The scheme for calculating property tax has not changed for the last 20 years: the basis was the inventory value. Since 2021, changes have occurred: in all regions of the Russian Federation, the transition to using cadastral value as a tax base has been completed. Now the amount is determined based on the cadastral value of the property.

Pavel Vanyashin, head of the property tax department of the Federal Tax Service for the Sverdlovsk region, told E1.RU that experts calculated property taxes for 2020 to be 30% less than a year earlier.

“The total amount of assessed taxes has decreased. At the same time, the number of people who paid tax increased by 10%. <…> On average, the amount of tax per payer has become less than in 2019,” he emphasized.

Checking tax debt: who needs it?

It is advisable for all taxpayers to check their tax arrears from time to time.

However, this procedure is more relevant specifically for individuals. Organizations calculate all taxes themselves, which means they must be aware of their tax obligations. “Physicists” in most cases do not participate in tax calculations. Property taxes are calculated for them by the inspectorate, and personal income tax is calculated by the employer. That's why sometimes tax debt comes as a surprise to them. We will tell you further about how to find out the tax debt of individuals.

What tax debt can be checked?

I love it. You can check your tax debt using your TIN:

- according to personal income tax;

- transport tax;

See also the article “How to find out the transport tax debt?” .

- property tax for individuals (for example, an apartment);

- land tax.

See the article “How to find out land tax debt?” .

In this case, you can find out the amount of current and overdue debt, as well as the amount of penalties and fines, if any.

ConsultantPlus experts explained in detail what actions the inspectorate can take if it reveals a tax arrears. Get trial access to the K+ system and upgrade to the Ready Solution for free.

Contact the tax office: long, but true

An individual or a representative of an organization can check the status of settlements with the budget at the Federal Tax Service: to do this, contact a tax inspector in person on a first-come, first-served basis. To do this, you will need to bring your passport with you. To obtain data on paper, request one of the following documents:

- a certificate of fulfillment of the obligation to pay taxes (done within 5 days - clause 10, clause 1, article 32 of the Tax Code of the Russian Federation), if information about tax debt without specifying the amount is required;

- a certificate on the status of settlements (done within 10 days - clause 10, clause 1, article 32 of the Tax Code of the Russian Federation) to find out the amount of non-payment of a specific tax;

- act of joint reconciliation of settlements (done within 1 day - clause 11, clause 1, article 32 of the Tax Code of the Russian Federation), if information is needed on the status of settlements for all taxes.

It is easy for an individual or legal entity to find out the debt at the tax office during a personal visit, but it will take time, and time means money. Internet resources can speed up the process. For example, individual entrepreneurs and organizations using telecommunication channels can order the above documents via the Internet.

How to find out if an individual has tax debts

Firstly, you can find out your tax debt online:

- in the taxpayer’s personal account;

- through the government services portal.

Secondly, this can be done by personally visiting your Federal Tax Service.

And information about tax debts that are in the process of collection can be obtained on the website of the bailiff service.

Note that in any case, this is a check of tax debt according to the TIN. So every taxpayer needs to know their identification number.

A way to find out tax debt on the official website of the Tax Service of the Russian Federation by TIN

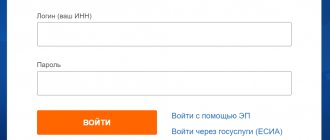

Currently, you can find out tax debt on the website of the Federal Tax Service of Russia only through the taxpayer’s personal account (PA), which is available at the link https://lk2.service.nalog.ru/lk/.

To do this, you need to register and gain access to your personal account. It is possible:

- by login and password received from any Federal Tax Service (you need a passport and a certificate of TIN assignment or a copy thereof);

- using a qualified electronic signature / universal electronic card (a qualified electronic signature verification key certificate is issued by a certification center accredited by the Ministry of Telecom and Mass Communications of Russia);

- using the access credentials used for authorization on the Unified Portal of State and Municipal Services, but only if you received them personally from the ESIA operators (at the Russian Post Office, MFC, etc.).

By logging into your personal account, you will see not only your tax debt, but also your entire tax history, including information on income and personal income tax filed for you by your tax agents (for example, your employer) for 3 years.

To find out whether an individual’s TIN must be included in his income certificate, read the material “The absence of an individual’s TIN in 2-NDFL is not a reason for a fine.”

Tax base, property tax rates and benefits

The tax base for property tax for individuals is determined based on the cadastral value of the object, with the exception of those constituent entities of the Russian Federation where a law has not yet been adopted establishing a single start date for determining the tax base for property tax for individuals based on the cadastral value of taxable objects.

In such regions, the tax base is determined for each taxable item as its inventory value, calculated taking into account the deflator coefficient based on the latest data on inventory value submitted in the prescribed manner to the tax authorities before March 1, 2013.

As of 2021, laws have not been adopted on determining the tax base for the property of individuals, based on cadastral value, in the following regions: Altai Republic, Dagestan Republic, Krasnoyarsk Territory, Primorsky Territory, Volgograd Region, Irkutsk Region, Kurgan Region, Tomsk Region, Republic of Crimea, Sevastopol.

Starting from January 1, 2021, the tax base for real estate tax for individuals is not determined based on the inventory value of real estate, even if a constituent entity of the Russian Federation has not adopted the corresponding law. Thus, the procedure for determining the tax base based on cadastral value will be in effect from January 1, 2021 throughout the Russian Federation, without exceptions.

Property tax rates

Tax rates are established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol).

