Citizens who need to fill out and submit a document such as 3-NDFL to the tax service often experience difficulties with concepts such as “amount transferred from the previous year” and “deduction for previous years.” These phrases, in fact, are standard and are associated with the process of returning the property deduction (since other deductions are not transferred). In the text, we will understand what constitutes a return on previous tax documents - declarations, how to calculate the figure transferred from past years, and how the declaration is filled out in this situation - what and where the payer needs to indicate.

Deduction for previous years

Deduction for previous year declarations

In the preface it was mentioned that the concept relates to property return - deduction of income tax during the construction or purchase of housing. This means that any personal income tax payer has the right to a refund of thirteen percent of the money spent on improving housing conditions. The tax is returned when a person acquires a house or cottage, as well as a plot of land for a residential building, an apartment or a room, as well as a share in all of the listed objects.

Let us remind you that all officially employed citizens working in our country are required by law to contribute part of their labor and other income to the state treasury. As a rule, these funds are withheld and transferred by the employer himself, who is in the status of a tax agent for hired employees. However, on unearned income - winnings, dividends, money from subletting or rent, citizens pay personal income tax personally.

How much can you expect?

For residents of Russia, the income rate is 13%, for non-residents – 30%. Note that the first are considered to be persons who reside in the country for 183 consecutive days within twelve months. It is permissible to leave for six months without losing your status for treatment, training or work in offshore oil fields. Employees of law enforcement and government agencies and representatives of local government bodies may leave the country for an annual period of time on duty.

Who is a tax resident of the Russian Federation? Our article will help you figure this out. In it we will look at what the tax status depends on, documents for confirmation, as well as the regulatory framework for residents and non-residents.

Let's return to the issue under study. All personal income tax payers can claim a refund in a number of life situations. Not all spent, but only a part less than or equal to the income contributions paid for the year. According to the law, there are six tax deductions in Russia, four of which are considered the most popular.

Table 1. Type of tax deductions

| Deduction | Decoding |

| Standard | Rely on parents with children, including adopted or guardian children. The benefit is designed for minor offspring, as well as full-time students until their 24th birthday. This type of benefit applies to veterans, heroes of the Union and the country, blockade survivors, Chernobyl survivors, released concentration camp prisoners, military personnel, disabled people and people suffering from a number of diseases. There is no deduction for previous years - the standard benefit is “delivered” to citizens on a monthly basis. |

| Property | We have already mentioned that the deduction is due to all personal income tax payers, without exception, who are considered residents of Russia. There are two restrictions on the deduction. Firstly, the limit on the value of real estate is two million rubles (maximum return - 260 thousand rubles) when paying for housing with your own money and three million rubles (maximum return - 390 thousand rubles) when paying for a mortgage. Secondly, you can get a refund once in a lifetime. That is, a person can purchase housing and receive thirteen percent of its cost until the limited figure is completed. |

| Professional | From the name it is clear that the professional type of deduction is due to representatives of specific specialties or people with nuances in their work activities. This includes the authors and heirs of significant cultural works, and secondly, private practitioners. The latter include tutors, traditional healers, lawyers, detectives and the like. Professional deductions are not carried forward, as they are due to payers every month. |

| Social | Social deductions are available to payers who spent money on maintaining health or gaining new knowledge for themselves or close relatives. The benefit can be returned for treatment or the purchase of pharmaceuticals, education, as well as payment for insurance, pension contributions or charity. Social returns are limited to one hundred twenty thousand rubles and are not carried over to subsequent years. But, for example, a refund for treatment can be made every year. |

Child tax deduction: how to prepare documents

In the material presented, we discuss how to go through this bureaucratic procedure and use the right to receive a cash deduction for children.

Calculating deductions for previous years is not at all difficult

From here we move on to the remaining questions.

From what month is the deduction due?

Even if the application is dated, for example, November, the deduction should be applied from January of the current year. This should also be done in a situation where the application says: “I ask you to provide a deduction from November...”.

The explanation is simple. According to paragraph 3 of Article 218 of the Tax Code of the Russian Federation, standard deductions are due for all months of the tax period during which a person was entitled to them. Simply put, the commencement of application depends on the date on which the right to deduction arose. And the date indicated in the application does not play any role.

Where did the deduction for previous years come from?

Let us remind you that the maximum when receiving a property deduction without using borrowed money is 260,000 rubles (thirteen percent of two million Russian rubles). We remember that it is impossible to receive more funds at a time than were contributed to the state treasury for taxes in a year.

Let's do the math with an example. Evgeny Aleksandrovich Shchukin receives 25,000 rubles monthly or three hundred thousand annually. That is, for the year he will deduct 39 thousand rubles as a tax on labor income (thirteen percent of three hundred thousand rubles). Then let’s compare two figures – the refund limit in the amount of 260 thousand rubles and taxes paid in the amount of 39 thousand rubles. This means that for the year Shchukin can only claim a similar return figure. What should I do? We are getting to the heart of the matter. 221 thousand rubles for Shchukin will become a deduction carried forward to subsequent years.

