The legislative framework

The buyer has the right to return the product to the supplier even if it is not defective or damaged. This rule is established by Article 421 of the Civil Code of the Russian Federation. There are the following reasons for a return:

- All necessary documents are missing.

- Defect detected.

- The product has expired.

- The supplier sent products in a smaller volume than was agreed upon, or the wrong product was delivered (according to Articles 466 and 468 of the Civil Code of the Russian Federation).

- Unsatisfactory product quality (Article 475 of the Civil Code of the Russian Federation).

- There is no container if there should be one (Article 482 of the Civil Code of the Russian Federation).

Upon acceptance of the goods, the buyer must carefully inspect it. If any defects are found, a refund will be issued.

How is VAT charged to the buyer when returning goods to the seller ?

Procedure for returning goods for various reasons

All cases of goods returned to the supplier can be considered as one of three aspects.

- Inadequate quality, defects, discrepancies in assortment, set or packaging are detected upon acceptance - then a return is issued without transferring the goods to the buyer, it is immediately returned to the supplier, since acceptance does not occur.

- Despite the detected deficiencies, the receiver is forced to accept the goods, knowing that he will have to issue a return later. In this case, the products are accepted by the buyer for safekeeping.

- Planned returns of products not sold on time - the so-called reverse sales.

The reasons for the return are fundamental when processing the transaction. The accounting entries used depend on them. The key point is whether ownership has already passed from the supplier to the buyer, or not yet.

How can a buyer get a refund when returning a product of good quality to the supplier ?

Return of low-quality products

If the buyer discovers the poor quality of the goods, he can choose one of several ways:

- Return of products with refund of money paid.

- Return of low-quality goods for exchange for quality ones.

How can a buyer return money when returning a low-quality product (defective) to the supplier ?

The procedure is regulated by Articles 518 and 475 of the Civil Code of the Russian Federation. It differs in a number of nuances:

- If minor defects are found on the product that can be quickly corrected, the buyer has only one option - returning the product to eliminate the defects.

- If a defect is detected not on the entire product, but only on part of the set, only this part is replaced.

- If a product is purchased by a legal entity for the purpose of resale (for example, products are purchased by a retail store), only the provisions of the Civil Code of the Russian Federation will apply, and not the Law on the Protection of Consumer Rights. The return procedure applicable to retail customers does not apply in this case.

Returns may be made within the warranty or expiration date. However, there are exceptions. You can return products within 2 years under the following circumstances:

- The buyer can prove that the deformation occurred before he received the goods (according to Articles 471 and 477 of the Civil Code of the Russian Federation).

- If the product does not have an expiration date or warranty period.

You can prove the presence of deformations using photos, videos and witness testimony.

Registration of return of low-quality goods

If the buyer finds any defects, he must immediately notify the supplier. This procedure is stipulated in Article 483 of the Civil Code of the Russian Federation. If no notification was sent to the seller, then he has the right to refuse the return.

IMPORTANT! The buyer, according to Article 514 of the Civil Code of the Russian Federation, must accept low-quality products for safekeeping until they are actually returned. Until this moment, it is he who is responsible for the safety of the goods.

If the supplier agrees with the claims presented to him, the following documents are drawn up:

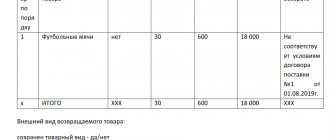

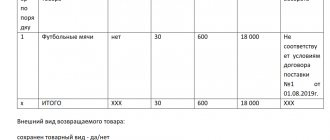

- A report on detected defects (can be drawn up in the TORG-2 form), which sets out existing claims.

- Return invoice for goods (can be issued using the TORG-12 form).

If the defects are minor, the products are returned to be corrected. It makes sense to draw up a document that specifies the deadline for correcting all detected defects.

If the supplier undertakes to eliminate defects in the shortest possible time, there is no need to issue a return invoice. The rule is stipulated by Article 518 of the Civil Code of the Russian Federation.

