Entering into an inheritance is a very important step in the life of every person, which, unfortunately, is often accompanied by annoying legal errors and sometimes fraud.

To avoid all these horrors, we prefer to contact a competent specialist, so we go to a notary who will allow us to competently assess the market value of all types of property, from an apartment and house to shares and shares in an LLC.

But sometimes notaries are stingy with words and do not provide enough information during their consultations. But this does not apply to notaries in St. Petersburg. Most of the specialists in St. Petersburg are competent, treat their clients with respect, and provide detailed and informative advice.

Is it in the interests of the heir to study the legislation of our state and find out what nuances may be revealed when assessing property?

What points should you pay attention to in the real estate valuation procedure and what should you ask a lawyer about during your consultation?

Who has the right to evaluate property?

Only appraisers - lawyers specially trained to solve this type of problem - have the legal right to evaluate inherited property.

Since the valuation of an inheritance is a difficult process, not without potential legal errors, only those legal appraisers whose qualifications meet the requirements of the Law “ On Valuation Activities in the Russian Federation”

.

According to it, a qualified appraiser will be a member of a self-regulatory non-profit organization of appraisers who has confirmed his liability with insurance in accordance with the requirements of current legislation.

In this case, the appraiser must have a higher legal education, have no criminal record, and regularly take advanced training courses.

Where can I get an appraisal for a notary?

Specialists from Cons AG LLC will help organize this procedure with minimal time and money. The advantages of the company's proposal are obvious.

- The use of a proven methodology for conducting assessments for inheritance allows us to set affordable prices for the service and provide the client with a completed report on average within half an hour.

- You can be confident in the quality of the result. The company has been providing valuations for inheritance since 1999. At the same time, only category I specialists with at least three years of experience are accepted into the company’s staff.

- The activities of the enterprise are organized in full compliance with current legislation.

- The company and its specialists are members of the SRO “Russian Society of Appraisers. The liability of the company and employees is insured by JSC VSK.

If you need an assessment of an inheritance for a notary, place an order right now on the Kons AG LLC website and receive a ready-made report today. Call for more information.

The purpose of assessing the inheritance is to calculate the notary fee

According to most lawyers, the assessment procedure is necessary to achieve two goals: resolving controversial issues between heirs (if there are several of them) and to calculate the notary fee. The last option is the most important.

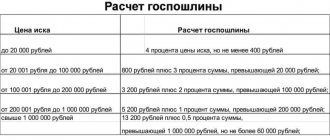

To determine the state notary fee for performing notarial acts, it is necessary to find out the market value of the inherited property.

Notaries are looking for a solution to this problem, guided by the current legislation of the Russian Federation.

The market value of the inheritance receives an independent assessment from experts of the organization that has received the right to conduct appraisal activities.

When preparing the calculation of the notary fee, the notary must draw up a special report, which contains data about the object of assessment, information on market analysis, calculations of the value of property given as an inheritance, etc.

The notary fee is paid in full to the notary.

It is necessary to take into account changes in the Tax Code of January 1, 2013, in the second part of the law

and it is indicated that the calculation of the state duty will now be calculated exclusively on the market value of the property.

What does the state duty calculation consist of?

Property valuation of property upon entry into inheritance is not the only indicator for calculating state duty. There is also a percentage calculated from the digital value obtained from the assessment. The specific percentage depends on the status of the applicant for the inheritance.

Payment amount

All applicants with the exception of beneficiaries are required to pay the fee. At the same time, based on the presence and degree of their relationship with the deceased, the amount of tax may be lower or higher. In general, only two standard figures apply here: 0.3 or 0.6% of the price of the inheritance. A reduced coefficient is offered to the closest relatives (children, parents, spouses, brothers and sisters), and an increased coefficient is offered to the rest.

Categories exempt from paying state duty

The bonus in the form of tax exemption applies not only to individuals, but also to types of transferable inheritance. The latter include bank deposits or property belonging to a person who died as a result of his performance of official duties of national importance (if death occurred immediately or subsequently).

