Seizure of a bank account by bailiffs is a security measure introduced to force the debtor to pay the debt to the collector. Almost always, the seizure of accounts entails a forced write-off of money received in this account. The bailiff can seize the account on the basis of a ruling or after the initiation of proceedings.

The bank is also obliged to accept and fulfill the requirements of documents submitted by creditors. In the article we will tell you what consequences the seizure of a bank account entails, what a debtor can do to avoid the seizure of accounts and withholding money from them, and what types of income cannot be written off by bailiffs.

What is the essence of seizing an account by bailiffs?

Seizure of property is one of the interim measures that bailiffs can use during enforcement proceedings. Money is also property, and the most liquid one, since it can be used to pay off debt instantly. Therefore, to block them on the account and subsequently write them off in favor of the creditor, arrest may be used.

The arrest mechanism works as follows:

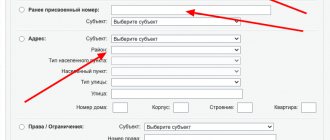

- The bailiff finds out in which banks the debtor has accounts and deposits

- for this, requests are sent to individual credit institutions or to the unified monitoring system of the Central Bank of the Russian Federation. Also, all data on any person’s accounts in all Russian banks is available at the Federal Tax Service inspection at the place of residence (registration) of the debtor. Banks are forced to submit such information to the tax office. The citizen is obliged to notify the Federal Tax Service himself about accounts in foreign banks; - a resolution is issued regarding the seizure of money, which is sent to the credit institution

- the bank that received the resolution is obliged to seize accounts and deposits within 1 day and notify the FSSP about this. At the same time, the bank is not obliged to notify the client about the impending blocking of the account and the threatening debiting of money from the debtor. Seizure is also imposed on individual investment (IIS) and brokerage accounts, and on electronic wallets; - interim measures will remain in effect until the debt is fully repaid, or until the bailiff cancels them

- in some cases, the debtor can get the blocking or write-off lifted, or reduce the amount of the monthly withholding.

Seizure of funds can be imposed not only by order of the bailiff. The court may introduce it when securing a claim, during the period of consideration of the case. In this case, the money will not be written off, but the bank will block all debit transactions of the debtor.

Also, seizure and write-off are allowed if the claimant himself sends the writ of execution to the bank. The debtor's algorithm for freeing his money from seizure is different for each of the listed cases.

Ekaterina Uryvaeva

Bankruptcy Lawyer for Individuals

As soon as the account is seized at the request of a bailiff, court or collector, the following consequences will occur for the debtor:

- he will not be able to dispose of all the money until he lifts the restrictions and arrests (if the withholding is carried out in a certain amount, the debtor can withdraw or transfer the remaining funds);

- on behalf of a bailiff or court, the bank can block transactions, including automatic payment for any services (for example, if you have an automatic payment planned for housing and communal services, the payment will not be executed and a debt will arise);

- You can top up your account, but the money will immediately go to the FSSP deposit or directly to the claimant. That is, putting money into a seized account is simply stupid.

Uniform rules for withholding accounts apply to all banks operating in Russia. It makes no difference whether you have an account with a large credit institution - Sberbank, Alfa Bank, VTB or others, or whether you have a salary card in a small regional bank.

All banks are included in the monitoring system of the Central Bank of the Russian Federation, so the bailiff learns about the availability of accounts and deposits within a few hours or days. Online banks and electronic payment systems (Tinkoff, Yandex-Money, WebMoney, etc.) are required to comply with the bailiff’s requirement.

Is it possible to get rid of the restrictions of the executive service?

It is possible to remove the seizure from a mortgage account, but only with the agreement of the executive service. To do this you will need to do the following:

- Find out from the bank why the seizure was imposed and in which branch of the FSSP the enforcement proceedings were opened.

- Pay off obligations within the framework of enforcement proceedings or agree on installment/deferred payments. Citizens have this right under Art. 203 Code of Civil Procedure of the Russian Federation.

If a positive decision is made, restrictions on the mortgage account will be lifted.

Seizure and write-off - what is the difference between these measures

There is a difference between arrest and write-off, and it is significant. The seizure of property or funds in itself does not entail their seizure. This is a security measure that means blocking the movement of money, prohibiting their withdrawal or transfer. For example, when securing a claim in a lawsuit, the money will not be written off, but only a ban on its disposal will be imposed.

Typically, bailiffs begin a hold simultaneously with the imposition of an arrest. This is logical, since writing off money is the easiest way to comply with a court decision.

