Grounds for calculating alimony

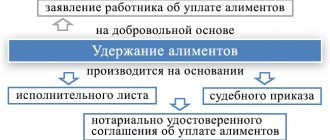

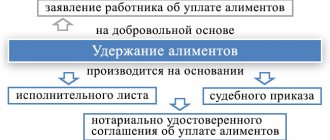

Equal rights for the maintenance and financial support of common children for parents are established by Art. 80 IC RF. The spouse or former spouse with whom the child lives has the right to collect alimony from the other party in any of the following ways:

- Performance list. This is relevant if the father refuses to pay the money voluntarily, but attempts to conclude a child support agreement before going to court are not necessary. The result of the consideration of the case is the issuance of a writ of execution (IL).

- Agreement on payment of alimony. It is drawn up between the parties by mutual agreement.

- Court order. The claimant submits an application for an order to the court, and after 5 days he receives the finished document in his hands.

The basis for collecting alimony payments is the existence of an agreement, IL or court order. The claimant has the right to submit any of the submitted documents to the organization at the place of employment of the alimony obligee or to bailiffs.

When providing IL for an enterprise, alimony is withheld by the accountant monthly within 3 days after the salary is calculated by sending a payment order to the bank.

If the IL is sent to the bailiff, he has the right to transfer it to the debtor’s place of employment or take any coercive measures:

- seizure of bank accounts;

- restriction of the right to drive vehicles;

- property search;

- ban on leaving the Russian Federation.

A copy of the IL is always sent to the person obligated to pay alimony. If he pays the funds in good faith, the claimant does not have to transfer it to the FSSP, but this right remains with him.

Documenting alimony payments: nuances

In order to effectively record obligations within the framework of enforcement proceedings, it makes sense for the employer to use separate accounting documents.

For the purposes under consideration, the employer may use:

1. Book of registration of writs of execution.

The fact is that for the loss of a writ of execution, an official of the employing company can be fined up to 2,500 rubles. (Article 431 of the Code of Civil Procedure of the Russian Federation). Therefore, the employer needs to appoint someone responsible for storing such documents and oblige him to use a special accounting book.

Writs of execution must be kept for 5 years, but not less than the period during which alimony payments are made, as well as another 3 years after the expiration of this period (Clause 1, Article 29 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, Clause 4 of Article 21 of Law 229-FZ).

2. Journal of alimony payments.

It makes sense to use such a document in order to generally improve the efficiency of accounting for transfers to an employee. The journal can classify such payments in various ways (for example, by the recipient’s marital status, by the method of calculating alimony - in a flat amount or as a percentage of earnings).

3. A form for notifying bailiffs about the fact of the debtor’s dismissal (and about his new place of work - if information about him is available).

The procedure for applying the first 2 documents should be fixed in the company’s accounting policy (clause 4 of PBU 1/2008).

On what income is alimony calculated?

The list of types of earnings of payers from whom alimony is withheld is approved by Decree of the Government of the Russian Federation No. 841. It includes the following:

- remuneration for work at the main place and part-time;

- allowances, salaries;

- fees;

- payments in foreign currency or in kind;

- bonuses and allowances established by the enterprise’s wage system;

- vacation pay;

- awards for professional achievements;

- additional pay for working on weekends and overtime;

- compensation for work in harmful or dangerous conditions;

- old age or disability pensions;

- scholarship;

- sick leave;

- unemployment benefit;

- any payments in case of staff reduction or liquidation of an organization;

- income of individual entrepreneurs from business activities;

- earnings from dividends and shares;

- rations (food expenses);

- compensation for damage to health.

Also, maintenance funds are accrued from earnings received from the contract for the provision of services.

Details of the income from which alimony is withheld.

What income is not subject to alimony?

