3

Entering into an inheritance has become firmly established in a person’s life. Today, there are two ways to receive the property of a deceased citizen: according to a will and by law. If the owner did not leave a will, his property goes to his relatives in order of priority. The priority applicants are a widow/widower (husband), daughter and son, mother and father. However, there may not be first-line heirs. The question arises: how is property inherited in this case? In this regard, a second line of kinship is provided. Read our article about who is included in it, when they can inherit and how this happens.

Inheritance Institute

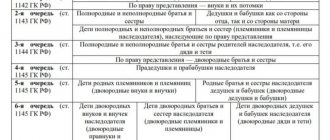

The Civil Code of the Russian Federation records representatives of all seven orders of kinship. There are also applicants who can receive valuables by right of representation. The use of the institution of inheritance by law is necessary in the absence of a will of the deceased citizen. Also, if the will is declared invalid or has been appealed in court, then the distribution of material benefits will occur among citizens in the order of legal priority.

When opening inheritance proceedings, the notary must establish whether there are first-level relatives between whom values can be divided. If there are none or they are:

- found unworthy;

- abandoned their values;

- did not contact the notary with an application to open the inheritance within the prescribed period.

Then the entire amount of valuables goes to second-level relatives. If there is at least one representative of the first priority, then no one else can lay claim to the property.

Important! If among the heirs of the second priority according to the law there were persons who were dependent on the testator, then in some cases they may claim an obligatory share of the inheritance.

Article 1143 of the Civil Code of the Russian Federation

The Civil Code of the Russian Federation takes care of Russians, dead and living. If we talk about inheritance, the legislation clearly describes who belongs to the 2nd line of heirs. It is important that these queues exist if the deceased did not leave a will or if the fact of its existence is not proven. Since, according to the will, all property can go to completely different people who, by law, are not even relatives or close people of the deceased person.

So, who inherits first by law, and who belongs to the category of people who receive inheritance by right of representation?

Heirs of the second stage

According to the articles of the Civil Code of the Russian Federation, the second stage of legal heirs includes:

- natural grandparents from both parents (with the exception of grandparents who acted as guardians of the testator and were deprived of guardianship rights);

- siblings.

Grandparents can claim inheritance regardless of whether they are legally married or living together. Also, if the testator was raised not by biological parents, but by adoptive parents, then their parents also automatically become claimants to the inheritance. This is due to the fact that relatives who have acquired the rights of kinship legally without blood ties are automatically equated to biological relatives.

As for brothers and sisters, the following features of the distribution of values between candidates need to be taken into account:

- inheritance can be received by full-blooded sisters and brothers from biological or legal parents;

- half-blooded relatives, but only after registration of an official marriage between the parents;

- step-relatives cannot claim material assets, except for the facts of joint adoption by spouses of children from other marriages.

Other heirs who may be called to inherit on an equal basis with heirs of the second stage

The law provides for a special category of heirs who will be called upon to inherit along with relatives - representatives of any line relevant in terms of claims to the testator's property. These include dependents who were supported by a deceased person or who received a significant part of their income from him (Article 1148 of the Civil Code of the Russian Federation).

More distant relatives than those who belong to the second line may be called to inherit if the testator was under their care and support for at least a year before his death.

Strangers can also act as heirs. This happens if, as dependents, they lived together with the person who left the inheritance for at least a year before the opening of the inheritance.

Heirs of the second stage by right of representation

Also in civil law there is the institution of the right of representation. This means that when the legal heir cannot exercise his rights to receive material goods, then representatives take ownership of the valuables instead. This is only possible if the potential heir has died or has been declared missing or deceased in court.

Thus, the second line of inheritance includes the following successors:

- children of sisters and brothers (that is, nephews).

Who owns the obligatory share?

The legislation also outlines situations where it is possible to receive a certain share of the property or rights of the deceased, regardless of whether there is a will or not.

There is a circle of people who are entitled to a mandatory share of the testator’s property. These include:

- whether the disabled children of the deceased are minors (this even includes adopted family members);

- spouses who do not have the physical ability to provide for their existence and this is documented;

- the parents of the deceased, even if he was previously adopted by them;

- dependents.

