Starting from 2021, the procedure for withholding income tax when an employee goes on vacation has changed. Considering that the employer acts as a tax agent in this case, it is worth figuring out how to withhold personal income tax from vacation pay, when to pay to the budget in 2021, and what date is recognized as the moment of receipt of income.

Guarantees of labor legislation upon dismissal

Provisions of Art.

140 of the Labor Code of the Russian Federation prescribe the payment of all amounts due to the employee (including earnings, compensation for unused vacation, severance pay, and other amounts) on the day of his dismissal. If the employee was absent from work on this day, then he must be paid the next day after he submits an application for final payment. Upon personal application, an employee can take off unused vacation and only then resign. In this case, the last day of vacation is the day of dismissal (Articles 84.1 and 127 of the Labor Code of the Russian Federation).

What you need to know about unused vacation, so as not to receive a last-minute refusal from the employer, can be read in the article “How to properly arrange vacation followed by dismissal?” .

In the latter version, the settlement standards with the employee are slightly different. So, in a situation with a vacation and subsequent dismissal, the final payment must be made before the employee goes on vacation, that is, on the last working day before him (since after the end of the vacation the parties will no longer be connected by any relations). This position is adhered to by Rostrud (letter dated December 24, 2007 No. 5277-6-1). A similar conclusion is contained in the definition of the Constitutional Court of the Russian Federation dated January 25, 2007 No. 131-O. The exception is payment for the vacation itself, which should be made in the usual manner: no later than 3 days before its start.

Important to consider! Recommendation from ConsultantPlus: For untimely payment to an employee upon dismissal, there is, in particular, administrative, financial and even criminal liability.

To find out in what specific cases you may be held liable for what type of liability, see K+ by receiving trial demo access to the system. It's free.

Managers also quit

And, accordingly, they have the right to an honestly deserved severance pay, but only on the condition that there are no illegal actions on their account or they did not make decisions that negatively affected the finances of the enterprise. In what cases are labor benefits accrued to top managers:

- if they are removed from office by the decision of the founders without any guilt (clause 2 of Article 278 of the Labor Code of the Russian Federation);

- the boss, his deputy, the chief accountant, whom the new owner of the business decided to fire.

FOR YOUR INFORMATION! If, by a court decision, a person (whether a manager or an ordinary employee) has been prohibited from engaging in certain types of activities, then, upon leaving this position, he also has the right to a “severance” payment.

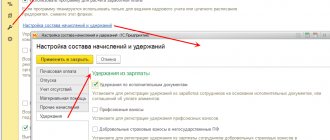

Basics of reflecting information in 6-NDFL, including calculations upon dismissal

From reporting for the 1st quarter of 2021, the form was updated by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11 / [email protected] Now the 6-NDFL form includes information from the 2-NDFL certificate for each employee, because 2-NDFL certificates, as an independent report, have been canceled since 2021. And our usual form of 6-personal income tax has changed a lot.

Use the 6-NDFL sample for the 3rd quarter/9 months of 2021, compiled by ConsultantPlus experts, and check whether you filled out everything correctly. This can be done for free by getting trial online access to the system.

The current 6-NDFL form can be downloaded here.

In order not to get confused about the deadlines for fulfilling the duties of a tax agent for numerous types of income payments to employees and to accurately fill out the form, the accountant must be well versed in the Tax Code, namely in the part devoted to personal income tax (hereinafter referred to as income tax f/l).

We will try to create a cheat sheet on the timing of withholding and transfer of income tax for the most common cases.

Table of income correspondence to the moment of occurrence of obligations to the budget

| Income received | Date of receipt of income (Articles 223, 217 of the Tax Code of the Russian Federation) | Deadline for transferring income tax f/l (clause 6 of article 226, 226.1 of the Tax Code of the Russian Federation) |

In the form of wages:

| Last day of the month | No later than the day following the day of payment of income |

In cash:

| Day of payment of income (including to the employee’s bank account or, by his order, to the accounts of other persons) | |

In cash:

| Last day of the month in which the payment was made | |

Upon termination of the employment contract before the end of the month, including:

| Employee's last day of work | No later than the day following the day of payment of income (the Tax Code does not contain a special procedure for this type of payment, so the general principle applies) |

In the case of payment of income that has the same actual receipt date, but different tax payment deadlines, the data in section 1 of the calculation is filled out separately for each personal income tax payment deadline (letter of the Federal Tax Service dated May 11, 2016 No. BS-4-11/8312).

IMPORTANT! Page 021 reflects the date no later than which the tax agent must fulfill the obligation to transfer the amount of tax in accordance with the Tax Code of the Russian Federation, and not the date of the actual transfer of the tax. Moreover, if the final date for the transfer of income tax falls on a weekend or holiday, then it is postponed to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

Also read about the features of tax transfer in this article.