The exception is the types of income from which deduction is not made:

- compensation for harm due to the loss of a breadwinner;

- maternity capital and other government payments;

- travel expenses, compensation in connection with moving to another area for work, using personal tools in work activities;

- compensation for injuries received while performing official duties;

- compensation in connection with death;

- state and regional payments at the birth of a child;

- insurance payments;

- financial assistance for funerals;

- alimony received by the alimony obligee;

- reimbursement of costs for trips to sanatoriums in the Russian Federation.

It will not be possible to recover funds from the inheritance, gifts or government payments received by the alimony payer.

Statement of claim for collection of child support

Amount of child support for one child in 2021

Has paternity been established?

Alimony is collected by the court only directly from the child’s parent; the fact of paternity (maternity) must be recorded in the birth certificate. If the alleged alimony debtor is not the father of the child “on paper”, in order to collect alimony it will also be necessary to establish his paternity in court.

The presence or absence of marriage between the parents of a minor does not matter; alimony can be collected even if you are in a marital relationship with the defendant.

Amount and form of alimony

The form of payment is determined by the claimant and established by the court. There are three types:

| Share | For one child 25% is paid, for two – 33%, for three or more – 50% |

| Fixed size | It is established according to PM in the region when it is not possible to clarify the exact amount of the payer’s earnings, in the absence of employment or receiving a salary in foreign currency (Article 83 of the RF IC) |

| Mixed | Combines the two forms above. Relevant if the person obligated for alimony has both a stable and “floating” income |

When collecting alimony as a share of the salary, the amount depends on the payer’s earnings and the number of children.

If alimony is collected in a fixed sum of money (TDS), the cost of living and the financial situation of both parties are taken into account.

The above is only relevant when claiming through court. When establishing alimony obligations by agreement, the parties independently determine the form, amount and procedure for payment.

Who is responsible for calculating and withholding alimony from wages?

This is the responsibility of the employer. As a rule, the accounting department deals with the calculations. Alimony is calculated and withheld once a month (for the previous month worked). They must be transferred within three days after the alimony payer’s salary is calculated (Article No. 109 of the RF IC). You cannot pay alimony in advance.

If the alimony payer does not work and does not pay himself, alimony is collected by bailiffs (FSPP). Bailiffs use all legal means available to them to do this.

From when does alimony begin?

Child support is calculated from the date the claim is filed in court, regardless of the duration of the proceedings.

By agreement, the parties independently determine the date of occurrence of alimony obligations. When payments from various incomes are transferred:

- salary, allowance, other types of remuneration and sick leave: within three working days from the date of payment;

- income from business activities, profit from winning the lottery: within the period specified in the IL.

If the drawn up agreement was not submitted to the organization at the place of employment, the date of transfer of the salary to the alimony obligee does not matter: he must pay the money within the period established by agreement.

When submitting a document to a company, accountants are guided by a three-day period (Article 109 of the RF IC).

Remember

- The parent who lives separately from the child is required to pay child support.

- Neither lack of work nor the state of health of the payer relieves the obligation. Civil servants, the unemployed, entrepreneurs and the disabled - everyone must pay alimony.

- Payments can be established by agreement, court order or writ of execution.

- The agreement is concluded voluntarily and certified by a notary. If the father does not voluntarily pay according to the agreement, then it can be handed over to the bailiffs so that alimony is withheld forcibly.

- A court order is issued at the mother’s request by the court district at the father’s place of residence within 5 days from the date of application.

- A writ of execution is issued on the basis of a court decision after it enters into legal force.

- The amount of alimony depends on the agreement of the parents, the father’s income, the level of the child’s needs, the cost of living for the child in the region and in the Russian Federation, as well as on indexation.

Video for dessert: 10 Most Unequal Fights in Sports History

How is alimony calculated?

The obligation to calculate alimony when transferring personal income at the place of work rests with the accountant.

There are several features here:

- The calculation takes into account income received after the date specified in the IL.

- Withholding is made after deduction of personal income tax.

- If the employee uses a tax deduction, the full amount of earnings is taken into account.

