Interest calculation rules

The rules for calculating interest on the amount of overpayment not returned on time by the tax authority are established by paragraphs. 2.5 tbsp. 6.1, paragraphs. 6, 10, 12 tbsp. 78 Tax Code of the Russian Federation.

More details about the contents of Art. 78 of the Tax Code of the Russian Federation, read the article.

To calculate interest, you can use the following formula:

Refinancing rate (%)

Pnv = Snv × ——————————————— × Dnv,

KDG

Where:

Pnv - the amount of interest that the tax authority must accrue in connection with violation of the deadline for the return of overpayments;

SNV - the amount of overpayment, the return period of which has been violated;

KDG - number of days in a year (365 or 366 in a leap year);

Dnv - the number of calendar days of violation of the deadline for the return of the overpayment.

The calculation of interest, as well as the refund of overpaid taxes, is done in rubles (Clause 13, Article 78 of the Tax Code of the Russian Federation).

How to determine the refinancing rate

To calculate interest, the refinancing rate of the Bank of Russia is used, which was in effect on the days when the deadline for returning the overpayment was violated (paragraph 2, clause 10, article 78 of the Tax Code of the Russian Federation). The refinancing rate (discount rate) until 2021 was set by the Central Bank of the Russian Federation separately from the key rate introduced in September 2013. From 2021, the refinancing rate is equal to the key rate, and in connection with this, its size has increased significantly.

Information on the size of the refinancing rate (key rate) can be found in the reference information.

Pay attention! If during the violation of the deadline for returning the overpayment the refinancing rate has changed, then for each period the corresponding rate is valid, interest is calculated separately.

Example

The amount of overpayment of income tax is RUB 18,617,987.48.

The organization wrote to the inspectorate an application for the return of the overpayment on 01/11/2020.

The overpayment was returned in violation of the deadline for 95 days - from 02/12/2020 to 05/17/2020.

The refinancing rate was:

from 02/12/2020 to 04/26/2020 - 6%;

from 04/27/2020 to 05/17/2020 - 5.50%.

Let's calculate the amount of interest:

- Interest for the period from 02/12/2020 to 04/26/2020 (73 days): RUB 18,617,087.48. × 6% / 365 days × 74 days = 226,465.39 rub.

- Interest for the period from 04/27/2020 to 05/17/2020 (21 days): RUB 18,617,087.48. × 5.50% / 365 days × 21 days = 58,911.61 rub.

- Interest for the entire period: RUB 226,465.39. + 58,911.61 rub. = 285,377 rub.

Material compensation

Late payment of taxes leads to the accrual of penalties and fines against the taxpayer. Exactly the same measures apply to the Federal Tax Service, which violates the deadlines for transferring deductions. The obligation to compensate for moral damage is specified in paragraph 10 of Art. 78 Tax Code of the Russian Federation.

The amount of compensation is calculated as follows:

Compensation amount = deduction amount*length of delay in days*Central Bank refinancing rate in effect at the time of delay/100%*1/360 days.

The current refinancing rate is 5.5% per annum (from June 15, 2021).

Example. Venediktova received approval for a property deduction for 2019 in the amount of 60,000 rubles. The money was supposed to be transferred to her on May 11, but it was credited only on May 25. What compensation is she entitled to? The payment amount will be as follows: 60,000*14*5.5/100*1/360 = 128 rubles.

Typically, tax authorities do not transfer compensation on their own initiative. Therefore, you will need to declare your rights. Although the payout amounts are not so large, many people solve this problem by “hushing up”.

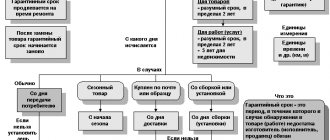

Rules for calculating days of delay

The norm is clause 10 of Art. 78 of the Tax Code of the Russian Federation has not established whether the day of return of the overpayment is included in the calculation of calendar days of delay.

The opinion of the Ministry of Finance of the Russian Federation is contradictory:

- interest is not accrued for this day (letter dated January 14, 2013 No. 03-02-07/1-7);

- the day of return is included in the billing period (letters from the Ministry of Finance of Russia dated 06/08/2015 No. 03-04-07/33140 and the Federal Tax Service of Russia dated 07/01/2015 No. BS-4-11 / [email protected] ).

The Presidium of the Supreme Arbitration Court of the Russian Federation (Resolution No. 11372/13 dated January 21, 2014) is of the opinion that the rules for calculating interest should be uniform, including for those accrued for late return of VAT amounts subject to reimbursement from the budget, and other overpaid (collected) ) taxes. And they are as follows:

- the period of delay is determined by the actual number of calendar days of delay, taking into account the day of actual receipt of funds by the bank, while in accordance with clause 10 of Art. 78 of the Tax Code of the Russian Federation, interest is accrued for each calendar day of delay (violation of the deadline) for the return of the overpayment;

- the calculation is made based on the actual number of days in the year (365 or 366).

