Home / Complaints, courts, consumer rights / Litigation

Back

Published: 09/06/2018

Reading time: 7 min

0

476

An appeal is a second review of a case by a higher court. The procedure is carried out in the case when a complaint has been received from a citizen that he is not satisfied with the court decision during the first trial.

- Who must pay the appeal fee?

- Amount and procedure for paying the fee Filing with a court of general jurisdiction

- Submission to arbitration court

- If you are not satisfied with the decision of the district court

Filing an appeal to the arbitration court is regulated by certain legal norms of the current legislation of the Russian Federation. These include:

- Chapter 34 of the Arbitration Procedure Code of the Russian Federation.

- Article 272 of the Arbitration Procedure Code of the Russian Federation.

- Articles 257, 259 and 260 of the Arbitration Procedure Code of the Russian Federation.

Filing a complaint to the courts of general jurisdiction is governed by the following legal norms:

- Article 322 of the Code of Civil Procedure of the Russian Federation.

- Article 320 of the Code of Civil Procedure of the Russian Federation.

- Article 133 of the Code of Civil Procedure of the Russian Federation.

Calculation features, example

A state fee must be paid for filing a complaint with the arbitration court of appeal. Moreover, its size may be different. So, the state duty is equal to:

- In case of filing a complaint against the decision of the first court (or in cassation against a court order) - 50% of the amount of state fees charged for filing non-property claims (Part 12, Clause 1, Article 333.21 of the Tax Code of the Russian Federation, Clause 34 33 of the Resolution of the Plenum of the Supreme Arbitration Court of Russia No. 46 of July 11, 2014).

- When filing a supervisory complaint with the RF Armed Forces - 100% of the amount of the fee paid in case of filing non-property claims.

For comparison: The state fee for an appeal in civil cases, that is, cases within the jurisdiction of courts of general jurisdiction, is equal to 50% of the amount of the fee for accepting a non-property claim by the court (Part 3, Clause 9, Clause 1, Article 333.19 of the Tax Code of the Russian Federation). To make it more clear, the table below shows all the amounts of the state duty and the grounds for its collection.

| № | Appeal against the decision of the first arbitration court on | State duty amount | |

| For individuals | For legal entities | ||

| 1 | Corporate disputes | 3,000 rub. | 3,000 rub. |

| 2 | Failure to fulfill contractual obligations | 3,000 rub. | 3,000 rub. |

| 3 | Cancellation of an arbitration court decision due to violations committed in the arbitration process | 3,000 rub. | 3,000 rub. |

| 4 | Claim for enforcement of a court decision located outside the Russian Federation (arbitration award) | 3,000 rub. | 3,000 rub. |

| 5 | Non-property claims (for example, for recognition of rights) | 3,000 rub. | 3,000 rub. |

| 6 | Actions, non-normative decisions or legal acts of government. authorities, regional and city authorities | 150 rub. | 1,500 rub. |

| 7 | Securing a claim | 0 rub. | 0 rub. |

| 8 | Establishment of significant circumstances (facts) in the case | 1500 RUR | 1500 RUR |

| 9 | Registration of writ of execution(s) | 1,500 rub. | 1,500 rub. |

| 10 | Debtor's claim for bankruptcy | 150 rub. | 3,000 rub. |

| 11 | The plaintiff’s application to appeal the regulations, which provide clarifications of the legislation of the Russian Federation | 150 rub. | RUR 2,250 |

| 12 | Statement of claim to appeal decisions (acts) of Rospatent (FAS, Ministry of Agriculture) in the field of protection of exclusive rights to a patent, containing detailed explanations of the legislation of the Russian Federation on this issue | 150 rub. | 1,000 rub. |

A calculator for calculating the state duty on an appeal can be used here .

Conditions for filing an appeal

In order to consider paying the state fee when filing an appeal, it is worth knowing the main nuances and conditions of this procedure.

If, in your opinion, a court or other government agency made an incorrect decision in any case, you can file an appeal and defend your rights. The following categories of citizens can submit such applications:

- Prosecutors.

- Defendants.

- Plaintiffs.

- Persons who turn to government authorities to protect their own rights.

Filling out a complaint

The complaint must be filed in a timely manner, within strictly defined deadlines. After this period, the decision on the case will become final, and filing complaints and appeals will become impossible.

When filing a complaint, special requirements must be observed. They are regulated by Articles 269 and 270 of the Civil Procedure Code of the Russian Federation.

