Can heirs receive the pension savings of a deceased relative? What steps need to be taken to do this?

We talked about how the funded part of a pension is formed and how to increase it or at least maintain it given today’s inflation.

But, unfortunately, in Russia there are often situations when a person does not live to see retirement. A person can die after retirement, leaving an unpaid portion of pension savings.

First, let us remind you what is due to the future pensioner.

Types of pension savings payments

There are 3 options for paying pension savings (Article 2 of Federal Law No. 360-FZ dated November 30, 2011):

- lump sum payment - payment of the entire amount at once.

Such a payment is prescribed if the amount of the funded pension is 5% or less in relation to the amount of the old-age insurance pension and funded pension.

- urgent payment - the payment period cannot be less than 10 years.

Such a payment is assigned to persons who participated in the State Co-financing of Pensions Program and also allocated maternity capital funds to form a future pension.

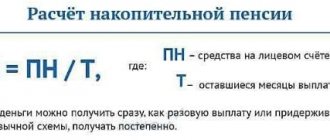

- funded pension - paid monthly and for life.

Its size from 2021 is calculated based on the expected payment period - 258 months.

For example, a person has accumulated 400 thousand rubles in his individual account. Then the monthly payment amount will be:

400 thousand rubles / 258 months. = 1,550.39 rubles.

The later a person applies for its assignment, the higher the pension amount will be.

Who is entitled to a pension

The circle of persons to whom the payment goes is legally limited. Thus, these could be family members who lived in the same living space as the deceased. However, this rule does not apply to persons who were dependent on the pensioner. Their place of residence is not of fundamental importance.

Family members include:

- spouse;

- children;

- parents;

- grandparents;

- grandchildren.

This list is not closed, therefore, under certain conditions, persons who have more distant degrees of relationship with the deceased can also receive payment.

Several persons may have the right to receive a relative’s pension at once. In this case, the amount is divided in equal proportions, that is, without prioritizing the degree of relationship.

As for the funeral benefit, both relatives and other persons who have incurred the costs associated with the funeral can count on it.

The payment in question can only be made if the deceased pensioner was not registered with the Social Insurance Fund. In other words, he did not work for hire and was not an individual entrepreneur.

Attention! The amount of the funeral benefit in 2020 is 6124.86 rubles.

The amount of benefits for compensation of expenses associated with the funeral is equal to the size of the social pension. However, in some cases, citizens who performed funerals may be provided with additional allowances.

Thus, in climatically unfavorable areas, the so-called regional coefficient is taken into account when calculating benefits. In addition, in some regions of our country, in addition to this benefit, local payments are provided. They are carried out at the expense of local budgets and are intended only for persons living in a specific subject of the Federation.

To clarify the availability of additional regional payments, you must contact local authorities , for example, departments of social protection of the population.

Who is owed unpaid pension savings?

Of course, many of us want to get more money by delaying the retirement date. However, we should not forget that by putting off applying for a pension, even a seemingly healthy person may not use his pension savings at all.

While still alive, a future pensioner has the right at any time to write to the Pension Fund a statement about who will receive his savings. In NPF, heirs are indicated in a separate clause of the agreement.

A person can identify specific recipients of these funds, as well as determine in what shares the specified funds should be distributed among them (Clause 6, Article 7 of Law No. 424-FZ “On Funded Pension”).

The future pensioner has the right to name any person who is not even his relative as an heir.

And if a person did not write any application or did not include anyone in the contract, then who has the right to claim his pension savings? Then the payment is made to the legal successors of the deceased from among his relatives in order of priority:

- first priority - children, spouse and parents;

- second line - sisters, brothers, grandmothers, grandfathers, grandchildren.

The distribution of the pension among the heirs of each line is carried out in equal shares.

Heirs of the second stage will be paid the deceased’s pension in the absence of applications from close relatives of the first stage.

Is the pension accrued after death?

As soon as the question arises of how to receive the pension of a deceased relative, it is best to understand the features of pension accruals.

The pensioner receives cash payments to his account every month. This process stops on the 1st of the following month after the death occurs. However, if the pensioner did not withdraw the last accrued pension from the account before his death (sometimes several pensions in recent months), the relatives who lived with the deceased have every right to claim the entire remaining shortfall in pension accruals.

Whatever the date of death, the payment must be accrued for the entire month. Even in cases where death occurs on the 1st of the month, money is accrued in full. If at least part of them, in comparison with the full monthly payment, is withheld, this is illegal and may be a reason for going to court.

Funeral benefit

What will the heirs receive?

The payments that the heirs can receive depend on several factors: whether a pension was assigned to the deceased, how much pension savings have already been paid.

The legal successors of the deceased will receive pension savings in the following cases:

- the person died before he was assigned a funded pension or urgent payment, or before its amount was adjusted.

- pension savings are inherited in full, with the exception of maternity capital funds.

- the deceased person has been assigned a funded pension or an urgent payment.

As a general rule, payment of a funded pension stops on the first day of the month following the month in which the death of the insured person occurred. That is, if a person died in October, then in November he is no longer assigned or paid a pension. And the balance of the current unpaid pension is subject to payment to disabled members of his family who lived together with the deceased and for whom the deceased was the breadwinner. For example, these are his minor children.

If the death of the insured person occurred after the appointment of a funded pension, then the legislation of the Russian Federation does not provide for the payment of pension savings to his legal successors.

The rule is the same for both Pension Funds and Non-State Pension Funds. It turns out that the remainder of the assigned funded part of the pension simply “burns out.”