[email protected] is given in accordance with the actual number of days in the year (order of the Federal Tax Service of Russia dated September 16, 2016 No. ММВ-7-8/ [email protected] ).

Receiving two social tax deductions for education and treatment at the same time

Example 3

Lvova N.T. received an income of 350,000 rubles in 2021. in StroyKomplekt LLC, from which personal income tax was withheld and paid to the budget in the amount of 43,316 rubles. subject to standard deductions. Last year, she paid for her daughter’s education in the amount of 80 thousand rubles. and expensive treatment of the spouse 540 thousand rubles, included in the list approved by Decree of the Government of Russia dated March 19, 2001 No. 201.

NOTE! SINCE 2021, a new list has been in effect, put into effect by Decree No. 458 dated 04/08/2020. When filing the 3-NDFL declaration for 2021, you need to focus on it.

In this case, there are several options for filling out the declaration, and all of them will lead to the same result.

Option 1:

In 3-NDFL, a citizen of Lvov has the right to reflect a deduction for treatment and education at the same time - it is provided to her by law. That is, she enters:

- in line 100 of Appendix 5, the amount for her daughter’s education is 50 thousand. This is the maximum she can declare;

- in line 110 of the same application - the remaining 300 thousand of her income minus the child deduction provided to her by her employer, i.e. 283,200 rubles. This amount does not cover all the costs of expensive treatment.

Option 2:

Since the amount of an individual’s income is less than the amount of expensive treatment, training expenses may not be shown in 3-NDFL. Line 110 will reflect the maximum deduction amount equal to income minus standard deductions already provided - RUB 333,200.

That is, no matter what option N.T. Lvova chooses to file the declaration, the tax office will return to her only what was transferred from her income during the year - 43,316 rubles.

Example 4

Let’s change the condition as follows: Lvova N.T. paid for her education in 2020 in the amount of 80 thousand rubles. and treatment of the husband, which is not expensive, in the amount of 540 thousand rubles. With such input data, the amount of deductions for training and treatment at the same time will be 120 thousand rubles. 3-NDFL can also be filled out in two different ways:

- fully show the expenses for your education, and indicate the expenses for your husband’s treatment in the amount of 40 thousand rubles. (120 thousand – 80 thousand);

- do not show training expenses, but fully declare a deduction for ordinary treatment in the maximum amount of 120 thousand rubles.

The inspection will return Lvova N.T. 15,600 rubles. for 2021.

Example 5

In example 3, we clarified that personal income tax was withheld from Lvova’s salary, taking into account the standard deductions provided. But what about the situation if she were not provided with them at her place of work, i.e., 45,500 rubles were withheld for a year? Is it possible for her to receive several tax deductions at the same time by filing a 3-NDFL declaration at the end of 2021?

Yes, an individual can exercise this right and claim social and standard tax deductions at the same time. You just need to fill out the declaration correctly. Filling out data on standard deductions occurs in section 1 of the same Appendix 5.

During the year, Lvova’s income did not exceed 350 thousand rubles. This means that she is entitled to a standard deduction for her daughter in the amount of 1,400 rubles for all 12 months. Total: 16,800 rub. If the employer did not provide her with these deductions, then line 070 will remain empty, and Lvova will declare the entire amount in line 080 on the declaration.

Lviv tax authorities will return 45,500 rubles.

By the way, this section is also filled out if standard deductions are received from the employer, but then line 070 would have the figure 16800.

Clarification of the amount of interest by the tax authority

If the tax authority did not pay the interest or paid it in full, it must pay it in addition (clauses 10, 11, 12 of Article 78 of the Tax Code of the Russian Federation).

The additional payment occurs within three days after receiving notification from the Federal Treasury about the date of actual return of the overpayment amount (clause 6, article 6.1, clause 12, article 78 of the Tax Code of the Russian Federation). Next, the inspection makes a decision on the return of interest for the remaining days of delay and sending the order to the Federal Treasury.

Example

The application for the return of the overpaid amount was drawn up on January 26, 2020.

Returns must be made no later than 02/26/2020.

The decision to refund the overpayment was made by the tax authority on April 20, 2020.

The delay amounted to 53 calendar days - from 02/27/2020 to 04/20/2020 inclusive.

