Inheritance after the death of an ex-husband by law

The legislation establishes the fact that the official spouse, parents and children are the recipients of the inheritance, who belong to the first priority. If none of the primary heirs has declared their right to receive the inheritance, then it goes to people from the second, third order - and so on until the seventh.

However, former spouses are not included in any of the lines of heirs, therefore, according to the law, a woman will not be able to receive the property of her ex-husband after he has died.

However, there is an exception to this ruling. According to paragraph 2 of Art. 1148 of the Civil Code of the Russian Federation , there is a separate category of heirs, which include dependents. These are citizens who are not relatives of the deceased person. They do not belong to any line of heirs. However, such people were dependent on the deceased person due to lack of ability to work or lived with him in the same territory, ran a common household, everyday life, and budget.

As a result, a woman can become an heir to her ex-husband’s property after his death in the following situations:

- she is deprived of the ability to work due to retirement age or disability;

- the woman lived on the territory of her deceased husband and was financially supported by him.

In such a case, she will need to collect documents that prove this fact and provide them to an employee of the notary agency.

As for children from the first marriage, they are full-fledged claimants to receive property - along with children from other marriages of a deceased person. Even if a man did not indicate children in his will, they are entitled to receive a mandatory share of the property by law. At the same time, the current age of the children is not important - even if they are adults, they retain the right to enter into inheritance rights.

How to prove cohabitation?

If disputes arise with other heirs, the common-law wife will have to prove cohabitation and the right to inheritance through the court.

Where to contact?

The claim is filed with a magistrate or district judge at the defendant’s place of residence. If legal facts are proven (for example, dependency), then the citizen can submit an application at her location.

Application deadlines

The claim is filed within 6 months after the death of the testator.

In some cases, this period may be extended by 3 or 6 months. If an inheritance case has been opened, it can be suspended. To do this, you must submit an application to the notary and attach to it a copy of the statement of claim and a certificate from the court stating that the application has been accepted for consideration. If the deadline is missed for a good reason, it can be restored.

The judge will consider illness or a long business trip as valid reasons for late application. The legislation does not indicate a list of reasons that can be considered valid, so this fact remains at the discretion of the official. To restore the deadlines, you must file a claim in court. Written evidence of good cause must be attached to the application.

Sample application

The statement of claim must contain the following information:

- name of the court;

- personal data of the plaintiff and defendant;

- the grounds for the dispute;

- essence of the problem;

- evidence of cohabitation;

- requirements;

- list of attached documents;

- date and signature.

List of documents

To file a claim, you must prepare the following documents:

- passport;

- death certificate of a common-law spouse;

- evidence of cohabitation;

- receipt of payment of state duty.

If cohabitants had children, then their birth certificates must be provided.

Attention! The state fee depends on the plaintiff’s requirements. For statements of a non-property nature it is 300 rubles. If the claim states requirements for the division of property, then the fee to the treasury is calculated in accordance with Art. 333.19 Tax Code of the Russian Federation.

Proof

Evidence of an actual marriage can be provided by the testimony of witnesses.

The common-law spouse can also attach a package of documents that confirm the conduct of a joint household. It can be:

- utility bills;

- agreement to carry out construction and repair work on the property;

- a lease agreement indicating both cohabitants;

- registration in a real estate property;

- receipts and other financial documents for joint purchases.

The more evidence, the higher the chances that the judge will rule in favor of the plaintiff.

Obtaining a court decision

If the official confirms the fact of cohabitation and the right to inheritance of the common-law spouse, then she must receive a decree.

With it, the woman turns to the notary, who is handling the inheritance matter. The official will make a new division of property, taking into account the emerging circumstances.

Inheritance by will

Domestic legislation establishes the fact that the owner of property has the right to dispose of personal property at his own discretion. For example, he can transfer real estate to a person with whom he has formed a close relationship, but the heir is not related to him.

If a man made a will and indicated his ex-wife as the beneficiary of the inheritance, then the property will be allocated to her, even when the couple officially dissolved their marital relationship.

