What documents are needed to prove kinship and the right to inherit from a deceased relative?

In order to receive the inheritance of a deceased relative, you must prove your relationship with him. Therefore, any documents may be required depending on the situation. But in any case, you need to provide a death certificate. And documents proving the relationship may be as follows.

The simplest option is children and parents, especially if they have the same last names. In this case, a birth certificate is sufficient, where the deceased parent is indicated as such. But if a woman changed her last name upon marriage, then she must provide a certificate indicating her maiden (previous) last name and the one assigned after the registration of the relationship.

IMPORTANT.

If there were several marriages, then all the evidence will be required so that you can trace the series of changes in surnames.

If the relatives are somewhat further away, you will have to provide supporting documents for the entire chain. For example, if a grandson claims the inheritance of his maternal grandmother, then he will need his mother’s birth certificate, i.e. in this way it will be proven that the mother is the daughter of the deceased grandmother. Next, you need a document indicating that the grandson is the son of the deceased’s daughter.

Now the situation is different. An uncle has died and his nephew, who is the son of the deceased’s sister, is claiming his fortune. In this case, you need to prove the fact of relationship between the mother and uncle. This can be proven by their birth certificates, where the parents are the same people. And then the nephew must provide his birth certificate, which shows his mother. If she changed her last name upon marriage, a marriage certificate will be required.

Approximately according to this algorithm, one should prove a relationship with the deceased in order to claim his inheritance. At the same time, documents confirming the fact of relationship can be not only marriage and birth certificates, but also others:

• any documents from the registry office, for example, about adoption, etc.; • some certificates of kinship, which can be issued at the place of residence or work of the deceased or his heir. For example, if a citizen received a deduction for education or treatment of spouses or children, he was provided with vouchers for family members or New Year gifts for them, etc.; • entries in passports (about children and spouses); • certificates from social security authorities, if they, together with other documents, allow us to establish the degree of relationship (for example, the assignment of a pension as a result of the loss of a breadwinner).

There is another important point in challenging the right to inheritance: the heir must not only prove that he is a relative of the deceased and has the right to inheritance, but also that there are no other claimants to the property and fortune. Here you can act in exactly the same way: collect information that the deceased had, for example, children, but at the moment they have died (birth certificates, death certificates, extracts from house books, etc.). However, most likely, the notary will not formalize the inheritance before the six-month period required by law has passed. It is during this period that the heirs can declare their right to receive the inheritance or part of it. However, the more documents regarding proof of kinship, as well as the absence of other heirs, a citizen can provide, the better it will be.

Spouse's rights during inheritance

The right of inheritance belonging to a spouse by virtue of a will or law does not affect his other property rights related to his state of marriage with the testator, including the right of ownership of part of the property acquired jointly during marriage.

By a court decision, a spouse may be excluded from inheritance by law, with the exception of inheritance on the basis of the rules on compulsory share in the inheritance, if it is proven that the marriage with the testator actually ended before the opening of the inheritance and the spouses lived separately for at least five years before the opening of the inheritance. and did not conduct a common household.

DO YOU HAVE ANY QUESTIONS?

Look at the lawyer's practice, or read more on the topic, or -

What to do if there are no documents

If a person is unable to provide documents that would confirm his relationship with the deceased, then there are two options.

The first option is to try to restore the documents. Duplicates of basic papers and certificates can be ordered at the registry office. You can contact archives, village councils, territorial administrations - any governing body at the place of residence of one of the participants in the inheritance case.

If this does not work out, then the second option remains - to prove family relations with the deceased through the court. In this situation, the identification of a citizen is carried out in accordance with the provisions of Article 264 of the Civil Procedure Code of the Russian Federation. In order to establish the truth, you can provide the court with photographs, videos, correspondence, other documents and papers that will help establish that people were relatives. Witness testimony is also important. If in the end the court establishes that the deceased and the interested person are relatives, this means that the citizen receives the right to inheritance.

REFERENCE.

If the identified heir turns out to be closer to the deceased in terms of relationship, then other, more distant relatives may completely lose what they could be entitled to, or receive only part of the deceased’s estate.

There may also be situations when one or another fact of life cannot be documented. For example, in a chain where it is necessary to establish kinship, a civil marriage is discovered. Obviously, the registry office will not have a document registering the relationship. Therefore, a common-law wife is not an heir - of course, if there is no will. But when this document is missing, the common-law spouse can still receive an obligatory share in the inheritance if he was disabled. It means that:

• disability of groups I or II was established; • the age of the woman/man is greater than the official retirement age. It does not matter whether the benefit is accrued or not.

Also, if it is possible to prove that one of the common-law spouses was dependent on the other, that is, lived together with another person providing significant material support, then he will be entitled to a mandatory share, which is at least 50%. But such cases are not within the jurisdiction of notaries, but are resolved exclusively in court.