The inspectorate calculated the interest for 53 days and on the same day sent a payment order to the Federal Treasury to transfer it to the taxpayer.

On April 25, 2020, the inspection received a notification from the Federal Treasury that the refund of the overpayment and interest payment were made on April 24, 2020.

Therefore, for the period from 04/21/2020 to 04/24/2020 (4 days), the inspection must accrue an additional amount of interest and no later than 04/28/2020 send an order to the Federal Treasury to transfer it to the taxpayer.

Why is the tax office delaying the return of property deductions?

Property deduction is provided to citizens of the Russian Federation in accordance with the provisions of Art. 220 Tax Code of the Russian Federation. It is required when individuals carry out a number of transactions with real estate (including when purchasing land, houses, apartments, for mortgage interest). The essence of the deduction is that the tax authority returns to the taxpayer the income tax withheld from his income for the year in the amount of 13% of the amount of costs of a property transaction (from an amount of up to 2 million rubles for the acquisition of property and up to 3 million rubles for mortgage percent). To receive a deduction, a citizen must submit a 3-NDFL declaration to the Federal Tax Service at the end of the year with a set of documents certifying the right to the deduction and an application for tax refund.

The following objective reasons are possible why tax authorities do not transfer property deductions:

the applicant has a debt for other taxes, so the Federal Tax Service redirects the refund amount to pay off the arrears (this mechanism of action is provided for in clause 6 of Article 78 of the Tax Code of the Russian Federation);

an application for the transfer of tax refund funds was not attached to the declaration;

the application does not indicate bank details for transferring money;

Based on the results of consideration of the documents submitted by the taxpayer, a decision was made to refuse compensation, of which the applicant must be notified in writing.

Transfer deadlines

Receiving a deduction is not a quick procedure. A person needs to collect a lot of documents and fill out a tax return (3-NDFL), and the Federal Tax Service needs to check the accuracy of the information and transfer the money if everything is in order.

If you applied a week ago, there is no need to panic. The inspector is given 3 months for the desk inspection. Often it is done a little earlier, but according to the law, this is how long documents can be studied.

Found an error in your return and submitted a corrected one? Then be prepared that the period allotted for verification will be reset. That is, the countdown must be started from the moment the corrected documents are submitted.

The timing of the transfer of money for tax deductions is established based on:

Deadlines

If, after a desk audit, the tax authority confirms the amount, the transfer occurs as follows:

- When submitting an application for a refund after checking the 3-NDFL declaration, then no later than 1 month (30 calendar days) from the date the tax authority accepted this application;

- If the application was submitted simultaneously with the declaration, you will have to wait 4 months. The first 3 months the declaration is verified, and the last, fourth, the application is verified.

Depending on the situation, it is necessary to count down the specified period, and if the tax office does not pay the money, it is necessary to begin to act, and as soon as possible.

What is important to know

To begin with, it is worth clarifying that the Tax Code does not contain an article providing for the recovery of funds from the taxpayer in reverse order. That is, if the tax office itself, after an audit, returned a certain amount to a person, then it has no right to demand its return.

But there are exceptions. The initial decision to transfer the deduction may be reversed in several cases.

Namely:

- the payer violated the legislation of the Russian Federation (forgery of documents, collusion with the inspector);

- the citizen committed actions with some intent;

- the taxpayer himself made a mistake (included incorrect information in the tax return).

If the specified circumstances occurred, then the Federal Tax Service has the right to request that the overpayment be transferred as a deduction. But it is important to remember that you should respond to any requirements only after an official document is received from the tax office, and not a letter or notice signed by an ordinary employee. In general, this rule applies to all cases. Simply put, both when the tax authorities made a mistake, and when the taxpayer himself provided incorrect information.

Accordingly, it is important to remember that if you receive a call from the Federal Tax Service in which an employee of the designated organization reports that an overpayment was discovered on a previously paid deduction and demands to transfer the money, then there is no need to rush. In this case, you should request an official decision on the need for a refund, signed by the head of the tax office. In addition, the paper must clearly indicate the reasons that prompted the Federal Tax Service to file claims.

But it is not recommended to respond to verbal requests. Because if a mistake is made by the tax authorities, then there is a direct intention to correct their own shortcoming without publicity.

Is it possible to overpay by deduction?

According to the rules, the Federal Tax Service is obliged to thoroughly check the documents and information available in the system before transferring the deduction to the taxpayer. Such actions are considered a guarantee that no errors will be made during the return.

But in reality, there are precedents when, after a certain period of time, the taxpayer receives a call or receives a notification that the deduction previously provided to him turned out to be incorrect. Accordingly, the essence of such a notice is the requirement to return the excess amount back.