List of beneficiaries when assessing property transferred by inheritance for a notary:

- who lived together with the testator and continue to live in the same place;

- minors;

- incompetent.

The last two categories do not necessarily have to have documented dependent status. They cannot pay the tax not because of the fact of dependence, but due to their inability to provide for themselves independently (333.38 Tax Code). It also does not matter in what order these persons belong when distributing the inheritance according to the law.

Resolving disputes between heirs

An agreement between the heirs is a guarantee of a successful resolution of the case. But there is some specificity here.

Firstly, you should be aware that prompt resolution of controversial issues is necessary due to:

- limited period for registration of inheritance, which is 6 months.

- other heirs can quickly receive a certificate of inheritance during the opening of an inheritance and even claim sole ownership of the testator’s property.

- the possibility of restoring a missed inheritance period does not guarantee its restoration.

- It is beneficial to be an owner, since from the moment you take ownership, you can dispose of the testator’s property at your own discretion and carry out any actions with them, including sale, rental, etc.

It should be borne in mind that both you and other heirs may be susceptible to psychological stress caused by the death of a person close to you who is a common testator.

In a stressful situation, people, being affected, can behave inappropriately and provoke disputes, which does not contribute to achieving agreement.

How to effectively resolve property disputes between heirs?

Firstly , the best solution would be to contact a lawyer who will find a solution that satisfies all parties.

Probate lawyers will help resolve any conflicts and establish a comprehensive list of property and inheritance, including cash, securities, non-cash funds, property rights, etc.

Secondly , in order to understand the complexity of inheritance law, you need to familiarize yourself with it.

It is important to understand such legal categories as heir, will, opening of inheritance, queue, inheritance mass, obligatory share in the inheritance and others.

It is important to find out in what cases a will is considered invalid and the heir is considered unworthy.

You can learn about this on specialized resources dedicated to inheritance issues.

You will probably be interested in watching the mental map “How to receive an inheritance”, with step-by-step instructions for heirs

Or HERE you will find out how to enter into an inheritance

Necessity of an advance agreement when purchasing an apartment:

Cost-effective approach

The cost approach is based on the fact that the costs of creating a similar real estate property are suitable for estimating its value. That is, the market value of a residential building will be equal to the cost of materials and work for its reconstruction.

Within the framework of the approach, two types of cost are distinguished:

- replacement cost is determined by the costs of creating exactly the same object from the same materials, structures, the same quality of work and the nature of the layout - the object is reproduced with all its shortcomings and wear and tear;

- replacement cost is determined by the cost of building an object of the same value, but built using modern materials, design, and layout.

This method allows you to evaluate real estate taking into account the land on which it is located.

Features of inheritance valuation

Property valuation is necessary, since without it it will be impossible to enter into inheritance rights.

When registering the right to inheritance from a notary, the heir pays a state fee, which is calculated based on the assessment carried out by a lawyer-appraiser.

This procedure may also be necessary if any property disputes arise between other heirs involved in the process of obtaining rights to the testator’s property.

Do not forget that any inherited property will automatically be subject to taxation.

When is the assessment carried out?

In connection with the death of the owner of the property, an inheritance case is opened; for six months, relatives and other applicants make claims to the inheritance, submit documents confirming inheritance rights, conduct an assessment of the inherited property and pay a state fee calculated on its basis. Six months after death, the heirs receive a Certificate of Inheritance.

Thus, the assessment of the value of the inheritance must be carried out within 6 months from the date of death of the testator.

The appraisal report must be dated in the same way as the death certificate; accordingly, the value of the property must be determined as of the date of death of the owner.

Documentation

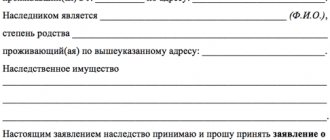

First of all, the heir needs to come to the notary with the initial package of documents.

It includes a passport, death certificate of the testator, including a copy, a certificate from the Federal Migration Service from the last place of residence of the testator in Form No. 9, or an extract from the house register in the original.

Different types of property will require different types of documents:

- The assessment of a land plot will require a certificate of ownership/act of allocating the plot to personal ownership, a certificate from the tax office confirming the absence of tax arrears and a cadastral plan of the land plot.

