When you need to send a return of goods from a buyer to a supplier, it is often difficult to figure out what documents to fill out so as not to make mistakes. You should know in which cases this is easy to do and in which it is not documented. And the main thing is to remember the rules and nuances of the process and reimbursement of expenses. The Civil Code stipulates that the buying party may not accept and send back the cargo in several cases. This is possible if there is no corresponding clause in the contract. Let's look at what this looks like and what to do.

How to return when the product is of poor quality

There are two articles in the Civil Code that give the opportunity to the person or organization who bought it to send the purchase back to the owner - 518 and 475. Products that do not comply with the contract must have serious deficiencies in:

- types of models, colors;

- configurations;

- quality;

- external signs.

If the violations are small and easily corrected, then sending the order to the seller is allowed only to correct the problems. If part of the kit breaks, then this particular part will be replaced.

But if there are large and noticeable defects, as well as those that cannot be eliminated, the buyer returns the product. He can then choose one of two options:

- get money back;

- exchange for the same new and intact cargo.

This operation is available as long as the product is in good condition and is covered by the manufacturer's warranty. This is also possible within 2 years from the date of purchase if:

- the owner of the product will be able to provide evidence that the defect was identified before the end of the warranty period;

- There was no warranty period specified for the product.

It is important to remember that the articles do not apply to those items that were purchased for further resale. Therefore, if a delivery agreement has been concluded, then you should not count on sending the improper purchase back.

How to avoid conflict?

Show that you care about the client's feelings. If a customer receives a faulty product, admit the mistake and offer a bonus such as a discount or gift card.

Remember that discounts of up to 10-15% are perceived as the norm. If you want to appease an angry but important client, then the discount should be more significant.

Some stores offer a discount on a product if its flaws are not significant, and many buyers agree to this. In fact, it is better to replace the product. The client will quickly forget about the discount, but the faulty purchase will remain with him for a long time; he will remember the store as the place where he was sold a bad product.

By admitting your mistakes, you earn trust points with customers. But in no situation should we forget about employees.

Those who actually run the store suffer from the principle “the customer is always right.” Consultants and salespeople often have to deal with rude and hyperactive customers, whose complaints are often very far-fetched. Let your subordinates know that you share their possible dissatisfaction.

Laws

It is possible to return products to the supplier without conflict situations if the documentation is completed correctly. And also if you remember about the legislation that governs the return rules.

Art. 475 of the Civil Code of the Russian Federation. If defects are detected, the buyer-entrepreneur may demand:

- reduce the amount paid or demand that all violations be eliminated within a reasonable time;

- claim a refund for the money spent on fixing the problems yourself;

- if significant or irreparable deficiencies are identified, the buyer can completely withdraw from the contract and receive the finances back;

- is able to claim the right to replace a low-quality product with something that fully complies with what is specified in the contract.

Art. 476 of the Civil Code of the Russian Federation. The supplier is obliged to bear responsibility for defects that appear before the start of sales. There are 4 reasons why he will have to bear responsibility if he cannot prove the occurrence of violations after the transfer of the cargo to the customer.

Among them:

- violation of storage conditions;

- damage by third parties;

- misuse;

- irresistible force.

Quality is checked by a special supply agreement concluded by the parties. If it is not there, then everything is studied according to Art. 474 Civil Code of the Russian Federation.

Art. 477 Civil Code of the Russian Federation. During use of the purchased item, flaws or noticeable defects appeared. This also allows you to send it back at the designated time:

- until the warranty or the period for which the product is designed has expired;

- if this is not established, then within 2 years from the date of purchase.

What legal norms govern

According to the bill adopted in the first reading, from 2021 suppliers and retail chains are prohibited from entering into agreements that contain a condition for the return of goods unsold within the expiration date.

Today, many retail chains refuse to cooperate with suppliers if they do not include in the contract a condition for the return of expired goods. Moreover, this approach causes serious damage to the economic interests of suppliers and manufacturers.

Federal Law No. 364444-7 amends two Federal Laws: “On the Development of Agriculture” (Article 5) and “On the Basics of State Regulation of Trade Activities in the Russian Federation” (Article 13). It will be prohibited in supply contracts to stipulate conditions for the return of food products to the supplier after a certain period (meaning expiration date) or for the replacement of goods with similar ones or for reimbursement of their cost.

Now such conditions can formally be included in contracts by agreement of the parties, but their imposition is prohibited.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Product return in 1C: Trade Management

This operation can be carried out independently or using a document. To return goods from a customer, the sequence of actions will vary.

