Alimony for a minor is money that is intended to support the life of a child. Parents who receive money are obliged to spend it exclusively on the child, therefore, although they formally manage it, they are not the rightful owners of this money. When talking about whether alimony payments can be seized for debts during enforcement proceedings, it is necessary to remember that no, they cannot. These funds are not subject to seizure during the execution of a court decision.

Do bailiffs have the right to withdraw money paid as alimony?

Bailiffs have a fairly wide range of powers and there is no doubt that during enforcement proceedings they have the right to seize the debtor’s funds, his income, including periodic payments such as pensions or wages, and bailiffs also have the right to seize accounts the debtor, on his property and foreclose on the seized property and sell it at auction, and use the proceeds to pay off the debt.

The actions of bailiffs are regulated by Federal Law dated October 2, 2007 N 229-FZ (as amended on May 28, 2017) “ On Enforcement Proceedings ” and must follow not only this law, but also other regulatory legal acts, but we will not go far, because everything is spelled out in law.

I’ll tell you right away, bailiffs in no case have the right to enforce alimony paid in any form, but with the development of bank cards and electronic money transactions, it has become very easy for bailiffs to empty debtors’ cards, because bailiffs only need to send a request to the banks that owe them provide information about the existence of the debtor’s accounts, and when the debtor’s account is known, there is no difficulty in writing off money from it.

But the account does not indicate what funds are being credited to it, because there is a certain list of income defined by law, which bailiffs cannot collect during enforcement proceedings, but it turns out that bailiffs indiscriminately withdraw money from cards, without even delving into the details and purpose of these accounts.

About alimony I will say the following, according to paragraphs. 7 paragraph 1 of Article 101 of the “Law on Enforcement Proceedings”, bailiffs do not have the right to foreclose on amounts paid as alimony. This is an article of the law that no bailiff can argue with, and of course, such actions of the bailiff to write off alimony from the card account are not legal, since they violate the provisions of Article 101 of the “Law on Enforcement Proceedings.”

It is important to know! The bailiff is inactive when collecting alimony: where to go?

Can a bailiff seize alimony for debts?

If the voluntary agreement does not contain details, then you can make a bank account statement indicating the purpose of payment. Typically, the payer always indicates that this is alimony for a certain period. This extract must be attached to the notarial agreement. In most cases this is enough. If it is not possible to prove the targeted receipt of funds based on the voluntary payment of alimony by the second parent, then you will have to go to court to conduct a trial.

What to do if child benefits are seized?

First, you need to remember what debts the recipient of the benefit has. If your memory fails, then get a bank account statement and demand information: who seized the account and on what basis.

If a bank employee issues a copy of the arrest order, you should contact the bailiff who issued it and ask for clarification. An employee of the bailiff service is obliged to provide you with complete information on the basis on which you are a debtor in enforcement proceedings.

According to the law regulating the activities of bailiffs, the bailiff had to notify the recipient of the child benefit that proceedings had been initiated against him in accordance with the judicial act that had entered into legal force. Failure to comply with this requirement entails the illegality of the bailiff’s actions, in connection with which you can file a complaint against him in court or to a higher official.

If the debtor, the child’s mother, knew about the existence of the debt and all formalities were followed, then the following should be done.

It is important to know! Where to submit a court order for alimony?

Procedure and terms of money return

So, we found out whether bailiffs can impose an arrest. They have no right to do this. But what if the money was withheld?

Many debtors find out about the arrest only when they do not receive alimony payments on time. Then they contact the bank for clarification of the issue, and receive a response about the arrest.

From this moment on, the defaulter has 10 days to appeal the actions. You can stop blocking funds upon application, but in order to return previously withheld funds you will need to add an additional clause to the application. Because this service will not be implemented automatically.

If the recipient writes a request for a refund of the withheld amount, then, according to bank calculations, it will be returned within 30 days from the date of the request.

Child benefits are not subject to seizure

Federal Law “On Enforcement Proceedings” in Article 101 defines a complete list of income received by citizens, which the bailiff cannot seize due to the prohibition established by law.

Paragraph 12 of this article stipulates that the above includes benefits for citizens with children, paid from budgets of various levels. Thus, the executor does not have the right to seize funds that are state assistance to persons with children under 1.5 years of age. However, it is unlikely that his actions will be recognized as illegal, since the money on the account or card can be impersonal and the bailiff does not see where it came from and cannot determine its intended purpose.

Clause 14.1 of Article 30 of the law states that an employee of the bailiff service, when initiating enforcement proceedings, must necessarily request from the debtor information and evidence of the presence of a source of income that cannot be seized and foreclosed on. That is, the interested person is obliged to strive to inform the bailiff, otherwise he will bear the risk of adverse consequences in the form of seizure of child benefits.

In order to comply with the bailiff's request, the debtor must submit:

- child's birth certificate;

- a copy of the work book;

- a copy of the employer’s order to provide maternity leave;

- a certificate of the amount of accrued compensation;

Non-working mothers are required to send:

- documents for the child;

- a certificate from the social security authority regarding the calculation and payment of benefits.

From the moment of receiving information that the funds received into the debtor’s account are child benefits, the bailiff must make a note in the materials of the enforcement proceedings and not seize amounts protected by law.

It is important to know! How is alimony debt calculated by bailiffs?

How is a complaint handled?

When an application is submitted and all necessary documents are collected, the arrest must be lifted immediately. This requirement is established at the legislative level. However, in practice this is not always done. Sometimes bailiffs themselves initiate a delay in lifting restrictive measures. However, such a delay will definitely affect the child. There may be a situation in which the mother’s main source of income is alimony. Simply put, after the account is blocked, people simply have nothing to live on.

