The procedure for entering into inheritance according to the law, if there are several heirs, is prescribed in Art. 1145-1145, as well as Art. 1168-1169 SCRF. It is in them that information is displayed that determines the rights of heirs who have priority. According to Russian legislation, entry into inheritance rights is possible in two ways: by law or by will, regardless of how many heirs claim the inherited property. So, let's look in more detail at the issue of receiving an inheritance if there are several successors.

The procedure for inheriting escheated property

Article 1154 of the Civil Code of the Russian Federation (Civil Code) allows citizens six months from the time of the death of the testator to submit an application for inheritance. The article also states that if one of the heirs refuses the inheritance, the next in line can receive it within six months from that moment.

If none of the heirs has accepted the property, or none of them can accept it, the procedure for recognizing escheat begins. In particular, this requires one of the following conditions:

- there are no heirs either by will or by law (or nothing is known about them);

- the heirs are excluded from their right or do not have this right under Article 1117 of the Civil Code;

- all the heirs renounced their right and did not indicate to whom it was being transferred;

- no one ever entered into the inheritance within the prescribed period.

In any of these cases, the relevant authority of the local municipality or city begins the procedure for registering escheated property. Such property can be both movable and immovable property, including land, houses, apartments and shares in them.

In some cases, by a court decision, escheated property can be transferred to the heir even after six months. To do this, you will need to prove that the heir did not apply for the inheritance in a timely manner for a good reason.

Dependents

Another condition for how the inheritance is distributed between applicants without a will is related to the presence of dependents, that is, persons who are financially supported by the deceased citizen. Citizens may be recognized as dependents in the following cases:

- complete loss of ability to work;

- the person’s only financial income is the assistance of a deceased citizen;

- the minimum period of cohabitation with the support of the testator must be 12 months.

This group of applicants for material benefits may include relatives of the testator or strangers who are not related by kinship.

According to the provisions of the Civil Code of the Russian Federation, the maximum share of property that owners can count on is 25% of the total volume of material goods. The exception is situations where voluntary agreements on the division of inherited property are drawn up (drawn up according to a universal model).

Recognition of property as escheat

In the Russian Federation, the procedure is carried out relatively rarely and, as a rule, in relation to property with large debts: Article 1145 of the Civil Code of the Russian Federation regulates 7 lines of inheritance. That is, there are almost always distant relatives who inherit.

Even if the heir did not submit an application within the prescribed period, the court may recognize him as the owner on the basis of Article 1153. For example, if a citizen paid bills for the communal property in the inherited apartment, lived in it or otherwise participated in its maintenance, there is a high chance of refusal to recognize escheat.

How are shares of inherited property distributed among successors?

As mentioned above, entry into the right of inheritance is regulated by the Civil Code of the Russian Federation, and is carried out on a first-come, first-served basis.

The heirs of the first priority have the right to receive the inheritance first. That is, if the inheritance was received by the spouse, children, siblings of the deceased, then other relatives will not be able to claim it. The exception here is inheritance by view, but more on that later.

The property of the deceased is divided into equal shares among all pretending successors in the line entering into inheritance rights. If a dispute arises between them regarding the division of inherited property, then it can only be resolved through legal proceedings.

Thus, the inheritance is accepted in the case where there are no exclusion factors. These include:

- Receiving an inheritance by right of representation. It is provided to relatives who have the right to become a replacement for the deceased heir. For example, if the testator had a son and grandchildren. The testator's son died before him, which means the grandchildren will become the rightful heirs of their grandfather.

- Acceptance of the obligatory share of the inheritance by the dependents of the deceased. Recognition of such a right is possible only by a court, and only if the dependent lived with the deceased in the same living space for a year.

- Preferential right of inheritance. Such a right can be obtained by successors who lived in his apartment at the time of the testator’s death and used his things that became the subject of inheritance. In this case, the person who has a share in the property has the priority right to inherit indivisible property, for example, a car. This could be the spouse of the deceased.

If the share of the primary successor is greater than the shares of the remaining heirs, then he is obliged to pay them the difference in money or other property.

- Recognition of the aspiring successor as unworthy. An heir may be deprived of the right to receive an inheritance if, through the court, he is found guilty of the death of the testator or another heir. The reason for deprivation of inheritance rights may also be a threat to the testator or other successors in order to receive a larger share of the inheritance.

The procedure for registering escheated property as municipal property

The procedure begins with the local administration filing an application with a notary. Officials can notify possible heirs in advance through the media, but the law does not impose such a requirement. This is usually done to facilitate the registration procedure.

