18

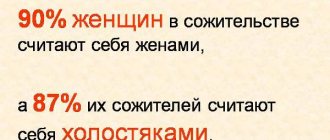

The practice of living together between a man and a woman without registering a marriage has long been rooted in society. Everyone has their own reasons for refusing to submit documents to the registry office. In this case, children of common-law spouses are usually registered in the name of both parents. Citizens realize the importance of a legal family union when one of the spouses dies and the question of inheritance arises. Let's try to figure out what rights a common-law spouse has after the death of her husband.

The difference between the rights of a civil and official wife after the death of her husband

Civil marriage is the cohabitation of a man and a woman for the purpose of running a common household and forming relationships, but without official registration with the registry office. Such a marriage is not recognized on the territory of the Russian Federation.

A common-law wife, unlike an official spouse, is deprived of the following rights:

- spousal share - the absence of an official marriage deprives a woman of the opportunity to claim half of the property acquired after the start of cohabitation, unlike official wives;

- compulsory share - an official spouse or ex-wife with a disability can receive a compulsory share of inherited benefits, regardless of the legal order and the presence of a will; these rights do not apply to a common-law spouse;

- inheritance in order of legal order.

A joint child is a first-degree heir, regardless of the existence of an official marriage between the parents. In order for him to receive part of the property, it is necessary to confirm his relationship with the testator.

Nuances

In order to avoid lengthy legal proceedings, it is recommended to take care in advance of registering relationships and property while both spouses are alive.

Is it possible to make a joint will?

On November 1, 2021, a law was passed according to which a husband and wife can jointly draw up a will.

The main condition for this must be an officially registered marriage. And the common-law wife cannot take part in the preparation of this document.

How to avoid difficulties

It is advisable to get married officially at the registry office. This will allow the common-law wife to become the legal heir even in the absence of a will.

If due to some circumstances this is not possible, then it is necessary to draw up a will. Do not neglect the opportunity to receive an inheritance provided by law. In addition, do not forget about collecting the necessary evidence of the existence of your family.

Can a common-law wife claim inheritance?

A common-law spouse has the right to initiate the process of opening an inheritance after the death of her husband on the following grounds:

- in the presence of a will (an administrative document by which the deceased testator established a strict list of heirs and their shares);

- as a dependent (if the woman was financially supported by the deceased man).

The share of property that she will receive depends on the grounds on which the common-law spouse claims the inheritance.

In law

Article 1142 of the Civil Code of the Russian Federation provides for the division of property on the basis of legal priority. All relatives of the deceased are divided into queues depending on the degree of relationship. Primarily include official spouses, parents and children.

In total, there are 8 queues in Russia, and common-law spouses are not included in them. But the wife may be classified as a dependent due to incapacity or being a minor. This is the eighth line of heirs.

Minor common-law spouse:

After registering an official marriage, minor citizens are considered to have received full legal capacity. This rule does not apply to cohabitees, therefore, after the start of cohabitation, the minor wife remains incapacitated. Therefore, she can claim the property as a dependent.

Common-law spouse – disabled:

Disability is associated with receiving a disability group. This can only be the first or second group, in which a person has limited opportunities for official employment. That is, when a woman is not able to fully provide for herself.

By will

Every person has the right to draw up a will - an administrative document that establishes a list of heirs and shares of property that will be transferred to them after the death of the testator. You can make mention of relatives, third parties, charitable organizations, and law firms in your will. Therefore, a common-law husband can leave part of the property or all the property to his wife.

When drawing up a will, it is necessary to follow the rules established by law, since there is a high probability of appealing the administrative document and its cancellation. Often relatives of common-law spouses try to challenge documents in order to deprive the cohabitant of property rights to property.

Only those persons who are interested in dividing inherited goods can challenge documents:

- close relatives of the deceased;

- other heirs specified in the will.

The appeal takes place in court in a federal court of general jurisdiction.

Grounds for challenge:

- violation of the form of the document;

- violation of the contents of the will;

- drawing up an administrative document by an incapacitated citizen;

- making a will under duress;

- other grounds indicating a violation of the law.

The testator could indicate a testamentary refusal in the administrative document. This is a condition under which a common-law wife can live on the territory of his real estate for life, but the property becomes the property of another heir.

That is, a woman does not have the right to dispose of property, but can use it for its intended purpose. This applies to the operation of household appliances, vehicles, and other personal property of the deceased testator. A notary opening inheritance proceedings, an executor or an engaged commercial lawyer can control the execution of a will.