Carrying out the operation manually

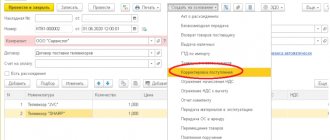

To complete a return transaction, you will have to go to “Returns and Adjustments” - “Return Documents” - click “Create” (document).

Subsequently, you need to select “Return from the client”. A window will appear to create a document called “Return of goods from the client.” Here you fill in the details of the document and the plate included in it. Here you do not need to fill in only the date and the appropriate compensation variation.

Details for filling out the document:

- organization - set automatically when records are kept for a single organization, or you need to act through “Research data and administration”;

- client - the choice is made based on information from the directory about partners;

- counterparty - filled in automatically after identifying the client, or you will have to act through the partner directory;

- warehouse—filled in from the “Warehouses and Stores” directory;

- agreement - after filling out the first two positions, you are allowed to view variations of agreements in the list (if necessary);

- compensation - filled in when the refundable amount exceeds the repayable debt (the option is activated after the description of the goods in the plate).

There are two ways to fill out the document: return the finances according to the document “Write-off of non-cash DS” or leaving it in the form of an advance. In the second case, the repayment amount from the client is included in mutual settlements (in the category “Customer debt reduced”).

The plate of the document “Return of goods from the client” is filled out line by line when you click “Add” or by clicking on the selection window. This can also be done by transferring information via the clipboard from external documents.

Additional fields for document generation:

- “Manager” - filled in automatically;

- “Transaction” - filling is relevant if there are transactions;

- “Division” - replenished automatically or selected independently;

- “Contact person” - replenished from the list of contacts;

- “Settlements financial accounting group” - replenished from the list of existing groups (decide whether you need to indicate such information);

- “Numbering of incoming document” - replenished independently using a paper return document;

- “Currency” - replenished automatically from the contractual document/agreement with the counterparty;

- “Payment” - filled in automatically;

- “Operation”—indicated automatically when setting the type of operation;

- “Taxation” - select one sales variation from three: subject to VAT/not subject to VAT, or sale subject to UTII;

- “Price for sale includes VAT” - if the icon is checked, the price is registered with VAT, if unchecked, it is calculated on top of the prices of the goods;

- “Return of reusable containers” - when values for containers are included, the document is supplemented with information about them (for accounting purposes, it is necessary to reflect the arrival of these goods and materials at the warehouse);

- “Deposit for containers” - this icon is turned on automatically if the requirements for its operation are specified in the contract document, or independently.

Placement in the warehouse is carried out taking into account the characteristics of the cost of goods in a separate line. In this case, the “Fill in cost” function is used. It is equal to the amount in this line. Information about it is taken from the sales document or indicated independently.

Carrying out an operation on the basis document

This is an alternative and simplified method of document generation that minimizes possible shortcomings. The operation is carried out as quickly as possible here. To implement it, you need to go to the “Basic Document” (as the document “Sales of goods and services”). After opening it, you need to go to “Input based on”. Here, tabs and plates are automatically filled in, and the document itself is adjusted.

As a result, you just need to click on “Save” to save the document. You are then allowed to handle the document at your own discretion. You can also generate the final version of the document in the program.

You can order the implementation of 1C:UT by phone

Reasons

Return of defects to the supplier is permitted if the defects are not indicated in advance in writing. This applies to both the entire product and individual parts. In reality, you can return it in different situations:

- products that do not meet quality standards, with visible flaws inside, on the container or box;

- differences in the amount of pieces, type, other features;

- the characteristics included in the contract do not work or are missing.

To determine discrepancies based on barcodes, volume and other parameters at the time of acceptance, it is worth installing special equipment. The use of a data collection terminal ensures that possible differences can be quickly identified - just scan the packaging to count it. After confirmation, the data will go into the database and be registered.

The presence of extra boxes, a lack of required packs, a different volume, color or similar appearance will be immediately determined by the technology. To install and configure the correct software and purchase suitable devices, you should contact Cleverence. The company will recommend quality equipment to help minimize costs and expenses due to unscrupulous contractors.

How to properly prepare documents for returning any goods to the supplier

We recommend that you complete the documentation correctly. To understand what papers to prepare and send to the contractor, you should find out whether ownership of the object has been transferred to the acquiring party. If you haven’t already, everything will be as simple as possible.