What cannot be arrested?

The legislation establishes the types of accounts that cannot be seized. Following the text of Art. No. 101 Federal Law “On Enforcement Proceedings”, the following types of income of citizens cannot be detained or seized:

- Money received as compensation for damage caused to the debtor's health.

- Funds that were received from the state budget in the event of the loss of a breadwinner by the debtor's family.

- Money assigned as compensation, which is paid to the debtor due to his receipt of work-related injuries and injuries (to disabled people).

- Funds paid as compensation to victims of radiation and man-made disasters.

- Money allocated by the state for a program to care for citizens who have lost their ability to work.

- Monthly compensation payments transferred to citizens on the basis of orders of federal legislation.

- Alimony and other payments transferred for the maintenance of a minor.

- Monetary compensation established by labor legislation.

Art. No. 103 of the Federal Law clearly answers the question: is it possible to seize child support? Such accounts cannot be seized for debts incurred by the child’s mother/father, since this money in fact does not belong to the debtor parents, but directly to the children themselves.

It is important to know! How to get alimony through bailiffs

Going to court

Statistics show that the largest number of complaints against bailiffs is related to their indifference and inaction. And when child support money is the only source of living, then there is no time for lengthy negotiations with FSSP employees.

A painful situation needs to be resolved extremely quickly. And, citizens’ complaints are considered by employees of the very institution where the guilty bailiff himself works. Therefore, it makes sense to start defending your rights in court. The algorithm of actions when going to court is as follows:

- Collect documents that were necessary for an administrative appeal, and supplement them with correspondence with FSSP employees (complaint and response to it).

- File a claim.

- Pay the state fee.

In a statement of claim to a judicial authority, the applicant must literally demand the following:

- removing the seizure from the alimony account;

- punishment of the guilty bailiff who imposed an illegal arrest;

- oblige bailiffs to pay compensation for moral damage caused.

Expert opinion

Sergey Nikolaevich

Judge, judicial experience - 20 years

You should know! If a parent confidently stands up for his rights and the rights of his child in court, then he can count on receiving additional money paid in the form of compensation from the FSSP. But, for this you will have to spend a lot of time and nerves, or contact an experienced lawyer.

Cases giving bailiffs the right to write off money

A long delay in any payments will sooner or later lead to a court decision to collect the debt, and if the debtor does not have the desire or financial ability to execute the decision at once, its forced execution will begin through the bailiff service. The nature of unfulfilled financial obligations can be different:

- outstanding loans;

- housing and communal services;

- taxes, etc.

Execution of decisions on the collection of funds in 2021, as before, will be carried out, among other things, by deduction from accounts. The amount of deductions can reach half of the transfers on the account, and if we are talking about alimony and a number of other payments, then up to 70%. The presence of dependent children by the debtor limits the deduction ceiling to 30% of all credits.

When enforcement begins, funds can be blocked, amounts written off, etc. The contractor is not obliged to check the nature of the transfers (from where and for what), especially since they lose their ownership after they are credited to the account. The debtor must notify himself that funds for child support are being transferred to the account as soon as he learns about the decision.

In fact, deduction of funds from payments for children is unacceptable, but if there is a court decision, and the bailiff is not aware that social payments are being received, deductions may be made erroneously, but not unlawfully

It is important to know! Collection of alimony through bailiffs

Other forms of appeal

In addition to filing a complaint through the bailiffs, regardless of this, it is possible to appeal to the court and the prosecutor's office. As a prosecutorial response, citizens' appeals regarding the actions or inactions of officials are considered.

Any form of complaint is not provided for by law. The appeal is issued in any form. It can be made according to the type of statement described above. The decision of the bailiff can be challenged in a court of general jurisdiction within the framework of procedural legislation. If the applicant’s demands are confirmed, the decision is subject to cancellation as illegal.

So, can bailiffs seize child support? As it turns out, no. Therefore, a parent who finds himself in this position can safely defend his position.

If a citizen is one of the debtors, this does not mean that he has no rights. The illegal behavior of the bailiff can also be stopped by restoring your rights. Moreover, they are aimed at protecting the interests of minor children.

Summary

After reading this article, you found out whether bailiffs have the legal right to seize child support. Let's summarize.

If you are a debtor, and money intended for the maintenance of a minor child is seized from your alimony account, you should first immediately contact the head of the FSSP, and then go to court (in the case where the leadership of the FSSP does not react in any way).

According to the law, alimony cannot be seized under any circumstances. This money, despite the fact that the debtor receives it, actually belongs to the child: ah, the child cannot be a debtor.

A comprehensive documentary package must be attached to the complaint. You must apply within 10 days from the moment the account was seized; or when the recipient of child benefits (the wife of the alimony payer) became aware of such an offense on the part of the bailiffs.

List of documents for filing a claim

The following documentary “arguments” must be attached to the complaint (or claim):

- A copy of your ID.

- A copy of the child's birth certificate.

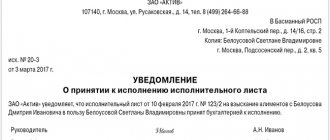

- IL (court order or voluntary alimony agreement) – any of these documents that serves as the basis for imposing obligations for alimony payments.

- A copy of the bailiff's decree stating that the alimony account in the bank has been seized due to the debt on the loan (the decree should be obtained by contacting either the bank or the FSSP branch).

- A certificate from the bank containing the following information:

- Full name of the payer;

- details of the account that has been seized;

- duration of payment transfers and frequency of financial transfers;

- purpose of money transfers;

- dates and amounts of alimony.

State duty amount

This category of administrative claims involves payment in favor of the state treasury in the amount of 300 rubles .