If in 2021 a taxpayer paid for educational services with his own money, from which income tax was withheld, then in 2021 he has the right to return this personal income tax in an amount not exceeding 13 percent of the social tax deduction - to return the tax, you must fill out a tax return 3-NDFL and submit to the Federal Tax Service at any time in 2021.

The filing format is either paper or electronic through the taxpayer’s personal account. In 2021, you should fill out the form according to the new form approved by Order of the Federal Tax Service dated August 28, 2020 No. ED-7-11 / [email protected]

When is a personal income tax refund possible for training?

Situations in which a personal income tax refund for training is possible are listed in subsection. 2 p. 1 art. 219 of the Tax Code of the Russian Federation (see table):

| Who can return personal income tax | Conditions under which a social deduction for education is possible | Amount of deduction when calculating personal income tax refundable |

| Taxpayer for his studies in educational institutions | The age of the student and the form of training does not matter | In the amount of actual expenses, but not more than 120,000 rubles. (together with other expenses of the taxpayer: payment for his own treatment, treatment of family members, except for expensive treatment, payment of pension (insurance) contributions and additional contributions to the funded part of the labor pension) |

| Brother (sister) of a full-time student in educational institutions | The age of the studying brother (sister) is no more than 24 years old | |

| Parents for full-time education of their children | Children must not be older than 24 years old | In the amount spent on training, but not more than 50,000 rubles. for each child in the total amount for both parents (guardian or trustee) |

| Guardian for full-time education of the ward in educational institutions | The age of the ward is up to 18 years | |

| Acting guardian or trustee for full-time education of former wards after termination of guardianship | The age of former wards should not be higher than 24 years |

Before applying for a tax refund, you should check whether the criteria established by the Tax Code of the Russian Federation for receiving a deduction for education are met. Namely, a person applying for a personal income tax refund:

- has official earnings from which income tax is deducted to the budget;

- pays for studies (for himself, his children, brothers, sisters or wards) in a licensed educational institution;

- entered into a written training agreement;

- has documents confirming the fact of payment for educational services.

If the listed criteria are met, to return personal income tax you will need to fill out an application and declaration 3-NDFL. We will tell you how to do this in the following sections.

Note! For reporting for 2021, Form 3-NDFL must be completed on an updated form, approved. by order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected]

ConsultantPlus experts told us what has changed in the form. Get free demo access to K+ and go to the Review Material to find out all the details of the innovations.

Example 6: Receiving a deduction for several years of study

Conditions for receiving the deduction: Petrov A.A. I studied at the university in the correspondence department from 2021 to 2021 and paid 40 thousand rubles a year for tuition. About tax deduction Petrov A.A. I learned it only in 2021 and wants to get it for all the years of study.

Income and income tax paid: During the entire period of study Petrov A.A. officially worked, earned 15 thousand rubles a month and paid 23 thousand rubles in personal income tax per year.

Calculation of the deduction: According to the law, you can receive a tax deduction only for the three previous years, therefore in 2021 Petrov A.A. will be able to receive the deduction only for 2021, 2021 and 2020. For each year Petrov A.A. will be able to return 40 thousand rubles. * 13% = 5,200 rubles. In total for three years Petrov A.A. will return 15,600 rubles.

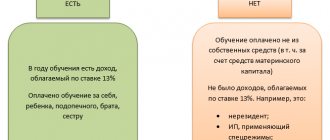

When you can't get a tax refund

It will not be possible to return personal income tax from the cost of training if (for example):

- the spouse paid for his wife’s education (and vice versa) - the law does not provide for such an opportunity;

- Tuition was paid for using maternity capital funds - para. 5 subp. 2 p. 1 art. 219 Tax Code of the Russian Federation;

- a non-working student used a survivor's pension as payment - there is no income subject to personal income tax (13%);

- payment documents are lost and cannot be restored - one of the prerequisites for providing a deduction and refund of personal income tax under paragraph. 3 subp. 2 p. 1 art. 219 of the Tax Code of the Russian Federation is the availability of documents confirming payment for studies;

- the child’s education was paid for by a person who is not his father according to documents and who did not officially adopt him - there is no such provision in the Tax Code of the Russian Federation;

- in other cases.

The listed situations of impossibility of returning personal income tax when paying for education are mainly related to:

- with the degree of relationship between the student and the person paying for the education - the tax can be returned only if the education of an individual is paid for by close relatives (father, mother, brother, sister);

- lack of properly executed necessary supporting documents;

- with the legal origin of the income of the person who paid for the education - these must be legally earned funds, from the amount of which personal income tax is transferred to the budget.

The article “Distance Worker Abroad: We Pay Fees, But Not Personal Income Tax” will help you understand why a person working remotely abroad will not be able to return personal income tax for training.

