Reasons for refusing a claim or returning

Both in courts of general jurisdiction (hereinafter also COJ), that is, district/city, regional/territorial/republican courts, magistrates, and in arbitration courts, the rules for accepting and returning claims are approximately the same.

The main circumstances when a plaintiff thinks about the fee paid for the consideration of a dispute are:

- voluntary waiver of the claim;

- refusal/return on the initiative of the judge.

Refusal of your own free will.

Everything is more or less clear here. The citizen changed his mind about suing because he realized that the case was unwinnable or, on the contrary, the defendant had paid everything or the debt was simply forgiven, etc. You just need to meet a few conditions for the refusal to be valid:

- made before the court makes a decision on the merits of the case. This can happen before the court accepts the claim, and during consideration in the first or appellate instance;

- declared by an authorized person. Either the plaintiff himself does this, or his representative acting under a power of attorney (if the power of attorney has such authority);

- the form doesn't matter. It is allowed in writing, and can also be stated on record in the court record;

- may be complete, or may be partial. For example, two demands were made: to collect the amount of debt on the receipt and interest for the use of other people's money. So the applicant may not collect interest, only the debt;

- must not violate the rights of others or be contrary to law. Usually such cases occur when there are more than two participants in the process (several plaintiffs, third parties).

Judge's initiative.

Claim documents submitted to the court may be returned to the party to the dispute. But they may also not return (remain in the archive), but in this case the movement on the case is terminated, without resolving the dispute. However, there must be clear reasons for this. Let's list them.

- refusal to accept the case for proceedings/return of documentation:

- the dispute is not considered by the court at all (that is, these issues are dealt with by other bodies, for example, the police, the investigative committee);

- wrong court address. For example, the case should be transferred to arbitration, but was sent to the city court of general jurisdiction;

- there is already a legal decision (including an arbitration court) on similar proceedings between the same persons;

- the type of production is incorrectly selected. Instead of a court order, a lawsuit was filed;

- there are violations when registering and applying to the court (the application was not signed, the pre-trial claim was not presented to the defendant, documents supporting the argument were not attached, etc.). In this case, the court first gives the opportunity to eliminate the violations. And only when the violations are not corrected within the prescribed period, the materials will be sent back.

- termination of consideration of materials that remain in the archive (sent back):

- a similar case is already being considered by another judge;

- the claim procedure has not been completed, if it is mandatory for a specific case (type of legal relationship);

- the parties do not appear at the trial;

- the appeal was on behalf of an unauthorized person and the present applicant did not confirm the intention of the proceedings;

- the disputants came to terms with the conclusion of the agreement.

Legal expenses in case of settlement agreement

As we know, court costs consist of state fees and costs associated with the consideration of the case.

As a general rule, the parties must provide in the settlement agreement the procedure for the distribution of legal costs.

If the parties did not provide for the corresponding condition in the concluded agreement, then when considering this issue, the courts proceed from the fact that in connection with the conclusion of a settlement agreement, the court does not make a decision in anyone’s favor, therefore, the legal costs of the parties are not subject to distribution.

NOTE: legal costs incurred by the court when considering a case at the expense of the budget, amounts to be paid, for example, to witnesses, are distributed equally between the parties by the court.

In what cases can you receive a refund of the state duty if the claim is rejected (returned), deadlines

The mechanism for receiving funds from the budget is triggered provided that the amount of the fee has been paid when going to court. And then the reasons described above occurred.

Standard procedure

When the initial payment must be properly posted. That is, according to the necessary details, an authorized person (either the payer himself - the plaintiff, or a person with a power of attorney from him, or a legal representative of the organization). The repayment mechanism will be described in more detail below.

Incorrect amount paid

Since the calculation of the amount of state duty before a judicial appeal is carried out independently, this calculation is not always correct. Therefore, in addition to the exact payment, a payment in a smaller amount or with an overpayment can be made to the budget.

If the amount was less than expected, the return procedure will be standard. And if it was in a larger volume, then there will be options:

- the judge does not evaluate the correctness of the calculation of the duty and allows the whole thing to be returned. This happens when the case is not accepted for proceedings because a request has been received to withdraw the application;

- if legal proceedings are initiated, then when deciding the issue of refund, the judge indicates that there was a fact of incorrect (inflated) calculation. Two amounts are offered for refund: what should have been paid and the excess. Although, again, the judge may not attach any importance to this and give the go-ahead to receive the entire amount from the budget according to a single procedure.

There is also a special case when the case is considered to the end, that is, there is no refusal. Then the only question that arises in court is about the excessively transferred funds. Regardless of the outcome of the litigation, excess court fees are subject to refund. This is specifically indicated in the decision and a certificate is issued.