Another situation is the lack of passporting in any territory. In this case, you should turn to the records of the village councils, which kept records of births and deaths.

Heirs of subsequent queues

If the deceased does not have heirs of the first, second, third and fourth degrees, the right to inherit according to the law is received by relatives of the testator of the third, fourth, fifth and sixth degrees of kinship, not related to the heirs of previous orders, and relatives of a closer degree of kinship exclude relatives of a more distant degree from inheritance kinship.

The degree of kinship is determined by the number of births separating relatives from each other. The birth of the testator himself is not included in this number.

In accordance with these rules, inheritance is called for as:

1) relatives of the third degree of kinship - great-grandparents of the testator;

2) relatives of the fourth degree of kinship - children of the testator’s nephews and nieces (cousins and granddaughters) and the siblings of his grandparents (great-uncles);

3) relatives of the fifth degree of kinship - the children of his cousins’ grandchildren and granddaughters (great-great-grandsons and great-granddaughters), the children of his cousins (great-nephews and nieces) and the children of his great-uncles and grandmothers (great-uncles and aunts);

4) relatives of the sixth degree of kinship - the children of his great-great-grandsons and great-granddaughters (great-great-great-grandsons and great-great-granddaughters), the children of his cousins nephews and nieces (second cousins and granddaughters) and the children of his uncles and aunts (second cousins).

Heirs of the same degree of kinship called to inherit inherit in equal shares.

Features of the procedure if the testator and heir are citizens of different states

Contesting and receiving an inheritance takes place under the jurisdiction of the state where the testator lived before his death and where his property is registered. Therefore, if he was a citizen of Russia, then regardless of what citizenship the heir has, he must act according to Russian laws. Consequently, it will be necessary to prove kinship in exactly the same way as was described for citizens of the Russian Federation. However, the procedure has certain nuances.

The notary is obliged to notify the heir that he has become one. But since it is not always easy to find a person within the allotted period (six months from the date of death of the testator), it is possible to restore him through the court. Then it is necessary to prove that the heir may not have known about the inheritance due to reasons beyond his control, or that this fact was hidden from him due to the intent of third parties.

A foreigner can conduct business to prove kinship with the deceased through a representative. This is regulated by Article 1153 of the Civil Code of the Russian Federation. If such a representative will be an employee of the consulate or embassy, then there is no need to issue a power of attorney. It will only be enough to provide a document confirming the official authority of this person.

It is also important that if an agreement on the rules of inheritance is concluded between the Russian Federation and the country whose citizenship the heir has, the period for consideration of the case on the right to inheritance is calculated from the day when the applicant was notified of the inheritance, and not from the date of death of the testator. There are separate cases when the subject of inheritance is land property. In this case, only citizens of the Russian Federation can take ownership. A foreigner will only be able to claim compensation, which can be established by a court decision. A year after the issue of inheritance was opened, the land plots are transferred to the ownership of the state. During this year, you can evaluate the site and register the right to compensation. In such a situation, the funds will subsequently be transferred to the foreigner through the justice authorities. If the foreigner is not the only heir to the land, but the Russians also lay claim to him, then they will compensate the share of the inheritance to the citizen of another country.

Inheritance of citizens' property

Inheritance law is an independent institution (part) of civil law. Its norms are contained in the third part of the Civil Code of the Russian Federation, in section. 5.

Structure of inheritance law:

a) the concept of inheritance, inheritance law, inheritance legal relationship; b) legislation on inheritance; c) stages (stages) of inheritance; d) powers and responsibilities of heirs.

Stages of inheritance:

- opening of inheritance;

- protection of inheritance;

- expression by the heir of his attitude towards the opened inheritance: acceptance or refusal of it;

- entry into inheritance.

Inheritance is the transfer of property and property rights and obligations of a deceased person (testator) to living persons (heirs) in the order of universal succession, unchanged as a single whole and at the same moment (Article 1110 of the Civil Code).

An example of another type of succession is the assignment of a claim by a living person to another person. A feature of hereditary succession is its universality: all the rights of the deceased are transferred as a single whole, simultaneously and without the mediation of third parties. As a result of legal succession, an inheritance legal relationship arises. The inheritance legal relationship has the following structure: objects, subjects, content (powers of the heirs). In addition, the basis for the emergence of an inheritance legal relationship is identified.

The object of the inheritance legal relationship is the things belonging to the testator on the day of opening of the inheritance, as well as property rights that are not related to the personality of the deceased.

Thus, the latter’s obligation to pay alimony to his son from his first marriage does not pass by inheritance to the wife of the deceased. The set of transferable rights and obligations is called inheritance or “inherited mass” (Article 1112 of the Civil Code). It includes all things, other property, as well as property rights and obligations that belonged to the deceased on the day the inheritance was opened. The inheritance does not include personal non-property rights and intangible benefits (for example, the right of authorship), as well as rights inextricably linked with the personality of the deceased.

