Enforcement proceedings are a process that is initiated after a lawsuit regarding non-payment of a debt. The creditor, IRS, or other payee has the right to sue. If the judge rules in his favor, enforcement proceedings will be opened against the person with the debt. The Federal Bailiff Service will intervene in the case. It has the right to seize a person’s property and sell it at auction, as well as block accounts and automatically withdraw up to 50% of income from them. All this is done to pay off the debt. Since the trial can be carried out without the presence of the defendant, the person himself may not know that the bailiffs are looking for him. Fortunately, if necessary, you can find out about this in just a few clicks - the FSSP itself provides this opportunity.

Ways to find out about open enforcement proceedings

Through the FSSP

The Federal Bailiff Service maintains a Data Bank of Enforcement Proceedings. This is a database in which you can see whether a person has a debt that is handled by bailiffs. The data bank has three tabs: search for individuals, individual entrepreneurs, organizations. To find out information about a specific person, you only need to enter his full name and date of birth. To find an organization, you must indicate its official name. You can access the Data Bank:

- through the corresponding page on the FSSP website;

- using the “FSSP of Russia” application for smartphones;

- through the application of the same name on the social networks Odnoklassniki and VKontakte.

You can also call the Federal Bailiff Service or visit the department in person. You should contact the branch at your place of registration.

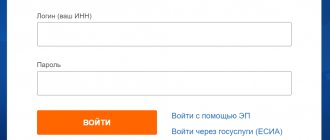

Through State Services

The unified portal of public services can provide information on enforcement proceedings: the website has a page “Judicial debt”. On this page a person can fill out an application and leave a request. It will be sent to the FSSP, and the applicant will be sent information about open enforcement proceedings. To use the service, you will need to have an account on the portal. The result will be displayed in your personal account. The service is available for both individuals and legal entities.

Checking debts from bailiffs

Information about debts to the FSSP is published in the public domain. You can check not only your debts, but also those of others. This is useful to do if you have doubts about business partners, as well as when buying a car or real estate.

On the official website for checking and paying debts of the FSSP, you can quickly find out whether you have a debt to the bailiffs. The check is free. There are several search methods on our website:

- For individuals. It is enough to enter the minimum data: last name, first name, patronymic, date of birth and select the region in which the person is registered.

- For legal entities. It is necessary to indicate the name, address of the enterprise and region.

- By number of enforcement proceedings (IP). Convenient if you already know about the debt and you need to pay it online.

- By the number of the executive document (ID). Required data: ID number and type, name of the authority from which the document was received, region.

- The search is carried out in the official FSSP database - all existing debts of both individuals and legal entities will be found. Unlike other services, registration is not required here. The verification will only take a few minutes.

In addition to the official website, there is a mobile application. It allows you to always be aware of new court debts and makes it possible to conveniently pay them directly from your smartphone.

What to do if open enforcement proceedings are discovered

If enforcement proceedings have been initiated against you, you should receive information about it: case number, date, details. You can use this information to pay off your debt. If you contacted the FSSP Data Bank, the information will be displayed in the form of a table: it contains links to receipts and to the online debt payment page. You can:

- print out a receipt and go to a bank branch to pay for it;

- pay the debt through the State Services portal, if you have an account on it.

If you have the opportunity to pay off your obligations, it is better to do so as soon as possible. This way you can prevent the visit of bailiffs and get rid of the restrictions associated with open enforcement proceedings. Once the debt is paid, the case will be closed and you will have no outstanding obligations.

Who can you get information about?

You can check the debt with bailiffs in relation not only to yourself, but also to another person (individual or legal). There is no need for an ordinary person to monitor the debts of citizens (relatives, acquaintances, neighbors).

But it is very easy to find out about the financial condition of the company with which he is going to cooperate. If a company has a large debt to bailiffs, there is a high probability that it will not fulfill its obligations properly. Or perhaps he won’t be able to cope with them at all.

How often should you check for enforcement proceedings?