Since we are talking about paying for education, a logical question arises: does the content of the training program and (or) the form of the educational institution affect the possibility of returning personal income tax? Find out about this in the next section.

For what type of training can you return personal income tax?

In Art. 219 of the Tax Code of the Russian Federation, devoted to the conditions for providing a social tax deduction from the cost of education, there are no instructions or prohibitions regarding the form of educational institutions and training programs.

This means that the legislation does not make the right to receive a deduction and return of personal income tax dependent on:

- from a private or public educational institution;

- type of institution carrying out the educational process (school, kindergarten, children's sports school, art school, driving school, foreign language learning center, advanced training courses, etc.);

- specifics of training programs - basic or additional;

- location of the educational institution - in Russia or abroad.

Which institutions are included in the national education system - see the diagram:

Study the accounting and organizational aspects of the work of educational institutions using the materials posted on our website:

- “When educational services are subject to VAT”;

- ;

- “Nomenclature of affairs of an educational institution”.

When will the money arrive if you filed a deduction with the tax office?

If everything is in order, the tax office will return the money within 4 months. Of these, 3 months are allocated for verification and another one for payment.

The start date of the audit is the date of submission of documents to the tax authority. Moreover, the date of submission of the last supporting document.

How to record this date:

- when submitting online, the system records every step or request;

- If you submit documents in person, ask the inspectorate to mark the acceptance of the document on the second copy or copy of the application for a tax deduction.

The status of consideration of the application is monitored in your personal account on the Federal Tax Service website.

You can also communicate with the inspector there - he is obliged to respond within a month. In most cases, the inspection is completed without the participation of the applicant, but you must be prepared to provide original documents or clarify controversial issues.

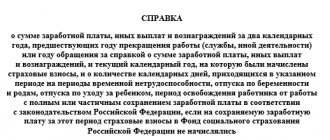

Documentary justification for the right to a personal income tax refund: what to collect and what to fill out

All papers that need to be sent to tax authorities in the situation of a personal income tax refund from the cost of training can be divided into 3 groups:

- prepared by the taxpayer (application for tax refund, declaration 3-NDFL);

- available to the taxpayer (identity documents, proof of relationship, etc.);

- received (requested) from other persons (2-NDFL certificate from the employer, agreement with an educational institution, etc.);

The diagram below will help you familiarize yourself with the list of documents that a person applying for a personal income tax refund needs to collect:

For detailed information about the required documents, see the material “How to return personal income tax for education.”

Particular attention should be paid to the nuances of document preparation. For example:

- the presence in the training agreement of the details of a license for the right to carry out educational activities - in the absence of such information, a copy of such a license must be attached to the agreement;

- payment documents and a training agreement must be issued to the person applying for a personal income tax refund.

A video tutorial will help you fill out an application for an income tax refund, which is posted on our YouTube channel - “We are preparing an application for a personal income tax refund (sample, form) .

Find out about the nuances of filling out an application for a personal income tax refund from the articles:

- “In the application for personal income tax refund, bank details must be indicated in full”;

- “Account name in the application for personal income tax refund (nuances)”.

An equally important moment is filling out 3-NDFL. We'll tell you how to do this below.

How to draw up a 3-NDFL declaration for studies

Filling out the 3-NDFL declaration for training can occur in several ways. For example: fill out a declaration form manually, contact a consulting company or professional consultants. One of the common ways to prepare a 3-NDFL declaration for study is to use a computer program posted on the Federal Tax Service website. Let's take a closer look at this option.

Scheme of working with the program when filling out the 3-NDFL declaration for training:

- downloading the “Declaration 201X” program from the Federal Tax Service website to your computer and installing it;

- sequentially filling out the fields of the declaration, selecting the desired option from those proposed by the program, placing the necessary checkboxes, entering information from supporting documents;

- automatic verification of correct filling of 3-NDFL;

- generating an electronic file or a paper version of 3-NDFL (printing it if necessary).

Check whether you have correctly filled out the 3-NDFL declaration for your child’s education with the help of explanations from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

The algorithm for fixing the necessary conditions in the program and the sequence of entering the initial information are presented in the table:

| Program section | Fields to be filled in | Choice |

| Setting conditions | Declaration type | 3-NDFL |

| general information | Federal Tax Service number (select from the list) | |

| Adjustment number - “0” when submitting the initial declaration | ||

| Taxpayer attribute | Other individual | |

| Income available | Put o | |

| Reliability is confirmed | Select the appropriate option according to the 3-NDFL presentation form:

| |

| Information about the declarant | Full name, tax identification number, date and place of birth of the declarant | Filled out according to the taxpayer’s identity card (passport) |

| Citizenship data | Check the box:

| |

| Code of the country | 643 — Russia (select from the drop-down list) | |

| Information about the identity document | All available fields are filled in:

| |

| Income received in the Russian Federation | Payment source | Select the tax base (13%) and add new lines according to the number of employers who received income last year (information is taken from 2-NDFL) |

| Information about income and deductions | Plus add data from the 2-NDFL certificate (month, code and amount of income, code and amount of deduction) | |

| Total amounts by payment source | The calculation occurs automatically - you need to check them with 2-NDFL | |

| Deductions | Provide social tax deductions | Check the box “Provide social tax deduction” |

| Amounts spent on | Select the required box (your education or the amounts paid for your children’s education) and enter the amount of education expenses |