If the rules and requirements are not followed, the complaint becomes invalid and is not subject to further consideration.

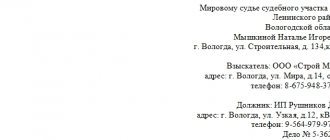

The appeal must contain the following information:

- Full name of the judicial government body to which the complaint is filed.

- Last name, first name and patronymic of the applicant.

- Place of residence of the applicant.

- Information about other participants in the proceedings.

- Available documents.

- Articles and other bills that confirm the violation of the applicant’s rights.

Procedure and terms of payment by an individual, where to get details

The state duty can be paid only before sending the appeal to the court (Article 333.18 of the Tax Code of the Russian Federation). In this case, the tax fee is paid to the address where the AAS is located. You can pay it:

- cash (banknotes);

- in non-cash form (by card, via the Internet).

State duty is paid (optional):

- In the bank.

- Through online banking (on the bank's website).

- At the Russian Post Office.

- In your personal account on the State Services website.

The fact of payment of the state duty by bank transfer (by card, via the Internet) is confirmed by a notification with a stamp from a local bank or a division of the Federal Treasury about its execution.

Evidence of payment of the state duty by bank transfer is considered to be a receipt, which, in accordance with clause 3.8 of Part 1 of the Regulations of the Central Bank of the Russian Federation No. 2-P of October 3, 2002 on settlements by bank transfer in the Russian Federation, indicates:

- in the field “Writing off from the payer’s account” - the date of writing off the money from the taxpayer’s current account (if paying the state duty in installments - the day of the last payment);

- in the item “Bank Mark” - the stamp of the bank (Federal Treasury body) and the personal signature of the responsible official.

The fact of paying the tax fee in cash is certified (optional):

- notification from the bank about payment of the fee;

- a receipt from the cashier or from an employee of the government agency (institution) where the payment was made.

The fact of payment of the state duty is also confirmed using the information provided in the payer’s personal account on the State Services website. Moreover, when paying such a fee in the personal account on the State Services portal, documentary evidence of such actions is not required.

The state fee must be paid before filing an appeal with the court (Article 333.18 of the Tax Code of the Russian Federation). It happens that the plaintiff does not want to voluntarily pay such a tax fee. Then, after the final court verdict on the complaint is made and such a decision comes into force, the judge issues a writ of execution to collect the fee.

The state duty is credited to the Federal Tax Service at the address of the court of appeal in arbitration. Details for paying such a fee are posted on the AAS website. Thus, when sending a complaint to the Ninth Arbitration Court of Appeal, payment details for the state duty are taken from Letter of the Federal Tax Service of Russia No. 13 for Moscow No. 20-21/01560 dated January 25, 2021.

In the event of early closure of the appeal proceedings, the state fee paid when filing it is returned (clause 11 of the Resolution of the Supreme Arbitration Court of the Russian Federation No. 46). Foreign companies (firms), foreigners and stateless persons pay it in the manner and amounts that are introduced for enterprises (companies, firms) and individuals (clause 4 of article 333.18 of the Tax Code of the Russian Federation).

Payment order

There are several ways to pay the state fee. The most common options are:

- Depositing funds on the official website of Sberbank online . To do this, you need to register a personal account and log in.

- Personal contact with an employee of any bank and payment through the transaction service window.

- Payment of state fees through self-service terminals in Sberbank . To do this, you need to fill in the details that the system asks for, as well as the amount of the amount. Payment can be made in cash or with a plastic card.

To confirm payment of the state duty, you must keep a printed receipt (if paying through a terminal) or a receipt issued by a bank employee.

How to submit a payment order for state duty to the arbitration court

The procedure and deadline for paying state duty are regulated by the legislation of the Russian Federation. Despite this, many participants in the arbitration process, when paying the fee, make the most common mistakes related to the timing and procedure for paying the state fee.

As a result, the appeal remains without consideration. To avoid this, keep in mind that:

- Individuals pay a notice to pay the state duty, and legal entities pay a payment order.

- The receipt must contain a note from a credit institution, bank or regional branch of the Treasury of the Russian Federation about the write-off of money to pay the state duty.

- The notice (payment order) is presented to the court only in the original. Submission of a photocopy of the payment document is permitted only when filing a complaint through the AAS website or in the My Arbitr system (my.arbitr.ru). However, you will still need to submit the original receipt to the court later (at the request of the judge).