Therefore, in the resolution that goes to the bank, the bailiff will immediately indicate:

- information about the seizure of all accounts that are opened in the name of the defaulter;

- about the amount of debt for the repayment of which funds will be withheld;

- about the amount of deduction if money will be written off from certain types of income (salary, pension, benefits, etc.)

A copy of the resolution will be sent to the debtor. However, sending a document by mail can take several days or even weeks. Therefore, debtors often unexpectedly learn about write-offs from SMS and notifications in the online banking system. The later you find out about the lien, the more difficult it will be to get your money back.

Reasons for the seizure of a Sberbank bank card

Seizure means blocking of money on a personal account linked to a specific client card. The amount of blocked funds is determined by the amount specified in the executive document or the available balance. Blocking means that the client’s funds cannot be used for any transactions, including paying for purchases or withdrawing cash from an ATM. At the same time, a Sberbank client can still use money in excess of the blocked limit.

The bank must notify the client of the imposed sanctions by sending an SMS message. The most common reasons for arrest, which are obtained based on Sberbank statistics, are listed on the official website of the financial institution.

A seizure on a client’s card or account means that the bailiffs have a court decision and have initiated enforcement proceedings. The reason for such actions is the appeal of an individual’s creditors with a statement of claim to collect debt from the client.

It is important to note that such activities are usually started several months after the client has an overdue debt. In other words, the borrower is given a lot of time to repay the debt and prevent the card from being seized.

How to freeze the debtor's accounts

To avoid writing off a large amount of money or to take protective measures in time, it is advisable to know the basic rules for seizing a bank account. Since 2021, they have changed, as banks have been entrusted with control over the source of funds. Below we will talk about the actions that the bailiff performs as part of enforcement proceedings.

At the legislative level, a list of funds was previously established that bailiffs do not have the right to write off from citizens’ accounts as debts. These include:

- alimony;

- maternal capital;

- child benefits;

- survivor's pension;

- health compensation payments;

- monetized benefits;

- payments for caring for disabled citizens;

- other social benefits.

The essence of the changes in the system of writing off funds from bank accounts is that on July 1, 2021, government agencies that transfer funds from these payments to citizens’ accounts are required to mark (or “color”) the purpose of the transfers. Otherwise, banks do not see that money cannot be written off according to a writ of execution.

As part of enforcement proceedings, bailiffs now do not have the right to demand from banks that opened cards for debtors that they write off social and other funds that are not subject to collection.

In addition, the list of “untouchable” money was supplemented with benefits paid in connection with the death of citizens, injury to health or loss of property during man-made disasters.

But if the Pension Fund or the social security department transferred money without noting the “social” status of the money in the transfer, then the bank has the right to write off these funds as payment of the debt. And the debtor will again have to go to the bailiffs and prove the intended purpose of the payment. Unfortunately, glitches still happen.

Initiation of proceedings

In order to seize the debtor's property and funds, the FSSP officer is obliged to initiate proceedings. In the application, collectors can immediately indicate account details and the location of the property - for example, if a person has both a deposit and a loan in the same bank for which he does not pay. This simplifies the work of the FSSP, but bailiffs may request additional data.

The resolution to initiate proceedings may immediately contain a note about the arrest, a ban on registration actions and operations. In the 3 days that are given to check the debtor's documents, the bailiff can request information from the federal registers and the monitoring system of the Central Bank of the Russian Federation. Subsequently, the FSSP employee may request information about other accounts if they were opened after the initiation of the case.

A copy of the decision to initiate a case is sent within 1 day to the following addressees:

- to the collector, since he has the right to know about all enforcement actions and control them;

- the debtor, since he is given time for voluntary performance (5 days);

- to the bank where the defaulter’s accounts and deposits are opened (if the debtor is a client of several banks, the bailiff will send a resolution to each of them).

There is an important nuance with the timing of voluntary execution. Property and funds can be seized immediately after the initiation of a case. But you can start writing off only after the expiration of the period provided for voluntary execution. This period is counted from the moment the debtor receives a copy of the resolution.

If a registered letter with notification is not received, after 30 days it will be returned to the FSSP. This will also be considered the fact that the debtor has been notified of the commencement of proceedings.

In practice, if an account is seized, collection will begin immediately, including before the expiration of the period for voluntary execution. Many bailiffs do not wait for “their clients” to receive a document from the post office confirming delivery of a copy of the resolution, and immediately transfer the materials to the bank for retention.

