How to collect wage arrears from an employer? What chances does an employee have to recover an unofficial portion of wages in court?

The employer is obliged to pay the full amount of wages due to employees within the terms established by the Labor Code of the Russian Federation, the collective agreement, internal labor regulations, and employment contracts (Article 22 of the Labor Code of the Russian Federation). And according to Article 136 of the Labor Code of the Russian Federation, wages must be paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued.

LABOR DISPUTES

If peaceful negotiations with the employer on the payment of wage debts have no effect, the employee can contact the labor inspectorate, file a complaint with the prosecutor’s office, or go to court.

Accrued but not paid wages to an employee can be recovered from the employer in the order of writ proceedings (Article 121 of the Code of Civil Procedure of the Russian Federation, clause 1, clause 5 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of December 27, 2016 No. 62).

A court order is issued if the amount of money to be recovered does not exceed 500 thousand rubles.

An employee can apply to the court to issue a court order only if there are documents confirming this requirement (for example, a pay slip, a certificate of accrued wages) (clause 5, part 2, article 124 of the Code of Civil Procedure of the Russian Federation). However, if the employee does not have supporting documents, then he will be denied acceptance of the application for the issuance of a court order (clause 3, part 1, article 125 of the Code of Civil Procedure of the Russian Federation).

In this case, you can go to court through a lawsuit and petition to obtain evidence from the employer in court.

If the employer violates the established deadline for payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest in an amount not less than 1/150 of the key rate of the Central Bank of the Russian Federation in force at that time on the amounts not paid on time for every day of delay until the day of actual settlement (Article 236 of the Labor Code of the Russian Federation).

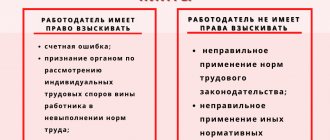

If the employee has an official salary, then there are no problems with debt collection (for example, Decision of the Industrial District Court of Perm dated November 26, 2018 No. 2-4449/2018). It is much more difficult to collect the so-called unofficial part of wages.

LABOR DISPUTE RESOLUTION

What does the legislation guarantee regarding wages?

Labor legislation protects the rights of employees to receive wages in full and on time (Article 130 of the Labor Code of the Russian Federation):

- The minimum wage has been established (Article 133 of the Labor Code of the Russian Federation).

- Salaries are paid at least every half month (Article 136 of the Labor Code of the Russian Federation).

- The employer's liability for violation of labor legislation has been established (Article 142 of the Labor Code of the Russian Federation and Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

In case of violations, the employee has the right to file a pre-trial claim with the company for non-payment of wages or immediately contact the regulatory authorities and the court. And also suspend work if the delay exceeds 15 days.

If salaries are not paid on time, employees must be paid compensation for each day of delay in the amount of at least 1/150 of the Central Bank discount rate (Article 236 of the Labor Code of the Russian Federation).

IMPORTANT!

Personal income tax is not withheld from compensation for delayed wages.

A lawsuit - how to do it right

If all of the above actions do not produce results, go to court. In the face of non-payment of money, you have to think about how to collect documents, file a claim, and not miss deadlines without the help of a lawyer. First of all, let's look at the timing.

The general rule for the time limit for filing individual labor disputes in court is 3 months from the moment the employee became (could have become) aware of a violation of rights (Article 392 of the Labor Code of the Russian Federation, Part 1). At the same time, cases of non-payment of wages require a longer period - 1 year (Article 392 of the Labor Code of the Russian Federation, part 2).

Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2 (clause 56) states that if an employee does not resign due to delay or incomplete payment of wages, the deadline for going to court for him in all cases will not be missed.

If dismissal occurs, the period is counted from the date of dismissal. If the deadline is missed for a good reason (for example, a proven injury or illness of the employee), the court may reinstate it.

When going to court, the following procedure is followed:

- Preparation of a package of documents.

- Filing a claim.

- Preliminary proceedings.