The heirs will only be able to receive the remainder of the urgent pension payment, with the exception of maternity capital funds.

If a lump sum payment is assigned but not paid to a deceased person.

It can be received in order of inheritance by:

- family members of the deceased, if they lived with him;

- disabled dependents.

Payment can be received within 4 months from the date of death.

If there are no such persons, then the payment amount is inherited according to the general rules.

Where to go to receive the deceased's funded pension?

To receive the funded pension of the deceased, his relatives need to contact the Pension Fund. If the pension savings of the deceased were kept in a non-state fund, then the relatives of the deceased need to contact the institution with which the pension insurance agreement was concluded.

To receive the deceased's funded pension, an application must be sent to the pension fund within six months after the death of the testator. The decision on payment is made in the seventh month after the death of the pensioner. The pension fund notifies the relatives of the deceased within five days after the decision is made, and makes the payment within twenty days. If the legal successor does not apply within the established period, then in order to submit an application he needs a court decision “On restoring the deadline for the payment of pension savings”.

How can an heir receive a pension?

Whatever fund the accumulated savings of the deceased are in, the fund will not initiate the inheritance procedure.

The initiative to receive an inheritance pension comes from the heirs themselves, who must submit an application to the Pension Fund or Non-State Pension Fund and attach the necessary papers.

The list of documents can be clarified at the fund. As a rule, this is: a death certificate of the insured person, a passport of the heir, SNILS of the deceased and the heir, documents confirming family relationships.

The application period is limited - no later than six months from the date of death of the insured person (Article 1154 of the Civil Code of the Russian Federation). A missed deadline can only be restored through a judicial procedure.

Benefit amount in 2021

From 02/01/2021, the amount of the funeral benefit for a pensioner is 6,424.98 rubles. In accordance with the norms of Federal Law No. 8-FZ of January 12, 1996, it is annually indexed to the inflation rate or higher (the index is established by the government). All unemployed Russian citizens are entitled to receive this social benefit. This is the federal basic amount; in some regions of the Russian Federation, additional compensation for the funeral of a pensioner is established, which is paid simultaneously with the federal part. Thus, relatives of deceased non-working elderly citizens of retirement age will receive:

- in Moscow - 18,470.98 rubles. (additional payment 12,046 rubles);

- in St. Petersburg - 9945 rubles. at burial and 12,353 rubles. during cremation;

- in the Moscow region - federal payment and additional payment for low-income families.

In areas where a regional coefficient has been established, the amount of payment is determined using this coefficient. If the deceased had an additional preferential status, for example, a veteran of the Great Patriotic War or a liquidator of the Chernobyl accident, his relatives will receive increased compensation, the amount of which depends on the status.

Instead of a monetary payment, the applicant has the right to request that a social funeral be organized for the deceased. In this case, compensation is not paid, but a set set of accessories and ritual services is provided. The choice of how to receive help is made at the time of application.

Where to get benefits for the funeral of a pensioner

In most regions of the Russian Federation, submitting an application for payment is allowed only to the branch of the Pension Fund of the Russian Federation where the pension file of the deceased is located. In Moscow, MFCs do not provide this service, but other Russian regions have their own rules, and the application is allowed to be submitted through the MFC. Upon the death of a veteran of the Great Patriotic War with a military rank, or a military pensioner, you should apply for payment to the military registration and enlistment office at your place of residence. It will not be possible to submit an application and receive benefits for the funeral of a pensioner through Gosuslugi; the portal contains only a description of the service and an appointment with the Pension Fund or MFC. This is due to the timing of the service.

Algorithm for applying to the Pension Fund for the unpaid part of the insurance pension

Below is an approximate procedure that is recommended to be followed when receiving the unpaid portion of the pension due to the pensioner.

1. Prepare the necessary package of documents:

- application for pension payment;

- applicant's passport;

- documents confirming the death of the pensioner;

- documents that can confirm family relationships with the deceased;

- certificate of inheritance.

2. Send the documents to the Pension Fund.

A package of documents is submitted to the territorial body of the Pension Fund. Moreover, it can be presented personally by the applicant, as well as through the MFC.

In connection with the current epidemiological situation, it is recommended to first clarify the procedure and mode of operation of a specific PFR body.

Unreceived funds must be paid to the applicant within 5 days from the date of receipt of the application by the Pension Fund. The method of receipt is previously indicated in the application.

What does the pension consist of?

Let us remind readers that the pension in the Russian Federation consists of two parts: insurance and funded.

The insurance part of the pension is a monthly and lifetime cash payment that represents compensation for lost income. Today, all insurance contributions transferred by the employer (22% of the employee’s salary) go towards the formation of an insurance pension.

To date, all contributions go only to the formation of the insurance part of the pension.

Let us dwell in more detail on the savings part, since this is what the heirs can claim.

Holders of pension savings can be divided into 2 categories:

1. Citizens who were born in 1966 and earlier. For such citizens, pension savings were formed only from 2002 to 2004 inclusive, at the expense of contributions to the Pension Fund paid by the employer. Thus, the funded part of the pension of this category of citizens took only 2 years to form, and the amount of such pension savings is unlikely to represent an impressive amount.

2. Citizens born in 1967 and younger. Their default funded pension was formed from 2002 to 2014 also at the expense of contributions paid by employers to the Pension Fund. Since 2014, a moratorium on the formation of the funded part of the pension until 2023 was introduced.