The number listed in the serial identifier system of the tax inspectorate and assigned to each citizen of Russia is not subject to change under any circumstances. It is given to a person from birth and exists with him until the end.

But what about those who change their passport data due to a change in marital status or for a number of reasons and take a new first or last name? No one has canceled the receipt of a new TIN certificate with the same number but different personal data.

Design methods

How to request a TIN? The production time for such a document depends slightly on how exactly the citizen prepares the paper.

You can submit a request:

- personally;

- through the Internet;

- with the help of a representative.

In addition, the application is sent to the authorized bodies:

- by mail;

- remotely;

- by directly contacting the registration services.

How exactly to act, everyone decides for themselves. It is only worth noting that in the case of an independent visit to the authorized bodies, you will have to wait less for the readiness of the tax registration certificate than with postal items.

Required documents

Obtaining a new certificate does not require much time. To re-register, it is enough to provide a small list of documents.

Table 1. Documents for replacing the TIN

| Document | Note |

| Identification | A tax certificate can only be replaced if you have a passport with a new surname |

| Marriage certificate or other document confirming the change of surname | The original document is provided |

| Previous TIN |

Real data - contact the tax office

How long does it take to obtain a TIN? Unfortunately, legal norms are not always observed. This happens for various reasons. For example, due to the high load on registration authorities. In any case, it is best to order documents in advance. This way you can protect yourself from unnecessary negative surprises.

In practice, when applying to the Federal Tax Service for a TIN, you have to wait about 5 days for the corresponding document to be ready. In some cases, the period may be 10–14 days. As a rule, the average time for issuing tax registration certificates is a week.

In what cases can a surname change?

Any Russian citizen can change his first, last and patronymic names upon reaching 14 years of age. This right is given by Article 58 of Federal Law No. 143. Most often there are two reasons - marriage and divorce. Also, employees of the civil registry office (registry office) can meet halfway and allow a change of surname if it:

- cacophonous or misspelled;

- difficult to pronounce or spell;

- does not match the surname of other family members;

- does not correspond to the religious and other beliefs of the wearer.

With the consent of both parents (with some exceptions), you can change the surname of a child under the age of 14.

Multifunctional centers

The MFC is a kind of intermediary between the state and the population. With the help of such organizations, citizens can obtain various services and documents in one place, without visiting authorized services. Very comfortably!

True, turning to such centers is not always beneficial. Especially if the document needs to be completed urgently. How much is the TIN made through the MFC? By law, the period is 3-5 days, in practice you have to wait longer.

On average, it takes about two weeks to produce a tax ID, sometimes even more. In any case, a visit to the MFC slows down the procedure, albeit slightly. This is due to the fact that multifunctional centers first accept an application from a citizen and then forward it to the Federal Tax Service. This takes time.

What documents need to be changed when changing your last name?

Almost all the basic documents that a person uses in civilian life fall into this category. Each of them has its own replacement order.

Passport

Replaced first. This can be done at the territorial internal affairs agency, and, if possible, at a multifunctional center or through the State Services website. Paragraph 15 of the Passport Regulations allows no more than 30 days for this, otherwise you will face a fine. The fee is 300 rubles. You can pay it at Sberbank or via the Internet.

After replacing your passport as a citizen of the Russian Federation, you will need to replace the remaining documents as quickly as possible. Many of them will be invalid even if a certificate of registration of the name change is presented.

SNILS

The insurance number of the individual personal account (green laminated card) does not have a set replacement period. However, if this is not done, there may be problems with the calculation of pension contributions. And you won’t be able to use it as a document, for example, in a bank. The replacement itself takes place at the Pension Fund branch and is free.

You can also replace the document via:

- your employer;

- MFC;

- Civil registry office (not in all cases).

Additionally, at this stage it is worth asking the employer to make a note about the change of name in your work book.

International passport

It will need to be changed to travel outside the country. It is issued at the Federal Migration Service of the Ministry of Internal Affairs, at the MFC or through the same State Services. The fee for an old document is 2,000 rubles, a new one is 5,000.

