Return of low-quality goods

If the buyer discovers a defect in the product, he may ask:

- Replace it with a product of the same or another brand. If the price of the goods is different, then he pays extra or you return the difference to him.

- Reduce the price for which he bought the product.

- Eliminate product defects free of charge or reimburse the buyer for the costs of correcting them.

- Refunding money for an item is the most common problem.

If the customer knew about the defect when purchasing, you are not obligated to accept the product and return the money. For example, in some stores they sell discounted goods and immediately talk about its shortcomings. Then they cannot be a reason for a return.

To find out the reason for the marriage, you can conduct an examination at your own expense. If it turns out that the buyer himself damaged the goods, do not accept it back and ask for reimbursement of the cost of the examination. The buyer is obliged to do this.

Return of defective goods from the buyer

In the buyer's accounting, the procedure for recording the return of low-quality goods depends on whether the defect was discovered immediately upon acceptance of the goods or after it was accepted for accounting.

When returning goods before they are accepted for accounting, the contract is terminated unilaterally, the goods are not accepted for registration by the buyer, and the ownership of it is retained by the seller. The buyer notifies the seller of the violation of the terms of the contract (Article 483 of the Civil Code of the Russian Federation) and accepts the goods for safekeeping. Defective goods are accepted for accounting in off-balance sheet account 002 “Inventory assets accepted for safekeeping” in the assessment according to shipping documents (by a simple debit entry to account 002). When the goods are returned to the supplier, the cost of the goods is written off from off-balance sheet accounting by a simple entry on the credit of account 002.

A separate transaction reflects the receipt of funds from the supplier for the submitted claim:

DEBIT 51 CREDIT 76 subaccount “Settlements for claims”

- funds received from the supplier for a claim.

Accounting for the return of goods before acceptance for accounting and receipt of funds requires the completion of only three business operations:

- an invoice for receipt of goods is registered;

- an invoice for writing off the goods is registered;

- The bank statement showing the receipt of funds is reflected.

If a defect is discovered after acceptance of the goods, the buyer makes a claim to the supplier for the value of the defective goods. Settlements on claims are recorded in account 76.6 “Settlements with various debtors and creditors”, subaccount “Settlements on claims”.

Typically, examples are used to consider operations for returning goods with payment after receipt of the goods.

We will look at an example of returning a product, complicating it by paying an advance to the supplier. Example 1

Riviera LLC bought a batch of nails from StroyBarier LLC (120 boxes of 3 kg each) for 25,000 rubles.

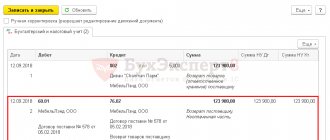

Before accepting the goods, Riviera transferred fifty percent of the cost for the goods in advance. After the goods arrived at the warehouse and were registered, it was discovered that almost all the nails were missing heads - the goods were rejected. The nails were returned to the supplier, and a claim was sent to him for the return of the previously paid advance. The accountant makes the following accounting entries: DEBIT 60 subaccount “Advances” CREDIT 51

- 12,500 rubles.

— paid to the supplier for goods (advance); DEBIT 68 CREDIT 76

- 1906.78 rub.

— VAT deduction on advance payment issued to the supplier is reflected; DEBIT 41 CREDIT 60

- 25,000 rub.

— goods received from the supplier are accepted for accounting; DEBIT 19 CREDIT 60

- 3813.56 rubles.

— input VAT is taken into account; DEBIT 60 CREDIT 60 subaccount “Advances”

- 12,500 rubles.

— the advance payment has been credited against the previously received prepayment; DEBIT 68 CREDIT 19

- 3813.56 rub.

— the supplier’s invoice is registered; DEBIT 76 CREDIT 68

- 1906.78 rub.

— VAT on advances issued has been restored; DEBIT 76 CREDIT 41

- 25,000 rub.

— goods are returned to the supplier; DEBIT 76 CREDIT 68

- 3813.56 rubles.

– VAT accrued is taken into account; DEBIT 51 CREDIT 76

- 12,500 rub. — funds were returned according to the reconciliation report.

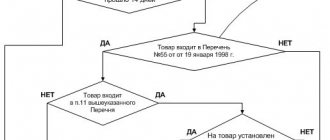

Return of quality goods

If a quality product does not suit the buyer in color or size, he can ask to exchange it for a suitable product. You may have three reasons for refusal:

- More than 14 days have passed since the date of purchase.

- The product has lost its appearance. For example, a customer brought shoes with worn soles or a shirt without a button.

- The product cannot be exchanged or returned by law. For example, cosmetics, underwear or jewelry. Remember that you can refuse for this reason only if the product is of high quality. List of goods that cannot be returned

If there are no reasons for refusal, you must exchange the product for one suitable for the buyer. And in his absence - return the money.

