It is almost impossible to meet a person whose rights have never been violated. At the same time, everyone reacts differently to the violation or infringement of their rights, some intend to fight and sue, while others will leave this case without trial. When it comes to finances, many will want to understand why their rights were violated and will want the perpetrators to be punished. In order to protect your civil position, you can contact many supervisory organizations or the court, it all depends on the specific case of violation of rights.

Very often, it is bank clients who are faced with inappropriate attitude of staff, illegal commissions, fines, aggressive debt collectors and other infringements of rights and violations on the part of banks. A complaint against the bank can be left with several supervisory organizations, including the Central Bank, Rospotrebnadzor, the police, or you can file a claim in court. In this article we will look at how to file a complaint against a bank with the prosecutor's office.

Collection of evidence

Where can I complain about the water utility?

Where to complain about the tax office?

How to complain about Euroset?

How to correctly draw up a cassation appeal

Where can I complain about an insurance company under compulsory motor liability insurance?

How to write a complaint to the prosecutor about the actions of officials?

Before moving on to drawing up an application to the prosecutor's office against the bank, it is important to collect evidence that your rights have been violated. They write a statement to the prosecutor's office only when a criminal offense is committed.

For example, if it concerns threats coming from a bank’s debt collection service, then it is necessary:

- Record calls using a voice recorder;

- Order call details from your mobile operator;

- Keep all written notifications from the bank;

- Take photos and videos during meetings with institution employees.

Info

If you do not collect evidence of violations on the part of the financial organization, the prosecutor’s office may leave your application without consideration, due to the fact that it is groundless, since no evidence of violations on the part of the bank is provided. Of course, in general, the prosecutor's office should still look for facts of violation of your rights, but the system does not work very well and if few facts are indicated, it will be easier for them to refer to the fact that the application was sent to them without grounds.

Reasons for complaint

The main reasons for filing a claim against the bank:

- regular malfunctions of ATMs, violation of the procedure for crediting funds, refusal to issue funds when they are written off from the balance sheet;

- the use of illegal conditions in the provision of credit and other financial services, the imposition of certain banking products;

- poor customer advice, rude treatment;

- groundless debiting of funds from accounts, illegal charging of interest or commissions;

- Violation of deadlines for opening or closing an account or issuing a bank card;

- illegal transfer of credit debt in favor of third parties (collection agencies);

- changing the terms of payment of interest on a loan unilaterally, entailing the accrual of additional interest, an increase in sanctions and penalties, and the entry of negative data into a citizen’s credit history;

- disclosure of banking secrets, for example, disclosure of the contents of personal documents, information about terms, amounts of payments, total loan amount;

- constantly receiving calls from the bank at unauthorized times and more often than the law allows.

- refusal to issue a loan or bank card without legal grounds.

In addition, the basis for filing a claim is any violation by the bank of the current legislation of the Russian Federation.

Application procedure

To contact the prosecutor's office with a complaint against the bank, you will need not only an application, but evidence and documents confirming what is written in the application. Therefore, before writing an application, you need to think carefully about what you will include in it and what documents you can attach. It is also worth noting that the form of the complaint is not as important as the content of the description of the problem in it. Everything must be written in official language, without the use of obscene language and with facts.

You can file a complaint with the prosecutor's office yourself, or by sending it by registered mail with acknowledgment of receipt. The application is submitted in two copies, with a signature indicating receipt and the registration number of the application placed on them. One copy will remain in the prosecutor's office, the other is with you. You can also send a copy of the complaint to the bank to familiarize yourself with your intentions.

Typically, the application at the prosecutor's office is considered within 15 days, if additional checks are required - 30 days.

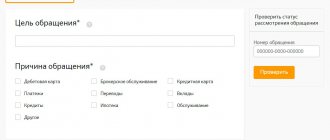

Help online

On the website of almost any bank you will find a feedback window. There, everyone can leave their complaint or claim, however, this form of communication with the bank is not always effective. The message may not reach the recipient due to technical reasons or may be missed by the operator. If the matter is really important to you, duplicate the email message with a paper claim.

There is an alternative option: Internet portals that accumulate consumer complaints. Some of them are answered by experts and representatives of the credit institutions themselves - it is often possible to draw attention to the problem quite quickly. Bank employees have long been “settled” on such resources for prompt communication and increasing customer loyalty.

Sravni.ru advice: Often an effective way to combat dishonest banks is reviews left on various sites on the Internet. Credit institutions are afraid of public negative assessments, so they often resolve controversial issues in favor of the client.

How to make a request?

To correctly draw up a complaint against a bank to the prosecutor’s office, you can use the services of a lawyer to draw up statements, or you can find and use a ready-made sample application to the prosecutor’s office.

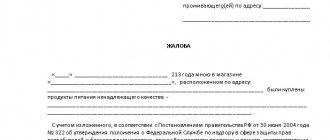

The header of the application indicates: to whom the application was sent, the full name and position of the person, the name of the department and address, then the full name and contact information of the applicant. It is important to indicate your contacts, as an official response to your request will be sent to this address.

Then you need to write “Application” or “Complaint” in the middle of the line , and below state the essence of the problem. In this section, you need to state the essence of your complaint against this bank or collection organization as accurately and reasonably as possible, citing as an example the evidence that you were able to find. The essence should not be expressed too expressively; it should be written in understandable language, without exaggeration.