And one more right that a common-law wife has is the ability to renounce allotted material assets, regardless of whether the woman receives them on the basis of a will or on the basis of dependency.

Inheritance contract

Since 2021, the Civil Code has added the ability to draw up an inheritance agreement. This is a bilateral agreement in which the testator (common-law husband) and the potential recipient of property (common-law wife) sign a contract according to which, after the death of the testator, all property or its individual parts are transferred to the spouse.

The agreement is approved by a notary and registered in the notary register. The implementation of the agreement begins after the death of the testator. The agreement may contain obligations that the common-law spouse must fulfill in relation to the testator or property.

An inheritance agreement can be signed not only between relatives, but also between strangers. Therefore, it is permissible to draw up an agreement between common-law spouses.

Actual acceptance

Civil legislation provides for another possibility of obtaining inherited assets - the actual acceptance of property. The only reason under which an heir can receive property without actually submitting an application to a notary is if there are no applicants for the property. The common-law spouse, as a dependent, can actually accept the property provided that she lives together with the testator for at least one year before the day of his death.

Household items, equipment, and personal belongings of the deceased testator are transferred along with the real estate. The actual acceptance of the inheritance is evidenced by the following actions:

- using things for their intended purpose;

- guarantee of property safety;

- independent repayment of the debts of the deceased testator.

In order to receive property as actual acceptance of the inheritance, the cohabitant must complete the necessary actions within 6 months from the date of death of the testator.

Next, the woman applies to the territorial office of the notary to obtain a notarial certificate. The document allows you to re-register property rights to inherited values.

Who has the right to inheritance after the death of one of the spouses?

How to enter into an inheritance correctly after the death of a husband?

How does property division happen?

In accordance with the Civil Code of the Russian Federation, the person with whom the deceased cohabited is not considered a spouse in full, and therefore cannot claim rights to the spouse’s fortune.

According to the legislation of the Russian Federation, there is a certain sequence according to which those with the right to receive property or monetary property are distributed:

- Heirs of the first stage. These include children, legal spouse and parents of the deceased. What does Article I26I of the Civil Code of the Russian Federation indicate;

- Heirs of the second stage. This, in accordance with Article I262 of the Civil Code of the Russian Federation, includes blood brothers and sisters, grandparents on both sides;

- Heirs of the third stage. These are uncles and aunts (Article I263 of the Civil Code of the Russian Federation);

- Heirs of the fourth stage. As stated in Art. I264 of the Civil Code of the Russian Federation, these are applicants who have lived with the testator for at least 5 years.

In connection with the above, the common-law spouse can be classified as the heir of the 4th stage. And then, only if she manages to prove the existence of an actual marital relationship.

How to prove cohabitation?

Proving a civil marriage is necessary when there are disputes with other potential recipients of property. The common-law wife should collect the necessary documents and begin the procedure for forced recognition of an unofficial marriage through the court.

Where to contact?

Depending on the circumstances, the case may be heard by a magistrate judge or a federal court judge. If there is a defendant, the lawsuit is filed in the federal court located in the defendant's place of residence. In the absence of a defendant, the cohabitant sends a petition to the magistrate's court located at her residence address.

Application deadlines

The Civil Code establishes that the general period for accepting an inheritance is six months. It can be extended for 3 and 6 months depending on the circumstances.

If a common-law spouse wishes to receive property after the death of a cohabitant, then it is necessary to initiate legal proceedings to recognize the civil marriage within the 6 months allotted for inheritance. It is not so easy to do this after receiving a court decision. Therefore, the legislation provides for the possibility of suspending the period of inheritance. To do this, the common-law wife prepares a handwritten statement to the notary with a request to freeze the six-month period. The application is supported by a copy of the statement of claim sent to the court, and a certificate from the court confirming the acceptance of the application for consideration.

Statement

The legislation does not provide for a single form of claim for recognition of a civil marriage. But it is allowed to include the following questions in the content of the petition:

- withholding child support for a common child;

- establishing paternity;

- division of jointly acquired property;

- establishing the fact of cohabitation;

- receiving an inheritance.

A woman can add several issues that interest her to the content of one claim.

Payment of the state fee is carried out separately for each issue, and not for accepting one claim.

The statement of claim is prepared on a computer in as many copies as there are main participants in the process (notary, lawyers, defendants). The claim consists of the following sections:

- header (name of the court, personal data of the plaintiff and defendant, name of the document, date and city of filing the claim);

- introductory part (the grounds for the dispute between the participants);

- descriptive part (detailed description of the conflict, methods used to resolve it);

- legal requirements;

- submitted evidence (inventory of documents that are numbered).