The will must be drawn up in accordance with all legal norms and requirements:

- the document is drawn up in writing, indicating the date and address of preparation;

- it contains information about the testator and recipient of the inheritance;

- the will is certified by an employee of a notary agency or any other official with appropriate authority.

It is necessary that at the time of making a will, the man is fully capable and aware of the legal consequences of his decisions and actions. Making a will under the influence of threats, fraud or violence is prohibited.

If the will was drawn up in violation of domestic legislation, then other interested parties - for example, recipients of inheritance by law - have the right to initiate legal proceedings and challenge the document.

If the court makes a positive decision on the claim, the will will be declared illegal, as a result of which the document will lose its legal force. A woman who has already received the property of her ex-husband will need to return the inheritance to other claimants.

Actual acceptance of inheritance

If the ex-wife performed actions indicating the actual acceptance of the inheritance, then in accordance with Article 1153 of the Civil Code of the Russian Federation it is recognized that she accepted the inheritance.

What actions indicate actual acceptance of the inheritance:

- owns and manages property (lives in her ex-husband’s apartment, keeps order, pays utility bills);

- took measures to preserve property (installed a home alarm system);

- incurred expenses for maintaining the inherited property (made repairs and replaced old furniture with new ones);

- paid the testator's debts at her own expense (repaid the property tax debt in full).

How can a woman accept her husband's inheritance after a divorce?

If there are legal grounds for receiving the property of the former spouse, then you will need to go through the standard inheritance procedure.

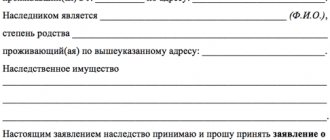

First, a woman needs to visit a notary agency and draw up an application to enter into her inheritance rights. The application shall indicate the following information:

- name of the notary agency;

- information about yourself: full name, registration address;

- grounds for entering into inheritance rights (for example, the deceased indicated the applicant in the will or the woman was his dependent in the last year, despite the dissolution of the marital union);

- a list of property objects that are inherited and the address of their location;

- information about other recipients of inheritance under a will or law;

- list of attached documents;

- date of application, signature.

A sample application form is available online. The following rules and features must be taken into account:

- if the application is written by hand, use a black or blue ballpoint pen (but recently many people prefer to type documents on a computer);

- Full name, names of cities and streets are written without any abbreviations;

- The listing of hereditary property objects is best presented in the form of a list, and not in continuous text;

- adjustments and blots are unacceptable - the same applies to ambiguous wording that can lead to a controversial situation and conflicts between recipients of the inheritance;

- The woman’s signature is certified by an employee of the notary agency.

The required package of documents includes the following:

- photocopy of passport;

- a photocopy of the death certificate of the ex-husband;

- a photocopy of documents that confirm the woman’s incapacity for work, her dependency, if entry into inheritance rights is carried out by law;

- a photocopy of the will – if the inheritance is transferred precisely on its basis.

Required documents

In order to formalize inheritance of property to your ex-wife according to the law, you must first collect the following list of documents:

- Application for acceptance of inheritance, written in free form.

- Passport or other identification document.

- Death certificate of the testator, issued by the registry office.

- Information about the last place of registration of the testator - a certificate from the housing and communal services.

- Certificate of divorce.

- Documents confirming ownership of property, these can be technical passports, cadastral passports, certificates of registration of ownership, etc.

- Power of attorney – if a representative acts on behalf of the heir.

In the event that we are talking about inheritance by an ex-wife under a will, the list of documents will be supplemented by the will itself, otherwise the list remains the same. It is recommended to contact a notary in advance to clarify the list of documents required to open an inheritance case and receive property.

The application for acceptance of inheritance is written in free form, that is, there are no strict requirements for the document. To help you navigate this issue, you can use the attached sample.

Applications for accepting an inheritance and issuing a certificate of inheritance can be found here.

Features of payment of state duty

When a woman is the recipient of an inheritance under a will, she will need to pay a state fee in the amount of 0.6% of the value of the inherited property ( maximum 1 million rubles ). When a woman has a disability group of 1 or 2, she pays half of the amount established by law, and if she lived with her ex-husband in the same territory and was a dependent, then she is exempt from paying the state fee.

What rights do spouses have in a civil marriage?