The credit institution is obliged to comply with the requirements of the FSSP. If the debtor finds out about the start of the write-off before receiving a copy of the resolution, he can appeal the actions of the bailiff. But if the money has already left the FSSP deposit for the claimant, then it will be impossible to return it.

Seizure, retention at the request of the bailiff

Having received a resolution from the FSSP, the bank is obliged to execute it within 1 business day. To do this, the following activities are carried out:

- the correspondence of the data on the debtor and the account holder is checked;

- if the debtor owns the accounts and deposits, then, by order of the FSSP, the bank imposes a seizure (for this purpose, special notes are made in the programs);

- if the resolution provides for withholding, the bank will write off the money and transfer it to the FSSP deposit;

- Bank employees send a notification to the FSSP about each deduction made;

- if the funds withheld were not enough to fully repay the debt, restrictions and prohibitions will remain. Write-offs will take place automatically;

- After each receipt of money into the account, bank employees will again make write-offs and transfer the money to the FSSP deposit.

New instructions from the Central Bank, adopted in 2021, oblige banks to check the intended purpose of funds received in the accounts of their clients. For this purpose, special payment purpose codes are checked. The employer (for wages), the Pension Fund and other social services (for pensions, benefits, social payments) are required to enter the code. Using the specified code, you can understand the amount of deduction allowed.

Now the new rules have just begun to be applied, so many mistakes are made when making deductions. But starting from 2021, liability has been introduced for illegal withdrawals of funds. In the fall of 2021, the Supreme Court made a decision according to which a citizen has no obligation to provide the bailiff with documents indicating which of his income can be written off and which cannot. It’s up to the banks and bailiffs to sort this out.

How long will the arrest last?

The resolution does not indicate how long the bailiffs imposed the arrest. The security measure will apply:

- until the debt is fully repaid (after which the documents are returned to the FSSP with a mark of execution);

- until the arrest is lifted under a new resolution of the FSSP, based on the results of consideration of the debtor’s complaints;

- before the expiration of the period for which periodic payments were assigned (for example, for child support, periodic collection continues until adulthood);

- until the contract is terminated and the deposit or account is closed (in this case, the bank is also obliged to return the documents to the FSSP indicating the reasons).

The death of the defaulter does not mean that the lien will be automatically lifted. The FSSP employee will check whether the debtor has legal successors or heirs. If they exist, then collection will continue from the inherited property and funds.

When the bailiff is obliged or has the right to lift the arrest

There are no laws prohibiting the seizure of accounts, regardless of the intended purpose of the funds. But in some cases, security measures will be lifted:

- if the entire debt is paid;

- if a FSSP employee transfers for sale the debtor’s property, which will be sufficient to pay the debtor;

- if the arrest order is canceled by the court or a higher bailiff upon the debtor’s complaint;

- if the documents are sent to the defaulter’s place of work to withhold periodic payments;

- if production is completed, terminated or suspended.

Let's give an example. An FSSP employee is obliged to cancel all arrests and bans if the debtor has filed for bankruptcy and his application is found to be justified. But if bankruptcy goes through the court, a new restriction on the disposal of money will be immediately introduced.

They can be withdrawn and spent only with the permission of the manager. For current expenses of the bankrupt, the manager opens a special account and sets a limit on transactions.

How to unblock

In case of blocking of funds on the account that are included in the above list, it is necessary to take prompt measures to cancel the decision of the bailiffs. Money can be written off quickly and without additional notification to the account owner.

It is necessary to immediately contact the official conducting the proceedings and inform him that the arrest was made illegally. After this, the bailiff will most likely ask you to come to a personal appointment and bring supporting documents or send them to him in another way (by email, regular mail, fax).

If an official establishes circumstances that prevent the application of an interim measure, he must decide to cancel the decision. If this does not happen, you will have to appeal the actions of the bailiff (out of court or in court).

What funds cannot be written off at the bank?

Seizure can be placed on any property. But certain types of income are not subject to debt write-off. These include:

- payments received to compensate for damage in the event of the death of the breadwinner;

- budget payments to citizens affected by radiation and man-made disasters;

- maternity capital funds;

- alimony payments;

- survivor's pensions and additional payments to them;

- child benefits;

- a number of one-time payments, amounts of financial assistance.

- military veterans' pensions.

A complete list of income that cannot be withheld from the debtor can be checked in Article 101 of Law No. 229-FZ.

Even despite clear rules on withholding limits, pensions, child benefits, and alimony are regularly written off from debtors’ accounts and cards. The reason is simple - until recently, neither banks nor bailiffs checked the intended purpose of the payment.