Unfortunately, there are situations when a person himself does not know that he has debt. For example, he has not lived at his registered address for a long time and has not received official notifications. There can be many reasons for this: an unpaid and forgotten fine or tax, an overdue loan, even the actions of fraudsters - a person may be given a microloan or a loan, which he will not even be aware of. To avoid situations where collection has already been filed in court, and the defendant does not even know that he has a debt, it is recommended to periodically search for your name in the FSSP lists. It’s free and doesn’t require registration, but in difficult situations it will allow you to notice the catch in time. Businessmen and self-employed people are advised to check new clients and partners through the service: if it turns out that enforcement proceedings have been initiated against a partner, it may not be worth doing business with him.

EOS recommends: if you have a debt, it is better to avoid a situation where a creditor or authorized body takes the case to court. Judicial proceedings and enforcement proceedings may entail the seizure of accounts and property, the seizure and sale of valuable items at auction. If you have the opportunity to pay the existing debt, it will be more beneficial for everyone to settle the issue out of court. And if your debt is in EOS, do not be afraid to contact us for help. We will help you organize a repayment schedule convenient for you, and if necessary, offer a discount.

What is debt

It is quite easy to become a debtor today. Every “malicious” alimony defaulter can acquire such a frightening status. The same applies to people who do not make tax payments or neglect their responsibilities to banks. If banks make claims against the defaulter, then his debt is defined as legal debts. In this case, the “disputed” issue will be considered only in court.

Most cases heard in court oblige a person to fulfill his obligations. This is explained by the validity of the claims. Several decades ago, creditors had the right to seize the debtor's property. According to new realities, they do not have such a right.

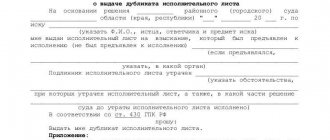

Sample arbitration court decision

But a person who has a debt should not relax, because bailiffs may visit him in the near future.

You can protect yourself from meeting such specific “guests”. To do this, a person planning to go on vacation abroad in the near future must find out in a timely manner about the state of his debt. Thus, he is able to avoid restrictions. Debts from bailiffs automatically presuppose their existence.

Where is the latest information stored?

All relevant information is stored by the Federal Bailiff Service. As soon as a debt record is entered into the database, all debtor data becomes available within 7 to 14 days. According to the new amendments that were adopted by Russian parliamentarians, the debtor is required to be notified of the “sanctions” that are imposed on him in connection with the debt.

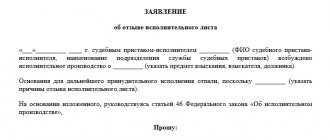

This is what an electronic database of debtors looks like

Thus, the debtor receives messages by e-mail stating that until the debt is repaid, he is limited in crossing the state border.

The message is sent by email immediately after information regarding the Russian’s debts is entered into the database. After 6 days, the letter is considered “issued” to the recipient. This is not a very convenient system. Not all debtors can find out about unfulfilled obligations to one or another institution of the Russian Federation.

But the bailiff may simply know the old email address or not know it at all. In practice, many people do not receive such notifications and think that they are doing well.

How to find out about the existence of a debt

Finding out about the existence of debt is quite easy. First of all, a person should seek help from the bailiff service. A message is sent to the debtor by email indicating the existence of a debt. In the same letter, a person can find out the details of “his” official.

In addition, everyone has the opportunity to contact the official dealing with a specific debt on the Internet. It is important to understand that bailiffs are not animals at all, and they are very happy when Russians who have a debt contact them themselves. This means that they will not have to start their unpleasant duties.

In addition, you can inquire online about the existence of debt. In order to make an online request, you need to go to the official page of the Federal Bailiff Service fssprus.ru.

It’s easy to check the presence of debt online, but there are cases when there is a debt, but the information has not yet been received on the site.

- Last name, first name and patronymic are indicated in the appropriate columns.

- After this, press the “Search” button.

- Then you will need to type a captcha and get all the relevant information.

- If a person has no debts to banks and other government institutions of the Russian Federation, this will also be displayed.

Making a payment

After the debtor has been able to check the existence of debts and is convinced of their existence, he must pay them. It's also very simple. To pay, you need to take the amount of debt and details and pay off your debt at a branch of “your” bank. If a person has not had any relationship with banks, he needs to contact the nearest branch. Bank employees will give him detailed information.

You can also make payment using the Internet. This is especially true for those who have unpaid fines. Next to the “fines” button there is a “pay” option. There are many methods to pay off debt.