Method 1. Document “Adjustment of receipts”.

In the receipt document, click the “Create based on” button and select “Adjustment of receipt”.

Attention! If this item is missing from the “Create based on” button, then you need to check the enabled functionality of the program.

Go to Main - Functionality - on the Trade tab, check the box “Correction and adjustment documents”.

Enter the receipt adjustment document:

On the Main tab, select the type of operation “Adjustment by agreement of the parties” to generate an adjustment invoice. The basis field indicates the source document on which the return will be issued. In the “Reflect adjustment” field, select the “In all accounting sections” option - accounting entries for the return of goods and a VAT entry will be generated for formation in the sales book or purchase book.

Because in our example, we are returning the goods, therefore, reducing the cost according to the receipt document, then a sales book entry is generated to restore the VAT previously accepted for deduction on the invoice, to which an adjustment invoice was issued (clause 4, clause 3, art. 170 of the Tax Code of the Russian Federation). To do this, check the Restore VAT in the sales book checkbox.

On the “Products” tab we reflect the return of defective goods. To do this, in the “SHARP” TV position, in the “After change” field in the “Quantity” column, remove the quantity of the product.

If I return the product partially, then in the quantity column in the field after the change, indicate the quantity that the buyer has left, and the program calculates the quantity of the returned product as the difference between the fields Quantity before change minus Quantity after change.

In the field “Corr. Invoice No., indicate the number and date of the adjustment invoice and click the “Register” button.

In the invoice we see the amounts to be reduced, and the transaction type code is 18. The entry in the sales book will go with this code.

From the invoice, using the “Print” button, we can print an invoice for the supplier

Since the adjustment was reflected in all sections of accounting, the program generated transactions and adjusted the balance of goods on the warehouse, mutual settlements with the supplier and adjusted the VAT amount.

VAT has been reinstated in the sales book:

You can print the following forms from the “Receipt Adjustment” document:

- Price change agreement

- TORG-12 (for return)

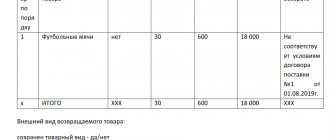

How to prepare documents for returning goods

Ask the buyer for an application and a cash receipt.

In the application, he indicates his passport details, states the reason for the return and the amount he wants to return. If the buyer has lost the sales receipt, he can prove the fact of the purchase in another way, for example, by referring to the testimony of witnesses.

When receiving goods from the buyer, prepare a return invoice. It can be arranged in any form. The main thing is that the invoice contains the buyer’s data and all information about the product: its name, quantity, cost.

Returning goods to the supplier: reasons, features and procedure

Ekaterina Nikolaevna Akinsheva, legal consultant of the Belyaevs and Partners legal group

From time to time, in the course of business activities, a legal entity, when supplying products, is faced with the return of goods. The return of goods may result from improper fulfillment of legal requirements and obligations undertaken by both the supplier and the buyer. Let's consider possible cases of returning goods under a supply agreement.

1. General terms and conditions of the supply agreement

Under a supply agreement, the supplier-seller engaged in business activities undertakes to transfer, within a specified period or terms, the goods produced or purchased by him to the buyer for use in business activities or for other purposes not related to personal, family, home and other similar use <*> .

In this case, the obligations arising from the contract must be fulfilled properly in accordance with the terms of the obligation and the requirements of the law, and in the absence of such conditions and requirements - in accordance with the usually imposed requirements.

2. Cases of returning goods

2.1. The supplier violated its obligations.

Let's consider return options in case of violation of an obligation by the supplier:

a) violation of quantity conditions.

If the seller, in violation of the terms of the contract, has transferred to the buyer a smaller quantity of goods than determined by the purchase and sale agreement, the buyer has the right, unless otherwise provided by the contract, either to demand the transfer of the missing quantity of goods, or to refuse the transferred goods and payment for it, and if it has been paid, to demand return of the amount of money paid for it <*>.

Thus, the legislator, in a situation of short delivery of goods, gave the buyer a choice - either to demand the transfer of the goods, or to refuse the already transferred goods and his obligation to pay for the goods. Moreover, such a choice is alternative and excludes the possibility of demanding the transfer of an item and, for example, the return of a sum of money. Otherwise, satisfaction of two requirements entails unjust enrichment of the buyer.

This rule contains features that require the attention of the parties when concluding an agreement: for example, when deciding on the return of goods on the above basis, it is necessary to take into account exactly how the parties agreed on the fulfillment of delivery obligations.