Therefore, each receipt was written off according to the debtor’s details. Bailiffs also do not always have information about what types of income go to the account of the defaulter. With the introduction of amendments to Law No. 229-FZ, the situation has changed. Read about it below.

Bailiffs have the right to seize your bank accounts and write off money from them

The money will continue to be written off until the debt is fully repaid. At the same time, the maximum that banks can write off on behalf of bailiffs is 70% of the incoming amounts. But bailiffs do not have the right to write off a number of social payments.

Myths about cards that bailiffs cannot seize

Below are popular myths among debtors - on thematic forums you can see stories about which bank cards are not seized by bailiffs and how to generally protect money from the FSSP. But, unfortunately, these myths do not work in reality.

Let's list some popular, but, alas, not working tips:

You need to open a debit card at a small bank

According to this belief, bailiffs interact only with serious banks at the federal level. And they “don’t get around to small regional organizations.”

In fact, the statement is false. All Russian banks are required to follow the norms of the regulator and the law on the FSSP. Accordingly, if such a bank receives a request for enforcement proceedings, it is obliged to immediately block the account.

Surely you would think that a small bank would fight bravely for every client. Alas. Such a war will cost a lot - sanctions, inspections, fines and other measures. The amount of penalties in such cases can reach 1 million rubles.

An inspection of the Central Bank will be initiated on the basis of a violation of the requirements of the regulations on compliance control. In this case, an unscheduled inspection will be organized.

You need to deposit money into your mobile operator account

For some reason, there is a myth that bailiffs do not have the ability to write off money that is tied to the balances of a mobile operator. Supposedly, you can take a card that is linked to an operator and make purchases from it without fear.

But these cards are also issued by banks. And there is an account, which, like a phone SIM card, is registered directly with the debtor’s passport details. Money cannot be hidden in this way - if the bailiff sends a request to the desired bank, the card will be blocked. Therefore, it is foolish to hope that bailiffs do not block cards of this type.

Hide money in an electronic wallet

The myth is that bailiffs do not have the right to seize electronic money. But in fact, this is just a misconception: NPOs are also fully regulated by law. If you open the electronic system agreement, you will see that arrests and blocking of such wallets are carried out at the request of government authorities.

You can use anonymous wallets. But a lot of restrictions have been introduced in relation to such wallets: you cannot transfer money freely, and the amount of allowable amounts for transfer is only within the limits of 15 thousand rubles.

You cannot withdraw money, you can only use it to pay for online purchases. With simplified identification, you can withdraw up to 40 thousand rubles monthly. The disadvantage of electronic money is the commissions that are charged for transfers.

You can store funds in cryptocurrency

This is also a mistake. If you think that your cryptocurrency money will not be found by bailiffs, you are mistaken. This method worked until approximately 2021, when cryptocurrency exchanges required almost no authorization and identification of clients.

With the growth of Bitcoin and the demand for cryptocurrencies, the situation has changed. Government policy also began to follow fashion trends. If earlier the State Duma scornfully stated that bitcoins are a bubble for narrow-minded people, then after 2021 the authorities suddenly decided to introduce regulation of this “bubble”.

In 2021, every exchange is required to require client verification. Accordingly, the cards through which money is deposited are also checked. Alas, you can’t buy cryptocurrency anywhere except on exchanges. The scheme is as follows: card-exchange-wallet. You won't be able to top up your wallet directly. And some wallets even require verification.

Accordingly, if desired, bailiffs will quickly receive information about the amount and exchange rate of the cryptocurrency that you hold in verified accounts.

New procedure for writing off funds in 2021

To eliminate violations of the interests of debtors during retention in banks, amendments were made to Law No. 229-FZ. Order No. 330 of the Ministry of Justice of the Russian Federation was also approved, which describes the procedure for writing off funds. The essence of the innovations is as follows:

- a system of codes has been introduced for each type of funds received into the account (for example, special codes have been introduced for salaries, pensions, social benefits);

- a mechanism for separate accounting of all deposits has been introduced (it is conventionally called “coloring” of all money for its intended purpose in the banking monitoring system);

- the bank is entrusted with the obligation to independently calculate the amount of funds that can be seized or foreclosed, even if these figures were not indicated by the bailiff.

Payment codes are provided by employers, social services, Pension Funds, and other structures and organizations. The bank is obliged to check them and take them into account when writing off. For example, if the payment slip contains a salary code, then it is prohibited to withhold more than 50%. If the payment card contains a child benefit code, these funds cannot be touched at all.