And then the person begins to doubt whether it is worth paying attention to such calls at all, whether they are legal, and what to do if the tax office demands a refund of the deduction. In fact, the solution to the problem depends on the accompanying factors. But, as practice shows, most likely the funds will need to be returned.

Desk audit results

Incorrect information or submission of an incomplete package of documents leads to the fact that the deduction is not approved. And it takes time to correct the data, and after that the deadline for the desk audit will begin again. Therefore, it is worth monitoring the status of your application yourself.

According to the law, the tax office itself must notify the applicant of the results of the audit within 15 working days (10 days to make a decision, 5 days to communicate it to the taxpayer, clauses 8 and 9 of Article 78 of the Tax Code of the Russian Federation).

In practice, the application does not always reach the addressee. But you can always find out about the results of the check:

- Calling the Federal Tax Service.

- Through your personal account on the official website of the Federal Tax Service. You will first have to log in to the system. Information about the status of the application will be displayed in tabular form.

The money hasn’t arrived – what should I do?

Let’s say the desk audit ended positively and more than 1 month has passed since its completion, but no money has been received into the account. What to do in this case? Where to contact? You can do this in several ways (any of them or sequentially if the others have no effect).

Receiving oral explanations

The easiest and fastest thing you can do is call the regional office of the Federal Tax Service at your place of residence. You need to contact the debt settlement department. There, most likely, they will simply say that the money is already being transferred. If this is not the case, then the staff will try to send them as soon as possible to avoid further proceedings.

Written appeal to the Federal Tax Service

After the call, the money usually arrives within a week. If after this the funds have not been received, you should contact the head of your Federal Tax Service in writing. The application must indicate:

- when the declaration was submitted;

- for what period and in what amount should the deduction be provided;

- the deadline for receiving notification of a positive decision on return (if it was not received, this must also be indicated);

- date of document preparation;

- on, which violates the tax authority by not fulfilling its obligations.

You can submit an application in person, by mail or directly on the Federal Tax Service website through the “Electronic Services” section. There are options for the most common reasons why citizens apply, for example, non-application of a tax deduction for property tax.

If you want to resolve the issue faster, it is more effective to come with an application to the Federal Tax Service yourself. And be sure to make a claim in two copies - keep the second one with a mark indicating acceptance of the document. When sending a document by mail, use registered mail with notification.

Ways to file a complaint

The applicant can contact the tax office in several ways:

- personal visit to the inspection;

- sending a complaint by mail;

- Submitting an application on the official website of the Federal Tax Service.

When visiting the tax office in person, the application should be prepared in two copies . One copy is handed over to an authorized tax officer, and the second remains in the hands of the applicant with a mark indicating acceptance of the application. It must indicate the date of acceptance of the document, as well as the full name and position of the responsible employee.

The second method is by post . The complaint can be sent by Russian Post, but you should choose a registered letter with return receipt requested. In addition, it would be useful to make an inventory of the contents. When the letter reaches the addressee, the sender will receive a delivery notification by mail. All mail documents must be retained. They are proof that the complaint was sent.

You can complain about violation of the deadlines for receiving a tax deduction on the official website of the Federal Tax Service . To do this, the taxpayer must:

- go to the official website of the Federal Tax Service;

- go to the “Individuals” category;

- from the proposed list, select the item “Filing a complaint to the tax authorities”;

- in the window that opens, you need to click on the option “I want to file a complaint against the actions/inaction of the tax authorities” and log in (register) to your personal account;

- if the applicant does not have a registered personal account on the Federal Tax Service website and does not want to register, then in this case you can select the item “I want to address another issue”;

- in the window that opens, you must select the category to which the applicant belongs: “Individual or individual entrepreneur”, after which the application form will open for filling out.

In the electronic form, you must fill in all required fields and send a request to the inspectorate. The response to the request will be sent to the specified postal address or email.

The applicant has the right to go to court regarding the actions or inaction of authorized persons of the tax service only after appealing the decision of the inspectorate to the Federal Tax Service.

conclusions

Most people simply forget that receiving absolutely all types of income taxes is the legal right of any person who works. That is why you need to very carefully collect all the documents, write the application correctly, and most importantly, intelligently defend your rights.

If complaints have no effect and there is no money, then the most correct solution would be to go to court, but you need to have a lot of evidence. The court is most often on the side of the taxpayer. The most important thing is that a person acts exclusively by legal methods. It is also very important to have accurate evidence of illegal tax actions.