It is necessary to immediately make a reservation: in Russian legislation, a civil marriage is an official marriage registered with the civil registry office. It does not apply to the cohabitation of a man and a woman, as is common in common parlance. But to make it clearer, later in the article the term “civil marriage” will be used in relation to couples who have not officially registered their relationship. To fall under this definition, living in one territory is not enough. It is necessary that the couple maintain a common household and possibly have children together.

Not a single law in Russia regulates relations developing in a civil marriage. From a legal point of view, this is simply cohabitation. This means that it does not carry with it any obligations within the couple in relation to each other. Even if there is a joint household for a couple, the concept of jointly acquired property is not used in relation to the acquired property. Each purchased object belongs only to the person for whom it was registered.

But it is still possible to resolve legal relations. You just have to focus on this issue not on the Family Code, as husbands and wives do, but on other legislative acts. Those. property rights will be regulated for men and women, as for strangers. For example, the Civil Code. This means that in order to obtain ownership of some property, you will need contracts of purchase and sale, donation, inheritance, etc.

This means that when purchasing property with joint money, you must act as if you were buying an item jointly with a stranger. Document everything, and not hope that in the event of separation in 2021, the common-law wife will receive half of the property from her common-law husband. As practice shows, people, even after living in an official marriage for many years and having several children, try to increase their share at the expense of their spouse. Therefore, it is necessary to insure against such troubles.

Allocation of ex-wife's share

The former spouse has the right to claim half of the property acquired jointly during the marriage. It doesn’t matter whose money it was purchased with.

If, after the divorce, the spouses did not divide the property, and over time the husband died, then the woman retains the right to divide the jointly acquired property. In this case, the first step from the property of the former spouses is to allocate a share for the woman, and then the remaining part is divided among the recipients of the inheritance.

If property was not divided upon divorce, does the former spouse have the right to inheritance?

Now let's consider another case when, upon entering into an inheritance, the former spouse can claim his rights to the inherited property. Or rather, for your share in jointly acquired property and allocating a share from the inheritance mass!

As stated, on the basis of Article 38 of the Family Code of the Russian Federation, the property of the spouses can be divided both during the marriage and after its dissolution at the request of any of the spouses.

Let’s imagine a situation where the spouses divorced, but they acquired property during the marriage, for example, an apartment, a summer house and a car. They did not divide the property during the divorce and it was registered in the husband’s name but was acquired with common money during the marriage. Let's say one of the spouses, let it be the husband, continues to use the jointly acquired property, but for some reason the husband dies. Accordingly, an inheritance opens, as stated, the ex-wife does not have the right to inheritance, but there is one point, as stated above, the spouses’ property was not divided for some reason after the divorce, but this does not mean that, say, the wife does not have the right to this property, because according to Article 34 of the Family Code of the Russian Federation states that property acquired by spouses during marriage is their joint property and each owns 50%. But it happens that, for example, everything is registered in the name of the husband, but this does not mean that the wife does not have the right to 50% of the property during a divorce or after it.

A wife in such a situation has the right, after the death of her husband, to apply to the court for the division of jointly acquired property (which was not divided during the divorce) and it must be divided, that is, in court, from the property jointly acquired by the ex-husband and wife, it will be allocated in favor of the wife share in the amount of 50%, and the heirs will not share all the property that remains from the deceased husband, but only 50% that belongs to him after the division, because half of the jointly acquired property was allocated for the wife in court and this is her property.

But there is also one point here: if the wife did not have time after the divorce within 3 years to file a claim for the division of jointly acquired property, then she may be refused, since the statute of limitations for the division of jointly acquired property is 3 years from the date of divorce. And if the husband died after a divorce 3 years later (the statute of limitations had passed), during which the property was not divided and was registered in the name of the husband according to documents, then the wife will not be able to receive her half of the property, since her claims will be denied on the basis of the expired statute of limitations .