The most important property right is the right of ownership of property (real estate (apartment, house, dacha), cash savings, in particular bank deposits, vehicles (car, yacht), personal belongings of the deceased, household furnishings and household items).

An inheritance that has been opened, but not yet accepted by the heirs, is called “lying”. It is subjectless in the period before the acceptance of the inheritance.

The subjects of the inheritance legal relationship are the testator and the heir.

The testator can only be an individual. In cases where the testator makes a will, he must have legal capacity. The same testator may have several heirs. The inheritance shares of such heirs are assumed to be equal.

Heirs can be all subjects of civil law: individuals and legal entities, the state (Article 1116 of the Civil Code).

The state can be the heir in the following four cases:

- if the property is bequeathed to him by the testator;

- the testator has no heirs;

- all heirs are deprived of the right of inheritance by the will;

- all heirs refused to inherit.

In cases where an individual is limited or completely deprived of legal capacity, his representatives: trustees and guardians enter into the inheritance. Heirs are divided into “ordinary”, “necessary” and “unworthy”.

“Necessary” include heirs for whom the law determines the share of inheritance, regardless of the contents of the will. These include minors and disabled children and spouses, parents and dependents of the testator (Article 1148 of the Civil Code). Such heirs are entitled to 1/2 of the share that they would have received if they had inherited by law (Article 1140 of the Civil Code).

Unworthy heirs are persons excluded from inheritance either by law or by a testator. These include (Article 1117 of the Civil Code):

- parents deprived of parental rights, as well as parents who maliciously evade child support (they cannot inherit after their children by law);

- heirs who, through deliberate, illegal actions, contributed to their calling to inheritance (actions must be directed either against the testator or against other heirs). This fact must be established by the court. Examples of illegal actions: drawing up a fictitious will, forcing another heir to renounce an inheritance in his own favor.

Heirs are also identified by right of representation. These are the descendants of heirs who died before the opening of the inheritance (Article 1146 of the Civil Code).

The basis for the emergence of an inheritance legal relationship is the opening of an inheritance.

The legal facts that give rise to the opening of an inheritance are the death of the testator or a court decision declaring him dead.

The significance of inheritance is that it is the basis (method) for the emergence of ownership rights to someone else's property.

The concept of “inheritance law” is used in two senses: objective and subjective.

Inheritance law in an objective sense is a set of rules governing the process of transferring the rights and obligations of a deceased citizen to other persons. These norms form a subbranch of civil law.

Inheritance law in the subjective sense is the right of a person to be recognized as an inheritor and his rights to property after acceptance of the inheritance.

The meaning of inheritance law in an objective sense:

1) it actually guarantees the protection of private property by the state, provided for in Art. 35 of the Constitution of the Russian Federation, since it contains legal guarantees for the lawful transfer of property rights from one person to another;

2) stimulates the practical activity of an individual in acquiring ownership of property, since it creates confidence in him that the acquired property after his death will pass to people close to him.

Sources of inheritance law relate to various branches of law, i.e. are complex in nature. These are the following regulations:

- Constitution of the Russian Federation 1993;

- Civil Code of the Russian Federation. Part three // Northern Territory of the Russian Federation. 2001. No. 49; RG. 2001. November 28;

- Law “On the entry into force of part three of the Civil Code of the Russian Federation” dated November 26, 2001 No. 147-FZ // RG. 2001. November 28; NW RF. 2001. Art. 4553;

- Fundamentals of the legislation of the Russian Federation on notaries dated February 11, 1993 No. 4462 // Armed Forces of the Russian Federation. 1993. Art. 357;

- Instructions on the procedure for performing notarial actions by state notary offices of the RSFSR, approved by order of the Ministry of Justice on January 6, 1987 No. 10/16-01 // Law. 1997. No. 7;

- Instructions on the procedure for certifying wills and powers of attorney by heads of prisons, approved by the USSR Ministry of Justice on May 14, 1974;

- Instructions on the procedure for certifying wills by chief physicians, approved by the USSR Ministry of Justice on June 20, 1974;

- Instructions on the procedure for performing notarial actions by officials of executive authorities dated March 19, 1996 // Heritage. Documents, explanations, judicial practice. M., 2000;

- Resolution of the Plenum of the Supreme Court of the Russian Federation “On some issues arising in courts in inheritance cases” dated April 23, 1991 No. 2 // Coll. resolutions of the Plenums of the Supreme Courts of the USSR and the RSFSR (RF) in civil cases. M., 2000.

When resolving inheritance disputes, the following rules are used:

- Family Code of the Russian Federation (clause 1, article 36, clause 3, article 60);

- Civil Procedure Code of the Russian Federation;

- other parts of the Civil Code of the Russian Federation (10 articles of the first and 13 articles of the second part).