- Valuation of securities for inheritance will require an extract from the register of shareholders, a report on the assessment of the market value of shares, a bank deposit agreement and a savings book.

- Valuation of a car for inheritance - the heir will need original documents - a registration certificate, a sales contract, a certificate of invoice.

- Valuation of an apartment for inheritance will require a share certificate from the housing cooperative, a certificate from the BTI in the original, an extract from the personal account confirming the absence of any debts, a certificate of ownership, agreements for shared participation in construction, a privatization agreement, including copies.

- Valuation of shares in property - a certificate of the right to inheritance.

What documents does the appraiser issue to the customer?

As a result of an assessment of an apartment, land plot, car or other property carried out by a specialized office, the client receives the following documentary package for inheritance: documents filled out when ordering services and final papers with the result of the assessment. The first refers to the contract and receipts.

The appraisal report can be lengthy and span several pages. It all depends on the characteristics of the inheritance being valued. In addition, the report is sometimes accompanied by additional documentation obtained when the appraiser contacts third-party experts. A positive aspect is the appraiser’s reliance on current regulations, which are indicated in the text of the report.

Specifics of assessment objects

Depending on the type of inherited property, different types of lawyers will be involved in the valuation procedure.

Experts from the Ministry of Internal Affairs or companies related to vehicle maintenance are invited to evaluate vehicles.

To evaluate real estate, BTI employees are involved, and if this institution is not located in the place of residence of the heir, then he will need to contact the corresponding municipal unit for the same purposes, which evaluates it at its residual value.

How to challenge an assessment

The customer has the right to challenge the results of the apartment assessment if doubts arise about their validity. At the same time, if only one of the permissible types of assessment was carried out, then it is recommended to postpone the claim to the court and first apply for a different type of service. For example, after receiving an extract on the cadastral price of real estate, order its determination from an independent appraiser using a market valuation model, or vice versa. If none of the values indicated in the reports suit the heir, then they should begin to challenge them.

The revision of the cadastral value can begin by submitting an application to a specialized commission operating under each territorial Office of Rosreestr. To do this, the interested party must make a request to provide the object data on the basis of which the assessment was carried out. If they are clearly unreliable, an appeal is drawn up to revise the assessment result. It must be accompanied by:

- an extract on the disputed cadastral value;

- documentary justification for the irrelevance of the information contained in the cadastre.

The commission undertakes to make a decision within a month to reject or satisfy the applicant’s request. And, if its contents do not suit the heir, he has the right to apply to the court with similar demands.

Filing a claim in court may also be caused by the customer’s disagreement with the report on the market value carried out by the appraiser or appraisal organization.

Income approach to valuation

This type of approach to valuation is currently used in real estate and is the most popular, since it does not provoke problems with finding calculations of initial information and is essentially universal, because any property generates income.

Lawyers conducting valuations using this method use two methods - direct capitalization and discounted cash flows.

These methods are based on determining the value of real estate by establishing current income and income that will be received in the future from this property, and the final price of the property will be fixed by agreement between the heirs.

Method of appraising an apartment

According to paragraphs. 5 p. 1 art. 333.25 of the Tax Code of the Russian Federation, the heir (or other interested party) has the right to use three methods of assessing property: cadastral, market or inventory. However, in reality, only the first two are available - the inventory assessment was abolished on January 1, 2014 by Letter of the Ministry of Finance of the Russian Federation dated December 26, 2013 N 03-05-06-03/57471.

The notary's demands to provide a certain type of assessment are considered unlawful. The payer can use one or two payment methods, choosing the report with the lowest cost.

The cadastral value is established by the state every 2–5 years. In this case, the method of mass analysis of identical real estate objects is used based on the information contained in the cadastre at the time of the assessment. The defining parameters include:

- date of construction of the apartment building;

- degree of distance from the nearest infrastructure facilities;

- average price per square meter of similar real estate in the region;

- apartment area;

- economic situation of the region.