Existing visas will also need to be renewed at consulates or visa centers, if available in your region.

Compulsory medical insurance policy

Without a valid compulsory health insurance policy, you may simply be denied treatment. Part 2 of Article 16 of Federal Law No. 326 allocates a month for its replacement. To do this, you need to find the office of your insurance company on the compulsory medical insurance website and contact there. Also, the insurer's contacts may be indicated in the policy itself. Replacement is free.

Bank cards

All cards will have to be reissued in a new name, and your new passport details will need to be entered into the database. The cost of services is determined by a specific bank.

If the card is a salary card, your employer must reissue it.

TIN

The taxpayer identification number itself does not change; you will simply be issued a new certificate with a new name. The procedure is regulated by Order of the Ministry of Finance No. 114n dated November 5, 2009. You can obtain the document at the MFC or your territorial tax office.

Certificate of disability

It will need to be replaced according to order of the Ministry of Health and Social Development No. 1031n dated November 24, 2010. The service is provided free of charge at the territorial bureau of medical and social examination. There is no need to re-pass the commission.

Military ID

According to Federal Law No. 53, failure to provide data on a change of surname to the military commissariat entails a fine, the amount of which is determined depending on the region. The maximum permissible replacement period is not specified. The service can be obtained free of charge both at the military commissariat and at the MFC.

Driver's license

The replacement fee is 2,000 rubles, and the service is provided through:

- branch of the State Automobile Inspectorate;

- MFC;

- State Services website.

The procedure is regulated by paragraph 29 of Government Resolution No. 1097. If you neglect the replacement, you will face a fine of 500 rubles.

Each institution will require its own set of documents. It is unique in each case and depends on the region and situation. The best solution would be to first clarify it with the required department or find it on the State Services website.

Postal services

How long does it take to create a TIN? We got acquainted with the main options for the development of events. As already mentioned, citizens can contact the authorized bodies using the services of postal services. This is not the best solution, but it is also necessary to know about it.

The point is that under such circumstances, the deadline for producing a certificate with a tax identifier will be blurred. This is due to the fact that everything will depend on the speed of postal services. According to the law, the direct production of a TIN will take 3–5 days, but you will be able to receive the document much later.

Sometimes such an operation takes about a month. Not too fast. That is why citizens refuse to contact any authorized bodies by mail.

Obtaining a new TIN certificate

- VRP

When can you apply for a residence permit after receiving a temporary residence permit?

- Elena Voropaeva

- 25.12.2020

We said above that the TIN is assigned once and for all. This is true. However, if your personal data changes (citizenship, last name, first name, etc.), you can contact the tax office again to update the data. However, the number itself will remain the same. In such a situation, this procedure will be free. But if the certificate is lost or damaged, you will have to pay a fee of 300 rubles to obtain a new one.

Important: the loss or change of a certificate does not mean a change of TIN.

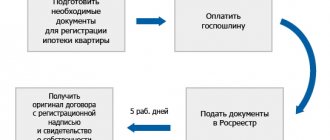

Registration procedure

How to apply for a TIN? To do this, just follow the simplest instructions. Let’s assume that a citizen decides to independently contact the authorized body for an identifier in the tax system.

Then he will have to:

- Create a package of certificates. It won't be too big.

- Contact the authorized body, fill out and then submit an application in the prescribed form.

- Receive a completed TIN certificate within a predetermined time frame.

The main difficulties can arise only at the stage of preparing the necessary documents. But we will deal with this issue later.

What is a TIN

- RRVP

Working with temporary residence permits: how foreign employees are hired

- Elena Voropaeva

- 26.02.2021

An individual taxpayer number is a sequence of 12 digits that is used to identify an individual when paying any taxes and fees. The first 4 digits are the number of the tax authority where the TIN was issued. The next 6 are directly an individual number, which allows you to eliminate confusion that may arise when other personal data coincides (full name, date of birth, etc.). The last 2 digits are control numbers. They are calculated using a special formula.