You can pay:

- Using the WebMoney service.

- Using the Qiwi service.

- Using your mobile device (you can make a transaction from your mobile phone account).

It is important to understand that for any transaction a commission is deducted from a person’s account. In this case, you can request a receipt.

Terminal for paying debts under a claim

You should be extremely careful. It is recommended to carefully check all entered information. Otherwise, a person can simply pay off the debt of his full namesake.

Debt collection

The bailiff can and is obliged to take all measures provided for by the law “On Enforcement Proceedings”. Thus, the bailiff has the full right to collect a fine from the debtor’s salary.

If a person is officially employed, then the bailiff can easily collect the debt through the boss or bank branch.

Some people confuse bailiffs with debt collectors. In fact, such harsh means as confiscation of property, money and eviction from an apartment or house are extreme measures and are taken very rarely. The state resorts to such measures only when the amount of debt and penalties assume astronomical proportions.

What income cannot be recovered under a writ of execution?

Bailiffs have the right to write off wages, fees, incoming card transfers when debts, bonuses and even part of a pension are returned to you by bank transfer. They can seize and seize the debtor's property.

But bailiffs do not have the right to write off some income, no matter what the amount of debt is. These include:

- Compensation received by the debtor for damages from third parties.

- Pensions for the loss of a family breadwinner.

- Alimony payments for the maintenance of children, disabled people, elderly parents, etc.

- Compensation for the purchase of medicines, travel and other expenses.

- Social insurance payments.

- Compensation that the debtor receives for caring for disabled persons.

- Child benefits.

- Compensation for vouchers to a sanatorium or health improvement.

- Compensation for travel expenses.

- Material assistance provided to victims of environmental disasters, natural disasters, and emergencies.

- Payments to military personnel who took part in hostilities.

The bailiff also cannot write off maternity capital funds. It does not apply to physical cards. persons, and is issued in the form of a certificate. The state certificate for maternity capital cannot be cashed out, sold or exchanged. Attempting to cash it will result in criminal charges. That is why bailiffs cannot write off funds from maternity capital.

When does the debiting of money by ID stop?

Enforcement proceedings do not have a statute of limitations as such. It begins to be calculated after production closes. If the creditor again applies for the resumption of collection - 6 months after closure, then the bailiffs will begin the proceedings again, and the calculation of the statute of limitations will stop.

A specific amount is written off monthly from the debtor’s salary or other income. If the debtor for some reason has lost income, then the write-off stops. The bailiff checks whether the debtor has property or other assets and closes the proceedings.

Also, termination of write-off occurs in the following cases:

- when a debtor goes to court with a complaint or a request for a deferment, one can refer to difficult financial circumstances, the need for treatment, maintenance of disabled dependents, or the need to pay other debts;

- when the debtor applies to the Arbitration Court for recognition of insolvency.

How much do bailiffs write off from monthly ID income?

If the debtor has property or funds in his accounts, then the bailiffs will first repay the debt from these assets. If they are missing, then a monthly write-off will be made from income. Again, if the debtor has these legal incomes.

The following is withheld from salary and pension:

- 50% of the monthly accrual amount in standard cases;

- Up to 70% of monthly income in some cases - for example, if a person owes alimony for the maintenance of young children.

Restrictions on traveling abroad

The bailiff has the right to prohibit travel abroad in two cases:

- The amount of debt on a loan, mortgage, taxes, fees, traffic police fines and other debt obligations exceeds 30 thousand rubles.

- The debtor detained over 10 thousand rubles in alimony or compensation for damage caused.

Although imposing a ban is a possible but optional measure to collect debt, we recommend that you make sure in advance that there are no restrictions. Such a check will allow you to avoid difficulties when passing border control.

When to find a writ of execution

Employers who are hiring a new candidate are primarily interested in such information. This is of particular importance when applying for a job related to the storage and processing of material assets, working with information of value, when entering the public service or law enforcement agencies. Firms are interested in checking information about business partners. Do they have arbitration debt for unfulfilled obligations? As a measure of administrative repression, a temporary restriction on travel abroad is used in order to prevent hiding in the territory of another state from paying a debt. The total amount of the debt must be at least 30,000 rubles in order for the debtor to be prohibited from leaving.