax stops being paid from the beginning of the month corresponding to the date of death or destruction. The procedure for the taxpayer is declarative. The form of this application is approved by the tax authority.

The deadlines for paying taxes and advance payments for all categories of taxpayers are centralized only in the Tax Code of the Russian Federation; the regions no longer set these deadlines. In particular, the tax is paid no later than March 1 of the following year, and advance payments no later than April 30, July 31, October 31 of the corresponding year. Such rules come into force from the beginning of next 2022.

Starting from the 2022 report, there is no need to submit a declaration for objects taxed based on cadastral value. Now taxpayers themselves calculate and pay the tax, and submit to the fiscal authorities, if necessary, only explanations or documents, or both, confirming the correctness of calculation, completeness and timeliness of tax payment, the validity of the application of reduced tax rates, tax benefits, or the existence of grounds for exemption from payment of tax. And the tax authorities only send a message about the calculated tax.

Bad debts:

Bad debts (debts that are unrealistic for collection) are also recognized as amounts of monetary obligations terminated to the taxpayer - a credit institution to pay the debt under the loan agreement, subject to the following conditions:

- the loan was provided to legal entities or individual entrepreneurs in the period from 01/01/2021 to 12/31/2021 for the restoration of business activities;

- in relation to the credit agreement of the credit organization in 2021 and (or) in 2022, a subsidy is (was) provided at an interest rate in the manner established by the Government of the Russian Federation.