The subsidiary liability of the director and founder of an LLC is an exceptional measure of the mechanism for protecting the rights of creditors. As a general rule, individuals are not liable with their property for the debts of the enterprise. However, this does not apply to situations where the financial insolvency of the company was the result of unlawful or dishonest actions of managers. The initiators of such lawsuits are tax authorities, arbitration managers or creditors. Statistics show an increase in the number of positive court decisions in this category of cases. Legal provides professional legal support to persons controlling the debtor to prevent negative consequences, protection from administrative and criminal liability. We provide comprehensive advice on how to bring the founder to subsidiary liability and how to avoid such a scenario, provide practical assistance, and provide comprehensive support for the bankruptcy procedure.

Instead of a preface

Industrial capitalism owes its flourishing to the emergence of LLCs and joint-stock companies... in their modern understanding. More precisely, “limited liability” within the authorized or share capital. Until the end of the 19th century, an entrepreneur (the owner of capital in Marx’s interpretation) bore full responsibility for the obligations of the enterprise and almost went to debtor’s prison. Therefore, factories with 20-30 people were considered huge.

The need for consolidated investments in new, ever-expanding businesses and the emergence of a plurality of co-owners also required legal instruments in the form of limited risks for the entrepreneur.

Following LLC and JSC, bankruptcy legislation has also improved. By the beginning of the 20th century, rules were universally introduced to write off most debts by creditors as part of bankruptcy.

In Russia, as always, the path is special. Over the past few years, the law has stubbornly followed the path of tightening the liability of company managers and founders. Including in bankruptcy.

As of 2021, the range of tools for punishing losers is huge and cool at the same time, which will certainly lead to the extinction of entrepreneurial activity among small and middle-aged people.

Think about it: over the past 10 years, the cost of entering a business for a new entrepreneur has increased 100 times! since risks in the ruble equivalent of potential liability should also be considered as an initial investment in the business.

We agree that an entrepreneur should behave reasonably. Yes, this is an activity at his own risk. But an entrepreneur cannot and should not be held responsible for the double deliberate devaluation of the ruble, for example... and even more so for the subsequent massive withdrawals of loans by banks. He cannot be held responsible for the end-to-end system of big business kickbacks.

For twenty years of condoning the almost universal use of “fly-by-night money” (including as a consequence of the end-to-end system of kickbacks), and then for a sharp change in the rules of the game - from tax rules to lending conditions.

An entrepreneur bears risks at least in that he spends part of his life, health, family well-being in every sense... and runs the risk of not earning anything at the same time, unlike his hired employees. For the delay in paying the salary for which he also bears criminal liability, and for trying to pay the salary in a difficult situation, even out of good intentions, to the detriment of tax obligations and creditors, he will be held accountable twice, or even three times... The circle is closed.

However, you are already in trouble running and/or owning a business. Let's break it all down.

Responsibility for violation of current legislation

Subject: head of the organization Responsibility: administrative, criminal What is provided for: Code of Administrative Offenses of the Russian Federation, Criminal Code of the Russian Federation

Boundless as the ocean, Russian legislation contains a huge number of standards, rules, orders and procedures, for violation of which not only the legal entities themselves, but also their leaders are brought to administrative and, if the result of the act is more disastrous, to criminal liability.

You didn’t return or issue a cash receipt to the buyer, you didn’t notify the relevant authority about the conclusion of an employment contract with a migrant, you violated the deadline for notifying the company’s founder about an extraordinary meeting of the company’s participants - you will receive a fine, both for this company itself and for its director. It is better to familiarize yourself with specific risks in advance, depending on the field of activity, by reading the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation at your leisure. The fines can be significant. The saddest thing: disqualification of the leader and, of course, imprisonment.

As for criminal liability specifically for tax crimes (Articles 198, 199, 199.1, 199.2, 199.3, 199.4 of the Criminal Code of the Russian Federation), there are several nuances.

In 2021, the threshold for criminal prosecution for tax evasion has been significantly increased. Up to 900 thousand rubles for individuals. And up to 5 million rubles for legal entities. In the media at that time this was called the clever word “decriminalization of the act.” However, the average amount of additional charges for one on-site tax audit was more than 7 million rubles in Russia. That is, any average tax audit gave grounds for initiating a criminal case (of course, if the taxpayer did not pay the inspection’s demand).

Now a similar marketing ploy is being launched again, aimed at “further creating conditions for creating a favorable business climate in the country.” It is planned to adopt amendments establishing new thresholds for criminal liability: 2.7 million for individuals; 15 million for legal entities. At the same time, the average amount of additional charges per GNP is 22 million rubles.

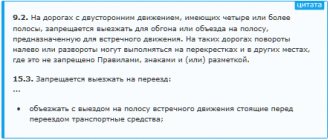

Special emphasis on Art. 199.2 of the Criminal Code - concealment of property from tax collection. Dashing business owners or managers, sensing something is wrong and holding in their hands a just-delivered tax decision to order an on-site audit, are feverishly looking for a way to withdraw money or property from potential collection. But in vain. This crime is very formal. It is relatively easy to prove. The fact of transferring money, alienating property and even directing proceeds bypassing the potential debtor directly to suppliers and contractors is a crime. Of course, if its cost starts from 2.25 million rubles.

There is no criminal liability for non-payment of social contributions, despite the fact that they have become Chapter 34 of the Tax Code. The corresponding bill lay in the Duma and turned sour. Apparently there will be a new one. Because it will definitely become a crime.

Is it somehow possible to shift responsibility to the person who worked under the individual entrepreneur?

It will not be possible to transfer the debt for insurance premiums to the actual owner. Contributions go to individual accounts in the Pension Fund and the Health Insurance Fund. Then, from this money (even if it is forcibly taken away by the tax authorities), the person will receive a pension and medical care under the policy.

There is a small chance of not paying under the contracts. You can also file a police report against the actual owner of the business if he cheated. We will outline each possibility. But you need to discuss your situation with a lawyer.

Agreements that the individual entrepreneur did not sign

An individual entrepreneur is not obliged to pay under contracts that he did not sign. This can happen when the actual owner of the business forged a signature, and did not call the individual entrepreneur every time to sign the agreement. For example, I bought goods in installments and signed the delivery agreement and invoices imitating the signature of an individual entrepreneur.

If the counterparty sues the individual entrepreneur for a debt from such an agreement, you must ask the court for a handwriting examination. Experts will write a conclusion that this signature is not an individual entrepreneur, and the court will not collect the debt.

Agreements for which the individual entrepreneur did not issue a power of attorney

It often happens that the actual owner of a business conducts business on behalf of a fake individual entrepreneur by proxy. It states what transactions he can enter into.

If the representative has concluded agreements that are not included in the power of attorney, he himself will pay for them - Art. 183 Civil Code of the Russian Federation. For example, an individual entrepreneur issued a power of attorney for the purchase of building materials for 100,000 rubles. And the representative bought goods in installments for a million and did not pay.

If a supplier in court asks an individual entrepreneur for a million, it must be said that the representative went beyond his authority. Then the debt will be transferred to the representative.

Fraud Claim

If a person has been deceived by a fake individual entrepreneur, you can file a fraud report with the police. The chance that a criminal case will be opened against the business owner and imprisoned is small. If a person filed an application with the tax office, signed contracts and withdrew money from accounts for interest, investigators are unlikely to see the fraud. But it's worth a try.

If investigators prove fraud, then the business owner can recover the lost money, in addition to insurance premiums for himself. This is called a civil claim in a criminal trial. But once again, the chances are slim. And you can’t do it without working closely with a lawyer.