In constituent entities of the Russian Federation that apply the procedure for determining the tax base based on the cadastral value of real estate, rates are set in amounts not exceeding the following values: - tax rate 0.1%

for residential buildings, parts of residential buildings, apartments, parts of apartments, rooms, garages and parking spaces;

economic buildings or structures, the area of each of which does not exceed 50 square meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction; — tax rate 2%

In relation to taxable objects included in the list determined in accordance with paragraph 7 of Article 378.2 of the Code, in relation to taxable objects provided for in paragraph two of paragraph 10 of Article 378.2 of the Code, as well as in relation to taxable objects, the cadastral value of each of which exceeds 300 million rubles

- tax rate 0.5%

Other objects of taxation

For objects that fall under the base rate of 0.1% of the cadastral value, tax rates can be reduced to zero or increased, but not more than three times, by regulatory legal acts of representative bodies of municipalities (laws of federal cities of Moscow, St. Petersburg and Sevastopol)

For example, in Moscow, tax rates on property of individuals (apartment, room, residential building) are differentiated depending on the cadastral value: - 0.1% - up to 10 million rubles. — 0.15% — from 10 to 20 million rubles. — 0.2% — from 20 to 50 million rubles. — 0.3% — from 50 to 300 million rubles. For any real estate with a cadastral value of more than 300 million rubles. a tax rate of 2% applies. You can find out tax rates in any region of the Russian Federation on the tax service website. It is necessary to select the type of tax, in this case – personal property tax, tax period and region. As a result, detailed information about rates in a specific region will be displayed.

Benefits for property tax for individuals

15 categories of taxpayers have the right to federal benefits, among them the following: pensioners, disabled people of groups I and II, as well as disabled children, participants of the Second World War and other military operations, heroes of the USSR and the Russian Federation, military personnel (the full list of preferential categories is indicated on the tax website services).

Tax benefits are provided for the following types of real estate:

- apartment, part of an apartment or room;

- residential building or part of a residential building;

- premises or structures specified in subparagraph 14 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- economic building or structure specified in subparagraph 15 of paragraph 1 of Article 407 of the Tax Code of the Russian Federation;

- garage or parking space.

Tax benefits are provided in respect of one taxable object of each type

at the choice of the taxpayer, regardless of the number of grounds for applying tax benefits. This point requires a separate explanation. For example, a pensioner owns two apartments, one house and one garage. In this case, only one apartment is subject to taxation, i.e. an apartment, a residential building and a garage are different types of taxable objects.

The tax benefit does not apply to real estate used by the taxpayer in business activities.

The taxpayer must independently notify the Federal Tax Service that he has a benefit.

If the taxpayer-owner of several real estate objects of the same type fails to provide notice of the selected taxable object, a tax benefit is provided in respect of one taxable object of each type with the maximum calculated tax amount.

In addition to benefits at the federal level, there are regional (local) benefits. Information about all types of benefits can be found by contacting the tax authorities or the contact center of the Federal Tax Service of Russia.

Tax deductions for personal property tax

In those regions of the Russian Federation where the tax base is calculated based on the cadastral value of real estate, the following tax deductions are applied when calculating the tax:

- for an apartment

, part of a residential building, the cadastral value is reduced by the cadastral value of

20 square meters

of the total area of this apartment, part of a residential building; - for a room

, part of an apartment, the cadastral value is reduced by the cadastral value of

10 square meters

of the total area of this room, part of an apartment; - for a residential building,

the cadastral value is reduced by the cadastral value of

50 square meters

of the total area of this residential building (at the same time, for tax purposes, houses and residential buildings located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, gardening, individual housing construction , refer to residential buildings);

Municipal authorities (legislative bodies of state power of the federal cities of Moscow, St. Petersburg and Sevastopol) have the right to increase the amount of deductions provided for by the Tax Code.

Checking tax debt by last name on the bailiffs website

You can also find out from tax bailiffs about tax debts, the collection of which is at the stage of enforcement proceedings. For this purpose, the FSSP website https://fssprus.ru/ operates a special service “Find out about debts”. The search for enforcement proceedings is carried out by full name and date of birth.

By the way, here you can get information not only about tax debts, but also about other enforcement proceedings, in particular regarding the collection of administrative fines.

How to pay property tax

After you have found information about property tax, you need to know how to pay it without leaving your home. To do this, go through the following steps:

- Go to the portal www.gosuslugi.ru.

- Authenticate by entering your username and password.

- Search for tax debts through the Authorities.

- If information about the debt appears, then in the Payments category, click “Pay.”

- You can make payment “By receipt” by indicating the UIN.

- In the window that opens, select the payment method:

- bank card;

- online wallet;

- using a mobile phone.

- Enter all requested details and confirm the payment.

- Wait for the payment to be credited.

A simpler method to go through this procedure is simply on the main page of the site by clicking the Pay button, which is located at the top. Then a window will also open for entering data and making a payment.

It happens that after payment the debt may still be displayed. This is because the payment has not yet been credited by the tax office.

Information can be transmitted to the Federal Tax Service within about 10 working days. If, after this period, the debt is still listed, then contact the tax office directly. But all receipts are saved in the payment history for all time.

Results

The issue of determining the presence and volume of tax debts is of interest to individuals, in contrast to legal entities and individual entrepreneurs, who do not have reasons for frequent interaction with the Federal Tax Service on this matter.

There are many ways to obtain such information. It can be found in your personal account on the websites of the Federal Tax Service or government services, in the Federal Tax Service itself, as well as in the bailiff service (if debts are already at the stage of forced collection). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.