That is, if all the property was registered in the name of one spouse, but was acquired during the marriage, then this is considered jointly acquired property. If during the divorce such property was not divided and remained with the owner’s spouse, and the second spouse did not apply for division of property, and then the owner’s spouse died, then the second spouse can file an application with the court for the division of jointly acquired property and receive his half of the jointly acquired property property, and after the deceased spouse, the heirs will no longer receive all of his property, but only half of the deceased spouse, because the second half of the jointly acquired property will be taken by the second spouse (the living one) by law. But you can file for division of property after a divorce only within 3 years (of course, no one forbids you to file for division even after 4 years, but at the court hearing the other party will claim that the statute of limitations has expired and your claim will be denied) from the moment of divorce, according to paragraph 7 of article 38 of the “Family Code of the Russian Federation”.

It turns out that if the jointly acquired property was registered in the name of the husband, there was a divorce and the wife filed for division of property after 3 years, then the court will accept the statement of claim, but if the second party (the defendant) declares in court that the statute of limitations of 3 years has expired . In this case, the wife’s claim will be denied and she will be left without property, and the heirs will divide all the property, and since the ex-wife is not married, she has no right to inheritance and has missed the statute of limitations on the division of jointly acquired property and has already sued her half can not.

What to do in controversial situations?

It can be difficult to say right away whether the former spouse has the right to inheritance, because the former spouse can mislead the heirs and may claim that investments were made in real estate on his part, which significantly improved the condition of the property and increased its value. But such investments must be proven, supported by documents (checks, contracts, etc.). In addition, the court will require evidence to substantiate the position.

It can also be difficult to prove in court that, for example, property during a marriage was acquired with funds from the sale of an apartment that was inherited by one of the spouses, and property transferred during the marriage to a bar or by inheritance is not jointly acquired. More details about this in Article 36 of the Family Code of the Russian Federation.

In any controversial situation, it is necessary to go to court, hire experienced lawyers and, with their help, prove that the former spouse is not involved in the inheritance, and prove that there is no share of the former spouse in the inherited property. You shouldn’t take on such cases yourself, since most of them are very complex and can last up to 2-3 years, it’s a whole red tape that seems endless, but in the end the one who provided more evidence and defended their position wins.

Courts often make unfounded decisions, but such decisions can always be appealed and this is often successful, so even in hopeless situations you should not give up.

In any controversial situation, go to court, there are no other options, build a line of defense, look for evidence to challenge the arguments of the other side, documents, witnesses, relatives, anything that can help you in your case!

Let's sum it up

Thus, according to the law, a woman has the right to claim an inheritance from her ex-husband if she is a disabled dependent and lived with a man in the same territory. Otherwise, she will be able to receive the property only in the situation if the deceased testator indicated it in his will.

If, after the divorce, the spouses did not divide the joint property, then after the death of the man, the first step will be to allocate the woman’s share, and the remaining part is divided among the remaining heirs.

Receiving an inheritance, especially if it occurs by law and not by will, is a complex procedure. It is necessary to convincingly prove your right to enter into inheritance rights, especially if the death of a person has led to numerous legal disputes and proceedings. In such a situation, you cannot do without qualified support from specialists - lawyers and attorneys will provide significant assistance in collecting documents and drawing up a claim.

Can a common-law wife apply for an apartment?

The most pressing issue in couples is the division of real estate: who can claim an apartment and in what shares. If the housing is the property of the common-law husband, then the woman living with him will not have rights to it during the division of property in 2021. If an apartment is purchased with joint money, then it is necessary to register it as common shared ownership. Otherwise, the common-law wife will not be able to sue for her part.

There are also situations when, for example, an apartment is the personal property of one person. But in the process of living together, good repairs are made in it at the expense of common money or the personal funds of the second “spouse”. In this case, as with an official marriage, it is possible to prove the fact of personal investments. Then the judge will accommodate you and, depending on the amount invested, will either allocate a share in the apartment or oblige the owner to pay monetary compensation for the common-law spouse.

Can a common-law wife claim her husband’s property?

If a couple has a child together who is officially recognized by both parents, then in the event of separation the judge can rule in his favor. This means that such a child will have the right to live in his father’s apartment until he reaches adulthood. And along with it, the mother will automatically acquire this right if the child officially remains with her. But such a decision is possible only on the condition that the mother does not have her own comfortable housing suitable for the life of a minor child.