Required documents

Depending on the circumstances, the petition must be supported by the following documents (copies are attached to the petition, and the originals are brought with you to the first meeting):

- applicant's passport;

- documents for common children (birth certificate or passport);

- death certificate of the testator or a court decision declaring the person dead;

- receipt of payment of state duty;

- evidence of cohabitation.

Proof

Evidence may include explanations from witnesses: relatives, neighbors, mutual friends and acquaintances.

The explanation is not official evidence, therefore each witness whose words are indicated in the content of the petition must be prepared to participate in the trial.

Other material evidence:

- a commercial lease agreement that includes both spouses;

- receipt for payment of utilities in the name of the common-law wife;

- a copy of the agreement on the involvement of repair teams for common real estate;

- an agreement with the management company of an apartment building, where the common-law spouse is indicated;

- certificate from the city council on family composition.

Lawyers advise collecting the most complete package of documents that at least indirectly indicates the cohabitation of common-law spouses and family relationships between them. Strong evidence is the presence of a joint child.

Obtaining a resolution

After receiving a court order, the common-law wife turns to the notary who opened the inheritance proceedings. The notary resumes the proceedings and re-divides the property taking into account new circumstances.

If other heirs have already managed to re-register property rights in their name, then the new notarial certificate is the basis for making changes to Rosreestr, the State Traffic Safety Inspectorate and other registers confirming the existence of property rights.

Inheritance within the framework of actual acceptance

Civil legislation provides for another possibility of obtaining inherited assets - the actual acceptance of property.

The only reason under which an heir can receive property without actually submitting an application to a notary is if there are no applicants for the property. The common-law spouse, as a dependent, can actually accept the property provided that she lives together with the testator for at least one year before the day of his death. Household items, equipment, and personal belongings of the deceased testator are transferred along with the real estate. The actual acceptance of the inheritance is evidenced by the following actions:

- using things for their intended purpose;

- guarantee of property safety;

- independent repayment of the debts of the deceased testator.

In order to confirm the actual acceptance of the inheritance, the heir may submit a certificate of residence together with the testator, a receipt for payment of tax, payment for living quarters and utilities, a savings book in the name of the testator, a passport of a vehicle that belonged to the testator, a contract agreement for repairs. works and other documents. If the heir does not have the opportunity to submit documents containing information about the circumstances to which he refers as substantiation of his claims, the court may establish the fact of acceptance of the inheritance, and if there is a dispute, the relevant claims are considered in the manner of litigation.

IMPORTANT! The receipt by a person of compensation for funeral services and social benefits for burial does not indicate actual acceptance.

If the heir has committed actions indicating the actual acceptance of the inheritance, then in this case the law does not require the heir to submit an application for acceptance of the inheritance. The time limit for applying for a certificate of right to inheritance by the heir who actually accepted the inheritance, as well as by the heir who accepted the inheritance upon application, is not limited by law.

If the heir does not apply to the notary for the issuance of a certificate of the right to inheritance, and the notary has reliable evidence of his actual acceptance of the inheritance (as a rule, such circumstances occur when the heir and the testator live together), the specified heir is considered to have actually accepted the inheritance if otherwise was not proven in court, since his rights should not be infringed upon when issuing certificates of inheritance to other heirs.

If, after the expiration of the period established for acceptance of the inheritance, the heir, about whom the notary has information about his actual acceptance of the inheritance, denies this fact, then the fact of the heir’s non-acceptance of the inheritance can be decided in court.

How to enter into an inheritance for a common-law wife?

To enter into inheritance rights after the death of her common-law husband, a woman must complete the following steps:

- contacting a notary working in the region of the deceased testator’s last residence;

- writing an application for opening an inheritance;

- submission of necessary documents;

- payment of state duty for receiving an inheritance.

List of required documents

Required documents:

- personal passport;

- passport of the deceased testator;

- a document confirming the grounds for inheritance (death certificate, court decision declaring deceased);

- certificate of family composition;

- a document confirming the last residence address of the deceased testator.

If a woman represents the interests of a still minor child of a deceased testator, then she submits the child’s birth certificate or passport and permission from the guardianship and trusteeship authorities for the child’s participation in the process of accepting the inheritance.

Statement

Regardless of the presence of a will, a woman can receive an inheritance only at her own request. Confirmation of the will of the common-law spouse is her handwritten application for opening an inheritance, submitted to a notary.