Refusal to satisfy the claim

As a general rule, the loss of the plaintiff means the loss of the fee paid for going to court. That is, it is considered that the judicial service has been provided, the fee remains in the budget. Accordingly, if the claim is refused, the state duty is lost and the right to a refund does not arise.

But satisfaction/refusal is not always made in its pure form. Some claims may be left without consideration, or the initiator of a legal dispute may not insist on some claims, etc. Then an overpayment is formed (for those claims that were not considered by the court), it is determined by calculation in proportion to the amounts claimed. This overpayment can be claimed back.

Deadlines

If the fee check (in the original) was returned to the failed plaintiff, then this document can serve for another appeal to the court. And the period for such repeated application is not limited. Except if the payment amount or details change.

But a refund of the fee when returning a statement of claim is possible only within 3 years from the date of actual payment (that is, the date that appears on the payment document).

This was about the period when you can express your desire. The process itself lasts approximately about 2 months - until the court makes the necessary determination, plus consideration of the application by the tax service and the transfer of money itself.

If the plaintiff has not paid the state fee

In cases where the plaintiff received a deferment in payment of the state duty, upon approval of the settlement agreement, its collection is carried out as follows:

- 50% of the state duty for which a deferment was granted is not collected from the parties;

- the remaining 50% is distributed between the parties.

The distribution of 50% of the state duty is made on the terms of a settlement agreement.

In the absence of such conditions, the court distributes the state duty in proportion to the amount of claims satisfied by the defendant under the terms of the settlement agreement.

If one of the parties is exempt from payment, then payment is made by the other party:

- if the plaintiff is exempt from payment, then the state duty is collected from the defendant in proportion to the amount of claims satisfied by the defendant under the terms of the settlement agreement (in this case, the amount of the state duty to be collected from the defendant is reduced by 50 percent);

- if the defendant is exempt from state duty, then it is collected from the plaintiff in proportion to the amount of claims satisfied by the defendant under the terms of the settlement agreement. In this case, the amount of the state duty to be collected from the plaintiff is reduced by 50 percent (Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 13, 2004 No. 82).

State duty refund procedure

In general, the fee can be disposed of by re-applying to the court for an indefinite period. And even with a claim against another defendant, if the amount is sufficient and a specific defendant was not indicated in the payment order. That is, the same receipt (after all, its original is returned to the applicant along with all the materials) is presented again with a new claim.

If you need to return the money, then a special procedure is carried out. It consists of 3 stages:

1. Resolution of the issue in court . On its own initiative or in connection with the appeal of the plaintiff citizen/organization, the court issues a ruling. It describes the brief essence of the matter and, most importantly, the amount of state duty that can be received back from the budget. The determination is made without the participation of the parties according to a simplified procedure. After it is issued, you need to wait until it comes into force. It is obligatory to put a mark on this ruling on entry into force in the court office and certify it with the official seal.

If the issue of the fee is resolved during the meeting, among other things, with other judicial issues (in one document), then the judge also issues a certificate to the citizen. It reflects information only about the duty.

A certificate is also issued if a person made a payment but did not go to court. True, such a certificate is signed not by the judge, but by an employee of the court office.

Along with the determination/certificate, the applicant is given the original payment document (if the refund is in full) or a certified copy (if the refund is partial).

2. Contacting the tax office. But not just anywhere, but at the location of the court that conducted the proceedings (issued a certificate). An appeal involves submitting an application and annex to it. It mainly consists of:

- a court ruling (certificate) on the return of the paid state duty in case of abandonment of the claim;

- payment document confirming payment of the same duty in the original. And if part of the fee is required, a copy of the payment slip (check) is sufficient;

- details of the bank account where the payment will be made.

3. Waiting for a transfer from the tax service. This period is no more than 30 days from the date of submission of documents to the Federal Tax Service. Money can only be received by bank transfer.

State duty in a court of general jurisdiction

The procedure for concluding an agreement in the civil procedural code of the Russian Federation devotes very little space. All issues relating to the content and procedure for reaching agreement are subject to the will of the parties.

In other words, the parties who decided not to wait for the court’s verdict or who decided to resolve the issues of execution of the court decision after issuing a writ of execution must independently agree on all the nuances. About how legal costs for payment of state fees will be distributed in the event of a settlement agreement in the magistrate’s court.

If this issue is not specified, the judge may:

- do not approve the text as a whole;

- return it for revision;

- be guided by the provisions of Part 1 of Art. 98 of the Code of Civil Procedure, when satisfying the plaintiff’s demands, recover legal costs from the defendant or distribute them between the parties in relation to the demands satisfied by the court.