Inheritance issues are also regulated by separate articles of various laws, as well as decisions of the Plenums of the Supreme Court of the Russian Federation on the application of these laws, for example:

- on legal entities (joint-stock companies, non-profit organizations, agricultural cooperation, consumer cooperation, limited liability companies, gardening and dacha associations of citizens);

- on copyright (protection of computer programs and databases, topology of integrated circuits);

- on the privatization of housing stock.

A special group consists of regulations governing the collection of state duties and taxes on inherited property:

- Law of the Russian Federation “On tax on property transferred by inheritance or donation” dated December 12, 1991 // Armed Forces of the Russian Federation. 1992. No. 12. Art. 593; NW RF. 1995. No. 5. Art. 346; SAPP RF. 1998. No. 50. Art. 4861;

- Law of the Russian Federation “On State Duty” of December 9, 1991 // SZ RF. 1996. No. 1. Art. 19.

However, the most important source of inheritance law is the Civil Code of the Russian Federation, part three.

Section five of part three of the Civil Code of the Russian Federation consists of five chapters:

- Ch. 61. General provisions on inheritance.

- Ch. 62. Inheritance by will.

- Ch. 63. Inheritance by law.

- Ch. 64. Acquisition of inheritance.

- Ch. 65. Inheritance of certain types of property.

Methods (grounds) of inheritance (Article 1111 of the Civil Code):

- by will;

- in law.

Drawing up a will is the only way in which the testator (testator) can dispose of his property in the event of his death. The peculiarity of a will as a document is that it comes into force only when the testator can no longer confirm or reject one or another interpretation and execution.

Intestate inheritance occurs when a deceased person has left dispositions regarding his or her property in the event of his or her death. This disposition is called a will.

Drawing up a will is a one-sided transaction, since it expresses the will of one person - the maker. This transaction is conditional, since the order will come into force only in the event of the death of its originator. Since the moment it comes into force will be the moment of death of the originator, this transaction should be considered “conditional, completed under a suspensive condition.”

The choice of heirs and the principle of distribution of property between the heirs is the prerogative of the testator alone. This manifests “freedom of will” (Article 1119 of the Civil Code). It is limited by the rules on the obligatory share in the inheritance (Article 1149 of the Civil Code), which must be no less than half the share that would be due to a person upon inheritance by law (clause 1 of Article 1149 of the Civil Code).

A will can be drawn up as follows:

- certified by a notary (Article 1125 of the Civil Code);

- certified by an official specified in the law (Article 1127

- GK);

- drawn up in simple written form in the presence of two witnesses under extraordinary circumstances (Article 1129 of the Civil Code) and handed over to the notary in a sealed envelope; such a will is called closed (Article 1126 of the Civil Code).

Special methods of disposition used when drawing up a will:

- sub-appointment of a reserve heir in the event of the death of the main heir by the time the will comes into force (Article 1121 of the Civil Code);

- imposing on the heir the obligation to perform socially useful actions (Article 1139 of the Civil Code);

- appointment of the executor of the will - executor (Article 1133 of the Civil Code);

- testamentary refusal (legate) - imposing on the heir the fulfillment of an obligation in favor of a specific person (legatee) (Articles 1137, 1138 of the Civil Code).

The secrecy of the preparation and contents of a will is protected by law (Article 1123 of the Civil Code). The testator must have legal capacity and make the will in person. A will, like any transaction, can be declared invalid both in whole and in part (Article 1131 of the Civil Code). Invalid wills and the consequences of their invalidity are subject to the rules of limitation. A will can be changed and canceled by the testator during his lifetime (Article 113O of the Civil Code). Corrections are not allowed.

Inheritance by law occurs if the deceased person did not leave a will. A limited number of persons then act as heirs - only those specified in the law.

The circle of heirs according to the law is divided into the following queues:

- First of all, the children, spouse, and parents of the testator inherit. The grandchildren of the testator and their descendants inherit by right of representation (Article 1142 of the Civil Code);

- in the second place, the brothers and sisters of the testator and his grandparents inherit. Nephews and nephews of the testator inherit by right of representation (Article 1143 of the Civil Code);

- in third place, the uncles and aunts of the testator inherit. The testator's cousins inherit by right of representation (Article 1144 of the Civil Code);

- in fourth place, the great-grandfathers and great-grandmothers of the testator inherit (clause 2 of article 1145 of the Civil Code);

- in the fifth place, cousins and granddaughters and great-uncles and grandmothers of the testator inherit (clause 2 of Article 1145 of the Civil Code);

- sixth, cousins, great-grandsons and great-granddaughters, as well as cousins and aunts of the testator (Clause 2 of Article 1145 of the Civil Code) inherit;

- in seventh place, the stepsons, stepdaughters, stepfather and stepmother of the testator inherit (clause 2 of Article 1145 of the Civil Code);

- in eighth place, disabled dependents of the testator who are not included in the circle of heirs inherit, but only in the absence of other heirs (clause 3 of Article 1148 of the Civil Code).