Depending on the circumstances, the notary can either immediately issue a certificate of inheritance or request additional documents. For example, a death certificate and confirmation of the absence of heirs from the notary district. In difficult situations, legal proceedings begin.

Next, officials apply for recognition of ownership rights to Rosreestr. The registered escheated property is transferred for operation or for evaluation and sale.

If you still have questions about registering escheat, you can get detailed advice from a property lawyer.

Distribution of inheritance among first-degree heirs. Shares

As noted above, the procedure for dividing property between potential heirs depends on several factors. These include:

- the presence of a will that excludes some applicants from among the heirs;

- entry into force of court documents declaring heirs void;

- presence of an official spouse;

- the emergence of grounds for representation.

According to the general rule, during the division of property between applicants, a notary performs actions in the following sequence:

- allocates the share of material goods belonging to the official spouse of the deceased citizen as personal property;

- allocation of common property, half of which belongs to the living spouse and cannot be inherited by other claimants;

- division of the remaining inheritance in equal parts between all representatives of the first priority;

- if there are heirs, they acquire their share of material wealth.

The legislator also allows you to formalize an agreement between heirs on the division of inherited property. Such a document is drawn up according to a universal template and contains a voluntary division of shares between all first-priority applicants. Signing an agreement between part of the heirs is not allowed. Participation of all candidates in the procedure is mandatory.

State duty for inheritance

To obtain a certificate of inheritance, you must pay a state fee. It is established by paragraph 22 of Art. 333.24 of the Tax Code in the amount of:

- 0.3% of the value of the entire inheritance within 100 thousand rubles, if the heir was a parent, child, brother or sister for the testator;

- 0.6% up to 1 million, otherwise.

For your information

In addition, you will have to pay 600 rubles for a notary’s inventory of the inherited property.

Heirs in accordance with Art. 333.38 of the Tax Code of the Russian Federation are completely exempt from paying duties if:

- They lived together with the testator in the inherited apartment at the time of the latter’s death.

- The testator died while performing state or public duties, a life-saving duty, or within a year due to an injury received in such circumstances.

- The testator was subjected to political repression.

- The heir is under 18 years of age or he has been declared incompetent due to a mental disorder and we have established guardianship over him.

- The testator served in the army or law enforcement agencies and died in connection with the performance of official duties or within a year after dismissal due to injury received as a result of the performance of official duty.

Disabled people of groups I and II are charged half the state duty.

Inheritance tax by law in 2021

When entering into an inheritance, no tax is paid . The corresponding amendments were introduced into the Tax Code by Federal Law No. 78-FZ of July 1, 2005. Since then, in accordance with paragraph 18 of Art. 217 of the Tax Code of the Russian Federation, income received as a result of accepting an inheritance is exempt from taxation.

The only exception is rewards to the heirs of authors of works of literature, science and art, as well as to the heirs of holders of patents for inventions, industrial designs or utility models.

However, tax on the sale of an inherited apartment if the transaction took place less than 3 years after the death of the testator.

Other heirs of the first stage

In addition to the main heirs of the first stage, there is an additional group of persons who can receive a share of the inheritance under the same conditions. If the testator's child dies, but he still has his own children, then the right of representation comes into force. The grandchildren of the deceased receive the inheritance for their parent. That is, the children of his children will receive their share on an equal basis with other heirs of the first stage. The basis for disinheritance is the will of the deceased, in which his will is written.

According to the law, dependents can become heirs. This could be any disabled relative of the deceased. An important condition for receiving an inheritance is the dependence of a disabled relative one year or more before the death of the testator. This person can be any relative from seven lines: uncle, second cousin and others. Also, people who are not relatives of the deceased can become participants in the division of the inheritance between the heirs of the first stage. For example, a best friend, a work colleague or other people. It is important to prove dependency in court.

Necessary conditions for inheritance of dependents:

- confirmation of disability with documents and medical certificates;

- cash support for a dependent, which was the main source of income;

- being supported for a year before the death of the testator;

- if the dependent is not a relative of the deceased, then cohabitation is required for a year before the death of the testator.

On what grounds can they refuse and what should they do?

The reasons and grounds for refusal to grant an inheritance may be the following:

In turn:

- lack of necessary documentation - this issue can be resolved by providing the missing documents or through legal action.

- Lack of evidence of relationship - can be resolved by providing additional documentation, ordering examinations, or judicial procedure. You can read about the procedure for establishing family relationships here.

- Delay - missing a deadline of 6 months becomes grounds for believing that the heir has renounced his share; the problem can be resolved in court with the provision of documentation justifying the delay.