There are only 3 possible scenarios:

- identified simultaneously with acceptance - there is no need to accept such products;

- the discrepancy was not identified immediately;

- by agreement, the contractor regularly picks up questionable cargo and those that were not sold within the sales deadline.

Registration of correct return of any low-quality goods to the supplier, important documents

The purchaser must notify the contractor immediately of any defective parts found in the lot. If you do not follow this rule established by Art. 483. Civil Code, the seller has the right not to accept the returned property.

For example, if an organization accepted a delivery without checking and did not report any defects, then even the court will not satisfy the requirements.

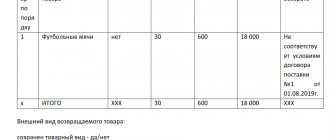

According to Art. 514, if everything is later sent back, the recipient is obliged to place the entire thing for safekeeping. His job will be to ensure the safety of the boxes until the shipper picks them up. If the manufacturer agrees with the existing defects and exports the batch, then the parties conclude:

- act of identifying inconsistencies (can be drawn up in the TORG-2 form);

- return invoice (TORG-12 is suitable as a basis).

If the purpose of sending products to the seller is to replace non-critical components or eliminate other minor defects, then everything must be done in writing. The days or weeks in which the shipper undertakes to replace defective parts, replenish or exchange parts should be agreed upon and specified in the documentation.

When the seller denies the possibility of violations, does not export and does not agree to change the defect, evidence is drawn up:

- claim;

- protocol according to which samples were taken for examination;

- a written or registered letter offer to participate in the inspection;

- expert opinion.

We must not forget that the statement of defects, written only by the recipient’s enterprise, only in a limited number of cases serves as an evidence base. This works if, when concluding the contract, both parties signed an agreement to apply such instructions. If it was not compiled, then it will not be evidence.

Grounds for returning quality goods to the supplier

Broken or incomplete shipments are not always returned. Sometimes you have to send fully working equipment or furniture because:

- other people claim these products (according to Article 460);

- the volume does not match - it is more or less than necessary (Article 466);

- incorrect assortment matrix - unordered color, taste, functionality (Article 468);

- incomplete set or refusal to complete the set (Article 480).

The list cannot be called complete. You can agree to change the conditions or supplement them. The contract includes the possibility of re-loading items not sold on time. For this, an additional formal basis is usually prescribed:

- there is no demand for the model;

- the product is expired;

- the season in which the part is sold has ended;

- other agreed justifications.

These are just some of the reasons why you can return a quality product to the supplier: the return procedure here does not differ from the main sequence. But there are also situations when there are no complaints at all, but the delivery is sent back.

To timely check the quantity and range of supplied cargo, you can go in two ways. An employee can look at each box, compare contents and check barcodes manually. But there is a faster way - simply install special software.

To do this, just contact Cleverens. The company will select the right equipment for the business, which will simplify not only acceptance, but also automate many other processes. This will minimize costs and problems with mis-grading and quantity discrepancies, and will make accounting faster.

How to document return of unrealized

It is important to remember that returning quality products is allowed only if this is agreed in advance in the contract. Otherwise, you won’t be able to send the sofa back just because it’s not for sale.

There is another way. If such a procedure is not documented, but the companies have agreed on the possibility of such outcomes, then it is permissible to simply formalize a reverse sale. For example, if not all bicycles are sold before the end of summer and the manufacturer agrees to take them back.

In fact, this will be the sale of his own packages to the former owner. Created:

- TORG-12;

- invoice.

The name of his own company is entered in the “seller” line, and the buyer is a contractor who removes his former cargo in the cell. There is no need to fill out TORG-2 according to the sample. Documentedly, such castling does not differ from a regular sale.

How to give money correctly?

There are several important rules. If the goods are returned on the day of purchase, the money is issued from the operating cash register, that is, directly from the cash drawer of the working cash register. This is if the buyer paid in cash. At the end of the work shift, you need to issue a KM-3 act and reduce the daily cash register revenue by the amount of returns for the day.

If the buyer comes to return the goods after some time (not on the day of purchase), the money must be taken from the main cash register.

When paying non-cash, you cannot give money from the cash register. The amount must be transferred to the customer’s card, or the transaction must be canceled if the product is returned on the day of purchase.

Find out how to send money back to the buyer’s card from your bank’s support service. It may not be possible to transfer money to the card. Then the amount must be withdrawn from the current account and only then returned.