Example calculated for 1 child:

For one child, R. N. Martynov pays 25% of income. IL has been transferred to the accounting department. In July, the payer earned 50,000 rubles.

50,000 x 13% = 6,500 rub. – Personal income tax.

50,000 – 6500 = 43,500 rub. – “clean” salary.

43,500 x 25% = 10,875 rub. – alimony.

43,500 – 10,875 = 32,625 rubles. - the total is in the hands of the person obligated to pay alimony.

Example of withholding alimony from an individual entrepreneur:

S.V. Averyanov transferred 25,000 rubles for two children. monthly. The payer is an individual entrepreneur, alimony is collected in a fixed amount. The amount of his income does not affect payments, so he must transfer money even in the absence of earnings.

Example of retention in mixed form:

Vyrovskaya O.N. filed a claim for the recovery of mixed alimony for two children: 33% of earnings and 5,000 rubles. from the income received by the payer from renting out housing for 15,000 rubles. monthly. The claim was satisfied.

In a month, the person obligated for alimony officially earned 70,000 rubles. How is the calculation done:

70,000 x 13% = 9100 – personal income tax.

70,000 – 9100 = 60,900 rub. - “net” earnings.

60,900 x 33% = 20,097 rub. – alimony.

20,097 + 5,000 = 25,097 rub. – the total amount of alimony payments.

60,900 + 15,000 = 75,900 rub. – the debtor’s earnings excluding alimony.

75,900 – 25,097 – 5,000 = 45,803 rubles. – income after payment.

Calculation of child support if the father is unemployed

Based on Art. 83 of the RF IC, the recipient has the right to recover payments in a fixed amount if the ex-spouse does not have a job or is unofficially employed. When the payer registers with the Employment Center, payments are deducted from the unemployment benefit as a percentage.

When alimony debt arises, the amount to be paid is determined by the bailiff based on the average earnings in the Russian Federation.

Case study:

By a court decision, the man was ordered to pay 25% of his income. A few months later he quit and stopped paying child support. The recipient submitted an application to the bailiff to determine the debt, which was calculated from the average salary in the country - 35,000 rubles.

The calculation was made for 3 months of non-payment.

35,000 x 25% = 8,750 rub. – debt for 1 month.

8750 x 3 = 26,250 rub. – total amount.

Learn more about collecting alimony from a child’s unemployed father.

Indexation of child support in 2021

Indexing has already been discussed above. It concerns only fixed alimony that is established by the court. Shares are not indexed. Indexation is directly proportional to the indexation of the cost of living.

The need for indexing is due to the following. Collecting alimony from evaders can take a long time. And, for example, the amount of alimony assigned in 2005 will be negligible in 2021. Therefore, the increase in the amount of debt is tied to the increase in the cost of living. Consequently, the draft dodger's debt will increase annually.

The cost of living for the first half of 2019 is now known. It was established by Order of the Ministry of Labor and Social Protection of the Russian Federation No. 561n dated 08/09/2019. The same amount will become the minimum wage and subsistence level for 2020. For the working population - 12,130 rubles, for children - 11,004 rubles. This is what we should proceed from when calculating alimony.

Procedure for calculating alimony

To transfer alimony payments, the accountant must do the following:

- Determine the amount of the payer’s earnings based on the timesheet and wage system.

- Withhold personal income tax, calculate alimony.

- Transfer the salary, reflecting alimony in the payment order - according to it, the money is transferred to the recipient separately.

Maintenance payments must be received by the claimant within 3 days after the accrual of earnings or other income.

Payment order

Completing this document when transferring alimony by the accounting department through the bank is mandatory. To do this you will need the following data:

- order number;

- Date of preparation;

- amount of alimony;

- TIN and checkpoint;

- name of company;

- Full name of the payer and recipient;

- name of the recipient's bank, account number, BIC;

- priority of payment – first;

- purpose of payment – child support (full name);

- basis for transfer: agreement, IL, order indicating the number.