The supplier may also deny that the product is of poor quality. In this case, it is necessary to prove the presence of defects using the following documents:

- Claims.

- Notifications to the supplier about the date of the examination.

- Protocol on preparation for examination.

- Expert opinion.

ATTENTION! A report on detected defects, drawn up unilaterally, is not evidence of low quality products. But there is an exception: the agreement between the parties specifies the application of the instructions “On the procedure for accepting goods” dated April 25, 1966.

Return of quality products

The buyer has the right to return quality goods to the supplier if the following grounds exist:

- Rights to products are vested in other persons (Article 460 of the Civil Code of the Russian Federation).

- The supplier did not timely deliver the accompanying documentation and components for the goods (Article 464 of the Civil Code of the Russian Federation).

- A smaller quantity of products was received than agreed upon (Article 466 of the Civil Code of the Russian Federation).

- The range of products was not observed (Article 468 of the Civil Code of the Russian Federation).

- There is no complete set (Article 480 of the Civil Code of the Russian Federation).

- The packaging does not meet the requirements for it established by law or agreement (Article 482 of the Civil Code of the Russian Federation).

You can add to the list yourself. For example, the supplier undertakes to transfer accompanying documents within a certain period of time. If he does not do this, the buyer has the right to issue a return. Additions must be fixed in the agreement between the parties. If the parties to the transaction have previously agreed, the products can be returned even without serious reasons. For example, a return is issued if the buyer does not sell the product within the agreed time frame.

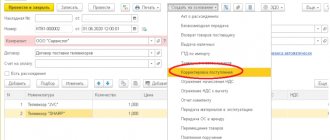

Registration of return of products that could not be sold

As mentioned earlier, the contract can provide for the possibility of returning goods that could not be sold within the specified time frame. From a tax point of view, the transaction has signs of reverse sale. That is, the supplier becomes the buyer, and the buyer becomes the supplier. To complete the procedure, the following documents are required:

- Packing list.

- Invoice.

IMPORTANT! Large retail chains do not have the right to return goods if they could not be sold. The exception is the sale of bakery products.

FOR YOUR INFORMATION! It is difficult to carry out such a transaction when selling alcoholic products, since the sale of alcohol requires the availability of separate licenses.

Is it possible to return unsold products?

A contract is a free expression of the will of the parties, expressed in the establishment of mutually beneficial conditions.

Return of unsold products is possible in two cases:

- the contract clearly stipulates the possibility of return and the grounds for it;

- an additional agreement has been concluded to return the products to the seller.

If it was stated in the contract

Dependence of return conditions on the moment of ownership of the goods:

- As a general rule, the buyer's ownership of the product arises at the moment of transfer of the product itself and signing of the settlement documentation. After this, the goods can only be returned by return sales. The buyer (owner) sells the goods to the former seller, who becomes the buyer.

- The easiest way for a return is when the contract states that ownership begins at the time of sale to third parties. In case of non-sale after a certain period, the products will be returned to the supplier.

If this was not specified in the contract

If there is no special clause in the contract related to the return of unsold products, the following ways to resolve the issue are possible :

- the participants mutually agree with the return - the reverse implementation is carried out;

- resolution of the case in court.

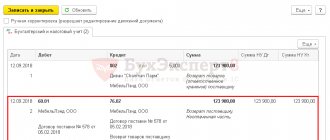

Reflection in accounting

Three transactions are recorded in accounting:

- Registration of invoice for goods receipt.

- Write-off of goods from credit.

- Fixing a statement about the receipt of money from the supplier (in this case, posting DT51 KT76 is used).

This procedure is relevant when defects are discovered before the products are accounted for. In this case, you need to draw up an act. The products will be returned to the supplier.

If a defect is identified after capitalization, it is required to issue a certificate of non-compliance to the supplier. Subsequently, all transactions are reflected in subaccount 76.6 “Calculations for claims.”