- Court.

- Judgment. If the claim is satisfied, it is formalized by a court order.

- Sending the order for execution to the bailiff service.

The package of documents consists of:

- statement of claim;

- copies of passport data;

- income certificates;

- job description;

- labor agreement;

- employment order;

- calculation of salary arrears;

- bank statements with payment transfer details;

- other documents additionally confirming the fact of debt.

If the employee has already been fired, a copy of the work record book confirming the dismissal is needed.

An additional factor in favor of the employee will be evidence that he has already tried to resolve the issue pre-trial, for example, he has contacted the State Tax Inspectorate, the CTS, the prosecutor's office, or with a statement to the employer.

At the stage of preliminary proceedings, the parties in court try to come to an agreement, present their arguments, and often find a solution. If this does not happen, a court date is set. The administration has the right to challenge a court decision made in favor of an employee within ten days. At the same time, the employee may demand, in addition to repayment of the debt and interest for late payment, compensation for moral damage (Labor Code of the Russian Federation, Article 237, paragraph 2).

It is mandatory to calculate salary arrears. It is made by the plaintiff on the basis of data received from the employer: either as a separate document or in the text of the claim.

If the employer's representatives refuse to provide documents required by the court, the employee has the right to submit a written request. The employer must respond and provide all documents within three days after receiving the request (Labor Code of the Russian Federation, Article 62).

If it is customary for a company to issue salaries or part of them “in envelopes”, unofficial documents can serve as proof of the actual amounts due: receipts, “gray statements” for previous months, confirmed by the signatures of employees, any other documents. Testimony from witnesses and colleagues can also help. It should also be borne in mind that a positive decision in favor of the employee leads to the need to pay additional personal income tax.

How to file a petition for suspension of work due to non-payment of wages

If wages are delayed by more than 15 days, employees have the right to suspend the performance of work duties. The employer must be notified of this in writing. Employees have the right to continue the suspension of work until the debt is paid in full.

How to write a claim for wages and suspension of work

Suspension of work is not allowed:

- when a state of emergency is introduced;

- in the bodies of the Armed Forces of the Russian Federation;

- in organizations ensuring the security and defense of the state and population;

- in organizations that ensure the life of the population (energy, water, gas and heat supply, communications, emergency medical care);

- civil servants;

- in particularly hazardous industries.

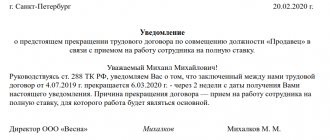

Procedure for filing a claim

In practice, there are two ways to file a claim:

- directly to the employer's representative;

- by mail.

The first method is faster and easier. For this purpose, the claim is made in two copies, one of which is handed over to the employer’s representative. Accordingly, on the second copy, the employee who accepted the document must indicate the position, initials, date of receipt of the document and sign. Next, the claim will be sent to the head of the organization or other competent manager as soon as possible.

The disadvantage of this option is the possibility of refusal to accept the claim. Since many employees simply do not want to take responsibility for receiving such documents. However, the law does not oblige them to accept them.

Accordingly, in case of refusal, the claim must be sent by registered mail with notification and a list of the contents. The employer will not be able to refuse such a letter, and the claim will be received by him.

Where and when to complain about an employer for non-payment of wages

The employee has the right not to wait for a voluntary transfer of wages from the company, but to immediately file a complaint with the regulatory authorities or file a claim in court. A labor dispute claim is submitted to the labor inspectorate, prosecutor's office or court.

The labor inspectorate, based on an employee’s application or on behalf of the prosecutor’s office, conducts an extraordinary inspection of the employer and forces him to fulfill his obligations to pay wages. In addition, the company will be subject to a significant fine for violating labor laws:

- from 30,000 to 50,000 rub. — on the organization;

- from 10,000 to 20,000 rub. - to an official.

The employee has one year from the date of non-transfer of wages to file a claim in court (Part 2 of Article 392 of the Labor Code of the Russian Federation).