The order of inheritance according to the law - the heirs of each subsequent line are called to inherit only if the heirs of the previous line are absent or have disappeared (clause 1 of Article 1141 of the Civil Code). In this case, heirs of the same line inherit in equal shares with the exception of heirs by right of representation (clause 2 of Article 1141, Article 1146 of the Civil Code) and the surviving spouse (Article 1150 of the Civil Code).

Disabled dependents of the testator inherit in a special manner. Thus, the disabled dependents of the testator are divided into two groups: the first group includes dependents provided for in Art. 1142-1145 Civil Code, i.e. from the second to the seventh stage inclusive; The second group includes dependents who are not considered heirs by law. Dependents included in the first group, but not included in the circle of heirs of the line that is called to inherit, inherit on an equal basis with the heirs of the line that is called to inherit, but provided that they were dependent on the testator for at least one year (clause 1 Article 1148 Civil Code). The same rule applies to dependents classified in the second group, provided that there are other heirs. However, in the absence of other heirs, they inherit independently and as heirs of the eighth order (clause 3 of Article 1148 of the Civil Code).

The right to an obligatory share in the inheritance is discussed in Art. 1149 Civil Code. Minor or disabled children of the testator, disabled spouses and parents, as well as disabled dependents of the testator who are subject to inheritance, inherit, regardless of the contents of the will, at least half of the share that would be due to each of them upon inheritance by law (mandatory share).

The right to an obligatory share in an inheritance is satisfied from the remaining untested part of the inheritance property, even if this leads to a reduction in the rights of other heirs under the law to this part of the property, and if the untested part of the property is insufficient to exercise the right to an obligatory share, from the part of the property that is willed .

An exception to the general rule of calling heirs by law is the following rule: an heir by law who lives together with the testator until his death has a preferential right to items of ordinary household furnishings at the expense of his inherited share (Article 1169 of the Civil Code).

Three categories of relatives inherit equally in the share that would be due by law to their deceased parent:

- grandchildren and great-grandchildren;

- nephews and nieces;

- cousins.

When inheriting by law, the “principle of representation” applies. It consists in the fact that the share of the deceased heir passes to his descendants if the heir died before the testator (Article 1146 of the Civil Code).

The shares of the heirs are assumed equal by law, but the share of the surviving spouse is always greater, since, in accordance with the Family Code of the Russian Federation, he has the right to half of the property acquired by him jointly with the deceased spouse - the testator (Article 1150 of the Civil Code).

In both methods of inheritance, the principle of “hereditary transmission” applies, according to which the rights of an heir who died during the period of inheritance are transferred to his heirs (Article 1156 of the Civil Code).

The acquisition of an inheritance includes:

- filing by heirs of an application for acceptance of inheritance;

- submission by heirs of an application for the issuance of a certificate of right to inheritance;

- receipt by the heir of a certificate of right to inheritance.

But the acquisition of an inheritance is preceded by two more legal facts: the opening of an inheritance and the adoption of measures to protect it.

The opening of the inheritance occurs at the time of the death of the testator, either from the moment the court declares the testator dead, or on the day of the testator's supposed death from an accident (Article 1113 of the Civil Code). The day of death of the testator is confirmed by a medical certificate or a court decision (clause 2 of Article 1114 of the Civil Code). Citizens who die on the same day do not inherit from each other (Clause 2 of Article 1115 of the Civil Code).

The determination of the following circumstances is associated with the time of opening of the inheritance:

- circle of heirs called to inheritance;

- composition of inherited property;

- deadlines for filing claims by creditors;

- the moment of emergence of the heirs' right to the inherited property;

- deadline for issuing a certificate of inheritance;

- legislation to be applied in inheritance.

The place of opening of the inheritance is the last permanent place of residence of the testator, and if it is unknown, then the location of his property (Article 1115 of the Civil Code). It is proven by certificates from housing and communal services, local administrations, police departments, a certificate from the place of work of the testator, as well as an extract from the house register. If the place of residence of the testator is unknown, it is established in court.

The place of opening of the inheritance determines the place of filing an application for acceptance or refusal of the inheritance, the place of organizing the protection of the inherited property, the place of issuing a certificate of the right to inheritance, etc.

Protection of the opened inheritance is necessary in order to preserve it, because half a year passes between the moment of its opening and the entry into the inheritance of the heirs.