A minimum share of compulsory inheritance has also been established. Neither a notary nor a court can change it. This is at least 2/3 of the share that would be due to each of the heirs according to the obligatory part .

Heirs of the second priority can also receive an obligatory share if it is proven that they were previously dependent on the deceased testator. The consent of other heirs is not necessary in order to receive a mandatory share of the inheritance. The law does not require this permission.

Division of shares between heirs of the second stage

Whether the second-priority heirs will receive the property according to the law and how the inheritance is divided depends on many circumstances. It is customary to distinguish between several ways of distributing material assets between candidates for inheritance. The main ones include:

- drawing up a voluntary agreement between the participants on the distribution of property (in what shares each applicant will own the inheritance, the parties determine independently);

- equal division of property between representatives of the queue;

- awarding different shares of the inheritance to candidates.

Different parts can be registered as the property of heirs under the following circumstances:

- the need to allocate a mandatory share;

- the presence of receivers who receive values on the basis of hereditary transmission;

- separation of the marital share from the common property.

Example

Citizen K., who did not leave behind a testamentary letter with the procedure for disposing of personal property, died in the accident. Therefore, the notary decided to distribute material benefits among representatives of the legal queue. A private house with a total cost of 2,100,000 rubles has been offered for inheritance.

Citizen K. has no close relatives left. The parents died long before the death of the testator and K. was never officially married and has no children.

Considering that there are no representatives of the first stage, the property passes to the heirs of the second level of kinship. Among these are not a full brother - the son of a stepfather from his first marriage, and a grandfather. Previously, the deceased K. had a sister who also died in the accident, leaving behind two daughters.

Thus, the values will be divided in the following way:

- the grandfather will receive ownership of a part of the house equal in value to 700,000 rubles;

- a half-brother obtains ownership of 1/3 of the property with a total value of 700 thousand;

- the daughters of the deceased sister will become the owners of the remaining third of the house, but 50% each, that is, each daughter will take ownership of a share of the house worth 350,000 rubles.

Distribution of the testator's property: Procedure

The order of inheritance is determined by the legislative framework and is described in Articles No. 1141-1145 of the Civil Code of the Russian Federation. Relatives from each subsequent circle of succession become heirs, but only if there are no previous recipients of property or they have lost inheritance rights. Heirs of the second circle of priority can receive property if its first-priority recipients abandoned it or did not enter into inheritance within the allotted time frame.

Children of half-brothers and sisters of the testator will receive inherited rights to the property of the deceased if their parents died on the same day as him or before the moment when the inheritance is opened. This right is called the right of representation.

If there are several second-order heirs, then the testator’s property will be divided between them in equal parts. However, the presence of property recipients who have the right to an obligatory part of the inheritance and those who have the right of representation is also taken into account. If controversial situations arise, after receiving a certificate of inheritance rights, it is necessary to conclude an agreement regarding the division of property in a notary's office.

Expert commentary

Kireev Maxim

Lawyer

The notary may not certify this agreement. It may define a different procedure for using the inheritance, different from that specified in the certificate. In this case, the heir who used it before the moment when it was distributed will have more rights to the property. It is also necessary to take into account that property can be divided only after the death of the testator or before entering into inheritance; in other situations, its division is prohibited. This prohibition applies only to property rights and real estate.

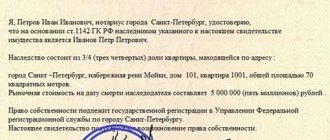

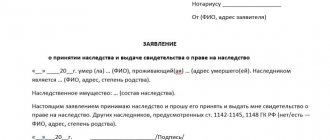

How to enter into an inheritance?

Whether a second-stage heir can claim a share in the inheritance is decided by the notary, referring to the provisions of the civil law of the Russian Federation. In order to claim your rights to inheritance, you must complete the following steps:

- establish a notary office whose jurisdiction extends to the area where the deceased citizen is registered;

- submitting an application to a notary to open an inheritance;

- provision of a full package of documents confirming the presence or absence of other legitimate applicants for material assets;

- waiting for the expiration of the six-month period allotted for making claims to the inheritance.