According to the new rules, no later than 3 days from the date of retention, the bank is obliged to inform the bailiff or collector about this. This is necessary to monitor the correctness of write-offs, file complaints and requests for clarification of transfers.

Do bailiffs write off money from a card with a credit limit?

A special attitude has developed regarding credit cards. The fact is that credit cards with a used limit (in whole or in part) are a category of funds that do not personally belong to the debtor.

There is a loan agreement under which the borrower has the right to use the credit limit. He pays a certain percentage monthly, but in general this is credit money kindly provided by the bank to the client in the amount of the credit limit.

Accordingly, when enforcement proceedings begin, the bailiff requests information from the bank. Some organizations report all cards except the credit account. And in general, this is the correct position - the money in the loan account belongs to the bank, not the debtor. But the bank can also be punished for such “silence” about the card. Why? Because any credit card user can deposit funds in excess of the credit amount into the card account and store them there.

Other banks report credit cards and are faced with a problem: bailiffs seize the account. As a result:

- the bank refuses to accept payments to the seized credit card;

- the credit limit becomes overdue.

In this case, it is necessary to deal with the FSSP and lift the arrest. If MTS Bank, Tinkoff, Megafon operator (operator bank - Round) or another bank informed you that your credit card has been seized, you will need to take:

- credit card statement;

- certificate of debt under the loan agreement.

Then, with these documents and the credit agreement on the card, you must come to an appointment at the FSSP to write an application to the bailiff to lift the arrest. If the bailiff refuses to lift the arrest, you must complain to the senior bailiff.

If the arguments don't work, try:

- make payments on the credit limit through bank cash desks. Although such a service is often paid;

- ask to open a separate account to pay off the limit.

As a last resort, you can appeal the bailiff's decision through the court. Let us note that debtors and collectors often appeal against the actions of bailiffs, but no less often they are faced with refusals. Therefore, if the court of first instance rejects you, try to overturn this decision in the Appeal.

Features of writing off funds

It is important to know the features of arresting and writing off money from different types of accounts. They differ significantly, and this information will be useful when filing complaints and refunds.

Salary

Most employers have long switched to non-cash payment of salaries via cards. It's faster and more convenient than dealing with cash and paying money through a cash register. Seizure of a salary account has the following features:

- no more than 50% can be withheld from wages, and for certain types of debts up to 70% (for example, if the debtor, in addition to the bank debt, also has alimony arrears);

- in the resolution, the bailiff indicates the maximum amount of deductions, but banks are now required to check this information as well;

- 50% is withheld from each salary deposit.

We recommend immediately withdrawing or spending the money remaining after writing off 50% of your salary. The bank has the right to write off the entire balance after the next part of the salary is credited. This rule is specified in Art. 99 of Law No. 229-FZ. Once the next periodic payment is received from the employer, the unwithdrawn money is no longer considered wages, so it is not subject to the 50% withholding limit.

Ekaterina Uryvaeva

Bankruptcy Lawyer for Individuals

Pensions, social benefits

A similar procedure applies when seizing a pension account. Deductions from it can be up to 70%, except for the survivor's pension. When transferring the next pension, the Pension Fund will indicate the payment purpose code. Using it, the bank will calculate the exact amount of deduction and write off the money. If your entire pension has been written off from your card, you can file a complaint and demand a refund.

For children's and social benefits, payment purpose codes are also indicated. If the payment cannot be collected, the bank does not have the right to write off the money. If a social benefit is subject to write-off, the amount of withholding cannot exceed 50 or 70%.

Please note that all social payments are now transferred only to cards of the Russian payment system “MIR”. Therefore, the bank knows in advance about the intended purpose of the money. But this does not mean that all the money coming to the MIR card is pensions or benefits. If violations were committed during write-off, you can file a complaint against the work of the bailiff in court.

Accounts with which you repay loans

The most difficult situation is when the accounts through which the debtor repays loans are seized. There are two possible options:

- if the bank debits money to repay the loan from the client’s regular account, they may be foreclosed on according to general rules (therefore, there may not be enough funds on the loan payment date);

- if money is deposited into a special credit account, it immediately becomes the property of the bank, and therefore it is not profitable for the bank to write it off. Especially if you are paying off this loan, and the arrest concerns debts to other financial institutions.

If you are a debtor, we recommend depositing loan money into a special account or through bank branches and terminals. If you put funds for the next payment on a regular card, they may not wait for the loan to be written off and will go to the FSSP deposit. Accordingly, you will automatically default on the loan schedule.