How to calculate deductions for previous years?

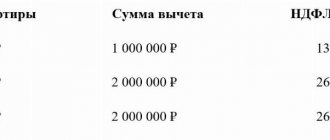

A citizen has the right to submit documents for the return of property benefits three years ago. Let's look at the second example. Let’s say Natalya Sergeevna Durova purchased a house worth three million rubles in 2014. During this year, Durova earned 300 thousand rubles, for 2015 - 400 thousand rubles, for 2021 - 500 thousand Russian rubles. At this point, she can submit a declaration for the return of part of the funds. You can submit documents earlier, but then the amount of the refund for the year cannot exceed 39 thousand rubles. In three years, Durova has already contributed 156 thousand rubles to the state treasury and can claim this money at once. But 104 thousand rubles are still in “reserve” - the state will pay them to Durova annually, according to the standards of personal income tax deducted by her.

Results

The need to submit a 3-NDFL declaration for a period exceeding one year arises either when correcting errors identified in previously submitted reports, or to obtain deductions, or in case of filing a report late. Regardless of the number of years the reporting will relate to, it is compiled separately for each year using a form relating specifically to this period.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to fill out 3-NDFL?

Let's simulate a situation similar to the example above in order to understand which lines and what data need to be filled in the declaration. So, Sergei Semenovich Vysotkov purchased housing last year and for the first time wants to get a refund. The actual expenses incurred on purchasing housing are either two million rubles or a larger amount. The tax base is Vysotkov’s income for the year, let’s take the figure of three hundred thousand rubles. The balance of the property tax deduction carried over to the next year is 2,000,000 rubles (limit on the cost of housing) minus 300,000 rubles (annual salary) = 1,700,000 rubles. This is data for the first year.

To receive any refund, you must fill out and submit to the Federal Tax Service a declaration in form 3-NDFL. Read our article on how to fill out this form.

We again repeat from the previous declaration the amount of expenses actually incurred - this is two million rubles. The deduction amount already accepted for accounting last year is 300 thousand rubles, we are also rewriting the data from the previous document. The balance, as we remember, is 1,700,000 rubles, it goes into the new year from the past year. Now the financial base figure is entered again. Let's assume that Vysotkov was promoted within a year and now he earned 400 thousand rubles. Accordingly, the balance of 1,400,000 rubles (1,700,000 minus 400,000) is again transferred to the next year.

When Vysotkov fills out the declaration for the third year, he will again indicate all this data, and if his salary does not increase, after three years the remaining deduction will be a million rubles. According to this scheme, the citizen will fill out all subsequent declarations for future years until the tax deduction due to him is returned in full.

Video - How to fill out the 3rd personal income tax declaration in 5 minutes

How to return money to an employee?

Due to the fact that from January to October the employer did not apply the deduction, it turned out that he charged and withheld an inflated personal income tax from the employee’s salary. Now it’s time to return the person’s over-withheld tax.

It may seem that to do this you just need to add the required amount to your salary for November. However, there is no need to rush. First, it is necessary to take a number of steps provided for in paragraph 1 of Article 231 of the Tax Code of the Russian Federation:

- Within 10 days from the date of receipt of the deduction application, inform the employee about the fact of excessive personal income tax withholding.

- Wait until the employee notifies the employer in writing about which account the money should be transferred to.

- Pay off your debt by bank transfer. The source of funds is personal income tax, which is subject to transfer to the budget for the coming periods for both this and other employees.

And only if the employee does not inform the accounting department of the bank account number to which the excessively withheld personal income tax should be transferred, the employer has the right to add the amount of debt to the salary for the current month (for more details, see: “How to return personal income tax to an employee: step-by-step instructions for a tax agent” ).

Instead of an afterword

Property return is the largest in terms of the amount of money that you can get back into your wallet. The higher a citizen’s salary and the larger the amount of income tax he transfers to the treasury, the more money he can return at a time using the deduction. But most often the transferred personal income tax is several times less than the maximum refund amount, so the payer receives the money in parts. We have explained in detail how this happens. Good luck getting your deductions!

Annually receiving part of the property deduction is a pleasant bonus to the family budget

Should I make clarifications to 6-NDFL?

This question arises if the application for the “children’s” deduction is written in the middle of the year, for example, in November. The accountant understands that he should have applied the deduction in January - October, but did not do so. As a result, 6-NDFL reports for the first quarter, half-year and 9 months of the current year were prepared without taking into account the corresponding amounts. Do I need to submit “clarifications”?

No no need. Although the employee had the right to deduct since January, the accountant only learned about it in November. This means that the recalculation for January - October should be dated in November and reflected in form 6-NDFL at the end of the year. No adjustments for previous reporting periods are required. The Federal Tax Service came to similar conclusions in letter No. BS-4-11/18095 dated September 17, 2018 (see “The Federal Tax Service reminded how to reflect property deductions in the calculation of 6-NDFL”). True, it talked about a property deduction, but this does not change the essence of the matter.

Fill out, check and submit the current Form 6‑NDFL via the Internet Submit for free