Important! If within six months from the date of death of the testator no claims to the inheritance have been made, then the benefits will be divided among representatives of the second priority.

The notary prepares a resolution on the possibility of entering into inheritance rights to material assets, after which you can begin to register ownership rights to the objects.

Application deadlines

According to the Civil Code of the Russian Federation, you should declare your rights within six months after the death of the testator. Moreover, if the inheritance period was missed for a good reason, the successor may apply to the court to restore it.

Inheritance after the expiration of the 6-month period without trial is also possible, but subject to the written consent of the remaining beneficiaries. In such a situation, the certificate issued by the notary is canceled and a new one is issued in its place.

Challenging inheritance by heirs of the second stage

Heirs of the second priority, claiming property without a will, as well as other potential candidates for material wealth, can initiate the procedure for annulment of the notary's decree and restoration of the terms for consideration of inheritance proceedings. Such disputes are resolved exclusively in court. And those persons who believe that their rights have been limited or violated can send a claim to the court office.

All disputes related to the entry into inheritance rights can be divided into the following groups:

- identification of fraudulent actions on the part of heirs who received material benefits without having the right to do so (if the court proves that the recipient of the inheritance deliberately submitted false documents in order to become the owner of the property, then his rights to the property will be canceled and the question of the possibility of criminal prosecution will be raised responsibility);

- establishing that the testator left behind a will (for example, if the document was drawn up in emergency circumstances and was not approved by a notary);

- missing legal deadlines.

Restoring missed deadlines is quite common. This happens when only a few years later a relative becomes aware that his loved one has died and the inheritance has already been successfully divided between claimants for the valuables. In this case, it is necessary to confirm that the plaintiff really did not know about the death of the relative. As practice shows, such claims are extremely rarely satisfied.

The second option is the birth of a child who is also an heir, but at the time of distribution of the inheritance he has not yet been born. The baby's mother files a claim to review the division of property between the claimants. 80% of such requests are granted by judges.

Challenging in court

Heirs of any order can challenge the inheritance. There are often situations when the fact of the death of a relative is hidden in order to obtain control of his property. If a similar situation happened to you, you can go to court at any time, no matter how much time has passed since the date of death or the court ruling declaring the person dead.

In addition to the statement of claim, the court must provide a document on the basis of which the relatives learned about the death of the testator. It will be considered as evidence that the fact of death was previously unknown to the plaintiff.

Responsibilities for debts and responsibility for accepted inheritance

Inheritance is not always represented only by values. Often, along with material goods, debt obligations are included. The distribution of financial obligations can occur as follows:

- equal distribution among all heirs;

- entrustment only to those candidates who receive property encumbered with monetary debts and loans.

Important! Inheritance is allowed only for all property due. You cannot refuse financial obligations and receive only valuables.

If the heir has become the owner of an apartment that is under a mortgage or has received the obligation to repay a separate consumer loan, then after assuming the rights of inheritance, the citizen must inform the creditor about this. The borrower draws up a new agreement, which states that further payments fall on the shoulders of the newly-minted heir.

In case of late payments or evasion of their execution, the heir will be subject to sanctions provided for in the contract. Therefore, you need to be prepared to strictly comply with the signed contract.

Cost and procedure

To ensure that inheritance passes without incident, preparations are made for the procedure in advance. In this case, the preparation is presented:

- Collecting the necessary package of documents.

- By contacting a notary office to confirm the absence of a testamentary act.

- By contacting a lawyer or notary to carry out the procedure correctly.

Important! In order to obtain rights to inherited property, one must contact a notary's office within the established time frame and write a statement expressing consent to receive the property due to him.

The services of a specialist will cost 0.3% of the inheritance amount. However, the amount cannot exceed 100,000 rubles. Other services that may be needed in the process of registering inheritance rights are paid according to a different tariff.

The procedure for obtaining rights to property can be considered completed only when they are transferred from the deceased testator to the heir. Often, residential real estate acts as an inheritance, which should be re-registered in Rosreestr. You should come to this organization with a certificate of inheritance in hand, which will become the basis for issuing to the heir a document on his ownership rights to housing.