The form of the instruction was approved by Order of the Bank of Russia No. 383-p dated June 19, 2012. You can use it to fill it out.

Methods of paying alimony

Depending on the relationship between the parents and their mutual agreements, there are a number of ways to pay child support.

1. From hand to hand. The transfer of funds occurs directly from the alimony payer to the recipient.

It is important to understand the fact that no matter how good the relationship between the former spouses is at the moment, the transfer of money or other things must be recorded. In this case, a standard receipt will be suitable, which will confirm the fact of receipt. It must indicate passport details, date, amount transferred (or other material assets), and signature of the recipient.

This precaution allows you to avoid problems if relations deteriorate in the future.

2. By bank transfer. This method is convenient for everyone. The payer and the recipient independently, or by court decision, can open a bank account into which alimony payments will be received monthly.

This money can be transferred both by the payer himself and by the accounting department of the organization in which he works from his salary. Often they come to this option if the parent paying the money was able to prove that the other spends it not on the maintenance of the child, but on his own needs. In this case, funds from the account can only be used by agreement of the parties.

3. Transfer to a bank card. The payment method can be chosen independently or determined by the court.

The payer either transfers the funds himself or reports the bank account to the accounting department of his enterprise. In the first case, the date of receipt of funds and their amount are determined. In the second, the accounting department is obliged to transfer alimony no later than 3 days after the payment of wages and other income to the employee.

4. Postal transfer. Most often, this method is used by payers living in different cities from the recipient.

If payments occur by agreement of the parties, the details and the amount paid are sufficient. But if alimony is ordered by a court decision, the following must be indicated on the postal form:

- Month for which penalties are paid

- Salary amount in a given month

- How many days were worked in the reporting month?

- Income tax amount

- Amount of alimony

- If there is a debt, provide objective information

Another convenient way for the payer is to deduct funds from wages. In this case, you must bring to the accounting department: a court order, a writ of execution or a notarized voluntary agreement. In this case, the company’s accountant is personally responsible for the timely payment of alimony.

Lawyer's answers to questions about calculating alimony

How to find out how much alimony is accrued?

The creditor can obtain information by viewing the history of transactions on the bank account. For this purpose, the payer has the right to order a salary certificate, which reflects all deductions.

You can find out the debt on the official website of the FSSP or by ordering the corresponding resolution from the bailiff. The document contains detailed information for each month.

How is alimony calculated if the payer is not officially employed?

Payments are collected in a fixed amount. If debt arises, the calculation is based on average earnings.

What are the features of calculating alimony when the payer is on leave without pay?

The accountant calculates payments from the actual accrued salary. If the person obligated to pay alimony is on long-term vacation, a debt will arise, which will be calculated by the bailiff based on the average salary in the Russian Federation.

An exception is payments in TDS: they are transferred even if there is no income at all.

How is alimony paid if the payer lives abroad?

Moving to another country does not relieve you of child support obligations. The parties can enter into an agreement. When collecting in court, payments are calculated in a fixed amount under Art. 83 of the RF IC, where the receipt of wages in foreign currency by the person liable for alimony is the basis for recovery in the TDS. Money is transferred in rubles, conversion and commission are paid by the alimony payer.

From what salary is alimony calculated: clean or dirty?

In case of shared recovery, only official, documented income is taken into account. The recipient can try to prove the fact of accrual of “gray” wages and recover money from it through the court. Read more about “clean” and “dirty” wages here. If payments are collected in a fixed amount, the payer’s earnings do not matter.

Rosstat data on the average salary in Russia in 2021

Since 2021 has just begun, at the moment it is only possible to obtain data on FWP in Russia for January - October 2021. The table below shows the published information from Rosstat on the average earnings (AE) of Russians in the entire economy of the Russian Federation (the table will be updated as new data becomes available).

| Month of 2021 | SZ size in rub. |

| January | 46674 |

| February | 47257 |

| March | 50948 |

| April | 49306 |

| May | 50747 |

| June | 52123 |

| July | 50145 |

| August | 47649 |

| September | 49259 |

| October | 49539 |

Penalty for late payment of alimony

You should start working with alimony arrears when alimony has already been collected by the court or established on the basis of a notarial agreement on the payment of alimony, but no payments are received from the debtor. It is important in this case to establish the debtor’s guilt in creating the debt, i.e. he is aware of the occurrence of alimony obligations, but he deliberately evades payments.