The law does not provide for a single form for such an application, but the application must contain the following sections of information:

- Full name of the deceased testator;

- Full name of the recipient of the funds (common-law wife);

- family connection or proof of cohabitation;

- a list of property that the woman claims;

- confirmation of familiarization with rights and obligations;

- date of application and signature.

State duty

Inheritance is not taxed, but the successful heir pays a state fee to receive the property. The common-law wife, since she is not officially a close relative, must pay 0.6% of the total value of the property received. The notary allocates the cohabitant's share of property, and then the percentage of state duty is calculated. The value of the property is confirmed by the conclusion of an appraisal examination or cadastral documents.

Inheritance by inheritance contract

Since 2021, it has become possible to draw up an inheritance agreement. This is a bilateral agreement in which the testator (common-law husband) and the potential recipient of property (common-law wife) sign a contract according to which, after the death of the testator, all property or its individual parts are transferred to the spouse.

The agreement is approved by a notary and registered in the notary register. The implementation of the agreement begins after the death of the testator. The agreement may contain obligations that the common-law spouse must fulfill in relation to the testator or property. An inheritance agreement can be signed not only between relatives, but also between strangers. Therefore, it is permissible to draw up an agreement between common-law spouses.

A lawyer's answers to questions about a common-law wife's right to her husband's inheritance

Does a common-law wife have the right to inherit if there is no will?

Yes, but only if she was dependent on the deceased testator. Dependency is usually understood as being in full support and financial care of the deceased testator. That is, the common-law wife had no other means of livelihood other than the income of her common-law husband. Having collected documents confirming your dependency, you must contact a notary to re-register property rights.

I lived with my common-law husband for 5 years. During this time, we purchased a car with joint money. The husband died, but he left behind children from his first marriage, who lay claim to the car registered to the husband. Is it possible for me, as a common-law wife, to inherit it?

Yes, but initially it is necessary to recognize the civil marriage in court. For this purpose, a statement of claim is prepared, which is confirmed by documents indicating cohabitation and the existence of a civil marriage. The second group of documents includes proof of purchase. The claim may contain 3 legal requirements at once: recognition of a civil marriage, recognition of a car as joint property, provision of the opportunity to inherit benefits after the death of a common-law spouse. The claim is heard by a federal court of general jurisdiction.

The father lived with his common-law wife. After his death, we, as the heirs of the first stage, are entitled to his apartment. Can we abandon her in favor of his common-law wife?

Yes, it is allowed to renounce property in favor of any participant in legal relations. Therefore, heirs of the first priority who do not want to receive property can write a refusal at the notary in favor of the common-law wife of the deceased testator. Refusals are registered with a notary and entered into the register, so it is difficult to appeal in the future.

What does a common-law husband need to do so that in the event of his death, I, as a common-law wife, can receive an inheritance?

The best option is to make a will. It is also convenient to draw up an inheritance agreement by which the common-law spouse transfers his values to the common-law wife. An agreement, like a will, is registered with a notary, entered into the register, and comes into legal force only after the death of the testator. By an inheritance agreement, a husband can oblige his common-law wife to fulfill a number of obligations (for example, providing financial assistance to his children, making regular contributions to charitable foundations, repaying debts and loans).

Inheritance by law within the queue

Article 1142 of the Civil Code of the Russian Federation provides for the division of property on the basis of legal priority.

All relatives of the deceased are divided into queues depending on the degree of relationship. Primarily include official spouses, parents and children. In total, there are 8 queues in Russia, and common-law spouses are not included in them.

But an unofficial wife may be classified as a dependent due to incapacity or due to being a minor . This is the eighth line of heirs.

Minor common-law spouse

After registering an official marriage, minor citizens are considered to have received full legal capacity. This rule does not apply to cohabitation, therefore, after the start of cohabitation, the minor wife remains incapacitated. After the death of her common-law spouse, she can claim the property as a dependent.

Disabled common-law spouse

In this case, the Law classifies as disabled people:

- minors;

- women over fifty years of age

- disabled people of groups I, II, III;

- students under 18 years of age, and full-time students - until graduation, but not longer than 23 years of age.