What is a CTS certificate of wage collection?

Another way to recover wages is to contact a labor dispute commission, if one has been established in the organization. The certificate issued by the CTS regarding the collection of arrears of wages is also a document of execution. It can be presented to the bank or addressed to a bailiff for execution.

| Important! Currently, draft amendments to the Labor Code have been published, prohibiting the consideration of complaints about the collection of arrears of wages in the CTS. After the amendments are adopted, salary cases will be considered only by the courts. |

How to give a payslip to an employee

The Labor Code does not regulate the procedure for handing over a pay slip to an employee. The Ministry of Labor allows the possibility of sending salary slips by email (letter dated 02.21.17 No. 14-1/ОOG-1560; see “Ministry of Labor: employers can send pay slips to employees by email”). At the same time, officials recommend enshrining this method of handing over a sheet in an employment or collective agreement or in a local regulation.

Draw up local acts using ready-made templates and prepare all personnel reports

Thus, the employer has the right to issue salary slips both in traditional paper form and in the form of an electronic document. The latter can either be sent to the employee’s email or placed in his personal account on the corporate portal.

The possibility of sending out payslips via instant messengers is controversial. Thus, Rostrud specialists believe that such a procedure is not provided for by law (see “Rostrud clarified whether it is possible to send out payslips via instant messengers”). However, the courts allow this method of communication with the employee in all cases when the Labor Code does not require his signature (see the appeal rulings of the Khabarovsk Regional Court dated 05/29/17 in case No. 33-4096/2017, the Perm Regional Court dated 10/04/17 in case No. 33-10980/2017, Irkutsk Regional Court dated 06.22.17 in case No. 33-5844/2017, Rostov Regional Court dated 11.17.16 in case No. 33-18542/2016 and the ruling of the Primorsky Regional Court dated 10.11.16 in case No. 33 -9899/2016). Also see “Firing via text message: when you can use email correspondence in labor disputes and relations.”

Results

An employer who decides to pay salaries to employees on a card must, in accordance with Art. 136 of the Labor Code of the Russian Federation, request from each of them the corresponding written consent in the form of a statement. It is sent by the employee to the general director or chief accountant of the company.

You can study other features of the legislative regulation of the use of salary bank cards by employer firms in the articles:

- “Not all commissions on salary cards can be included in expenses”;

- “Are the costs of producing and servicing “salary” bank cards for employees taken into account for tax purposes?”

Sources: Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

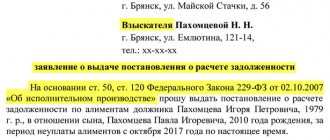

Sample application

If you want to receive your salary on a bank card and you need to write a corresponding application, look at his example - taking it into account and reading the comments, you can easily create the form you need.

- First of all, write in the application to whom it is intended: the name of the organization (full or abbreviated - it does not matter), then the position and full name of the manager (or the employee temporarily performing his functions).

- Next, enter your own data in the same way.

- After this, proceed to the main part - here, first make your actual request to transfer money to the card.

- Then indicate from what date you would like your salary to be transferred by bank transfer.

- Then enter your card details.

- In conclusion, indicate your position, sign (be sure to include a transcript of the signature) and date the document.

Structure of an application for salary transfer to a card

The application for transfer of salary to the card indicates:

- Full name and position of the compiler;

- Full name and position of the employee to whom the document is addressed (as a rule, this is the general director of the company or the chief accountant);

- name of the document: “Application for transfer of wages to an account in a financial institution (bank card)”;

- main text, where the employee, referring to Art. 136 of the Labor Code of the Russian Federation, expresses a request to transfer wages to a bank account and indicates the necessary details, including the card number;

- date of application.

The document must be signed personally by the employee. Some companies practice certifying the fact of its receipt by the management secretariat or accounting department by affixing the date of receipt and signature of the secretary or responsible accountant on the application.