But keep in mind that in many banks, replenishing accounts through the branch’s cash desk has long been a paid service. For withdrawals and deposits of funds to the card account through the cash desk, they charge a commission, for example, VTB and Alfa-Bank.

Mortgage account: basic information

A mortgage account is similar to a standard one and is opened in the client’s name at the time of concluding a mortgage agreement.

Using the details provided by the bank, the borrower pays the debt agreed upon under the mortgage agreement.

If a writ of execution is submitted to the bailiff service, the bailiffs can seize the property and freeze the debtor's assets as an additional measure to ensure the fulfillment of obligations to the creditor. Mortgage accounts can also be subject to garnishment, which automatically makes it impossible to repay the mortgage debt. Moreover, all borrower contributions received on the IP will be used to pay off the debt to the creditor who filed the writ of execution with the bailiffs.

What should a debtor do if he has his account seized and his money written off?

In conclusion, we will give some recommendations and advice on how to eliminate violations during arrests and withholdings, and where to complain about banks and bailiffs.

How to check if an arrest has been made

We noted above that the debtor can find out about the arrest after debiting from an SMS, statement, or through online banking. But if you lost the case and know in advance that the bailiffs will soon begin collection, you can be proactive.

Here are some tips:

- you can check online whether proceedings have been initiated by the FSSP (this can be done through the service on the bailiffs website);

- at a personal meeting with the bailiffs, you can also get information about the opening of the case, the arrests and restrictions imposed;

- suspension of account transactions may also indicate a seizure has been imposed, so we recommend that you check with the bank about the reason for the suspension.

Upon learning that proceedings have been initiated, immediately submit to the FSSP documents on the intended purpose of payments, if you have them. For example, by submitting a salary payment certificate on time, you can avoid illegal write-off of the entire amount. If possible, pay off the debt immediately or withdraw money from the card.

The situation will be even worse when the bailiff simultaneously sends documents for retention at the place of work and imposes an arrest. The following may happen: the employer will withhold 50% and transfer the second part of the salary to the bank.

Bank employees do not know about the withholding at the place of work and will once again write off the money to the FSSP deposit. To avoid such problems, immediately provide the bailiff with a certificate from work and from the bank to avoid double debiting.

How to cancel account seizure

Knowing why the arrest was imposed, you can try to lift it. The easiest way to do this is to pay off the debt in full and close production. Here are a few more reasons for removing the arrest from your account and stopping write-offs:

- appeal and cancel the judicial act based on which the collection is being carried out (in this case, you are required to return all the money withheld);

- appeal and cancel the bailiff’s decision if he violated the law (for example, if the withholding began before the expiration of 5 days given by law for voluntary payment of the debt);

- submit a certificate from your place of work, from the Pension Fund or social service about the strictly intended purpose of the account or card.

How quickly do bailiffs remove the seizure from an account?

Law No. 229-FZ states that the bailiff is obliged to send the resolution to the bank no later than 1 business day. Another day is given to bank employees to remove information from databases, remove blocking and restrictions on transactions.

Is it possible to get my money back?

If the illegally withheld money has already been transferred to the claimant, it is almost impossible to return it. The only option is to cancel the judicial act. In this case, the claimant is obliged to return all money received under the canceled proceedings.

If the money is on deposit with the FSSP, it will be returned at the request of the debtor. Refunds will take up to 30 days. The money will be transferred to the debtor’s account using the same details from which the deduction was made.

Results

In conclusion, we note that when officials seize an account, you should not despair - carefully study the proposed recommendations and, if the actions of the bailiffs are clearly illegal, use the appeal mechanisms.

Sources:

- Civil Code of the Russian Federation

- Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Latest changes in legislation

From January 1, 2021, legislative amendments regarding personal income tax on accrued interest on deposits and bonds will come into force. The amendments oblige credit institutions to report to the Federal Tax Service on the income of individuals received as interest.

If previously a debtor-citizen could gain time by placing money in a small bank outside his region, then after the adoption of the amendments, this option will most likely become unavailable. Now banks themselves will inform the fiscal authorities about the availability of deposits and the income received by citizens from their placement.

These amendments greatly facilitate the work of bailiffs. At their request, the Federal Tax Service will provide information on individual deposits opened in one or more banks in Russia. At the same time, it is important that the level of income from accrued interest is subject to taxation according to the new rules.

Information sources:

- Federal Law “On Enforcement Proceedings” - link.

- Official website of Sberbank of Russia - link.

- Reference information on the official website of the FSSP of the Russian Federation - link.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email