Measures to protect the opened inheritance are taken by notaries or executive authorities authorized to perform notarial acts (in areas where there is no notary). Protection is carried out at the place of opening of the inheritance. The basis for carrying out security actions is a statement from citizens or the initiative of these officials. The procedure for taking protective measures is regulated by Art. 1172 of the Civil Code of the Russian Federation, the basis of legislation on notaries, the Instructions on the procedure for performing notarial actions by notary offices and other regulations. Their essence boils down to the following: the notary describes the inherited property (the inventory is transferred for storage to the heirs) and transfers the inherited property into trust management to the person appointed by him (Articles 1026, 1178 of the Civil Code) on the basis of an agreement, or to the executor appointed by the testator in the will under a storage agreement . The custodian and trustee are warned of liability for improper execution of these contracts (see, for example, Article 1022 of the Civil Code). Persons providing security have the right to receive remuneration from the heirs for their work. These persons are also entitled to compensation for expenses incurred in connection with the protection of inherited property, minus the benefits they received (see, for example, Articles 1023, 1174 of the Civil Code). If the inheritance is protected by one of the heirs, the other heirs are not required to pay for his work.

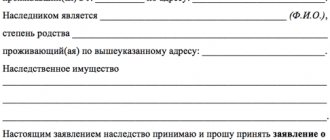

An application for acceptance of an inheritance is submitted at the notary's office at the place of permanent residence of the testator. It is drawn up in writing and must contain the following details: first name, patronymic, last name of the applicant, date of opening of the inheritance, address of the testator, desire of the applicant regarding acceptance of the inheritance. The application period is limited: up to six months from the date of opening of the inheritance. Filing an application for acceptance of an inheritance can be replaced by actual entry into possession, use and disposal of property. This is expressed in maintaining the property in proper condition, paying various payments for it (taxes, utilities, etc.). Such an heir does not have the right to alienate the inherited property before receiving a certificate of inheritance. If the heir dies before accepting the inheritance, the inheritance share due to him passes to his heir (hereditary transmission - Article 1156 of the Civil Code). The application for new heirs must be made within the remaining part of the period (6 months), and if it is less than three months, then this period must be increased to three months. The heir has the right to refuse the inheritance; the invalidity of such a refusal can only be recognized in court, provided that it was made under the influence of deception, violence, or threat. The refusal can be made in favor of a specific person, who must necessarily be the heir of the same testator and should not be recognized as an unworthy heir (Article 1157 of the Civil Code).

Refusal is a one-sided transaction. It must be made in writing, and the person who refuses must have legal capacity. The refusal is irrevocable (clause 8 of the resolution of the Plenum of the Supreme Court of the USSR of July 1, 1966).

The act of accepting an inheritance is a unilateral transaction; it is universal (applies to all property, wherever it is located), unconditional (acceptance of an inheritance under a condition is not allowed), irrevocable (the person who submitted an application to the notary to accept the inheritance cannot take it back ( Art. 1152 of the Civil Code) in nature, it is given retroactive force (the inheritance is considered accepted from the moment the inheritance is opened, and not from the moment of its acceptance).

A six-month period has been established for accepting an inheritance (if it is missed, the right to accept an inheritance is lost - Article 1154 of the Civil Code).

The missed deadline can be restored by the court if it recognizes the reason for missing the deadline as valid (Article 1155 of the Civil Code).

Ways to accept an inheritance:

- by submitting to a notary or an authorized official an application for acceptance of an inheritance or an application for the issuance of a certificate of the right to inheritance;

- by actually accepting the inheritance (if the heir already owns and manages the inherited property or protects it and incurs expenses in connection with this - Article 1153 of the Civil Code).

When several heirs accept an inheritance, the inheritance is divided. It is carried out by agreement of the heirs, and in the absence of such an agreement - by the court (Article 1165 of the Civil Code). If it is impossible to allocate property in kind according to the share of each heir, mutual settlement is made by paying compensation to the heir who received property of lesser value. If there is a conceived but not yet born heir, the division of the inheritance is suspended until his birth (Article 1166 of the Civil Code).

When applying for a certificate of the right to inheritance, the applicant is obliged to provide the notary with the following documents: about the existence of the inheritance itself, about the nature of his relationship with the testator; about the existence of his relationship or marriage with the testator, that he was dependent on the deceased, about his minority, etc. A certificate of the right to inheritance is issued at the place of opening of the inheritance, either one for all heirs, or for each heir separately (in accordance with their desire). If new inherited property is discovered after the certificate is issued, an additional certificate is issued (Article 1162 of the Civil Code).

A certificate of inheritance rights is issued by a notary after six months from the date of opening of the inheritance or earlier if the notary is sure that there are no other heirs besides the persons who expressed a desire to receive the inheritance (Article 1163 of the Civil Code). Obtaining a certificate is the right, not the obligation of the heir. However, without it it is almost impossible to be the owner of property; it is a document of title. The certificate must have certain details: contain information about the notary, about the heir, about the relationship of the heir to the testator, about the inherited property, about the amount of state duty paid. A certificate issued by a notary can only be annulled by a court. A notary's refusal to issue a certificate to an heir may be appealed in court. The court considers this refusal in a special proceeding or according to the rules of Chapter. 32 of the Code of Civil Procedure of the Russian Federation (if the heir submits to the notary all documents required by law), or according to the rules of Chapter. 27 of the Code of Civil Procedure of the Russian Federation (if the heir does not have the documents necessary to obtain a certificate).