Example By agreement, the parties provided that in the event of delivery of goods in a smaller quantity, the parties agree to return funds in proportion to the quantity of undelivered goods. Comment: In this case, it is legitimate to say that the parties have reached agreement on consequences other than those listed in paragraph 1 of Art. 436 Civil Code. Accordingly, returning the goods with reference to this standard will be unjustified.

It is also necessary to take into account cases when the legislator himself provides for other consequences of short delivery. Thus, the parties may provide for the delivery of goods in separate batches and, accordingly, the delivery times for such batches during the validity of the contract <*>. In this case, the consequences provided for in paragraph 1 of Art. 436 of the Civil Code and clause 11 of the Delivery Regulations do not apply and there is no right to return the goods on the specified basis.

In this case, special consequences arise. Thus, a supplier who has allowed a short-delivery of goods in a separate delivery period is obliged to make up for the under-delivered quantity of goods in the next period (periods) within the term of the contract, and under a long-term contract - within the year in which the short-delivery was made, unless otherwise provided by the contract < *>.

Example The parties entered into a contract for the supply of 100 units of goods specified in the contract. The deadline for delivery is within four months from the date of conclusion of the contract. Comment: If, after the specified period, only 50 units of goods are delivered to the buyer, he has the right to refuse the delivered goods, return the goods to the supplier and demand a refund of the money paid. If the contract agreed on specific delivery periods and the supplier violated the delivery terms batches of goods - delivered part of the goods not on the 10th day of the month of shipment, but, for example, on the 30th, but did not violate the delivery deadline, then the buyer does not have the right to refuse the delivered goods on the basis in question. In this case, other consequences of failure to fulfill the obligation apply. In particular, the supplier is obliged to deliver the underdelivered quantity of goods in the next month <*>;

b) violation of assortment conditions.

Return of goods is also possible if the supplier violates the terms of the assortment agreed upon by the parties.

An assortment of goods is understood as a set of goods in a certain ratio by types, models, sizes, colors and other characteristics <*>.

Goods that do not comply with the terms of the purchase and sale agreement regarding the assortment are considered accepted if the buyer does not notify the seller of his refusal of the goods within a reasonable time after receiving them <*>.

In this case, the return of goods that do not correspond to the assortment is possible provided that the buyer:

1) refuse the product completely;

2) refuse part of the goods;

3) will require the replacement of goods that do not meet the assortment condition with goods in the assortment provided for by the contract;

c) transfer of goods of inadequate quality.

The seller is obliged to transfer to the buyer the goods, the quality of which corresponds to the purchase and sale agreement. If there are no conditions in the contract regarding the quality of the goods, the seller is obliged to transfer to the buyer goods suitable for the purposes for which goods of this kind are usually used, and if the seller was informed about the specific purposes for purchasing the goods - suitable for use in accordance with these purposes <* >.

It is worth noting that the mere transfer of goods of inadequate quality to the buyer does not give him the right to demand that the seller replace the goods or refuse to fulfill the contract and demand a refund of the amount of money paid for the goods.

Return of goods is possible on the specified basis only if there are significant violations of the requirements for the quality of goods <*>. These are the deficiencies that:

- irremovable;

- cannot be eliminated without disproportionate costs or time;

- are detected repeatedly or appear again after their elimination;

- similar to those listed above;

d) transfer of incomplete goods.

The seller is obliged to transfer to the buyer the goods that comply with the terms of the purchase and sale agreement regarding completeness. In the case where the purchase and sale agreement does not specify the completeness of the goods, the latter is determined by the usually presented requirements <*>.

Similar to the situation with the return of goods of inadequate quality, the mere transfer of incomplete goods to the buyer does not give him the right to demand that the supplier replace the goods or refuse to fulfill the contract by returning the goods and demanding a refund of the amount of money paid for the goods.

The buyer has the right to carry out these actions only if the seller has not complied with the buyer’s requirement to complete the goods within a reasonable time <*>;

e) violation by the seller of the obligation to transfer a set of goods to the buyer.

Return of goods in case of violation by the seller of the obligation to transfer a set of goods to the buyer is possible on the same grounds as the return of incomplete goods <*>;

f) transfer of goods without containers and (or) packaging or in improper containers and (or) packaging.

The seller is obliged to transfer the goods to the buyer in containers and (or) packaging, with the exception of goods that, by their nature, do not require packaging and (or) packaging and unless otherwise provided by the sales contract and does not follow from the essence of the obligation <*>.

In this case, the parties may stipulate requirements for containers and packaging in the contract. If the parties have not agreed on this issue, the goods must be packaged and (or) packaged in the usual way for such goods, and in the absence of such, in a way that ensures the safety of goods of this kind under normal conditions of storage and transportation <*>.

If, in accordance with the procedure established by law, mandatory requirements for containers and (or) packaging are provided, then the seller engaged in business activities is obliged to transfer the goods to the buyer in containers and (or) packaging that meet these mandatory requirements <*>.