Taxpayer actions

If the apartment deduction is not paid on time, you should do one of the following:

- Call the Federal Tax Service directly, contact the debt settlement department, and ask why the institution is delaying the return of the property deduction. As a rule, this is enough for tax officials to hurry up with the transfers.

- If even after the telephone call the INFS does not return the deduction, a statement of claim is written. The header of the document is drawn up in the approved form, and in the text itself it is necessary to indicate when you submitted the declaration and application, and a positive decision was made.

The second way can be taken immediately by finding out why the tax deduction for the apartment is not transferred. This can be done either in person or through the website. To speed up the process, it is better to go to the tax office yourself and submit an application, receiving in response a mark that it has been accepted for consideration.

If 10 days pass again, and the money is still detained without explanation, it is possible to write a complaint to the central branch of the Federal Tax Service.

Registration of property and investment deductions at the same time

Example 2

Let's take A.B. Petrov's income as a condition for example 2. But let him in 2021:

- bought an apartment for 5 million rubles;

- replenished an individual investment account with 300,000 rubles.

The amount of his income again does not cover all annual expenses, and we remember that property deductions can be transferred, but investment deductions cannot. In this case, Petrov A.B. in the declaration for 2021 will fully show the investment deduction in line 210 of Appendix 5.

And he will partially claim a property deduction, but in the amount of 350 thousand rubles. (650 thousand – 300 thousand).

Thus, after receiving and checking the declaration for 2021 with the IIS deduction and property deduction issued at the same time, the tax office will return 84,500 rubles to Petrov A.B. In the following years, he will need to submit a declaration to continue to return the deduction for the apartment until the entire amount of 260 thousand rubles is selected. The total amount of tax refunded on these two grounds should be 299 thousand rubles.

If you are lazy and do not fill out Appendix 5 for 2021, then the return for the year will still be 84,500 rubles, but in general the individual will lose 13% from 300 thousand rubles, i.e. 39 thousand rubles.

Moral damage

Not all taxpayers know that if the transfer does not occur within the prescribed period, then the tax office is obliged to compensate for the damage incurred. The amount is calculated as follows: the amount of the refund is multiplied by the number of actual days of delay, then multiplied by the Central Bank refinancing rate and the result is divided by 360 days.

In practice, employees of the Federal Tax Service “forget” about this obligation and simply do not charge amounts for damage. However, if the delay was not too long, it does not always make sense to apply for compensation. If the delay was only 10-14 days, then moral damages will amount to about 600 rubles. When you receive it at the end of the year, you will have to report it as income and pay 13%. The fuss associated with the resulting responsibilities due to receiving this damage does not always justify its amount.

It is still recommended to submit a complaint to the Federal Tax Service of your region in person. Also, before filing a claim for an unpaid amount of tax within the prescribed period, you should check the documents confirming that the details have been filled out correctly. Often, taxpayers themselves make mistakes in indicating the current account, and then wait for the receipt to occur.

What do you need to do to receive interest?

If, after 4 months from the date of filing the application and declaration, the refund amount has not been transferred and there have been no notifications from the inspector by mail or telephone, you can safely write a complaint to the tax office, not only demanding to transfer the overpaid tax due to you, but also to pay interest for each day of delay.

If the tax office does not satisfy your demands, you must further defend your rights, but in court.

How to determine the number of days of delay?

You need to start counting from the next day after the expiration of the deadlines established by the state for conducting a desk audit and transferring funds, and up to and including the day the refund amount is received in the taxpayer’s personal account.

EXAMPLE. Sorokin A.V. filed a 3-NDFL declaration along with an application for a property tax deduction in the amount of 97,000 rubles on 03/16/2015. The desk audit ended on 06/16/2015, no notifications were received from the tax office, the deduction should have been transferred by 07/16/2015, but That did not happen. On July 20, 2015, Sorokin wrote a complaint to the tax office demanding that he transfer the overpaid tax and pay interest for the days of delay in returning it. On 07/23/15, the tax inspector called him and said that he needed to bring a copy of the receipt for the transfer of funds. The next day he reported it, and on August 5, 2015, the deduction was transferred to him. Thus, the number of days of delay (from July 17, 2015 to August 5, 2015) was 20 days.

How much interest is calculated?

According to paragraph 10 of Article 78 of the Tax Code of the Russian Federation, the interest rate in this case is equal to the refinancing rate in effect on the days of delay in repayment.

EXAMPLE. In the case of Sorokin, the amount to be returned will be as follows: 97,000 x 8.25% x 1/365 x 20 = 438.49 rubles.

IMPORTANT! Since interest received for late returns is also a tax, do not forget to pay income tax on them in the amount of 13% or offset it in the 3-NDFL declaration next year.