- The payer of the state duty must be the plaintiff. If the payer of the fee is another person, he must document that he has the authority to pay the tax fee on behalf and at the expense of the plaintiff. In this case, in the section of the notice “Purpose of payment”, information about for whom the tax payment was made must be indicated.

If the plaintiff submits an application for an installment plan (deferment) of payment of the state duty, the following must be attached to it:

- a list of payer accounts confirmed by the local Federal Tax Service and the addresses and names of banks and other similar credit institutions where such accounts were opened (including their branches);

- information certified by the bank(s) about the absence of money in the plaintiff’s current account in an amount sufficient to pay the state duty, as well as about the amount of debt on unpaid receipts and writs of execution (sheets).

As a sample, the details of the arbitration court for payment of state fees by legal entities can be found here. A sample of filling out a Notice for the payment of such a fee by individuals through branches of Sberbank of Russia can be found here.

Articles:

Receipt and details for paying the state fee for individual entrepreneur registration

Cancellation of a writ of execution and termination of enforcement proceedings

Who should pay the fee?

Section 333.36.

Benefits when applying to the Supreme Court of the Russian Federation, courts of general jurisdiction, magistrates In accordance with current legislative requirements, a payment document indicating the fact of transfer of the fee must be attached to the statement of claim, complaint, petition, etc. Consequently, the obligation to pay the deduction in question falls on the shoulders of the citizen filing an appeal against the decision made by the court of the previous instance.

However, based on the results of the appeal proceedings, the payment procedure may be reviewed by the court. The options are as follows:

- the court regards the appeal as legitimate and satisfies the demands of its author - the other party to the proceedings is obliged to compensate the costs;

- the court does not satisfy the appeal requirements - the money is not returned to the applicant;

- The appeal is partially granted by the court - the fee is distributed among the participants in the proceedings. The calculation is carried out in accordance with the percentage of the appeal granted. For example, if the applicant put forward 3 demands and 2 of them were satisfied, the second party to the proceedings will recover 2/3 of the amount of the state encumbrance. Section 333.36. Benefits when appealing to the Supreme Court of the Russian Federation, courts of general jurisdiction, and magistrates

Distribution of payment between participants in the process

Payment of state duty is carried out in accordance with the following rules:

- When filing a collective appeal, the state fee is paid by the plaintiffs in equal parts.

- If one of the applicants has benefits, their share is not paid by the others. Thus, the amount of the fee is reduced by the share of the person having the benefit.

- If the appeal is granted, the obligation to pay the fee falls on the losing party.

- The court's act usually imposes an obligation on the defendant to reimburse the amount of the fee within ten days from the date of the decision.

- If the claims of the complaint are partially satisfied, the amount of the state duty is divided proportionally between the parties. Let’s say that if half of the demands are satisfied, the state duty is divided in equal parts between the plaintiff and the defendant. If the fourth part of the claim is satisfied, the defendant pays ¼ of the fee.

If the applicant is confident that the decision of the court of first instance is illegal, then he can count on the defendant to return the amount of the paid state fee when revising the decision in his favor.

Debt collection and penalties (fines and penalties)

If you go to arbitration with a claim of a property nature, the state duty must be calculated based on the price of the claim:

- up to 100,000 rubles - 4% of the claim price, but not less than 2,000 rubles;

- from 100,001 to 200,000 rubles - 4,000 rubles. plus 3% of the amount exceeding 100,000;

- from 200,001 to 1,000,000 rubles. — 7,000 rub. plus 2% of the amount exceeding 200,000;

- from 1,000,001 to 2,000,000 rubles. — 23,000 rub. plus 1% of the amount exceeding 1,000,000;

- over 2,000,000 rubles - 33,000 rubles. plus 0.5% of the amount exceeding 2,000,000, but not more than 200,000.

The entire penalty, which was calculated by the applicant independently, is included in the price of the claim. Therefore, the duty is calculated on the entire amount of debt and penalties. If during the consideration the claims change or the arbitration court recalculates the amount of the penalty, then the state duty must also be recalculated.

How to use the calculator

Step 1. In the “Plaintiff” list, select who is the plaintiff, that is, who files the claim with the demands. This can be either an individual or a legal entity. The last option is selected by default.

Step 2. In the “Application Type” list, indicate what type of claim you are filing. This may be a property or non-property proceeding, or an appeal or cassation complaint.

Step 3. If you chose a property claim, you will need to indicate the amount of the claim. Enter it in the field of the same name. The amount of state duty will be displayed automatically. This setting option will be needed to collect penalties.