Civil liability in relation to the alimony debtor involves the collection of a penalty for late payments, namely:

0.1% of the debt amount for each day of delay.

To collect it is necessary:

- firstly, contact the bailiff with an application for debt settlement;

- secondly, with a statement of claim to the district court at the place of registration of the debtor or at your own place. In addition to the above documents, when collecting a penalty, the following must be attached to the application:

- court decisions on the collection of alimony or a notarial agreement on alimony;

- resolutions of the bailiff to initiate enforcement proceedings;

- resolution of the bailiff on the calculation of debt.

In this case, the state duty is not paid.

The calculation of the penalty is made independently; it can be attached separately or stated in the statement of claim.

The Office of the Federal Bailiff Service, which was responsible for conducting this enforcement proceeding, should also be involved as a third party.

We remind you that copies of the statement of claim for the recovery of a penalty, with copies of all the above-mentioned documents attached, should be sent to the defendant and to the Office of the Federal Bailiff Service before filing the claim. Shipping receipts are attached to the statement of claim to the court. Compliance with this legal requirement is mandatory.

An example of calculating a penalty when collecting alimony in the amount of 1/4 of earnings (after deducting 13% personal income tax) from January to March.

Method 1:

- January – salary 30,000 rubles, debt – 7,500 rubles, penalty for 1 day – 0.001 * 7,500 = 7.5 rubles, penalty for January – 7.5 * 31 = 232.5 rubles.

- February – salary 30,000 rubles, debt 7,500 rubles. + 7,500 rub. (alimony for January, February), penalty for 1 day - 0.001 * 15,000 = 15 rubles, penalty for February - 15 * 28 = 420 rubles.

- March – salary 30,000 rubles, debt 7,500 rubles. + 7,500 rub. + 7,500 rub. (alimony for January, February, March), penalty for 1 day - 0.001 * 22,500 = 22.5 rubles, penalty for March - 22.5 * 31 = 697.5 rubles.

- Total for three months a penalty was formed: 232.5 + 420 + 697.5 = 1350 rubles.

Method 2:

- Salary January - March - 30,000 rubles.

- Debt for January 7,500 rubles, penalty for three months 0.001 * 7,500 rubles* (31+28+31 days of delay) = 675 rubles.

- Debt for February 7,500 rubles, penalty for two months 0.001 * 7,500 rubles * (31+28 days of delay) = 442.5 rubles.

- Debt for March 7,500 rubles, penalty for the month 0.001 * 7,500 rubles. * (31 days of delay) = 232.5 rubles.

- Total = 1,350 rub.

For a year at such a salary, the penalty will be 17,895 rubles, for two years - 68,820 rubles, for three years - 149,820 rubles.

The amount of the alimony penalty has changed several times; in June 2008, the alimony penalty was increased from 0.1% to 0.5% of the amount of unpaid alimony for each day of delay. For ten years it was collected in this amount, until the Federal Law of July 29, 2021 No. 224-FZ “On Amendments to Articles 114 and 115 of the Family Code of the Russian Federation” was adopted, by which the penalty was again changed, only now in the opposite way: from 0 .5% to 0.1%.

The debtor, in addition to the amount of the principal debt, will be required to pay the entire amount of the penalty, in accordance with the court decision. But the legislator also protected the debtor in such cases; the court is empowered to reduce the amount of the penalty if it considers that it is disproportionate to the consequences of the violation. Reasonably influencing the court's decision on the amount of alimony penalty to be collected is an important task for a qualified lawyer.