Income that is completely exempt from taxation is not reflected in the calculation using Form 6-NDFL.

Here, in fact, are all the basic rules for filling out 6-NDFL.

How to reflect payments to a dismissed employee in 6-NDFL

Now let's talk about how to reflect the dismissal of an employee in 6-NDFL. At the same time, we will complicate the situation by allowing the employee to receive not only salary, but also other payments due upon dismissal, incl. severance pay and average earnings for the 2nd and 3rd months after dismissal, exceeding the non-taxable limit.

Note! Cases of payment of severance pay are strictly limited by the Labor Code of the Russian Federation. In our material, under the term “severance pay” we generalize any compensation upon dismissal, incl. upon dismissal by agreement of the parties.

There are no explanations about the differences in the principles of reflecting in form 6-NDFL the amounts due to an employee upon dismissal, attributable to wages, as well as other income.

If you follow the law literally, the date of actual receipt of income is:

- the last day of work, if we are talking about salary payments upon dismissal;

- day of payment of income - for other income received in cash upon dismissal.

For each type of payment, a separate block is filled in section 2.

We decided on this. Now let's look at non-taxable amounts.

Amounts of severance pay and cf. earnings for the 2nd and 3rd months after dismissal, not exceeding in general 3 times the average monthly earnings (6 times for workers in the northern regions), are not subject to income tax (paragraph 8, paragraph 3, art. 217 of the Tax Code of the Russian Federation). Since there are no deduction codes for these non-taxable amounts in Order No. ММВ-7-11/ [email protected] , only the amount in excess of the payment over the non-taxable part will be included in the calculation.

Thus, the calculation reflects:

- salary,

- compensation for unused vacation,

Read about its calculation in the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation.”

- severance pay and cf. earnings exceeding the limit.

Concept and rates of income tax in 2021

Income tax (NDFL) is a tax paid on income received by all residents and non-residents of Russia. The tax agent, i.e., calculates, withholds and transfers income tax from wages. person paying the income.

Almost all income of a physicist is subject to taxation:

- wage;

- bonuses, allowances;

- remuneration received as part of the execution of civil contracts;

- winnings;

- income received in kind, etc.

Income tax rates depend on the status of an individual and the type of income:

| Tax rate | It applies to: |

| 13% |

|

| 15% | dividends paid to non-residents |

| 30% | income from securities of Russian companies |

| 35% |

|

Filling out 6-NDFL upon dismissal (example)

Let's look at a specific example of entering information into the calculation when an employee receives the most possible dismissal payments.

Example

The employee went on vacation from 01/14/2021 to 01/28/2021. On the eve of his vacation, he wrote a letter of resignation effective January 29, 2021. He is also entitled to vacation pay in the amount of 20,000 rubles. and severance pay in the amount of 23,000 rubles. (exceeding the non-taxable limit). Vacation pay was received by the employee on January 11, 2021, and the income tax was transferred to the employee on the next day. Severance pay was issued only on January 29, 2021. The next day, i.e. 01/30/2021, fell on a non-working Saturday, which means the tax payment deadline was postponed to 02/01/2021. On this day, the income tax was paid in full.

This employee is not entitled to compensation for vacation, so in this example of calculating 6-NDFL it will not be available. But you can find explanations on this issue in the article “Form 6-NDFL - compensation for unused vacation.”

6-NDFL calculation upon dismissal (section 2)

| Report position | date |

| Vacation pay | |

| 021 | 01.02.2021 |

| 022 | 2 600 |

| Severance pay in 6-NDFL in the part exceeding the limit | |

| 021 | 01.02.2021 |

| 022 | 2 990 |

Since the tax payment deadline for both payments falls on 02/01/2021, personal income tax amounts can be combined into one line 022.

IMPORTANT! If an employee goes on vacation with the condition of subsequent dismissal, income tax on vacation pay is paid no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). This is in contrast to the tax on other dismissal payments - it is transferred the next day after the payment of income to the employee (letter of the Federal Tax Service dated May 11, 2016 No. BS-3-11 / [email protected] ).

General rules for issuing vacation pay

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

- Duration of vacation.

- Average employee salary.

- The period for which the calculation is performed.

The amount of the employee's salary is used to calculate the tax. This amount includes bonuses and various compensations issued for the year preceding the vacation.

IMPORTANT! Both budgetary structures and commercial enterprises and individual entrepreneurs are required to provide annual paid leave to their employees. The amount of vacation pay is calculated based on the official salary.

Results

Form 6-NDFL when dismissing an employee is filled out taking into account the nuances of determining the dates of payments accompanying such dismissal. The latter include:

- compensation for unused vacation;

- vacation pay for vacation taken immediately before dismissal;

- severance pay upon dismissal in the amount exceeding the non-taxable limit.

The determination of dates related to these payments is subject to the general rules contained in the Tax Code of the Russian Federation.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.