Step 4. If you have chosen a non-property application or an appeal or cassation complaint, the “Type of appeal” list will open. Find the appropriate item in it and mark it. The amount of the state duty will automatically be displayed at the top of the page.

For example, to terminate a government contract, you need to select the type - a statement of a non-property nature, and the type of application - the very last item “Other statements of a non-property nature, including statements of recognition of rights, statements of an award to perform duties in kind.”

If you change any of the parameters, the fee amount will also automatically change.

IMPORTANT!

Don’t forget, if the claim contains both property and non-property claims, you will have to pay two fees for each type of claim!

Subjects exempt from paying duties

The first group of subjects includes:

- plaintiffs in cases in the field of illegal administrative decisions regarding them; in the field of wages and benefits; about alimony; on the protection of the rights of persons with disabilities; about forced hospitalization in an institution providing psychiatric care; for compensation for damage from injury, death of the breadwinner or from a criminal assault;

- parties to divorce;

- prosecutors;

- subjects who have suffered from repression, displaced persons and refugees on administrative issues related to their status;

- Rospotrebnadzor, as well as other authorities in consumer protection cases;

- persons applying for children's rights, as well as for adoption;

- Commissioner for Human Rights, state authorities and local self-government;

- authors of the fruits of intellectual activity in certain categories of cases in the field of intellectual property.

The second group of people includes:

- disabled people of group 1 or 2 filing individual appeals and complaints on behalf of associations;

- veterans of military and combat operations;

- plaintiffs about violation of their rights as consumers;

- pensioners when filing an appeal about the payment of a pension.

Do I need to pay a state fee for issuing a court order?

Almost all types of legal proceedings require a fee. Rates and general calculation rules are described in the Tax Code of the Russian Federation. Also in this code you can find a list of preferential categories of citizens who are fully or partially exempt from paying state fees.

A few words about the rules of writ proceedings, which may affect the calculation of the duty:

- an order can be obtained only for monetary (property) claims and obligations that are indisputable in nature

- all such obligations are listed in the Code of Civil Procedure of the Russian Federation and the Arbitration Procedure Code of the Russian Federation, and they must be taken into account by the claimant when applying to a judicial authority; - writ proceedings are allowed in magistrates' courts and in arbitration

- judicial bodies of general jurisdiction consider only claims and complaints, including after the order of magistrates is canceled; - since orders are issued in a simplified manner and without a full trial of the case, it is no less easy to cancel them

- but after the cancellation of the court order, the claimant retains the right to file a claim, and he can offset the previously paid state duty; - when an order is issued, the amount of the paid fee will be collected from the debtor

- in the opposite situation, if the issuance of a court order is refused, the applicant will lose money.

In writ proceedings, you can collect debts on loans and borrowings, under receipts and agreements, and for housing and communal services. The orders also require alimony as a percentage of the debtor’s income. There is a limitation regarding debt - through the magistrate's court you can get an order for debts if their size does not exceed 500 thousand rubles. If the amount owed is greater, you need to file a claim.

The calculation of the payment when submitting an application directly depends on the amount of collection. It is calculated by the claimant independently when submitting documents to the judicial authority. If you incorrectly calculate the state fee or fail to pay it, the judge will refuse to consider it. But for some types of cases and categories of claimants there are preferential standards for paying state fees. Read more about this below.

How can I pay, methods

You can pay the state duty in Russia in completely different ways, choosing the closest option for yourself. For example, it is convenient for someone to contact the bank’s cash desk with their details, but for those who live remotely, an option would be an i-box or a terminal or an ATM.

Payment through a bank cash desk

One of the options that is relevant for the majority is the cash desk of Sberbank of Russia. It is always available and there are numerous branches throughout the country, even in sparsely populated villages.

Sberbank terminals are no less in demand than cash registers, especially among those who can handle the automated system quite independently and can enter details on the screen. This is in part more suitable for young people and the middle generation, who are more likely to encounter computers.

Whatever option the payer chooses, the main and mandatory rule is to correctly enter the details for making the payment. If you make a mistake, the money to pay the state fee may go in the wrong place, or it may get stuck in the system, and it may be difficult to get it back.

In this case, you will have to write a statement to the bank about incorrectly providing payment details and wait for a refund.

You can always file a claim in court, but it will not be accepted without paying a state fee. This is a prerequisite in most legal proceedings. However, there are situations where the party filing the complaint or claim is exempt from paying the fee. You can also later return the money spent on state duty.