Next, you need to indicate the laws and regulations that, in your opinion, were violated. You can cite excerpts from laws relevant to your situation. In order to correctly interpret the laws, you can consult a lawyer who will tell you which laws to rely on in your application.

Then you need to specify the requirements for the application. They are usually indicated after the heading “Please”. You can specify requirements for verifying the legality of the credit institution’s actions, the correctness of account transactions, disclosure of client personal data, etc. Be sure to write in the requirements your desire to be notified of the progress and results of the bank audit.

Then you must indicate the list of documents and evidence attached to the application. Be sure to attach a copy of your identity document, copies of agreements with the bank, and others.

At the end, indicate the date and signature of the application.

Heavy artillery

Dissatisfied with either the bank's response or the decision of the supervisory authorities? Then file a lawsuit and complain to the Central Bank of the Russian Federation. The chances of receiving financial compensation in this case are significantly reduced, but the likelihood of the dispute being resolved in your favor increases. But there are exceptions, it all depends on the nature of the dispute.

Credit institutions resolve many disputes with clients through arbitration courts established for these purposes within the banks themselves. In practice, the likelihood that the court will rule in your favor is extremely low. Usually the decision made will have to be appealed to higher authorities, but even there the chance of defending one’s case is small. If you decide to go through the troubles, it is advisable to enlist the support of qualified lawyers.

The Central Bank of the Russian Federation is called upon to regulate cash and credit flows using instruments that are assigned to it by law. Recently, the Central Bank has become stricter about the integrity of banks and more often revoke banking licenses.

An online reception area has been opened on the official website of the Bank of Russia, where you can leave a complaint, claim or suggestion regarding a particular bank. The message is delivered immediately to the audit department of the Central Bank of the Russian Federation. In practice, the reception desk works very efficiently and quickly.

Often, if due to circumstances you do not fulfill your loan obligations, the bank may put psychological pressure on you and threaten you, which is illegal. In this case, you should defend your rights by contacting law enforcement agencies - the police and the prosecutor's office, and not accept the provocations of debt collectors. All unlawful actions on the part of the bank should be recorded, material collected and a claim filed in court demanding compensation for moral damage.

How to file a complaint against a bank with the prosecutor's office, sample complaint?

Almost all adult Russian citizens today have to have some kind of relationship with banking institutions. This is receiving loans, salaries on plastic cards, making deposits, etc. Therefore, there are cases when clients enter into conflict situations with bank employees who have imposed unnecessary additional services on the client, unfavorable loan conditions, are intimidated due to non-repayment of the loan or use illegal methods impact on bank borrowers. Where can I complain about the bank, and how to act in the event of a conflict situation that arises between the client and the bank?

Legal basis

On the territory of the Russian Federation, the activities of banking structures are regulated by the Constitution, the law “On Banks and Banking Activities” and a number of other legal acts.

For any type of violation, a financial organization can be held accountable, and it can be not only disciplinary or administrative in nature, but also criminal.

The application can be submitted online and usually takes 5-7 days to be processed.

When will Rospotrebnadzor really meet you halfway?

Most often, Rospotrebnadzor (St. Petersburg, for example, or any other city) responds to cases of refund of credit insurance. If you repay the loan ahead of schedule, you have every right to demand the return of your insurance funds, but, as a rule, banks are not willing to cooperate. Moreover, according to paragraph 1 of Article 421 of the Civil Code of the Russian Federation on freedom of contract, a citizen does not have to necessarily insure his health and life, only if we are not talking about insurance of mortgaged property. It follows that banks carry out and issue insurance only on the basis of a voluntary act, which allows them to retain money. However, you can return your funds by submitting the correct application to the bank and Rospotrebnadzor.

Is there any point in suing?

The last authority where an individual can complain about the actions of a bank is the court. This is one of the most difficult ways, but the most effective.

At the very beginning, a claim is drawn up, a number of documents are submitted that prove the violation.

Attention! The response should come within 30 days, but as a rule, financial institutions resolve the conflict before litigation; they usually consider claims in the first 10 days after filing the paper.

We wrote about a violation of the loan agreement: what will happen next?

How effective is an appeal to Rospotrebnadzor and what result will your complaint against an unscrupulous bank bring? As a rule, minor violations of consumer rights are quickly stopped by the department. Rospotrebnadzor may decide to fine the bank in the amount of up to several hundred thousand rubles.

The competence of Rospotrebnadzor is related to bank commissions, refusal of service, and reluctance to issue the necessary statements or certificates. For other issues, the department may initiate an appeal to the court.

Writing a complaint in connection with a violation under a loan agreement - is this measure effective? Any actions related to the provision of services are controlled by government agencies. If the bank violates the terms of the loan agreement, you have the right to file a complaint with Rospotrebnadzor. But it is not always possible to get help from the department, since cases under already concluded agreements can only be considered by the parties to the agreement or through the court.

When imposing additional services, for example, insurance for lending or a bank card when opening an account, Rospotrebnadzor issues a warning to the bank to cease actions that are contrary to the law. And if a service has already been imposed on you, then you can only restore your rights through the court.