When you are assigned a TIN, you are given a certificate , but in the future it is rarely needed. Only the numbers themselves are important, since you are already in the tax database. When applying for a job, receiving UVM services, and in other situations, you usually only need to enter your Taxpayer Identification Number (TIN), but you do not need to document it.

Important: Despite the fact that an individual is not required to obtain a TIN certificate, the tax office will still assign him a number, even without his knowledge. This applies to all citizens of the Russian Federation, and those foreigners who receive an official salary.

You can always find out your TIN through the Federal Tax Service online service. You just need to enter your passport details.

An individual taxpayer number is assigned once and for all . Even if you receive it as a foreigner and then apply for Russian citizenship, the TIN will remain unchanged.

"Government services" to help

We found out how much TIN is required. What is needed to complete the above-mentioned paper via the Internet? To begin with, register with Gosuslugi, and then activate your account. Without it, you can forget about electronic services.

Once such actions are over, the person will need:

- Find the “Registration with the Federal Tax Service” section in the catalog of available options.

- Fill out the application form electronically, choosing a convenient place to receive the document.

- Submit a request for further processing.

- Come to the Federal Tax Service or MFC by invitation and pick up the certificate.

Nothing incomprehensible, difficult or supernatural. In the same way, you can order a duplicate of the TIN certificate.

Detailed procedure

Replacing the TIN through the State Services website occurs by submitting personal data to the Federal Tax Service (FTS). No application is required. The user only sends a request to visit the department, which is registered within one business day.

Step-by-step instruction:

- Registration on the portal. Only registered users can use the services of this site after the system has verified their registration data. To do this, you need to indicate your full name, phone number and email in a special form on the website. After this, the system will prompt you to confirm your identity: fill in the column with your passport number, SNILS and INN. The final stage of registration is receiving a special code by mail or at the Service Center.

Figure 3. Registration page. Source: State Services website

- Search for a section. On the main page of the site you need to find the “Taxes and Finance” category. Then click “All services”.

Figure 4. Home page. Source: State Services website

- Selecting a service. In the window that appears, click “Tax accounting for individuals.”

Figure 5. Tax services. Source: State Services website

- Sending data. After this, the service page will open. It contains information about how to provide it and deadlines. It is recommended that you read the information carefully. It is important to check the “Service Result” section. It should indicate “Submission of an extract from the Unified State Register of Real Estate”. To continue, you must click the “Make an appointment” button.

Figure 6. Appointment button. Source: State Services website

- The final stage. The user will be asked to select a Federal Tax Service branch. An online map will open with highlighted institution addresses. In addition, the page will contain information about the citizen. All personal information (full name and passport details) will be filled in automatically.

Note : If a citizen has an enhanced qualified electronic signature, a personal visit to the tax office will not be required. The completed TIN will be sent to the place of registration (in paper form) or by e-mail (in digital version) of the applicant.

After completing all points, the request will be sent to the institution. The answer can be viewed in your personal account on the State Services portal. It will also be sent to the email address provided during registration.

The citizen will be assigned a date to visit the Federal Tax Service to provide original documents.

How and where to get a TIN?

If you do not have a TIN, you can apply for one in one of the following ways:

- At the tax office. To do this, select any inspection that is convenient for you to come to and make an appointment online. If you pre-submit an application through the online service, then instead of twice, you will have to go to the tax office only once - to pick up the document on assigning a TIN.

- In any MFC. You can contact any MFC on the territory of the Russian Federation, but in this case, the time to obtain a TIN may be 7-10 days.

- By sending documents by mail. To do this, send a set of documents to any of the tax offices of your choice by registered mail with a list of attachments and notification of receipt. In this case, you will receive the TIN certificate by mail. It will be sent to the address you specified in the application.

Tax number on the Internet

Unlike the series and number of the passport, the TIN identification code is not information closed for distribution. Information about the code can be easily found on the Internet. To do this, just go to the tax service website, enter your passport data and you will receive a TIN code.

Similarly, you can use the State Services website. It is provided there, to quickly find it, enter its name in the search on the site.

We do not recommend using any other services to determine your TIN, as they may record the data sent in the future, this can lead to some kind of abuse of them, for example, fraud.