How it is issued in different cases

What to do if you brought expired milk or a cake for sale - send it back. But the papers must be drawn up correctly. The supplier will not need to document the return of goods if it is a trusted partner who guarantees to replace everything as soon as possible.

If the shipper does not mind picking up the defect that was sent by an inattentive employee, then you don’t even have to write additional documents. It is enough to cross out items from the invoice that will not be accepted onto the company’s balance sheet. The driver will load them back into the car and take them to the warehouse from which they came.

They will not be reflected in accounting. But the representative of the second party must also sign, so he will confirm that the procedure took place with his participation. Within 5 working days, the shipper sends a new document with corrected figures.

If the relationship with the contractor is trusting and cooperation has been going on for many years, a simpler option is also possible. The receiving party signs the invoice without changes, calls the sender and tells about the poor quality of the delivery. He promises to deliver quality products in a short time.

The latter method is good because there is no red tape, no possible inconsistencies, and quick operations through the base. But it is recommended to use it only when working with a trusted counterparty.

How to return in the absence of grounds, but with the consent of the other party?

What documents should I fill out?

Regardless of whether a return is provided for in the contract or not, the required documents for a return are :

- waybill (unified form TORG-12 or a self-developed document);

- invoice (you can find out how to issue an invoice for returning goods to a supplier, and also see a sample document here).

The important aspect is that in these documents the supplier will become the buyer and the buyer the supplier.

Packing list

The supplier of the goods is the former buyer . Accordingly, its data is indicated in the columns “name, address, details”.

The buyer will also be the shipper. It is not necessary to fill in the fields regarding the shipper (letter of the Federal Tax Service of Russia dated November 25, 2014 No. ED-4-15/ [email protected] ).

The consignee is the former seller (supplier) . His details are indicated in the “consignee” column.

The “Payer” column is filled in only if the former buyer receives money upon return.

The “Base” column is the most important point . This indicates “return of goods”. The details of the invoices on which the returned products were accepted, the details of the contract and other documents regarding the return are also listed.

Items about the product. Here it is necessary to clearly describe the products, quantity, packaging and other conditions, on the basis of which complete agreement with previously accepted products will be seen.

The document is signed by the manager, chief accountant, financially responsible person and recipient.

also indicate in the delivery note the documents on the basis of which the return agreement was concluded - letters, additional agreement.

Invoice

If the organization that previously acted as the buyer is on the general taxation system, then an invoice is issued. It is reflected in the sales book, and for the supplier - in the purchase book.

If the organization that previously acted as the buyer is under a simplified taxation regime, then an invoice is not issued, because this organization does not pay VAT and is not entitled to a tax deduction (you can learn about the nuances of returning goods to a supplier under different taxation systems, and also see how to correctly fill out a profit declaration here).

Registration procedure

There are two types of documents that must be properly prepared in order to make a return:

- claim;

- Act.

The first paper is drawn up on the organization’s letterhead. The signature of an accountant or other person authorized to sign the documentation is required.

Always indicated:

- legal and actual address;

- full title;

- information about the buyer - details, name, other information;

- information about the supply agreement that caused the claim, date, number;

- the reasons for creating the paper are described in full and in detail - discrepancies in quantity, quality, set;

- it is recommended to refer to the law;

- justification for the requirement - return, exchange, complete;

- time limits are established within which the supplying party must review and provide a written response;

- a census of everything invested.

Additionally, a return certificate is drawn up. This is a document that is drawn up by several authorized persons of the receiving company. It is confirmed by the results of the examination and is considered an official document sent from the buyer to the seller.

Here you need to provide information:

- date and place;

- details of both organizations;

- the name of the service or thing that is the basis;

- expert opinion;

- signs how purchased products will be returned to the warehouse;

- indicate invoice details for reverse transfer for low-quality goods;

- if there is compensation - terms and amounts;

- signatures;

- print.

Both parties will sign, but only the manager or other authorized person on each side. His right must be confirmed by a special power of attorney, otherwise the document has no legal force.

What to do if the supplier refuses?

Resolution of the issue in court

The content of the agreement when resolving a case through court is a key point. If there are legally established grounds for a return or the contract itself stipulates the grounds, you can safely go to court.

And if there are no legal grounds and the contract does not say anything about this, you will need to prove your claims based on business customs.

Drawing up a claim, application

The claim is drawn up in triplicate and contains:

- information about the court, plaintiff, defendant (name, address, legal details);

- description of the circumstances of the case;

- the rules of law on which the plaintiff relies;

- requirements;

- the amount of the claim and its calculation;

- signature, date;

- applications.