When issuing a certificate of inheritance, a state fee is charged. Its size depends on whether the heirs of the first priority or others are called, and whether the inherited property is located abroad or in Russia. The law provides for tax benefits. Thus, the following persons are exempt from payment:

- heirs of buildings who lived in them together with the testator;

- heirs of persons who died while performing public duty;

- heirs of persons subjected to political repression;

- heirs of bank depositors;

- heirs of insurance amounts under insurance contracts;

- heirs of royalties;

- minor heirs;

- heirs declared incompetent;

- financial and tax authorities upon receipt of a certificate of the state's right to inheritance.

In addition to the state duty, the heir bears another type of expense: he pays tax on the property he receives (does this after receiving the certificate).

The tax rate depends on two factors:

1) the value of inherited property (tax is levied only on property whose value is equal to more than 850 minimum wages) (The value of property is determined according to certificates issued by the competent authorities. Thus, the value of vehicles is determined by forensic institutions of the justice authorities or organizations related to the technical maintenance of vehicles funds. The cost of buildings (apartment, dacha, garage) is determined by technical inventory bodies, local government bodies or insurance organizations. The price of a land plot is determined by executive authorities of the constituent entities of the Russian Federation.);

2) on which priority heir the recipient of the certificate is (if the value of the property is from 851 to 1700 minimum wages, the heir of the first priority must pay 5% of the value of the property, the heir of the second priority - 10%, and other heirs - 20%).

Tax exemptions have been established. Thus, taxes are not levied on the following persons:

- from the spouse of the deceased testator;

- heirs of property of persons who died while performing a public duty;

- disabled people of groups I and II inheriting residential buildings and vehicles;

- heirs of apartments (houses) built by housing construction cooperatives, if the heirs lived in these houses with the testator.

The obligation to pay state duties and taxes is fiscal in nature: they go to state income. However, without paying tax it is impossible to make transactions with property received by inheritance.

Inheritance of certain types of property has some features. For example:

- when inheriting limited-transferable items received by the testator with a special permit (for example, weapons), the heir is not required to have a special permit at the time of acceptance of the inheritance, but such permission must be obtained later (Article 1180 of the Civil Code). If the heir is refused to issue such permission, the ownership of the thing is terminated;

- in the event of the death of a participant in a general partnership or a general limited partnership, a participant in a limited or additional liability company, or a member of a production cooperative, his share (share) in the share (authorized) capital of the corresponding organization is included in the inherited property. The heir to whom this share is transferred becomes a participant in these organizations if they agree (otherwise they must pay compensation for the testator's share). The heirs of an investor's share in a limited partnership and shares in a joint-stock company become participants in these organizations (Article 1176 of the Civil Code);

- the heir to a share of a member of a consumer cooperative has the right to be accepted as a member of this cooperative (Article 1177 of the Civil Code);

— two categories of heirs: individual entrepreneurs and commercial organizations have a priority right over other heirs to inherit an enterprise if it is part of the inherited property (Article 1178 of the Civil Code);

- the heir of a deceased member of a peasant farm, who is not a member of this farm, has the right to receive compensation for his share in the property of the farm no later than one year from the date of opening of the inheritance (Article 1179 of the Civil Code);

- a land plot that belonged to the testator under the right of lifelong inheritable possession or right of ownership is inherited without the heir obtaining special permission (Article 1181 of the Civil Code);

- if it is impossible to divide a land plot between several heirs due to its limited size, the land plot passes to the heir who has the priority right to receive it (Article 1182 of the Civil Code), and in the absence of such, the land plot passes to several heirs on the terms of common shared ownership (Article 1182 of the Civil Code). 1182 Civil Code);

- monetary deposits made by a citizen to a credit institution (bank) can be bequeathed both by registering a testamentary disposition directly at this institution, and in a will executed in a notary’s office for the entire inheritance. Such contributions are inherited on a general basis: to receive them, a certificate of the right to inheritance is required and the expiration of a six-month period from the date of opening of the inheritance; they are subject to the right of minors and disabled dependents of the testator to an obligatory share of the inheritance, despite the fact that they are not specified in the will in as heirs (Article 1128 of the Civil Code);

- the right to receive wages, pensions, benefits under the special insurance of the testator, as well as to receive payments compensating him for harm, belongs to his family members living with him, as well as his disabled dependents, regardless of whether they lived with him or not . Demands for payment of the specified amounts must be presented to the obligated persons within four months from the date of opening of the inheritance (Article 1188 of the Civil Code);

- vehicles received by the testator from the state or municipality free of charge are included in the estate, unless otherwise established by law (Article 1184 of the Civil Code);

- state awards of the testator are not included in the inheritance if they are subject to the rules on state awards. They are transferred to other persons in the manner established by the legislation on state awards. Honorary and name marks are included in the inheritance (Article 1185 of the Civil Code);