But, despite the improvement of the algorithm, its results remain rather average and do not always correspond to the real market value. Therefore, if the price seems unreasonably high to the customer, he can apply for a market assessment.

The market valuation, in contrast to the cadastral valuation, is determined based on the individual data of each analyzed object. The calculation takes into account the current situation on the local real estate market, and the resulting price most fully reflects the competitive cost of housing.

Which of the two options is better to choose for the cost analysis of the inherited apartment is impossible to determine exactly. In one case, it will be more profitable to order a cadastral valuation, in another - a market one. Surely this can only be found out by conducting both of them.

Comparative approach to assessment

In another way, this method is called market and is applied mainly to real estate.

It is a set of methods for estimating the final price, based on a step-by-step comparison of the valuation object with its taxes on the market, which have information about the cost of transactions with them.

The developed real estate market became the starting prerequisite for the subsequent application of the comparative approach in legal practice.

At the same time, assessment specialists are guided by several principles:

- supply and demand, since there is a relationship between limited supply and the need for a property;

- substitution, which states that the buyer will not pay more for the property than the market price.

results

The result of performing the government service to determine the cadastral value of housing is the receipt of an appropriate certificate. It is issued by the state registration service within 5 working days after the request is submitted. And when applying through the My Documents center, it may take twice as long to complete the procedure.

All calculations of the value of inherited property are made taking into account data current at the date of death of the testator.

The outcome of the appraiser’s work is the preparation and delivery to the customer of a report containing the following information:

- Number and date of issue.

- Confirmation of the professional compliance of the appraiser and the independence of the legal entity coordinating his actions on the basis of an employment contract.

- Purpose, standards and grounds for assessment.

- Step-by-step work plan.

- The derived cost of the apartment with comments regarding the scope of its application and other possible restrictions.

- The date on which the calculation was made.

- List of documents characterizing the object of assessment.

The report, submitted in paper form, must contain the personal signatures and seals of the performers and the organizations to which they are assigned. If a document is executed electronically, its authenticity is supported by an enhanced qualified electronic signature.

Inventory value

The assessment of inherited property to obtain the inventory value is carried out by the BTI bodies. To do this, the recipient of the property must apply for an assessment.

Important! Real estate assessment is carried out by the BTI body located in the territory where the property is located.

Inventory cost is the lowest. This is due to the fact that the BTI body does not take into account a number of factors influencing pricing. Among them:

- infrastructure;

- location;

- proximity to transport routes, ground transport stops, metro stations.

The state duty based on the inventory assessment act is considered underestimated. This issue has been repeatedly raised at the legislative level. However, to date, the issue has not been resolved.

The notary is obliged to accept from the heir a report on establishing the value of the property for the inheritance from the BTI. The refusal can be appealed to the notary chamber or through the court.

Market value assessment

Valuation of the inheritance in the form of market value for a notary is the most expensive option. Market value refers to the current price of an object at which it can be purchased or sold.

It takes into account the following factors:

- specifications;

- performance characteristics;

- demand;

- offer.

An assessment of market value can be carried out for any property that has a material price (real estate, vehicles, paintings, securities, jewelry, furniture). It is subject to objects that do not have an inventory or cadastral value.

To conduct an event, a citizen must contact a specialized organization that is licensed to conduct a specific type of assessment. When selecting, it is advisable to be guided by the organization’s reputation, customer reviews, and advice from friends.

How the inheritance is assessed:

- the recipient of the property independently or by prior agreement with other heirs selects a company;

- the heir and the organization enter into an agreement to conduct an assessment;

- the customer pays the cost of the work;

- a specialist conducts an assessment;

- The parties draw up a certificate of completion of work.

The contract must include the following information:

- data of the parties;

- characteristics of the object;

- location of the property;

- procedure for providing services;

- deadline for the report;

- price.

The assessment includes the following steps:

- choice of method;

- inspection of the property;

- determination of qualitative and quantitative characteristics;

- market analysis;

- preparing of report.

Attention! The document is transferred to the customer within the period established by the contract. On average, it ranges from 1 to 5 days. The report must include the final market value of the property. The customer provides the document to the notary to determine the state duty.