The defendant needs to send a copy of the application. Dispatch is made by registered mail with notification or by courier.

Attached documents:

- copies of documents that served as the basis for the dispute (agreement, acts, invoices);

- copies of documents indicating completion of the claim procedure;

- notice of service of the claim on the defendant;

- document confirming payment of state duty;

- copy of state certificate plaintiff's registration.

Which court should I go to?

Cases in which one party is a legal entity (or individual entrepreneur) are considered by the arbitration court at the place of registration of the defendant. The claim is filed directly with the court or via mail or through the Internet portal of the arbitration courts.

State duty

The amount of the fee depends on the amount of the claim and is established by Article 333.21. Tax Code of the Russian Federation. The losing party pays all legal costs.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What you should know about - tax issues

There are several nuances, knowledge of which will simplify the procedure:

- If the products were not accepted, then a separate operation is not created. In this case, VAT is not paid and the buyer does not issue an invoice. The shipper will send him the corrected papers.

- If everything was accepted at first, but then violations were discovered, separate documentation is drawn up. It's paper and procedure. First, the consignee sends an invoice to the supplier, who will accept VAT for deduction. If necessary, the owner of the outlet restores the tax amount, this is done in the same period with the actual refund.

Sometimes the parties agree that defective items must be disposed of. In this case, the shipper attributes the costs to expenses from defects.

Accounting in accounting and balances

There are only three paths you can take to reflect changes in the program:

- The simplest one, for those who have been collaborating for a long time. Don't make any notes, accept everything on the list, then call the supplier and report any discrepancies. He brings a quality replacement.

- More difficult if the goods have not yet been accepted. Note the differences on the invoice and cross out what is not accepted. Sign, get the driver's signature. Wait for new documents from him in which the information has been corrected.

- If the product was accepted, but then a discrepancy was discovered. A consignment note TORG-12 and an act TORG-2 are drawn up. The seller must agree with the violations.

- If he does not agree, then a claim is drawn up, a protocol on sampling is drawn up, and the shipper is invited for an examination.

Carrying out product returns in 1C: Accounting

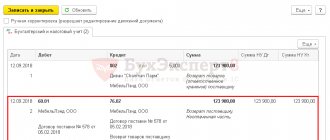

To maintain records, the seller, through the “Accounting” configuration from 1C, makes return entries and creates various documents. Often this is done using a sales document, a purchase ledger, or an adjusted invoice. The last document is drawn up by the seller when adjusting the price of inventory items shipped in the previous tax period.

Product return from a counterparty based on a sales document

Instructions on how to correctly return goods from a client. First you need to go to “Sales” and click “Sales”.

A window with sales transactions will appear. Find exactly the one for which the goods were sold from the warehouse. Open.

In the implementation, click “Create from.” Select the Implementation Adjustments category.

The following form will appear—adjustment form. Here in the line “Before changes” information from the implementation document is written. In the “After change” line, you need to enter the volume of goods remaining with the client after return. Returning an entire shipment means that the line remains blank. To complete the operation, the document is recorded and posted. To view the document posting, you can click on “DtKt”.

This reflects the adjustment to the cost of the returned goods, its sales and VAT.

Corrective invoice for product returns

Partial return of goods from a client that have not been registered must be indicated in the “Accounting” configuration from 1C by generating an invoice.

In the adjustment window, click on the issue of an adjustment invoice. A record with information about the document will appear.

To print, click on the document. A window will appear in which you need to initiate printing of the document and select an account or a universal “cord”. One copy of the document must be given to the buyer/client so that he can adjust the VAT.

Product return according to the purchase book

For VAT transactions, go to “Reports” and click on “VAT reporting”.

Transactions including VAT will appear in the window. Here we provide the necessary information. Click on the option to create entries in the specified book.

A form will appear in which we click “Fill out document”. The document will complete itself. Let's go to "Reduce sales cost".

There is a document called “Implementation Adjustments” here. Click on “DtKt” to check that the return of goods from the buyer/client has been completed on the basis of VAT.

A VAT posting window will appear. Here is a record of VAT on returned goods. If all steps are completed, the operation was successful. And the return of goods was correctly reflected in tax documents, including VAT. You can see the presence of wiring. In the operations window, click on the “Purchase Book” category. The operation “Return of goods from the client” is reflected here along with the code.

If you have any questions, please contact us for advice on the 1C Consultation Line at number, and also leave applications on our website or by mail