- property for which there were no heirs is “escheated” and becomes the property of the Russian Federation;

- the heir, who together with the testator had the right of common ownership of an indivisible thing, has a preferential right to receive it on account of his inherited share when dividing the inheritance (clause 1 of Article 1168 of the Civil Code);

- when property is inherited by several heirs, the share of the surviving spouse will always be greater than the share of the remaining heirs, since the surviving spouse owns half of the property acquired jointly with the testator. And, in addition, he is allocated his share of the other half. This share will be equal to the rest of the heirs (Article 1150 of the Civil Code). The allocation of the spousal share of the inheritance occurs at the initiative of the surviving spouse. A notary should advise him about the possibility of such an allocation (these rules are contained in the Family Code of the Russian Federation);

- copyrights of persons who created works of science, literature and art pass to their heirs only for 70 years;

- the six-month period after the opening of the inheritance cannot be shortened in the case of issuing a certificate of ownership of the inherited property to the state, etc.

Heirs are required to compensate:

- expenses to the person who cared for the testator before his death;

- debts of the testator to his creditors;

- expenses to the person who protected the inheritance (manager, custodian, guardian) and the person who paid for the maintenance of the testator's dependents;

- funeral expenses of the testator (Article 1174 of the Civil Code).

Compensation is made from funds received by inheritance.

You need to know the following about compensation by an heir for the testator's debt:

- the scope of the heir's liability is limited: he is liable only to the extent of the value of the property received from the testator;

- if one testator has several heirs, each of them is liable for the debts of the testator in proportion to the received share of the inheritance, but all heirs are jointly liable (clause 1 of Article 1175);

- the testator's creditors must present their claim to the heir no later than six months from the date of opening of the inheritance, and in writing. Missing this deadline will annul the rights of creditors. The rules on restoration, suspension and interruption of the limitation period when the deadline is missed do not apply in this case (Article 1175 of the Civil Code).

Who will inherit by right of representation?

Not all applicants can receive an inheritance by way of presentation. Heirs recognized as unworthy in accordance with the established procedure are automatically deprived of the right to represent their descendants (see the link for more information about unworthy heirs).

In this case, there is a special inheritance queue for the right of representation:

- the first applicants are direct descendants: son, daughter, grandchildren, great-grandchildren;

- the second are nephews (children of sisters and brothers of the same family);

- the third are children of sisters and brothers of cousins.

You will succeed if you accept the information we provide. If any difficulties arise, be sure to contact our probate lawyer. Write in the comments what question arose specifically in your situation, we will definitely look into everything individually.

Watch also the video on our YouTube channel on issues of inheritance and disputes in which our inheritance lawyer participates:

Confirmation of relationship through court

If it is not possible the relationship is established in court. According to the Code of Civil Procedure, the court, in a special proceeding, considers cases of establishing family relations as facts of legal significance and on which the change in property rights depends.

Attention

Since in such cases special proceedings are being conducted, and not a claim, the application is not filed as a claim. Also, the one who submits the application is considered the applicant, not the plaintiff.

An important condition for this, in accordance with the Civil Procedure Code, is the impossibility of proving relationship in any other way, if the necessary documents that can confirm family ties cannot be obtained or restored:

- The documents were lost beyond the possibility of recovery. For example, if the registry office in which the entry was made no longer exists , and the entries themselves were lost during the transfer.

- The necessary documents are in the possession of another person, and he refuses to provide them, or his whereabouts are unknown, and contacts with him are not maintained. For example, one of the parents may not give up their birth certificate.

- It takes too long to wait for documents. There are cases when the heir is a person born in another country and the necessary papers will have to wait so long that the period for accepting the inheritance will expire.

To substantiate your claims, you need to collect as much evidence as possible . When determining kinship, these may include:

- Letters, postcards, telegrams, etc., from which a relationship is observed.

- Testimony of witnesses - relatives, acquaintances, neighbors, colleagues, etc.

- Results of genetic testing.

- Certificate of recognition of paternity.

For your information

The period for considering an application to establish the fact of a family relationship and making a decision is 2 months .

Application to establish the fact of family relations with the deceased (sample)

Application, according to Art. 266 of the Code of Civil Procedure, is filed with the court at the place of residence of the applicant or at the location of the real estate, if, together with the relationship, the fact of ownership and use of it is established. It is drawn up according to the rules established for a statement of claim , in writing and contains:

- Name of the court to which the applicant is applying.

- His personal data - full name and residential address.

- The court is asked to establish the existence of a family relationship.

- Justification for the impossibility of confirming relationship in another way.

- Statement of facts proving family ties.

- List of attached documents, which include: Photocopy of the application.

- Documents serving as evidence of the applicant's position.

- Receipt for payment of state duty.

- A copy of the power of attorney, if interests in court are represented by another person.