From the icons located at the top of the program window, select the one you need in the following sequence:

- “Check” - if any data is entered incorrectly, the program will issue a corresponding warning;

- “Save” - after corrections have been made and re-checking;

- “View” - if you need to visually view the finished declaration;

- “xml file” and (or) “Print” - to create an electronic and (or) paper version of 3-NDFL.

Let's look at an example of filling out a 3-NDFL declaration for training.

The essence of the personal income tax deduction

What is the meaning of the personal income tax deduction? There are several types of personal income tax deductions, but the essence of their application is the same.

Personal income tax is calculated as a percentage of the tax base. A deduction is an amount by which the tax base can be reduced.

IMPORTANT!

A deduction is not an amount that can be returned, but an amount by which the tax base is reduced.

Let's look at an example. The income for the year amounted to 100,000 rubles. Deduction – 20,000 rubles. What will be the tax without applying the deduction and with applying the deduction?

Thus, when applying the personal income tax deduction, it becomes less. If the tax base for the year was calculated without taking into account the deduction, then personal income tax was overpaid, and the overpayment can be returned.

The next question is what amount of tax deduction can be applied.

An example of a completed 3-NDFL declaration for training

The following example will help you clearly see the finished tax return 3-NDFL for study (sample):

Petrova Anna Stepanovna paid for her studies at a driving school in 2021. The cost of training is 30,000 rubles. Anna works as a manager at Kolos LLC and earned 624,000 rubles in 2021. (personal income tax withheld and transferred to the budget (13%) = 81,120 rubles). At the end of the year, Anna decided to exercise her right to return part of her personal income tax and partially return the funds spent on training.

Anna’s algorithm for preparing initial data and filling out 3-NDFL:

- receipt of 2-personal income tax for the past year in the accounting department of Kolos LLC;

- completing a package of supporting documents (agreement with a driving school, payment receipt, passport, certificate of assignment of TIN, 2-NDFL);

- installation of the “Declaration” program (download from the Federal Tax Service website to a personal computer);

- entering data into the program;

- checking, correcting, saving and printing 3-NDFL.

See the sample filled out according to the example data on our website:

Package of documents

To receive a deduction, you need to collect the following package of papers:

- income certificate;

- contract from the place of study;

- if necessary, you need to have additional agreements;

- educational institution license;

- payment documents;

- request for deduction of funds.

Form 2-NDFL is attached in the original. For other documents, copies are acceptable.

If the deduction is issued for a child, you must take this into account and attach a birth certificate to the declaration.

Results

The 3-NDFL tax return and the refund for studies are interconnected—without 3-NDFL, it will not be possible to return part of the money spent on education. The declaration must be accompanied by an agreement and payment receipts, as well as a copy of a passport or other identification document.

Income tax can be returned only if you have legally received income, taxed at a rate of 13%, from which personal income tax deductions are made to the budget.

The place of study, as well as the private or public form of the educational institution does not matter. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Sample filling P.1

| Line (note number) | Explanation |

| 1 | When declaring n/v and returning funds to your hands, you must reflect the value “2”. |

| 2 | KBC for personal income tax refund from the budget - 18210102010011000110 |

| 3 | This code can be found on the Federal Tax Service website by indicating your residential address. |

| 4 | Since in our case only a tax refund is made, we indicate the value “0”. |

| 5 | We reflect the amount to be returned in person. This line is equal to line 140 R.2 |

| Line (note number) | Explanation |

| 1 | We indicate the amount of income received for the year without deducting personal income tax from it. |

| 2 | In our case, we indicate “0”, since there was no income not subject to personal income tax. |

| 3 | We enter the same amount of income as on line 010. |

| 4 | We indicate the amount of expenses (expenses made). |

| 5 | In our case, we reflect the value “0”, since there were no income-reducing expenses and no dividends either. |

| 6 | In this line we indicate the difference between the lines of paragraph 3 and paragraph 4 |

| Line (note number) | Explanation |

| 7 | This line indicates the amount of personal income tax that should have been calculated into the budget, taking into account the present value (item 6*13%). |

| 8 | This line reflects the amount of tax that was withheld from the salary and paid to the budget. |

| 9 | In our case, they are not filled. |

| 10 | The amount currently to be returned from the budget is indicated (clause 8-clause 7). |