Even if a woman is able to work, in order for the court to recognize the deceased’s common-law wife as his dependent, it must be proven in court that at least for a year before death the deceased fully supported his cohabitant, or she received regular financial assistance from him, which was her main source livelihood. The cohabitant may also have her own income, including a pension. However, the court will analyze the relationship between the cohabitant's assistance and her personal income. Testimony of witnesses, information about the income of common-law spouses, various types of payment documents confirming the maintenance of a dependent, etc. can be used as evidence of dependent status. In this case, cohabitation with the deceased for at least a year before his death is mandatory, and this fact is also established in a court.

What are the legal features of an unofficial marriage?

The concept of “civil marriage” does not exist in Russian legislation, since in everyday life the cohabitation of two people is called “cohabitation”. Nevertheless, this term has taken root in the colloquial speech of the public, so it is quite appropriate to reveal its definition.

Civil marriage is the actual residence, joint management of a household of two people without legal registration of the relationship, that is, an application to the registry office. Expanding on the topic, we can say that people in the legal sense:

- are not spouses in relation to each other;

- do not have a marriage certificate in their hands;

- cannot claim division of jointly acquired property;

- cannot be legal heirs in relation to each other's property.

In other words, a civil marriage does not give rise to any legal consequences for cohabitants.

REFERENCE! You can register a marriage only at the territorial registry office in accordance with Art. 11 IC of the Russian Federation. No other method of formalizing relations is provided for by law.

How to avoid disputes?

The best way to avoid further disputes is to register the marriage.

Only in this case can a woman become the heir of the 1st stage. No marriage contracts or agreements on the division of property will be valid, since their legal force applies only to official marital relations.

The second safe way is to draw up a will , where the common-law spouse is indicated as the heir. If the will is drawn up in accordance with the requirements of the law, then no one will be able to challenge it. However, when drawing up the document, the testator must take into account the share of obligatory heirs. The third method can be called an apartment/house donation agreement. In this case, it does not matter whether the testator has obligatory heirs or not. A common-law wife can become a full owner even before the death of her husband.

All other situations are extremely vulnerable to challenge, so the methods listed above are the best option for solving the problem.

What to do if the case is lost?

Losing in such situations is commonplace, but the common-law wife can appeal the decision to the appellate and cassation instances of the court.

This is the only chance for the cohabitant. To do this, she needs to go back to the court where the decision was made and write an appeal.

The general period for writing a complaint is 1 month according to Part 2 of Art. 321 of the Code of Civil Procedure of the Russian Federation from the date of the decision of the 1st instance. If the appeal hearing of the case does not help, then all that remains is to appeal the decision in cassation.

To do this, you need to contact the judicial institution of the subject of the Russian Federation and write a cassation appeal. The general period for filing a document is 6 months from the date the court decision entered into legal force.

REFERENCE! The appeal and cassation complaint are drawn up in accordance with the rules of Art. 322, 378 Code of Civil Procedure of the Russian Federation.

Other articles related to inheritance have been prepared on our website:

- The nuances of receiving an inheritance after the death of a spouse - husband or wife.

- Do spouses have the right to inherit if the other half dies?

- Does a wife have the right to a share after the death of her husband and how to inherit?

- When is an inheritance considered marital property in a divorce?

- Is inheritance divided between spouses during a divorce and what to do with property received during marriage?

- Who is the first priority heir after the death of a husband or wife?

- Rights of a spouse when inheriting property jointly acquired with her husband.

Possible problems

Each inheritance case is individual, so the degree of complexity may vary. However, the best option is when the testator, except for his common-law wife, has no more heirs at all, but this happens extremely rarely. Everything becomes more complicated when the following facts are present in the inheritance case:

- The testator has a lot of heirs and relatives who lay claim to the inheritance. The more relatives there are, the less chance of winning the case. In this case, the common-law wife will have to think carefully before filing a claim, since the game may not be worth the candle, especially when she has her own property.

- The testator is not listed as the father on the child's birth certificate.

In this case, the fact of paternity will be very difficult to prove, and the child may not become a mandatory heir by law. It will be extremely difficult to conduct a genetic examination after the death of the father, since the exhumation of the corpse is most often carried out in criminal cases. Joint photographs and videos may not be sufficient evidence for a judge. - The cohabitants lived separately, which is confirmed by documents, so it will not be easy to convince the court of the existence of a marital relationship.

Things become even more complicated if the testator was legally married at the same time. There is practically no chance of winning in this case.

- The common-law spouse has her own independent income and also has her own living space. She is not disabled and is not retired. In this case, it is impossible to refer to the fact of dependency, so the judge will resolve the case not in favor of the cohabitant.

- The absence of common children, to some extent, can become an obstacle to a positive resolution of the case.