- Persons who have been found to have evaded the duties of caring for the person providing the inheritance may be excluded from inheritance by court order.

In case of refusal of inheritance under a will:

- You can seek half the share for dependents, disabled people and minors;

- you can try to challenge the will in court;

- You can try through judicial procedure, questioning witnesses and expert examination to have the will declared invalid (written under influence or coercion, not in sober memory, etc.).

Priority categories

The circle of persons determined by the law directly related to the 1st stage certainly includes:

- spouses;

- children;

- parents.

Moreover, the following rules apply to spouses:

- the 1st stage includes the spouse who, at the time of the death of the person providing the inheritance, was in an officially registered marriage with him, according to state standards;

- Civil, married or former (in a state of divorce) spouses are not included in the general order of priority.

The following rules apply to children:

- children whose birth occurred within the framework of an official marriage union, whose relationship with the testator is precisely established or beyond doubt, are considered to be from any marriage;

- children who were born outside the procedure of official marriage, and in their relation it was established judicially or voluntarily that they were related to the deceased person providing the inheritance;

- children for whom the grantor of the inheritance does not have parental rights are not excluded from the first category;

- natural children born after the death of the person providing the inheritance, no later than ten months from the event.

IMPORTANT: Adopted children are of particular importance. Adoption is a procedure approved by the court, and the adoptee has the opportunity to maintain legal relationships based on blood kinship. That is, the adopted person has a choice - to inherit from his adoptive parent, or to remain the heir of his blood parent.

In terms of parents:

- adoptive parents and natural parents whose child died before them belong to the 1st stage;

- no importance is attached to the parents' marital status, their marital status and other similar circumstances;

- children cannot inherit from parents who have been deprived of parental rights by law.

We talked in more detail about how the inheritance of parents is divided between children and vice versa, and here you will find out what share of the testator’s property the spouses can claim.

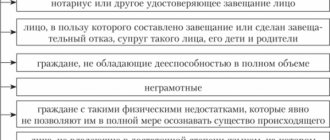

Inheritance by will. Mandatory share

When acquiring inheritance rights by will, legal priority may also be taken into account. Thus, in a number of circumstances, representatives of the first level of heirs can count on dividing property as a compulsory share. This means that such candidates will definitely register a share of property, regardless of the last will of the deceased citizen.

Important! The obligatory share implies that the candidate will receive at least 50% of the amount of value that would be available if inherited by law.

Such applicants include:

- children under 18 years of age;

- an elderly mother and father who receive only a pension and are not officially working;

- official spouse who has lost his ability to work;

- children - disabled children.

If there is an agreement on the division of inherited property, then the volume of the obligatory share may be greater. But installing a smaller part of the funds is not allowed.

Necessary documents for registration of inheritance and submission deadlines

Heirs of the first priority must submit an application to the notary for acceptance of the inheritance within six months from the date of death of the testator. If the heir misses the established dates without a good reason, then he thereby renounces his part of the inheritance. His share is distributed equally among the other participants in the process.

For example, family N has not communicated with their son for more than 15 years. One of the spouses dies. The son is told the news that one of his parents has died. To which the son decides to continue not to communicate with the family, so he misses the deadline for submitting an application. The entire inheritance will be divided among the remaining family members.

First priority heirs must submit the following documents to the notary:

- passport of each heir or other document confirming identity;

- death certificate of the testator;

- confirmation of family relationship with the deceased;

- a certificate of registration of the testator and those people who lived with him, or a house register.

Documents must be provided along with their copies.

Sources:

Civil Code of the Russian Federation. Part 3.

Who will get the property if there are no heirs in the first place?

In the absence of heirs of the 1st stage, the inheritance is transferred to the heirs of the second stage and further according to the seven degrees of priority provided for by law.

The category of the second stage includes sisters or brothers (by full or incomplete relationship), parents of the parents of the person providing the inheritance, and also, after the death of sisters and brothers, nephews and nieces.

The third category includes aunts and uncles, or nephews. Dependent relatives recognized by law, regardless of the degree of relationship, remain in the 1st category.

Legislative regulation of the issue is undertaken by the Russian Civil Code in articles numbered 1142, 1143, 1144, 1145 and 1148.

The first priority in terms of receiving an inheritance are children and parents, wives and husbands, dependents; these categories have the right to receive inherited property in the first place, and only if they refuse or are absent can subsequent categories proceed to receive property.

Along with the above options, there is the possibility of dividing the inheritance by agreement. Read about it on the pages of our website. We also recommend studying other materials from our experts. From them you will learn about who has the right to inheritance by law and will and what are the features of the procedure for dividing property in such cases.