Example of using postings

The company bought nails for the amount of 25,000 rubles. Before receiving the shipment, a transfer of 50% was made to the supplier. After posting, a defect was discovered - the nails were not straight enough. When returning, the buyer uses the following transactions:

- DT60 KT51 . Explanation : prepayment. Amount : 12,500 rubles.

- DT68 KT76 . Explanation : VAT reflection. Amount : 1,906 rubles.

- DT41 KT60 . Explanation : acceptance of products for accounting. Amount : 25,000 rubles.

- DT19 KT60 . Accounting for VAT in the amount of 3,813 rubles.

- DT60 KT60 . The advance has been credited.

- DT68 KT19 . Registration of an invoice in the amount of 3,813 rubles.

- DT76 KT68 . VAT restoration.

- DT76 KT41 . Return of products to the supplier.

- DT76 KT68 . Accounting for VAT in the amount of 3,813 rubles.

- DT51 KT76 . Refund by supplier.

The supplier uses other wiring.

Value added tax issues when returning goods

Taxation cannot be ignored when shipping or returning an item. If both the supplier and the buyer are on a common tax system, this is the simplest option. In this case, all deliveries are entered into the sales book, and then VAT is charged on them. When a product is sold, its cost is included in direct costs.

But if one of the parties to the transaction is on a special taxation system, this issue becomes somewhat more complicated, since for special systems:

- the VAT amount is included in the cost of the goods when they are posted;

- the cost of goods includes VAT, due to which the shipping price changes;

- no invoice is issued (VAT is not charged).

If the supplier is on OSNO, and the buyer is on “simplified”, then when he returns the cost of the receipt will be greater than in the delivery note - by the amount of VAT.

How to return a product if there are valid reasons?

Valid reasons according to the method of occurrence are divided into 2 types:

- directly established by law (Civil Code of the Russian Federation);

- established in the contract.

Upon receipt of the goods, the buyer is obliged to check it for compliance with all the conditions specified in the contract.

If any controversial issues arise, file a claim.

Making a claim

There are often cases when the supplier refuses to pick up the goods . In this case, it is necessary to go through the claim dispute resolution procedure.

A claim is a written demand to return a product for certain reasons. You can notify the supplier orally, but only a written claim will serve as evidence of the stated requirements. And if the case comes to court - judicial evidence.

The claim is made in simple written form in two copies, and contains:

- name and details of the party wishing to return the goods;

- details of the purchase and sale or supply agreement;

- product name, quantity, description;

- reasons for return;

- details of the discrepancy report;

- requirements with references to regulatory documents, agreement;

- manager's signature, seal.

It is best to send the document by registered mail with notification or by courier.

Response time

The agreement may determine the period for filing a claim and responding to it . If this is not specified in the agreement of the parties, then the total period for a response is 30 days.

If a decision is made to return money or goods - within 10 days.

The period for response is calculated from the day following the day of receipt of the complaint.

Required papers

Documentation depends on the stage of goods acceptance:

- Defects were identified at the acceptance stage and the goods were not received .

Products are accepted on the basis of an Acceptance Certificate in the TORG-1 form, while discrepancies are recorded by an Act in the TORG-2 form (or in our own developed form). Based on the discrepancy report, a claim is drawn up. They are sent to the supplier. If the supplier’s decision is positive, the return is issued with a consignment note in the TORG-12 form. It is necessary to indicate in it the details of the statement of discrepancies and claims. Changes are made to the invoice upon shipment. The seller issues an adjustment invoice to the buyer - it serves as the basis for the deduction. - The goods have been fully accepted and capitalized .

The buyer sends the seller a request to eliminate the defects, based on supporting documents (they may be different, the main thing is that they reflect the fact of discrepancies). For example, by attaching a complaint from a retail buyer. The return is carried out on the basis of the TORG-12 consignment note marked “Return of low-quality goods.” The buyer issues an invoice for the returned products to the seller, which serves as the basis for receiving VAT. If the buyer is not a VAT payer, the seller issues an adjustment invoice.

Read in detail about how to return goods to the supplier and how to reflect this in accounting, and from this article you will learn how to correctly draw up a product return act.