In cases where a product subject to packaging and (or) packaging is transferred to the buyer without containers and (or) packaging or in improper containers and (or) packaging, the buyer has the right to require the seller to package and (or) package the goods or replace the improper containers and (or) packaging ) packaging, unless otherwise follows from the essence of the obligation or the nature of the goods <*>.

Thus, it is clear that the return of goods is possible along with the replacement of improper containers and (or) packaging.

However, such a return is possible provided that:

1) the parties agreed on the delivery of goods in a certain container and this condition is violated;

2) the goods are subject to mandatory packaging in accordance with current legislation and these standards are violated during the delivery of the goods.

The return of improper containers or packaging should be distinguished from the return of reusable containers and packaging materials.

Unless otherwise established by the supply agreement, the buyer (recipient) is obliged to return to the supplier the reusable containers and packaging means in which the goods were received, in the manner and within the time limits established by law. Other containers, as well as packaging of goods, are subject to return to the supplier only in cases provided for by the contract <*>.

Thus, in this case, the law does not link the return of reusable containers in which the goods were received with improper fulfillment of the party’s obligations under the contract. In contrast to the return in accordance with Art. 452 of the Civil Code, such a return is a condition for the proper fulfillment of the delivery obligation, and not a consequence of its violation, and does not depend on the establishment of the fact of improper fulfillment of the contract.

If in one case, in order to return the goods, it is necessary to identify and record violations of containers and packaging, then in the other, the return is provided for by the delivery itself and does not require additional actions;

g) failure to provide accessories or documents related to the goods.

The seller is obliged, simultaneously with the transfer of the goods, to transfer to the buyer its accessories, as well as documents related to it (technical passport, quality certificate, operating instructions, etc.) provided for by law or contract <*>.

In case of improper fulfillment of this obligation, the buyer has the right to assign a reasonable period to the supplier for their transfer <*>. And only if the accessories and documents are not transferred within the period specified by the buyer, the latter has the right to refuse the goods, which also entails its return <*>.

2.2. The buyer violated his obligations.

It is also possible to return goods within the framework of the supply agreement under circumstances depending on the improper fulfillment of obligations by the buyer.

The purchase and sale agreement may provide for payment for the goods after a certain time after its transfer to the buyer (sale of goods on credit). In this case, if the buyer who has received the goods does not fulfill the obligation to pay for them within the period established by the contract, the seller has the right to demand payment for the transferred goods or the return of unpaid goods <*>.

The right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise provided by law or the contract <*>. It follows from this that the parties have the right to change the moment at which ownership rights arise by indicating a different moment, for example, at the time of settlement under the contract.

In the event that the transferred goods are not paid for within the period stipulated by the contract, or other circumstances do not occur in which the ownership right passes to the buyer, the seller has the right to demand that the buyer return the goods to him <*>.

2.3. Other cases of returning goods.

In addition to returning goods due to the discovery of improper fulfillment of delivery conditions, it is also possible to return goods in other cases.

For example, the consequence of declaring a transaction invalid is the obligation of each party to return to the other everything received under the transaction <*>. Thus, the return of goods may be the result of restitution in the event that the supply contract is declared invalid.

From the foregoing it follows that the grounds and procedure for returning goods depend on many factors, but the fact remains unchanged that the return of accepted goods is a business transaction, and accordingly, in any case, is subject to registration with a primary accounting document <*>. In particular, because When returning goods, there is a movement of goods from one organization to another and, accordingly, inventory items are written off from the consignor and (or) taken into account by the consignee; the return of goods from the buyer to the supplier is formalized using invoices <*>.

Read this material in ilex >> *follow the link you will be taken to the paid content of the ilex service

Buyer refund rules

How to correctly issue a refund to a buyer depends on when he contacted you.

Return on the day of purchase

If the customer paid in cash, give him the money directly from the cash register drawer. When paying for goods by card, refunds are also made by bank transfer - just cancel the transaction. In both cases, do not forget to punch the check at the cash register with the sign “return of receipt”.

Return another day

If the customer returns the item on another day, money cannot be taken from the cash register drawer. Issue money from the main cash register - this is what all cash in the organization is called. If you have an LLC, write out an expense cash order or RKO. Individual entrepreneurs do not need to do this, since they are not required to observe cash discipline.

Read more about this in the article “Cash discipline”

If the buyer paid for the goods using a bank card, return the money back to it. In this case, cash cannot be issued; this is prohibited by the Directive of the Central Bank of the Russian Federation. How exactly to return money to the buyer’s card, check with the support of the bank with which you have an acquiring agreement. If you cannot return the money back to the card, withdraw the money from the current account and return it to the buyer.