This outcome is unfavorable for the parties who decided to enter into an agreement. Therefore, they must make efforts to independently decide who will bear the legal costs and to what extent. Peace is always a compromise. Each side, striving for peace, is forced to make concessions and sacrifice something. This also applies to the issue of payment of state duty, since its size can reach significant amounts, especially for claims of a property nature.

Sample application for refund of state duty

Here we will have to talk about two sample documents: a sample application for a refund of state duty to an arbitration court (or general jurisdiction) and to the tax office.

Regarding the application to the court, this is an absolutely simple document, no special strict form is provided, it is written according to the standard version:

- name of the court;

- name of the parties to the process;

- ship's number;

- summary (1-2 sentences) of the claims;

- date of decision;

- please provide a copy of the ruling certified by the court with a note indicating that it has entered into legal force, or, if a certificate is requested, then a certificate.

By the way, if the court did not touch upon the duty issue, then you need to file an application to resolve this issue.

The application form is the same, only in the descriptive pleading part it should be indicated: “During the trial, the court did not resolve the issue of the return of the state fee paid by the plaintiff when filing a claim in this case. In this connection, I ask you to resolve this issue and issue the plaintiff a certificate for the return of the state duty, as well as a copy of the payment order for payment of the duty.”

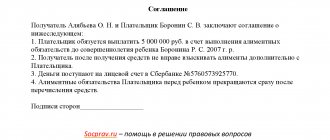

Application to the tax office

Here it is also better to adhere to a certain pattern so that there are no formal refusals.

To the Head of the Federal Tax Service of Russia for the Kirovsky district of Ekaterinburg 620062, Ekaterinburg, st. Timiryazeva, 11

Applicant: LLC “Kvadro” Location: 123456, Russian Federation, Sverdlovsk region, Ekaterinburg, st. Lenina, 33 TIN 661234567, OGRN 1073123456789

Application for refund of state duty in a case considered in the Arbitration Court of the Sverdlovsk Region

LLC "Quadro" filed a claim with the Arbitration Court of the Sverdlovsk Region against JSC "Bora" (TIN 66123456789) to collect a debt of 500,000 rubles.

In connection with the appeal to the court, the claimant LLC “Kvadro” paid a state fee in the amount of 14,238 rubles, which is confirmed by payment order No. 234 dated September 18, 2020.

By ruling dated October 3, 2020, the statement of claim was accepted for proceedings, and the case was assigned the number A60-1122344/2020.

By decision of the Arbitration Court of the Sverdlovsk Region dated December 15, 2020, the proceedings in the case were terminated due to the approval of the settlement agreement.

The said judicial act, among other things, decided to return to the limited liability company "Kvadro" (TIN 661234567 OGRN 1073123456789) from the federal budget the state duty in the amount of 9967 rubles, paid according to the payment order dated 09.18.2020 No. 234.

By virtue of clause 3 of Art. 333.40 of the NKRF, an application for the return of an overpaid amount of state duty in cases considered in courts is submitted by the payer of the state duty to the tax authority at the location of the court in which the case was heard and the refund is made within 1 (one) month by the relevant tax authority.

Based on the above, guided by art. 333.40 NKRF, please:

Refund the state fee paid for the consideration of case A60-1122331/2020 in the Arbitration Court of the Sverdlovsk Region in the amount of 9967 rubles.

Application:

- A copy of the ruling of the Arbitration Court of the Sverdlovsk Region dated December 15, 2020 in case A0-1122344/2020;

- Certificate for refund of state duty No. 1122331/2020 dated 01/11/2025.

12.01.2021

Sincerely, Director of Quadro LLC ______________ A.I. Kavilin

In arbitration proceedings for economic disputes

In the arbitration process, other rules for the return of state fees are established. The plaintiff pays only half of the costs.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

When concluding a settlement agreement and its approval by the arbitration court before the decision is made by the Supreme Court of the Russian Federation or arbitration courts, 50 percent of the state duty paid by him is subject to return to the plaintiff (Article 333.40 of the Tax Code of the Russian Federation).

However, if a settlement agreement is concluded and approved during the execution of a judicial act, the state duty is not refunded.

Civil claim within a criminal case

A civil claim within a criminal case is not uncommon. Such a claim may be filed as part of the consideration of the case during the investigation by the investigator. Or you can submit it when the materials are transferred to the court.

It is known that property claims against a criminal can be made in parallel with the criminal investigation.

The plaintiff can count on the same opportunities as in ordinary civil proceedings.

However, during a criminal trial, a civil claim is not subject to a fee. Therefore, there is no reason to return it.